NFT

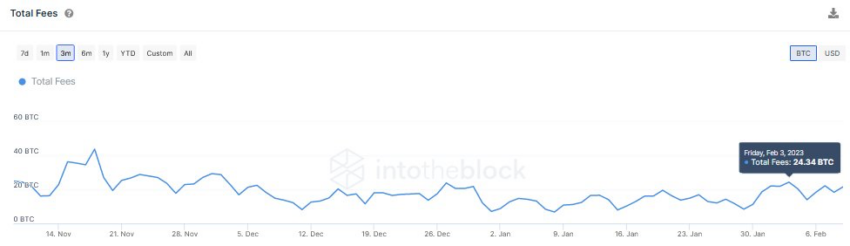

Ordinals NFTs have pushed transaction charges on the Bitcoin community to the very best ranges since November 2022, reveals on-chain information from IntoTheBlock.

Transaction charges on the Bitcoin community have doubled up to now two weeks, going from $0.77 on January 29 to a excessive of $1.95 on February 10. The blockchain’s median transaction charge has additionally elevated to $0.73 from $0.25 on January 30. CryptoQuant additionally famous that Ordinals NFTs transactions had elevated community exercise to Might 2021 ranges when China banned crypto.

Supply: IntoTheBlock

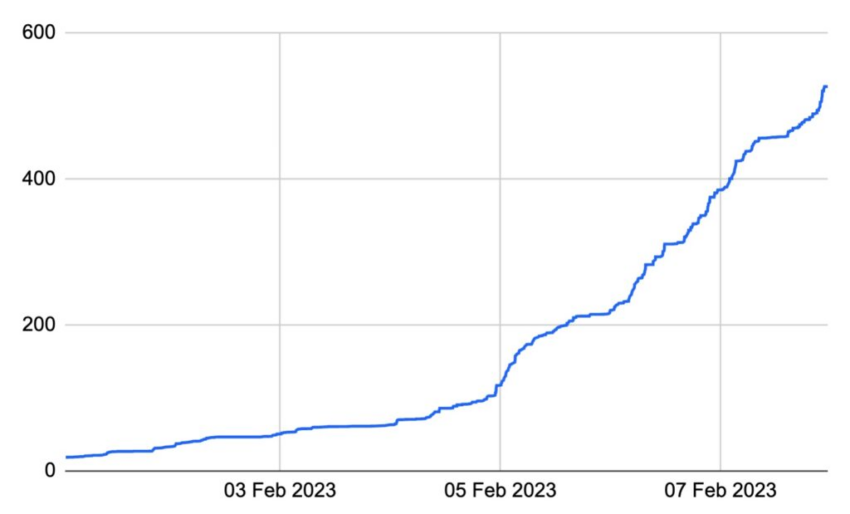

Ordinals NFTs Recognition Soars

The rise in Bitcoin community charges coincides with the elevated curiosity in Ordinals NFTs. A latest report by BitMEX Analysis revealed that over 10,000 NFTs had been minted between December 14 and February 7. Throughout this era, Ordinals NFTs have taken up 526 megabytes (MB) of block area, with creators spending 6.77 BTC on Ordinals-related transactions.

Supply: BitMex Analysis

Curiosity within the NFTs has additionally seen their worth rise to new highs. NFT Now reported that a few of these NFTs had been bought for as excessive as 11 BTC because of the skyrocketing demand.

Nonetheless, not everyone seems to be happy with the expansion of NFTs on the Bitcoin community. One such critic is lightning community developer Rene Pickhardt. Pickhardt believes persons are “squandering precious block area by spamming jpegs.”

Pickhardt’s remarks can’t be ignored as a result of Ordinals NFTs have consumed over 70% of Bitcoin’s complete blockspace regardless of solely accounting for about 3% of the entire transactions, based on BitMEX analysis.

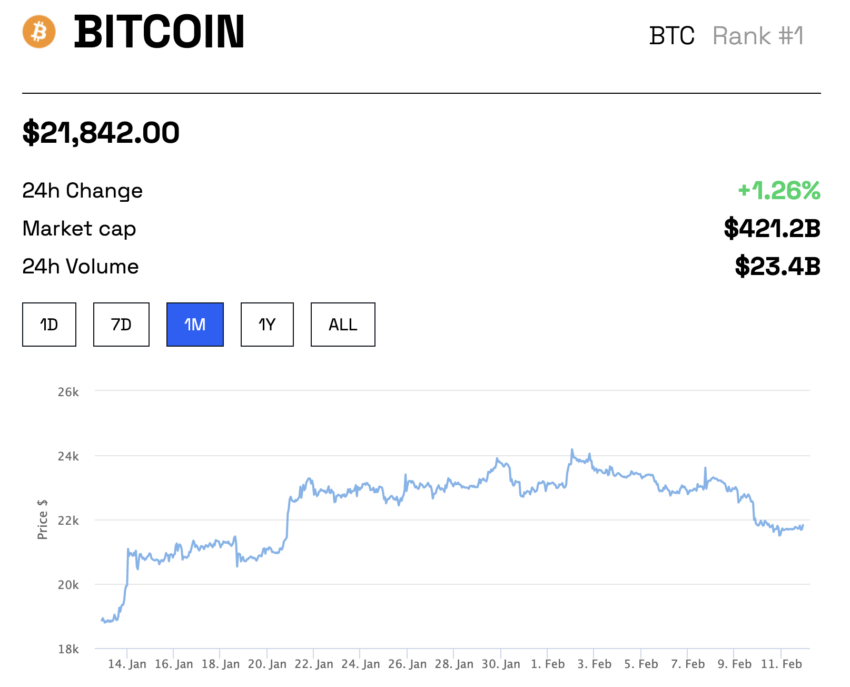

Bitcoin (BTC) Worth Falls Beneath $22,000

Regardless of the rising curiosity in Bitcoin Ordinals NFTs, BTC value dipped under $22,000 after buying and selling at a excessive of $24,300 on February 2. The 12% nosedive coincides with the US Securities and Alternate Fee’s (SEC) enforcement motion in opposition to the crypto alternate Kraken.

Supply: BeInCrypto

BeInCrypto’s International Head of Information, Ali Martinez, identified {that a} spike in shopping for stress adopted the latest value correction. Martinez affirmed that merchants on Binance Futures seem to have purchased the dip. Roughly 62% of all accounts on Binance Futures with an open BTC place had been going lengthy.