Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- NEAR was bullish at press time.

- However a key technical indicator was displaying an rising divergence, at press time.

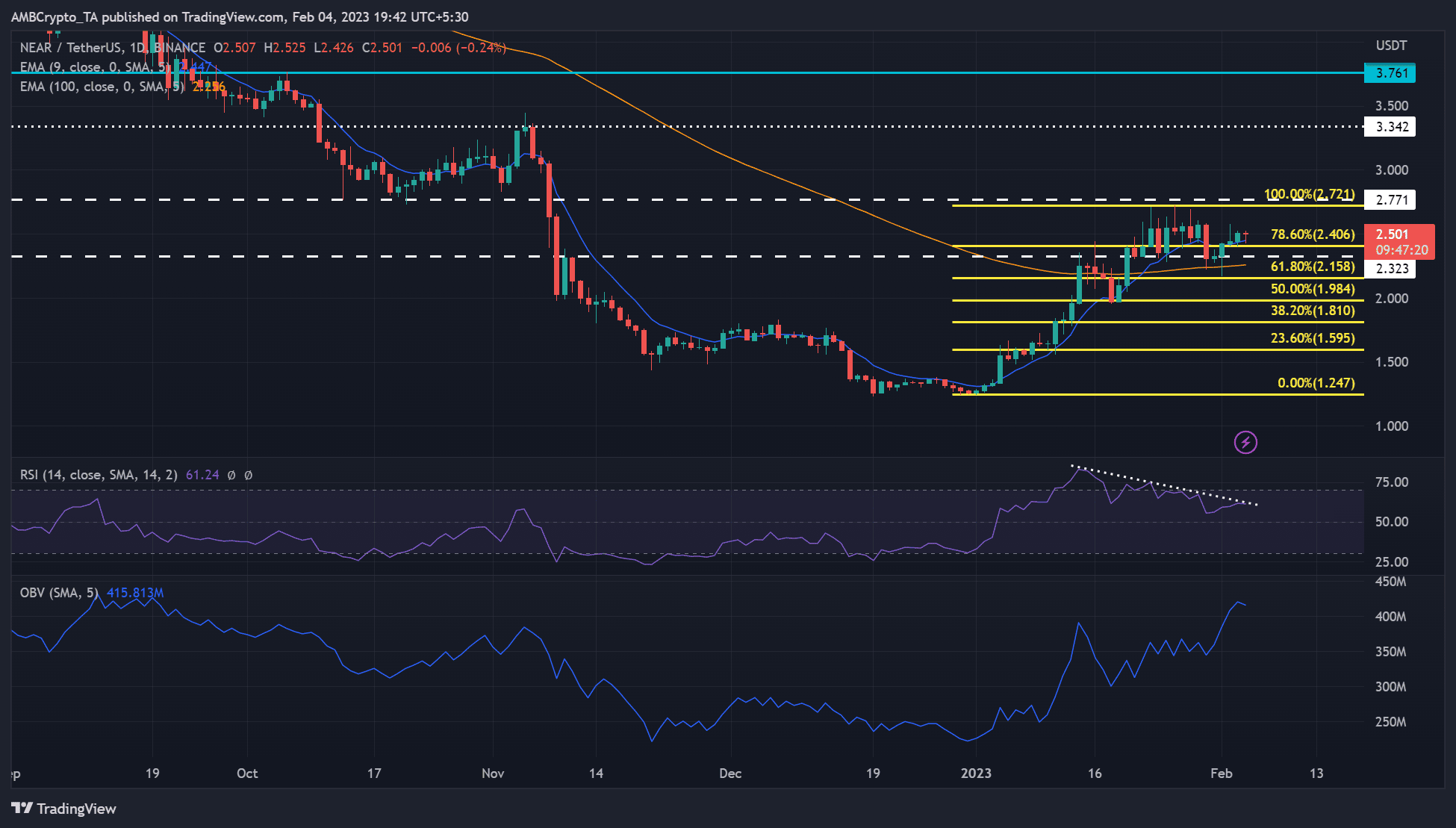

NEAR Protocol [NEAR] greater than doubled in worth after the January rally. It jumped from $1.247 to $2.721 however later fluctuated. At press time, NEAR’s worth was $2.501 however more and more confronted a possible correction due to divergence from a technical indicator.

