Disclaimer: The datasets shared within the following article have been compiled from a set of on-line sources and don’t mirror AMBCrypto’s personal analysis on the topic.

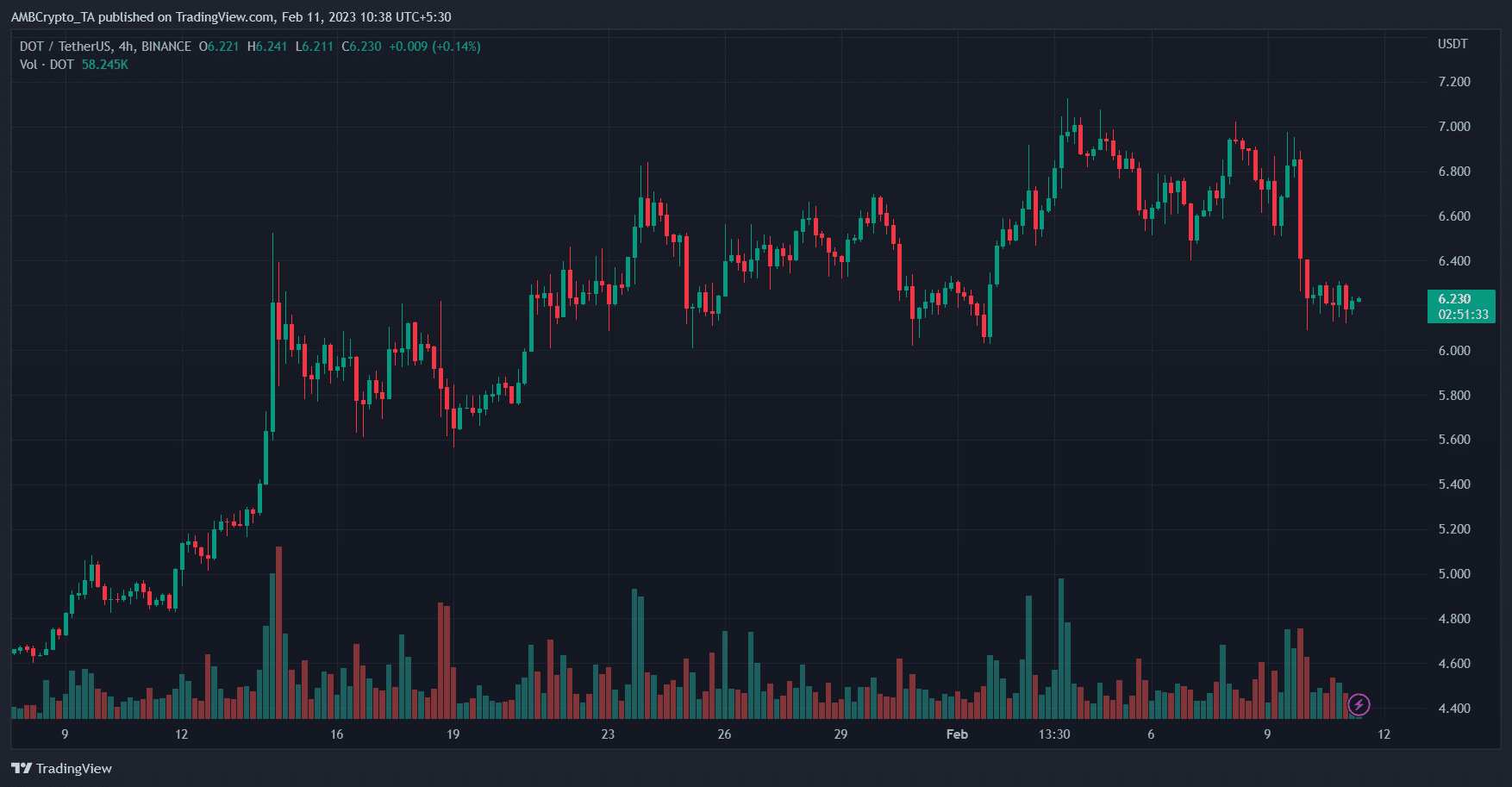

In a spot of fine information, in contrast to different crypto currencies, the worth of Polkadot (DOT) has not fallen so sharply. Remaining largely stagnant during the last seven days, DOT was buying and selling at $6.20 at press time. Up to now, it has been in a position to type a base above the $6.00 zone.

