Disclaimer: The datasets shared within the following article have been compiled from a set of on-line assets and don’t replicate AMBCrypto’s personal analysis on the topic.

VeChain is a blockchain platform that makes a speciality of logistics and provide chain administration. It makes use of a Proof-of-Authority consensus algorithm that helps safe transactions by a community of 101 Authority Masternode operators.

Learn Value Prediction for VeChain [VET] for 2023-24

VeChain was initially a crypto token constructed on the Ethereum blockchain however later rebranded as VeChainThor (VET) in 2018. The VeChainThor blockchain operates with two tokens, VET, the first token used for storing and transferring worth, and VTHO, used for transaction charges.

The separation of the 2 tokens helps guarantee a steady worth for the token used for transaction charges. VeChain raised funds by an preliminary coin providing (ICO) in 2017 and since its launch has grown to develop into a number one platform for provide chain administration options. The platform’s give attention to safety and transparency, in addition to its use of modern know-how, has made it a preferred selection amongst companies seeking to streamline their provide chains.

Based on knowledge from CoinMarketCap, VET was buying and selling at $0.02454 at press time, down 0.58% previously 24 hours. The token’s market capitalization stood at $1.7 billion, making it the thirty seventh largest crypto on the planet. The 24-hour buying and selling quantity got here in at $56,577,843.

After reaching an all-time excessive worth of $0.280991 on 19 April 2021, VET noticed a big correction in worth as the general cryptocurrency market cooled off. The value of VET fell to a low of round $0.25 in early 2018, earlier than progressively recovering over the following few years.

In 2021, VET as soon as once more noticed a big worth improve, reaching a brand new all-time excessive of over $0.70 in Might of that yr. Since then, the worth of VET has fluctuated considerably however has remained sturdy, with a present worth of round $0.40.

VeChain’s whole worth locked (TVL) has taken a big hit this yr. This metric has gone from $29 million firstly of the yr to $2.05 million as of the time of publication.

VeChain is a versatile enterprise-grade L1 good contract platform. VeChain began out in 2015 as a non-public consortium chain, collaborating with quite a lot of companies to research blockchain purposes. It helps firms to create decentralized purposes (dApps) and perform transactions with larger ranges of safety and transparency.

VET has skilled elevated volatility not too long ago. It rose to a 10-week excessive of $0.0280 on 8 November. Nevertheless, the next day, VET sank as little as $0.0190, a worth that it hadn’t seen since January 2021.

VET’s huge rally on 8 November was triggered by an announcement by the VeChain Basis. The agency introduced VeChainThor’s most vital mainnet onerous fork prepared for deployment following the profitable vote on VIP-220 dubbed the ‘Finality with one Bit’. This milestone improve will carry the ultimate part of VeChain’s proof of authority 2.0 and is predicted to happen on 17 November.

VeChain was actively involved in UFC 280, which befell on 22 October, as a part of its $100 million multi-year cope with UFC which was introduced earlier this yr in June.

The sustainability-centric blockchain is at the moment mulling over a big Proof of Authority improve which is able to combine VIP-220 with the VeChain Thor Mainnet.

If permitted by all stakeholders’ votes, VeChain will acquire finality and produce an finish to the trade-off that’s selecting between scalability with excessive throughput or instantaneous finality. The VeChain Basis acknowledged earlier that this improve will make it the “good real-world blockchain”

VET traders who had been upset with a three-month return of -11.5% on their tokens lastly acquired some excellent news when Binance U.S. revealed that VeChain prospects might stake their VET and earn 1% APY rewards in VeThor Tokens (VTHO)

DNV GL, a supplier of audit and certification providers for ships and offshore constructions, partnered with VeChain in January 2018 to offer audits, knowledge gathering, and a digital assurance resolution for the meals and beverage sector.

Other than this, PriceWaterhouseCoopers (PwC), a big auditing and consulting enterprise, has teamed up with VeChain since Might 2017 to offer its purchasers with larger product verification and traceability.

Moreover, beginning in April 2020, VeChain has been utilized by H&M, the Luxurious Vogue Model, the second-largest garments retailer on the planet with greater than 5000 shops.

Nevertheless, issues are usually not turning round so properly for the token. The value of VeChain dropped to its lowest stage within the final twelve months with the outbreak of the Russia-Ukraine 2022 conflict. As is frequent with cryptocurrencies, it started to get better the very subsequent day. Many merchants are actually uncertain if it might be sensible to speculate on this foreign money at the moment on account of this.