Learn NEAR Worth Prediction 2023-24

NEAR’s rising RSI divergence Is a correction possible?

Supply: NEAR/USDT on TradingView

Is your portfolio inexperienced? Take a look at the NEAR Revenue Calculator

The every day chart confirmed a bullish NEAR fronted a profitable rally in January however confronted value rejection on the overhead resistance degree of $2.721. Nonetheless, the rising value motion was the other of its Relative Energy Index (RSI).

The RSI has exhibited a downtrend from mid-January – a divergence with value motion that would counsel a doable correction within the subsequent few days.

Primarily based on the peak of the latest value consolidation vary of $2.323 and $2.721, the correction may goal the assist degree on the 50% Fib degree of $1.984.

However the drop may be held by the 100-day EMA, or 61.8% Fib degree. These may act as short-selling targets if the correction happens.

Nonetheless, the above bias could be invalidated if bulls break above the 100% Fib degree of $2.721. Such an upswing will enable bulls to retest the October assist degree of $2.771 or the November excessive of $3.342.

NEAR noticed fluctuating OI and a decline in lively customers

Supply: Coinglass

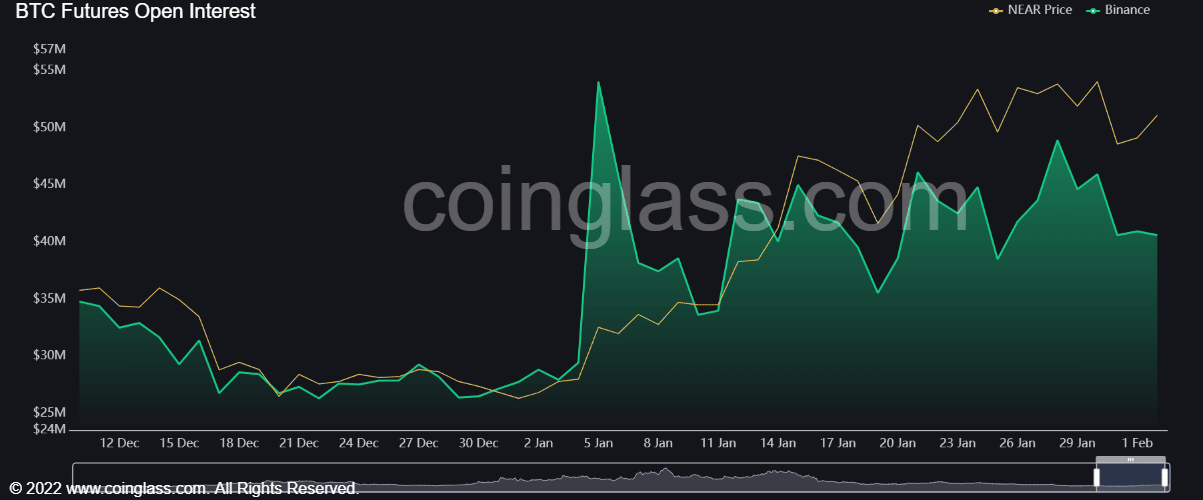

As per Coinglass knowledge, NEAR’s fluctuating open curiosity (OI) charges undermined a robust uptrend rally. At press time, NEAR’s OI had dropped sharply however flattened out, indicating a doable change of momentum that would assist NEAR’s uptrend.

Nonetheless, an prolonged drop in OI may undermine additional uptrend as extra money strikes out of NEAR’s futures market.