Learn Worth Prediction for Polkadot [DOT] for 2023-24

The Twelfth-largest cryptocurrency at press time, Polkadot had a press time market cap of $7,166,902,037.

In a blog post printed on 26 September, 2022, the Polkadot workforce supplied updates on their Roadmap Roundup.

The submit described the Asynchronous Backing which goals to perform three issues: scale back the period of parachain blocks to 6 seconds, improve the quantity of block house obtainable to every block by an element of 5-10, and permit parachain blocks to be reused once they don’t make it onto the relay chain on the primary attempt.

The transactions per second (TPS) capability of the community can also be anticipated to extend in mixture to 100,000-1,000,000, due to the replace.

Previous to its launch, the Polkadot venture had raised over $144.3 million by the Web3 Basis in an ICO itself in October 2017. DOT was buying and selling at $6.30 in August 2020 and stored oscillating between $4 and $5 all through the remainder of 2020.

The crypto bloom of 2021 proved to be wondrous for Polkadot too. All year long, it remained bullish and reached its ATH of $55 in November. Equally, the crypto crash witnessed within the second quarter of 2022 impacted its efficiency adversely. By mid-July, it was buying and selling at just a bit above $6.

A proof-of-stake (PoS) blockchain, Polkadot lately upgraded to the v9270 model, which was mirrored in some upward motion in its worth. Just a few days again, its efficiency was reasonably resurgent. However with the Merge, Ethereum has emerged as a critical competitor of Polkadot as a substitute PoS blockchain and DOT’s worth has been plunging since then.

Polkadot Co-Founder Robert Habermeier, nonetheless, claimed that he’s tremendous pleased to see Ethereum transition from PoW to PoS mechanism. Actually, he views Polkadot as an “ETH collaborator.” Polkadot, at press time, was buying and selling at $6.230.

Supply: TradingView

In December 2021, the biggest telecommunication firm in Europe, Deutsche Telekom, purchased a considerable amount of DOT tokens. T-Methods Multimedia Options, its subsidiary, has additionally purchased a considerable amount of DOT tokens to assist teams staking on the Polkadot community.

Engaged on the proof-of-stake consensus mechanism is exclusive in supporting a number of interconnected chains, serving to it earn a lot of customers.

Shawn Tabrizi, the lead developer at Polkadot community, talked about the potential of “a cohesive, multi-blockchain future” throughout an interview in February 2022. He additionally harassed the necessity for preserving the basics of information privateness within the Polkadot ecosystem.