If this pattern persists, VeChain would possibly simply attain $1 throughout the subsequent few years or much more. Something would possibly occur within the cryptocurrency market, so that is in no way a assure. Nevertheless, VeChain seems to be positioned for long-term development, and $1 looks as if a reachable objective within the foreseeable future.

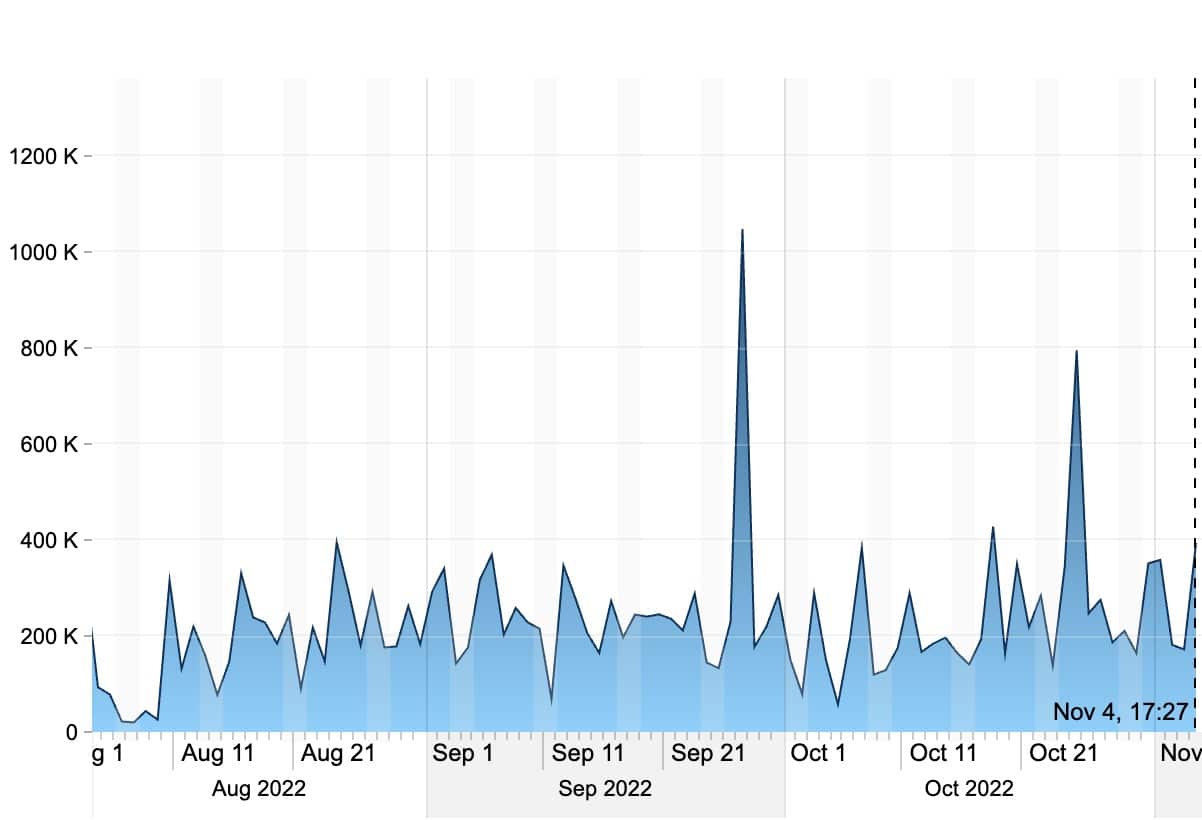

Supply: VeChain Stats

In reality, knowledge from VeChain Stats revealed a troubling decline in its mainnet exercise.

Though there was a visual spike in exercise because the starting of August, one can’t ignore the distinction in comparison with final yr, when the community was seeing over two million clauses every week. Not like many different cryptocurrencies, VeChain’s worth and its mainnet exercise began declining firstly of 2022. The market-wide sell-off following the collapse of Terra did impression VeChain’s mainnet exercise, however because the chart signifies, it has just about recovered to pre-bear market ranges.