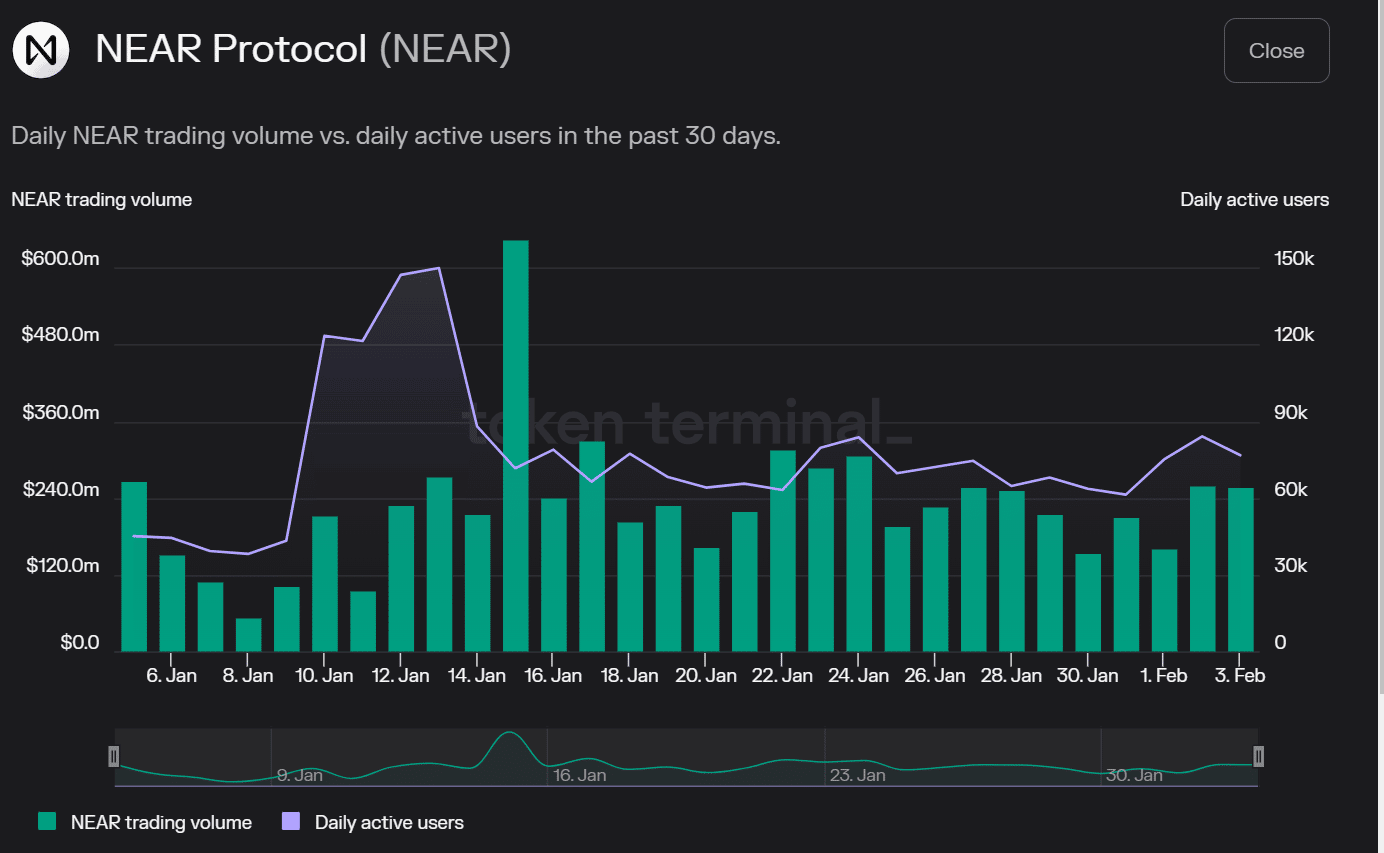

Then again, NEAR’s every day lively customers and buying and selling volumes dropped from mid-January. The pattern exhibits fewer accounts have been buying and selling NEAR, which may undermine shopping for stress wanted for a robust uptrend momentum.

Consequently, bears may very well be tipped to devalue NEAR and set it right into a correction.

Supply: Token Terminal

![NEAR Protocol’s [NEAR] key divergence calls for investors’ caution](https://ambcrypto.com/wp-content/uploads/2023/02/1674536455299-71f76b17-0522-4362-bdce-2402ec14a0ca-3072-1000x600.png)