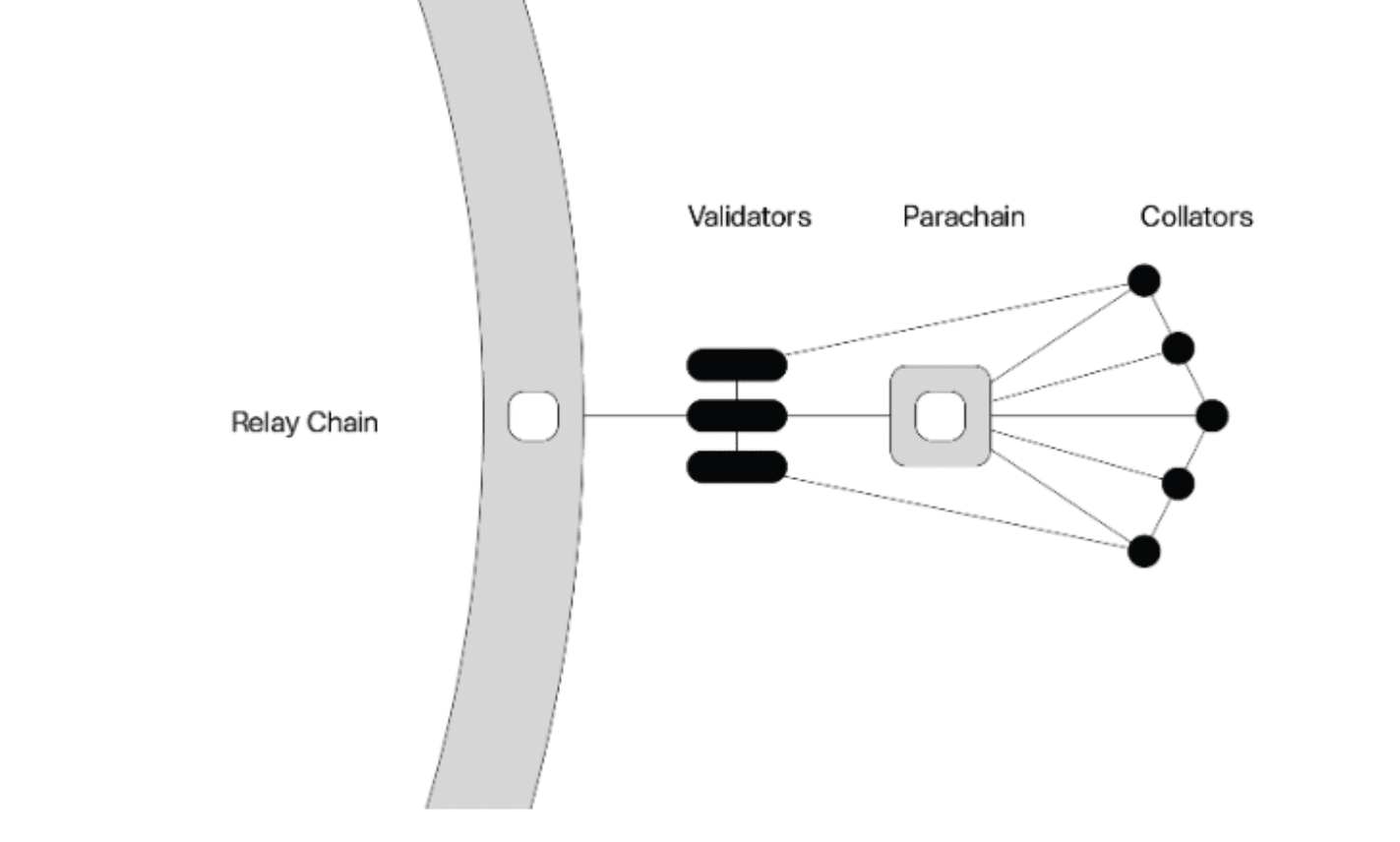

The Polkadot infrastructure supports two sorts of blockchains, relay chains, and parachains.

The central blockchain of the Polkadot infrastructure is the Relay Chain, the place validators present consensus for a transaction. The Relay Chain is inbuilt a option to coordinate the administration and operation of the entire Polkadot infrastructure, with minimal performance in regard to different functions.

A parachain, then again, is an application-specific chain on the Polkadot infrastructure that’s validated by the validators of the Relay Chain itself. Since these chains run parallel to the Relay Chain, they’re referred to as parachains. It’s right here that builders can develop each functions and their very own blockchains.

All of those parachains can talk with one another on the community. Briefly, this cross-chain know-how facilitates the switch of each belongings and knowledge throughout blockchains. Customers, due to this fact, don’t should rely upon a selected system for all of their cryptocurrency transactions.

Polkadot parachains can simply talk with different blockchains present on Ethereum and Bitcoin networks. The blockchain additionally gives higher management, flexibility, and safety, decreasing the danger to its miners attributable to unauthorized validators. Acala, Moonbeam, Clover, Astar, and Parallel are a number of the oldest initiatives working on the Polkadot community. The blockchain is rising quickly and appears to vow a dependable future to its customers.