Moreover, knowledge procured by SeeVeChain steered that VeChain Thor transactions have been on a gradual decline too. The every day burn fee of VETHO, the token required for facilitating VET transactions, could be seen persistently falling – an indication of diminishing VET transactions.

Nevertheless, because the starting of August, the every day burn fee has been setting larger highs, whereas shifting in a sideways route. This will likely counsel restoration and stabilization to some extent.

Supply: See VeChain

VeChain was within the information again in Might 2022, when it supplied Terra LUNA builders grants of upto $30,000 emigrate their layer 1 chains to VeChain following the collapse of terra.

There was a short rebound in VET’s worth in the direction of the top of the primary quarter of 2022. The token surged all the way in which to $0.089 following the announcement of VeChain’s partnership with Draper College which entailed a fellowship and a Web3 accelerator program. Nevertheless, Might’s market-wide crash despatched VET’s worth tumbling all the way down to $0.024. The value did not get better from the bearish pattern, regardless of information of a brand new partnership with Amazon Internet Companies and the Q1 monetary report from the VeChain Basis which confirmed a wholesome steadiness sheet.

In 2020, PwC estimated that blockchain applied sciences might enhance the worldwide GDP by $1.76 trillion by 2030 by improved monitoring and tracing. PwC’s financial evaluation and trade analysis confirmed that monitoring and tracing services and products has an financial potential of $962 billion. Buyers might be desirous to see how PwC’s blockchain companion VeChain advantages from this.

International market intelligence agency IDC launched a report in 2020. Based on the identical, 10% of the provision chain transactions in Chinese language markets will use blockchain by 2025. This might work out in favor of VeChain, with it being the main blockchain agency catering to produce chain options and given its vital presence in China. James Wester, analysis director at Worldwide Blockchain Strategies IDC, famous:

“This is a vital time within the blockchain market as enterprises throughout markets and industries proceed to extend their funding within the know-how. The pandemic highlighted the necessity for extra resilient, extra clear provide chains”

Based on a report printed by ResearchandMarkets.com, the worldwide provide chain administration market measurement is projected to hit $42.46 billion by 2027, with a Compound Annual Development Charge (CAGR) of 10.4% from 2021 to 2027. Specialists have indicated main alternatives for the combination of blockchain know-how in provide chain administration software program within the projected interval. Because the main blockchain agency catering to produce chain administration, VeChain might stand to realize from this.

It was reported in July that VeChain might be rolling out an answer for luxurious manufacturers that always discover their low cost knock-offs being illegally offered within the main and secondary markets.

VeChain will implant its proprietary chipset in luxurious merchandise, which is able to assist producers hold observe of their stock and monitor gross sales in real-time on the blockchain. Along with that, prospects will be capable of confirm the authenticity of their bought product utilizing a cellular software. The appliance would additionally present more information similar to carbon emissions related to their buy and the story behind their product.

A paper printed by The Establishment of Engineering and Expertise outlined blockchain purposes for the healthcare trade. The paper defined how start-up firms on this trade had been exploring the usage of blockchain know-how for scientific knowledge administration. The paper went on to quote the instance of the Mediterranean Hospital in Cyprus, which leveraged E-HCert, an information administration software primarily based on VeChain Thor.

On 10 August, VeChain and OrionOne, a worldwide logistics tech agency, announced an integration partnership. The three way partnership goals to mix the VeChain ToolChain with Orion’s best-in-class logistics platform to supply purchasers an environment friendly and efficient pathway to leverage blockchain know-how of their enterprise with out spending a ton on community infrastructure. Tommy Stephenson, CEO of OrionOne, whereas talking on this new partnership remarked”

“With regards to blockchain and provide chain, there’s just one sport on the town, and that’s VeChain. No different entity can compete with their low-cost, fast deployment, and ease of use.”

On 19 August, the VeChain Basis announced by way of Twitter that the VeChainThor public testnet had been efficiently up to date to accommodate VIP-220, also called the Finality with One Bit (FOB). The replace implements a finality gadget that enables the community to run twin modes of consensus, the Nakamoto and Byzantine Fault Tolerance (BFT) consensus, on the identical time. This transfer saved VeChain the difficulty of utterly changing its proof-of-authority consensus mechanism. A finality gadget helps blockchains execute transactions optimistically and solely commit them after they’ve been sufficiently validated.

