- Bitcoin merchants’ choice to open quick or lengthy positions may depend upon the FOMC end result.

- Whales have been taking earnings since 17 January however the tides would possibly change.

Traditionally, the Federal Open Market Committee (FOMC) conclusion has had a number of impacts on Bitcoin’s [BTC] worth. Usually, the choice to extend rates of interest results in decreased liquidity out there and a doable downtrend. Then again, the Fed’s choice to tighten the charges may assist maintain BTC’s inexperienced momentum.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Can’t put your cash the place your mouth is

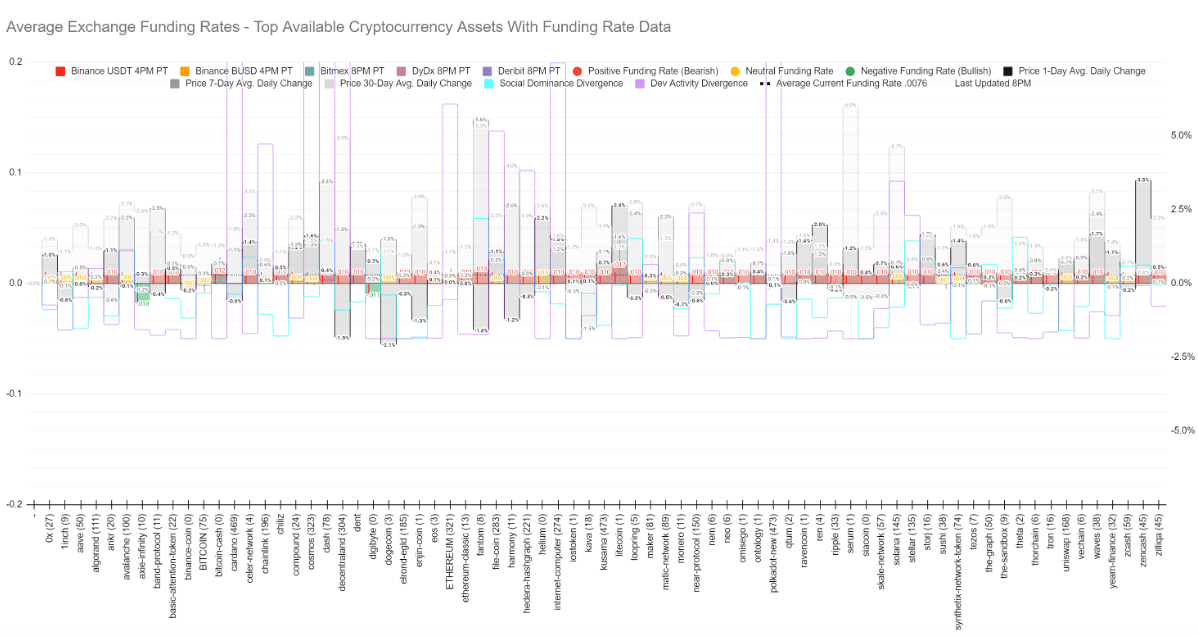

Within the lead as much as the 1 February FOMC assembly, BTC merchants’ motion was that of indecisiveness. In accordance with Santiment’s January recap report, these merchants loved a mean of 10.6% revenue within the final 30 days. This was because of the unimaginable BTC rally of the final month.

Nevertheless, merchants have not too long ago failed to carry a selected stance regardless of notable market capitalization will increase throughout the market.

Supply: Santiment

The above picture indicated that lengthy positions held by merchants earlier had subdued. Whereas shorts haven’t taken over, merchants’ sentiment evidently confirmed that they weren’t expectant of a direct inexperienced restoration.

On evaluating the derivatives’ market exercise, Coinglass revealed that over $14 million price of BTC had been liquidated within the final 24 hours. Nevertheless, the wipeout was not an in depth name between longs and shorts.

The derivatives info portal confirmed that longs had severely suffered the expunge. And, in fact, BTC’s current inconsistency in making a constant rally has been chargeable for the result.