Polkadot parachains can simply talk with different blockchains present on Ethereum and Bitcoin networks. The blockchain additionally gives higher management, flexibility, and safety, decreasing the danger to its miners attributable to unauthorized validators. Acala, Moonbeam, Clover, Astar, and Parallel are a number of the oldest initiatives working on the Polkadot community. The blockchain is rising quickly and appears to vow a dependable future to its customers.

Wooden believes that from a Internet 3.0 perspective, the inter-chain blockchain protocol of a community like Polkadot will join totally different technological threads right into a single financial system and motion.

The power to speak with out the necessity to belief one another is the cornerstone of the Polkadot system. The parachain auctions of Polkadot can really construct a democratic web house as decentralized or distributed community architectures type the infrastructure of the web world.

In Might this 12 months, a Polkadot improve enabled parachain-to-parachain messaging over XCM. The XCM format is geared toward serving to the Polkadot community turn out to be a completely interoperable multichain ecosystem. XCM permits communication not solely between the parachains themselves but additionally between good contracts and decentralized functions.

As a blockchain working on the PoS consensus mechanism, Polkadot is without doubt one of the most eco-friendly blockchain cryptocurrencies.

The PoS technique is extra sustainable than the PoW technique as there isn’t any race to mint extra cash.

As per a brand new study by the Merchants of Crypto, Polkadot, together with Cardano and Algorand, are among the many most environment-friendly cryptocurrencies. With annual CO2 emissions of fifty tonnes, Polkadot is the fourth most eco-friendly cryptocurrency.

For eco-conscious buyers, Polkadot has remained the popular possibility for years and continues to be.

Supply: TradersOfCrypto

The continuing Russia-Ukraine battle had a devastating impact on the worldwide neighborhood. The disaster abetted the crash of the cryptocurrency business however business leaders and a whole lot of others nonetheless got here collectively to help Ukraine in her second of vulnerability. In Might 2022, Polkadot co-founder Gavin Wooden donated 298,367 DOT price $5.8 million to Ukraine.

The contribution of the crypto neighborhood has additionally been acknowledged by Mykhailo Fedorov, Vice Prime Minister of Ukraine. On 17 August 2022, he tweeted that $54 million from these funds has been spent on army gear, together with rifle scopes, vests, helmets, and tactical backpacks.

A Forbes report quotes Bilal Hammoud, CEO, and founding father of Nationwide Digital Asset Trade, “Polkadot’s mission is to securely permit Bitcoin and Ethereum to work together with one another in a scalable method… Think about if you happen to retailer your wealth in Bitcoin and use that Bitcoin on an Ethereum dApp [decentralized application] to take out a mortgage for a home rapidly and securely.”

The interoperability and scalability of the Polkadot infrastructure have helped it endear itself to a variety of enthusiastic builders, thereby considerably elevating the worth of DOT.

Why these projections matter

Amongst all of the market’s main cryptocurrencies, what’s peculiar to Polkadot is that it presents a possibility to customers to function and transact throughout blockchains. With a circulating provide of over 1 billion cash, DOT is anticipated to stay one of many market’s hottest cryptos.

This additionally makes DOT one of the carefully noticed cryptocurrencies out there. Ergo, it’s vital buyers and holders stay conscious of what common analysts should say about the way forward for DOT.

On this article, we are going to briefly summarize the important thing efficiency metrics of DOT akin to worth and market cap. Thereafter, we are going to observe what the most well-liked crypto-market analysts should say concerning the present and future states of DOT, together with its Concern & Greed Index. We can even current metric charts to enrich these observations.

Polkadot’s Worth, Market Cap, and the whole lot in between

Polkadot carried out very properly in the course of the crypto-bloom of 2021, crossing the worth stage of $20 in early February and $30 in mid-February. It breached the $40-mark in early April and stored going up and down for the subsequent few months. After going by a tough patch, it hit an ATH of $55 in early November.

The final month of 2021 was a tough interval for your entire cryptocurrency market. Issues had been no totally different for Polkadot, with DOT buying and selling at just a bit above $26 on 31 December.