Builders have clarified that FOB has an edge over the present finality devices which comply with the view-based mannequin of Byzantine Fault Tolerance (BFT) Algorithms as a result of nodes in FOB are much less prone to be affected by community failure.

The replace will even assist VeChain cut back the complexity of its present proof-of-work consensus protocol, thus minimizing the potential dangers brought on by unknown implementation bugs, along with sustaining the usability and robustness of the community.

Earlier in June, VeChain had described block finality as:

“An indispensable property for a contemporary blockchain system as a result of it supplies an absolute safety assure for blocks that fulfill sure situations.”

The VeChain Basis knowledgeable its group on Twitter that from 5 September onwards, the community might be suspending $VEN TO $VET token swaps. The perform is predicted to renew after the Ethereum community stabilizes following the much-anticipated merge slated for mid-September.

Earlier this month, VeChain announced that it had entered a strategic partnership with TruTrace Applied sciences, a blockchain growth firm catering to the authorized hashish, meals, attire, and pharmaceutical industries. The partnership goals to combine complementary applied sciences and provide TruTrace’s purchasers enhanced traceability by leveraging VeChain’s seamless infrastructure.

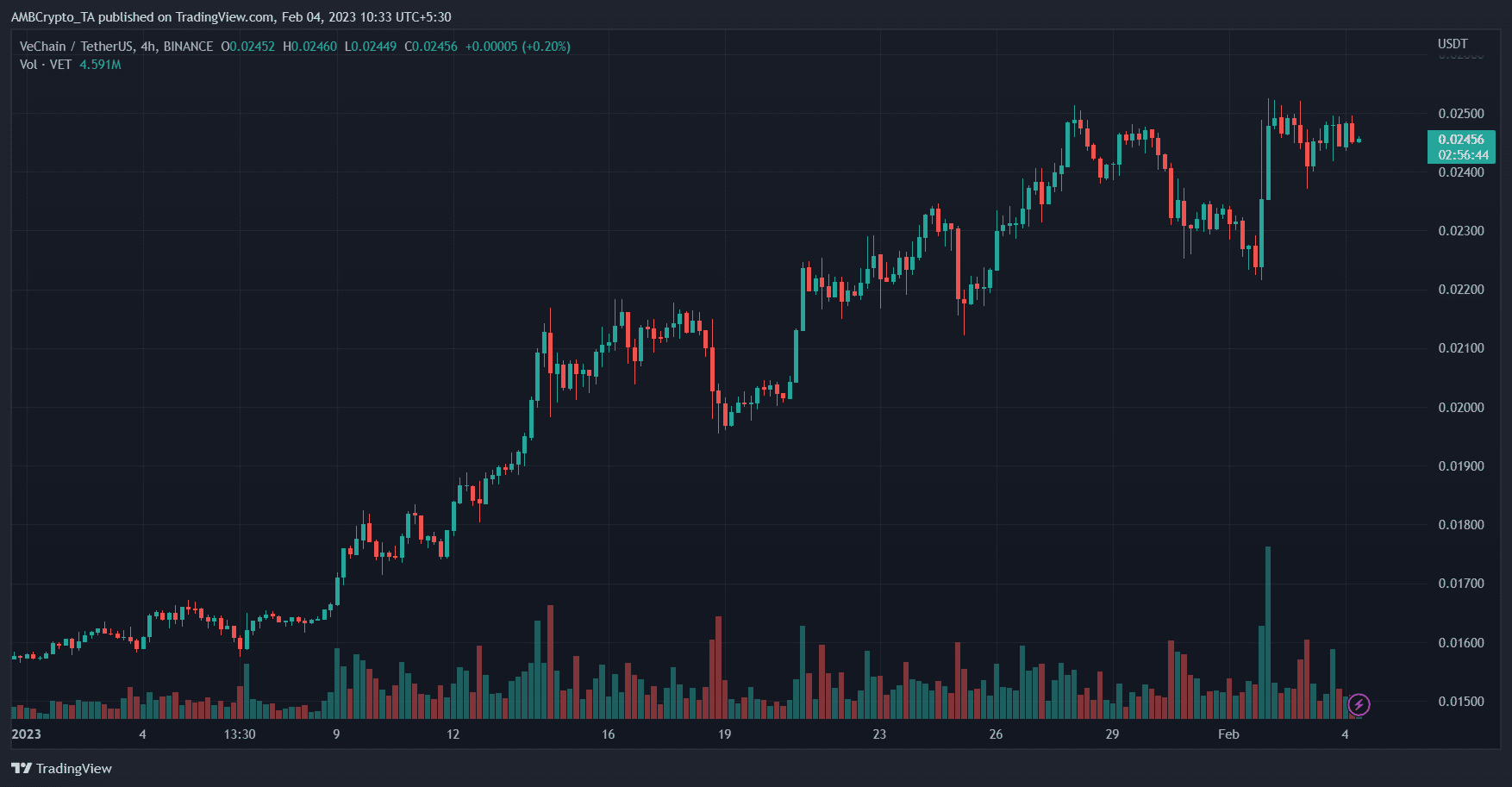

At press time, VET was buying and selling at $0.02456.

Supply: TradingView

The value of VET has been on a downtrend since April 2022. It’s clear from the VET/USD chart that ever since VET dropped under $0.039 on Might 2022, it confronted main resistance on the $0.034-level. The crypto moved sideways in a ranging sample between mid-June and July with key help on the $0.021-level. In direction of the start of August 2022, the pair lastly broke the three-week-long resistance on the $0.027-level and rallied 24% all the way in which as much as $0.034 by 13 August 2022.

The value has since, nevertheless, dipped again down. It’s now buying and selling at $0.02456, which can additionally emerge as a brand new help stage, though one can solely make certain after a pair extra retests. It’s unlikely that the worth of VET will return to what it was buying and selling for earlier than the market-wide sell-off in Might.

VeChain Tokenomics

Token minting predates VeChain’s rebranding, thus, figures have been transformed from VEN to VET.

VeChain initially minted 100 billion VET which was distributed within the following method –

- 22 billion VET had been retained by the VeChain Basis

- 5 billion VET got to undertaking crew members

- 23 billion VET went in the direction of enterprise traders

- 9 billion VET went in the direction of personal traders