Utility decline however whales and sharks have…

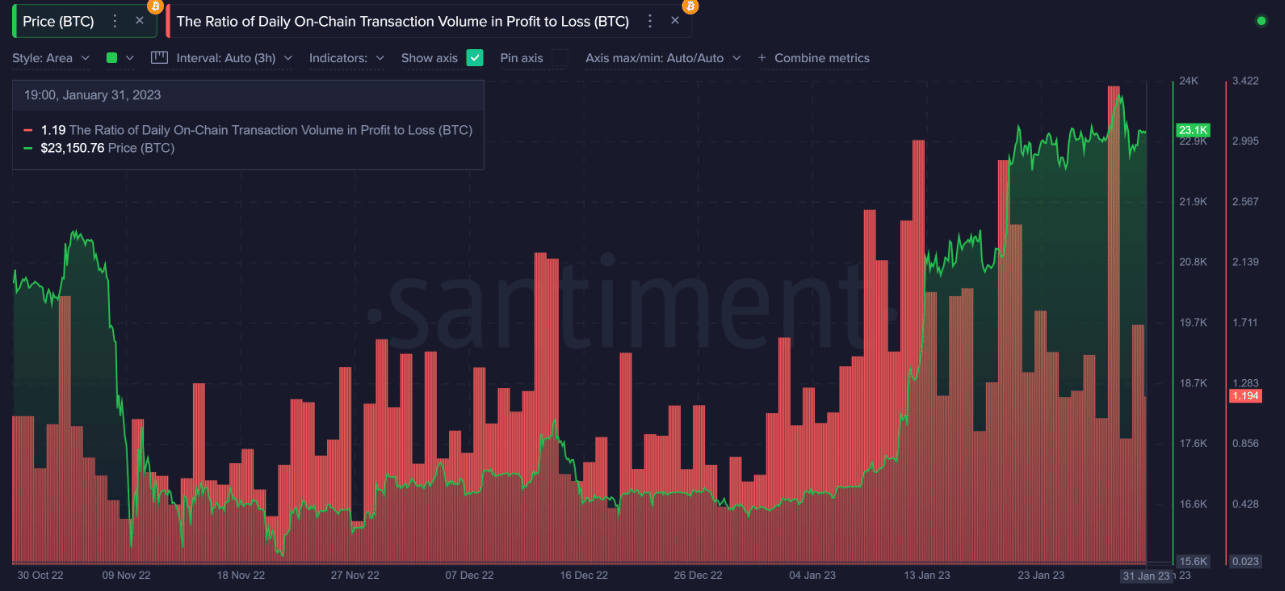

Additional, Santiment’s report identified the best way Bitcoin has been used of late. Notably, the quantity of Bitcoin shifting across the community was massively underwhelming.

What number of are 1,10,100 BTCs price right now?

This has additionally affected the coin circulation negatively. Moreover, the huge revenue taking over 30 January was additionally a part of the explanations BTC may discover it exhausting to instantly recuperate from its meltdown.

Supply: Santiment

Whereas there was a formidable uptick within the final month, it will require a big utility fee for the BTC worth to rise within the long-term. The Santiment report learn,

“We’ve seen the occasional pump regardless of low circulation up to now, however chances say {that a} viable long-lasting worth rise can’t happen till a justified quantity of utility begins.”

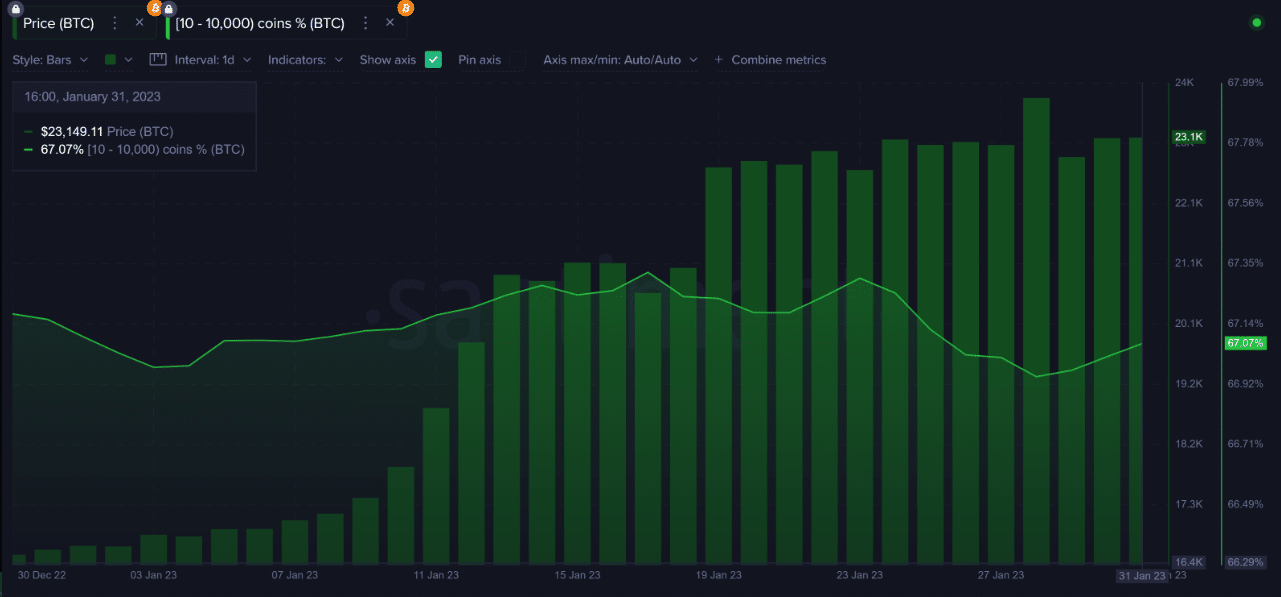

Regarding whales and sharks’ response, there has additionally been instability. Whereas addresses holding between 10 to 10000 BTC actively accrued between 1 – 16 January, the identical group started making earnings on 17 January.

Supply: Santiment

Though the BTC worth has jumped after, buyers might have to be cautious of a steady bullish course. In conclusion, the FOMC would most probably affect the short-term BTC worth. Because the assembly ends in hours from press time, buyers would hope that the result doesn’t find yourself hawkish.

![Assessing if Bitcoin [BTC] traders will change their tune after FOMC](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-01T093512.958-1000x600.png)