Come 2022 and the Russia-Ukraine disaster additional pushed the market into chaos. In January-February, DOT was buying and selling at round $18-20. It was thought that the Ukrainian authorities’s decision in March to just accept donations in DOT would enhance its prospects. Alas, it hardly made any distinction, because it was solely in early April that it crossed the worth mark of $23.

In Might 2022, the collapse of each LUNA and TerraUSD despatched shockwaves throughout your entire cryptocurrency business. Actually, on 12 Might, DOT’s worth plummeted to $7.32. June and July additionally remained dismal for your entire cryptocurrency market, with DOT dipping to as little as $6.09 on 13 July. The news of the Japanese crypto-exchange Bitbank itemizing Polkadot on its platform in early August introduced some respite, although.

Polkadot has additionally been scoring on different fronts. As an illustration, look no additional than Messari’s newest report on the regenerative finance actions. In response to Polkadot,

Pink is the brand new inexperienced🟢

21 parachains [blockchains], 250+ dapps, 2500 nodes together with 297 energetic validator nodes, and Polkadot stays the greenest blockchain. https://t.co/3V4FkMoIoC

— Polkadot (@Polkadot) August 12, 2022

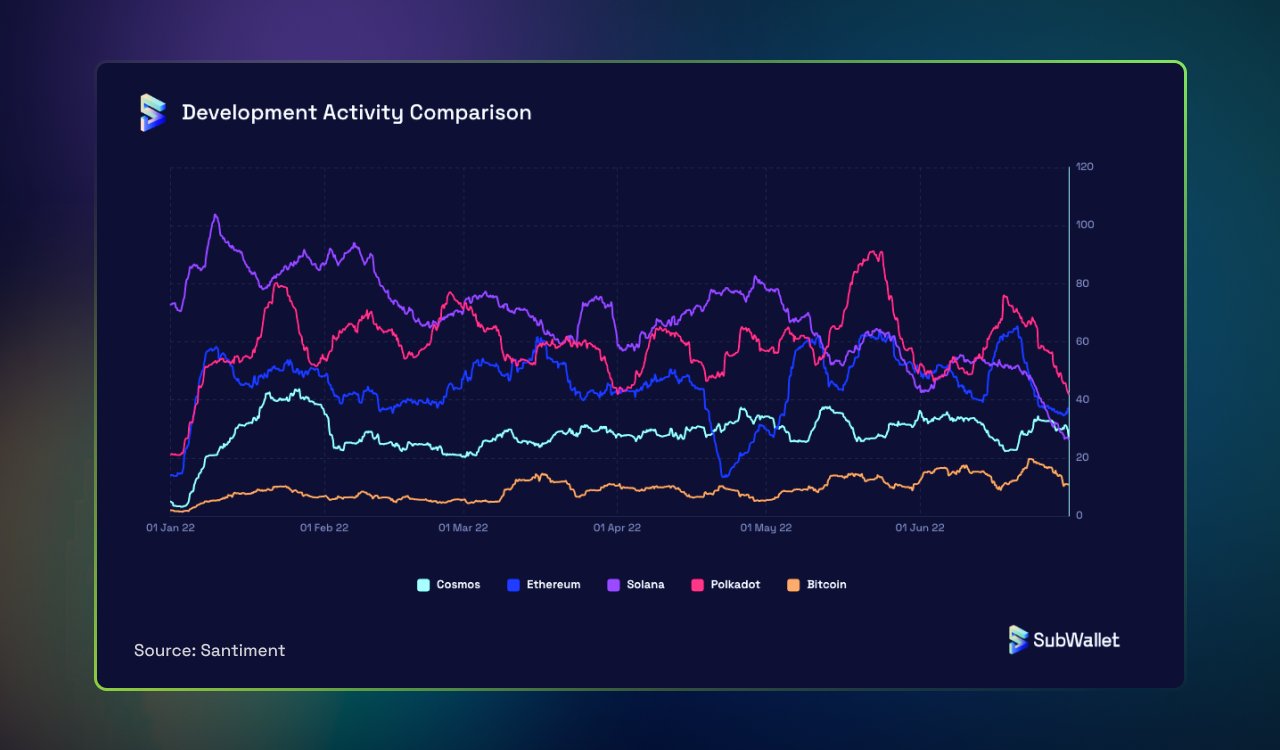

Equally, developer exercise has been constructive for Polkadot too. In Might and June, as an illustration, it had the best dev depend. Over the course of 2022, the identical for Polkadot has been second solely to Solana.

