Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- A degree of assist with a pocket of liquidity at $18 meant Avalanche retained robust assist regardless of latest promoting.

- A Bitcoin crash beneath $22.3k might make shopping for Avalanche dangerous.

Bitcoin [BTC] fell beneath the $23k mark over the previous few hours of buying and selling. On the time of writing, a lot of the crypto market stood within the pink for the day. Avalanche [AVAX] additionally famous losses through the day’s buying and selling. The asset fell from $20.24 to face at $19.73, a lack of 2.5%.

Practical or not, right here’s AVAX’s market cap in BTC’s phrases

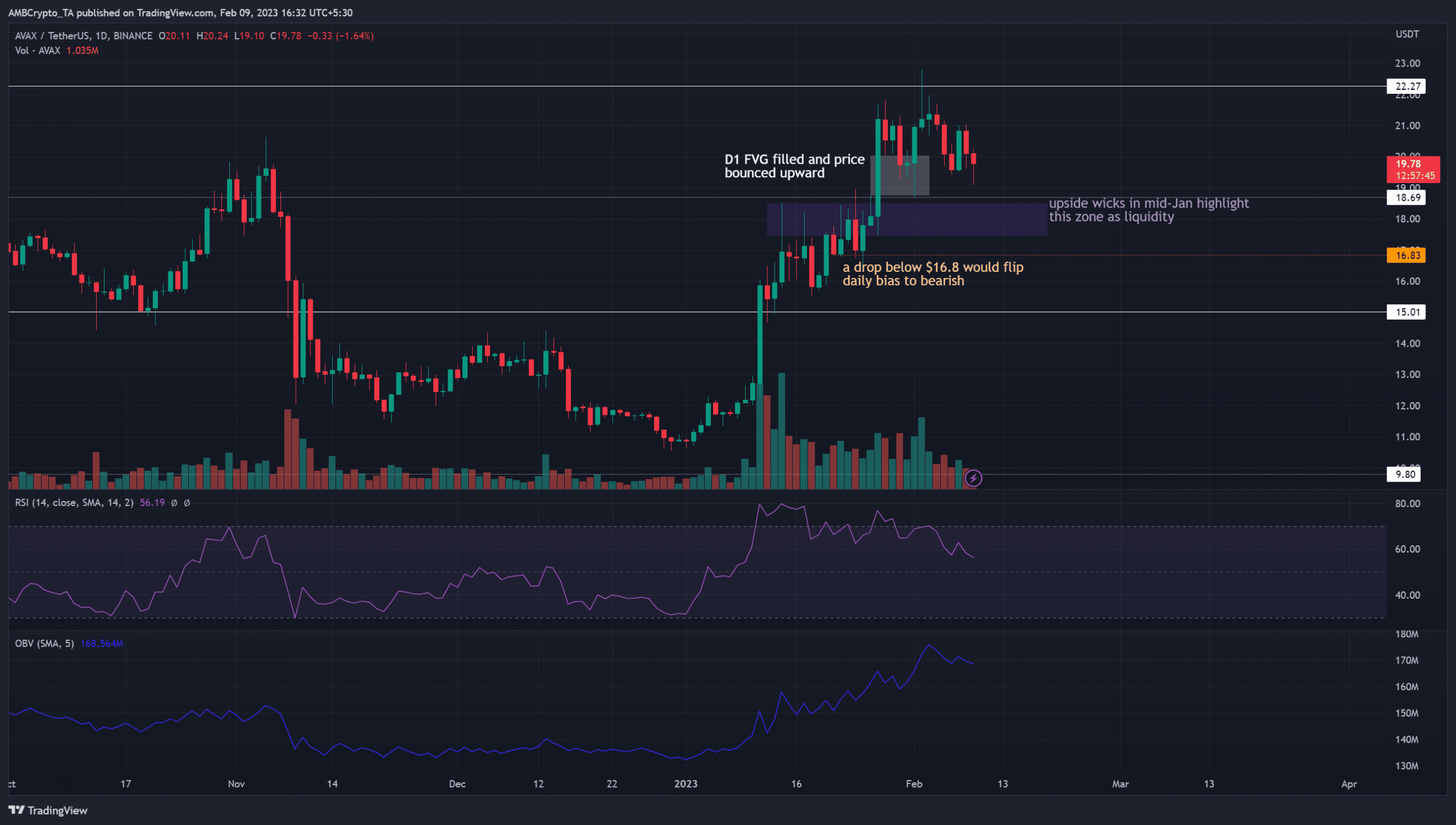

Larger timeframe evaluation confirmed that Avalanche might be set for a dip towards $18.7 and the $17.8 ranges. Bullish merchants can look ahead to a bounce and a decrease timeframe bullish market construction earlier than on the lookout for entries to lengthy positions.