- 27.7 billion VET had been offered within the crowdsale

- 13.3 billion VET had been burned by the VeChain Basis as a part of the token sale refund course of

VET Value Prediction for 2025

Crypto specialists at Changelly have projected VET to be price a minimum of $0.10 in 2025. They imagine the utmost it might go to is $0.12.

Knowledge gathered by Nasdaq means that the common projection for VET in 2025 is $0.22.

Based on knowledge printed on Medium, nevertheless, the common projection for VET in 2025 is $0.09.

What number of VETs can you purchase for $1?

VET Value Prediction for 2030

Changelly’s crypto specialists have concluded from their evaluation that VET ought to be price a minimum of $0.64 in 2030. The projection included a most worth of $0.79.

Knowledge gathered by Currency.com means that the common worth of VET in 2030 ought to be $0.38.

The specialists at Medium predict VET to be price an formidable $1.79 by the top of the last decade. Contemplating the present worth, that might quantity to a whopping 6200% revenue.

Conclusion

You will need to word that elevated adoption of VeChain doesn’t essentially translate to elevated demand for VET because the token is primarily used for staking and governance.

VeChain is arguably the one blockchain within the provide chain vertical that has survived the check of time. Rival tokens like Waltonchain and Wabi have seen their market capitalization and quantity dramatically diminish over the previous few months.

The continuing provide chain disaster would have been an excellent alternative for VeChain to show its capabilities however firms all around the world have been resorting to standard techniques relatively than exploring an modern blockchain resolution like VeChain. That being mentioned, the provision chain monitoring trade is ripe for disruption and VeChain is able to dominate the area within the close to future.

Critics have speculated that whereas VeChain’s blockchain could show helpful, the precise nature of its native token’s utility i.e. pertaining to the enterprise world, could develop into a hindrance to its development.

VeChain must give attention to what it’s good at – Enterprise-facing blockchain options for logistics and provide chains.

The key elements that may affect VET’s worth within the coming years are –

- Enhance in demand for VET by development in dApp exercise

- Improvement of VeChain cross-chain

- Steady financial atmosphere in China

- New partnerships with firms within the provide chain trade.

- Improvement of latest use circumstances for VET

In different information, the Worry and Greed Index improved briefly in early August, earlier than slumping again once more because the market fell during the last six weeks. At press time, the index was within the ‘impartial’ territory.

Supply: CFGI.io