Supply: SubWallet

Understandably, the market capitalization of Polkadot additionally mirrored the sentiment of the market. 2021 remained a blessed 12 months for cryptocurrency, with its market cap hovering to almost $45 billion in mid-Might. Nevertheless, the mayhem of the second quarter of 2022 crippled the Polkadot ecosystem.

Polkadot’s 2025 predictions

We should first perceive that the predictions of various analysts and platforms can extensively range and predictions can most of the time be confirmed fallacious. Completely different analysts deal with totally different units of metrics to reach at their conclusions and none of them can predict unexpected political-economic components impacting the market. Now that we’ve understood this, let’s take a look at how totally different analysts predict the way forward for Polkadot in 2025.

LongForecast predicts that DOT will open in 2025 with a worth of $10.76 and can fall right down to $9.38 by the tip of March. Actually, the predictions platform additionally projected a 2025-high of over $13.5 on the charts.

The likes of Changelly, nonetheless, have been slightly extra optimistic of their projections. Actually, it argued that DOT will go as excessive as $39.85 on the charts, with the altcoin accruing a possible ROI of over 370%.

Equally, South Africa’s Capex noticed that as DOT attracts extra consideration and generates optimism out there, its worth will rise in the long run. Consultants predict that DOT’s worth will hit $10 by the tip of 2022. It’s also predicted {that a} new bull market may arrive and push DOT’s worth to $15. The typical DOT worth in 2025, it argued, will sit at $15.82.

A Bloomberg information story published earlier this 12 months revealed that in response to a Crypto Carbon Rankings Institute research, Polkadot has the bottom whole electrical energy consumption and whole carbon emissions per 12 months of the six so-called proof-of-stake blockchains. Actually, it solely consumes 6.6 occasions the annual electrical energy consumption of a median American family.

Given the high-decibel conversations across the vitality utilization of cryptocurrencies, Polkadot’s vitality effectivity is prone to appeal to the eye of consumers.

Polkadot’s 2030 predictions

The aforementioned Changelly weblog submit argued that as per consultants, Polkadot will likely be traded for not less than $210.45 in 2030, with its most doable worth being $247.46. Its common worth in 2030 will likely be $218.02, it added.

In response to Telegaon, then again, DOT’s worth in 2030 can go as excessive as $140.15 and as little as $121.79.

Capex additionally noticed that as per fintech consultants, DOT’s worth is prone to improve steadily in 2030. It might simply climb as excessive as $35, it predicted.

Right here, it’s price highlighting that predicting a market 8 years down the road is tough. Ergo, buyers ought to conduct their very own analysis earlier than investing and be cautious of caveats connected to common projections. Particularly since proper now, regardless of DOT’s latest rallies, the technicals for the altcoin aren’t all bullish. Actually, security first is perhaps the most suitable choice proper now.

Supply: TradingView

The Concern and Greed Index was flashing a ‘Greed’ sign at press time.

Supply: CFGI.io

Conclusion

Though DOT has witnessed bullish runs at intervals, its worth motion stays very unpredictable. Although its announcement of it not being safety elicited a constructive market reception, it didn’t final lengthy as a result of ongoing squabble concerning FTX. Traders ought to be alert for any sudden adjustments in angle, although the market continues to be unpredictable.

Compared to different blockchains, Polkadot presents extra energy to its token holders, such because the roles of nominators, collators, and fishermen, in addition to that of validators. Briefly, DOT holders cannot solely mine the foreign money however be energetic members within the blockchain in different capacities as properly. This function places Polkadot above different PoS blockchains within the race.