Larger timeframe bulls can look ahead to AVAX to drop into an space of curiosity

Supply: AVAX/USDT on TradingView

The market construction of Avalanche remained bullish on the one-day timeframe. To the south, under $19, it has the next timeframe degree of significance at $18.6. The zone from $17.5-$18.6 represented a pocket of liquidity.

In mid-January, many candlewicks on this zone had been rejected on decrease timeframes. This meant that, at the moment, sellers had been dominant on this zone. When the $18.6 degree was breached in late January 2023, it signified bullish dominance. Therefore, a retracement into this pocket of liquidity would probably see robust patrons.

Additional south, AVAX has a degree of assist at $16.8 and at $15.77. A each day session shut beneath $15.77 will flip the construction to bearish. Till then, patrons can look to bid at essential assist ranges, though it might be dangerous.

The RSI was falling towards impartial 50 to indicate bullish momentum was waning. In distinction, the OBV was rising to indicate shopping for stress.

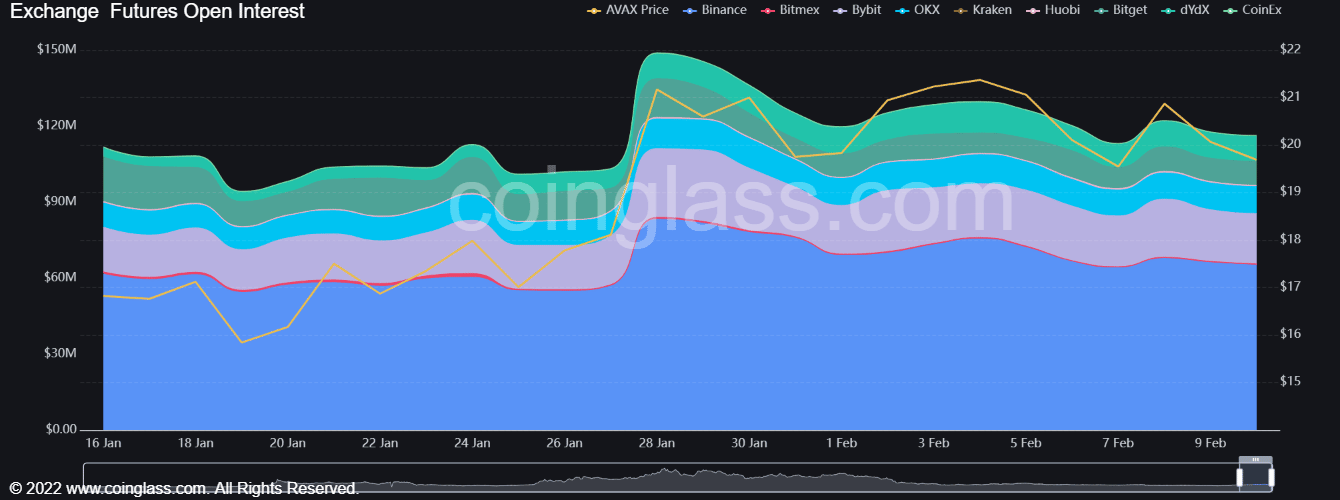

Open Curiosity falls, however funding price stays optimistic

Supply: Coinglass

How a lot are 1, 10, 100 AVAX value in the present day?

Open Curiosity spiked upward on 28 January. Since then, it has made a collection of lows. Throughout the identical interval, AVAX reached $21.6 and pushed increased to achieve $22.75. By this time, the OI had already weakened, to not point out the bearish divergence the RSI made with the worth.

The funding price remained optimistic, which urged market individuals had been bullishly positioned and haven’t but flipped strongly. Total, patrons seeking to maintain AVAX for a couple of weeks earlier than promoting can look ahead to a bullish response throughout the market earlier than shopping for, and lower their losses to a drop under $15.7.