Over time, Polkadot has attracted investments from a lot of enterprise organizations akin to Arrington ARP Capital, BlockAsset Ventures, Blockchain Capital, and CoinFund. At one time limit, even Three Arrows Capital had additionally invested a big quantity within the enterprise.

An formidable enterprise, Polkadot intends to compete with Ethereum. Although its interoperability has the potential to draw a variety of initiatives, solely a small variety of them have come aboard the community. However the fame of Ethereum, Polkadot is a comparatively new enterprise and might carry out higher in upcoming years given it is ready to appeal to bigger initiatives. Its effectivity and scalability ought to come in useful on this endeavor.

Polkadot limits the variety of parachains it may well help to round 100. Because the provide is proscribed, parachains are allotted by public sale, governance system, or parachains.

Solely lately, the Kylin community became the winner of the twenty fifth parachain public sale on the Polkadot community, making an enormous stride within the route of Internet 3.0 and DeFi improvement. Kylin received the supply with a bid of round 150,000 DOT.

The Web3 Basis even in the present day makes use of the proceeds from the sale of DOT tokens to help initiatives and initiatives being constructed on the Polkadot community. This basis is ruled by the Basis Council, consisting of Dr. Gavin Wooden, Founder-President, Vice President Dr. Aeron Buchanan and Reto Trinkler. The help supplied to the community by such a reputed group speaks volumes concerning the belief put in the way forward for the Polkadot blockchain community.

Solely lately, Web3 Basis, in affiliation with the web training platform edX, launched a course on cryptocurrency, Web3, blockchain know-how, and Polkadot. “It’s extraordinarily essential that we proceed to supply key information across the fundamentals of each Web3 know-how and the Polkadot community to assist information the subsequent era of gifted builders, builders, and entrepreneurs within the blockchain sector,” mentioned Bertrand Perez, CEO of Web3 Basis.

The Web3 Basis, which helps the Polkadot protocol, has once more introduced its argument that its native DOT token is just not a safety. In a Twitter thread, the Basis emphasised its efforts to adjust to U.S. securities legal guidelines, in addition to Securities and Trade Fee steerage on digital belongings, and declared that DOT had efficiently “morphed” and is software program, not a safety.

Just a few days again, the KILT Protocol created historical past by turning into the primary parachain to perform a full migration from the Kusama Relay Chain to the Polkadot Relay Chain. In circumstances the place the soundness and bank-level safety of Polkadot is integral to a parachain’s final design and function, Kusama could be very helpful as an preliminary improvement surroundings that presents an improve path to Polkadot.

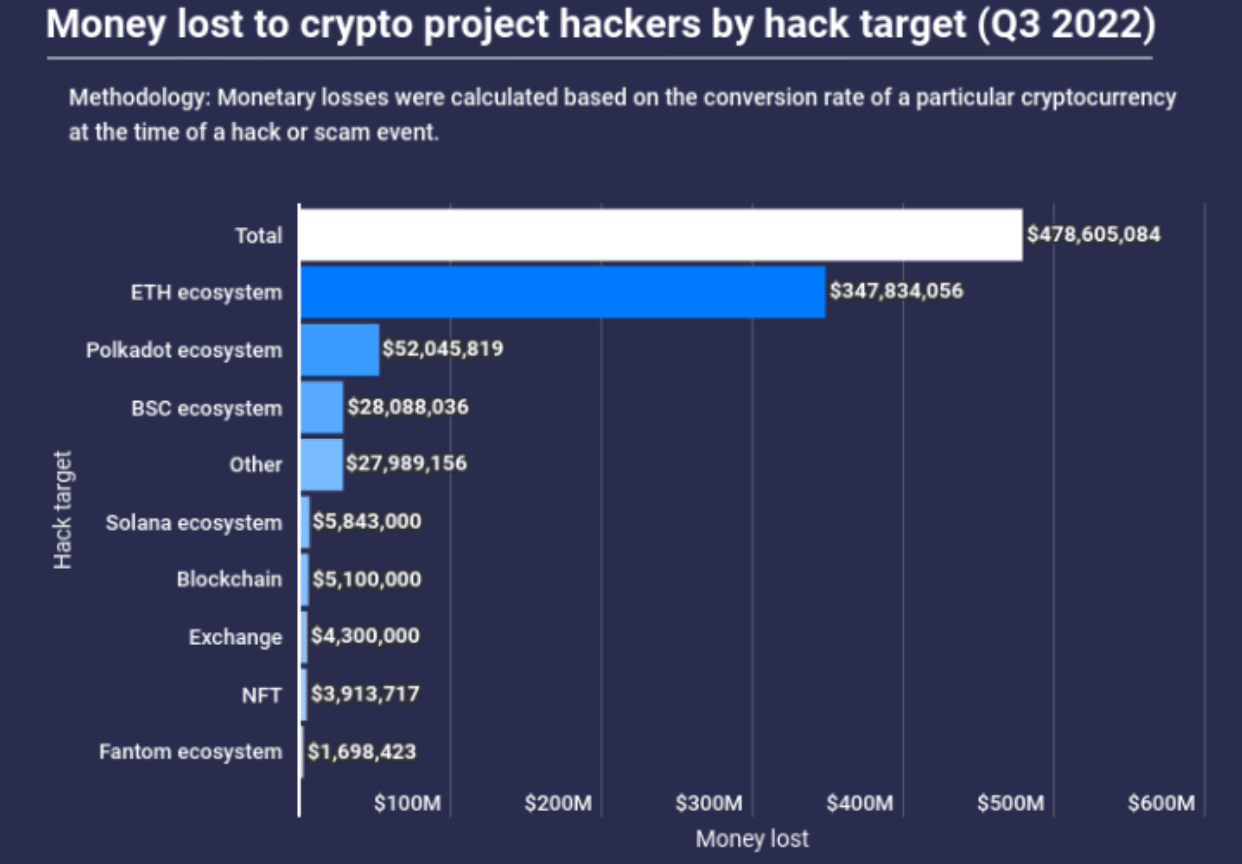

Safety on the Polkadot ecosystem stays a priority for buyers. A blockchain safety agency named Slowmist lately printed a discovering that over $52 million price of cryptocurrency was hacked over the Polkadot ecosystem in Q3 2022.

“In case you are new to the [cryptocurrency] house, it’s important to make investments your time studying and investigating the initiatives you have an interest in,” Hammoud advised. “Do not forget that the house is younger, and there are lots of alternatives to be taught and make the proper funding choices.”

Supply: Slowmist

It should be reiterated, nonetheless, that predictions aren’t set in stone and due warning ought to be taken by buyers earlier than investing out there.

Traders stay involved concerning the safety of the Polkadot ecosystem. Slowmist, a blockchain safety agency, lately revealed that over $52 million in cryptocurrency was hacked within the Polkadot ecosystem within the third quarter of 2022.

Polkadot (DOT) bulls had been in a position to pounce and invalidate the development after a bearish dominance. Its worth has elevated by 6% within the final two days. The development signifies that market volatility is rising. Because the market worth fluctuates towards the highest vary, this market temper is prone to persist.

Polkadot (DOT) posted its weekly roundup earlier this week, which talked about all of the notable developments that occurred in its ecosystem over the last seven days. The developments weren’t solely confined to Polkadot but additionally included updates for its parachains and different networks.

Polkadot Insider lately shared on Twitter that the community remained on the highest of the Nakamoto Coefficient hierarchy. On the time of writing, Polkadot was far above Avalanche [AVAX], Solana [SOL] and Cosmos [ATOM]. A excessive Nakamoto Coefficient gives safety for crypto networks in opposition to manipulation. With the Coefficient at 62, it meant Polkadot validators had been actively guaranteeing full blockchain functionally whereas obstructing community compromise.