Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- APT was strongly bullish throughout increased and decrease timeframe charts by press time.

- Bulls might goal the provision zone at $20 in the event that they clear key obstacles.

Aptos’ [APT] market construction has positioned buyers in a tough place. The weekly chart shaped a bullish flag that might supply additional good points. Nonetheless, the each day chart confronted essential obstacles that should be cleared earlier than buyers might take pleasure in extra income.

Learn Aptos’ [APT] Worth Prediction 2023-24

The $20 provide zone: Is it reachable?

Supply: APT/USDT on TradingView

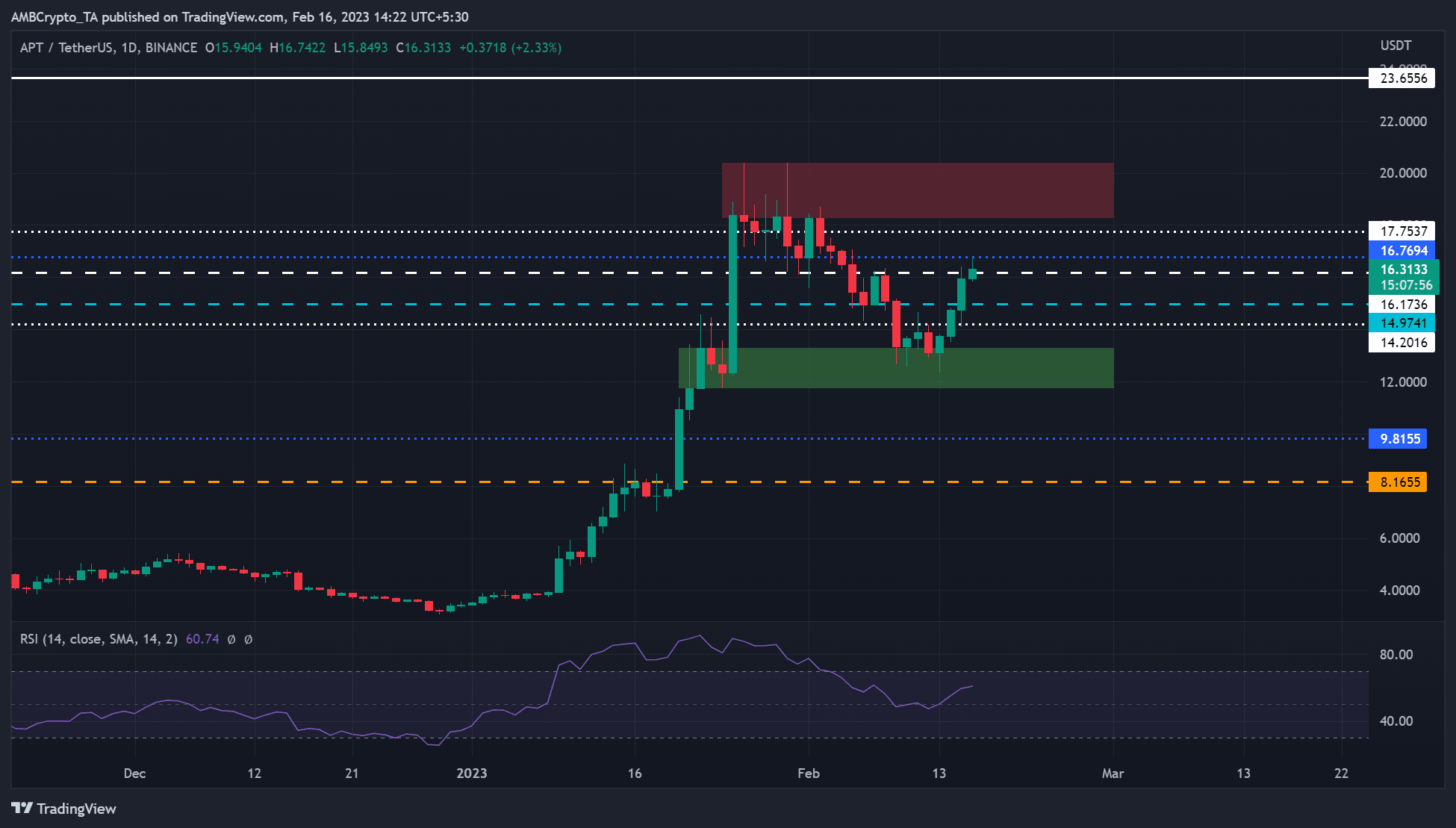

APT confronted a number of worth rejections within the $20 zone between mid-January and early February. The final worth motion within the zone ended up in a bearish order block that set APT right into a correction. It plunged over 25% earlier than hitting a crucial demand zone (inexperienced).

Because of this, the $20 zone grew to become a crucial promote stress zone on the each day chart. Apparently, APT’s market construction was bullish on weekly, each day, and decrease timeframe charts at press time. Notably, it chalked a bullish flag on the weekly chart, indicating APT might hit $23.66 if bulls overcome the promote stress zone. That will be one other 25% hike within the subsequent few weeks or months.

Nonetheless, the bulls should clear the obstacles at $16.1736, $16.7694, and $17.7537 to succeed in the $20 provide zone. Weak fingers might money out at these ranges, however diamond fingers might purpose on the $20 zone or $23.66.

The above bullish bias will probably be invalidated if APT breaks beneath the demand zone of $12.000. Bulls might place cease losses for lengthy entry positions beneath $12.000. However such a downswing might purpose on the bearish goal of $8.1655. The downtrend might supply shorting alternatives at $9.8155.

How a lot are 1,10,100 APTs value at this time?

APT’s Open Rate of interest elevated

Supply: Coinglass

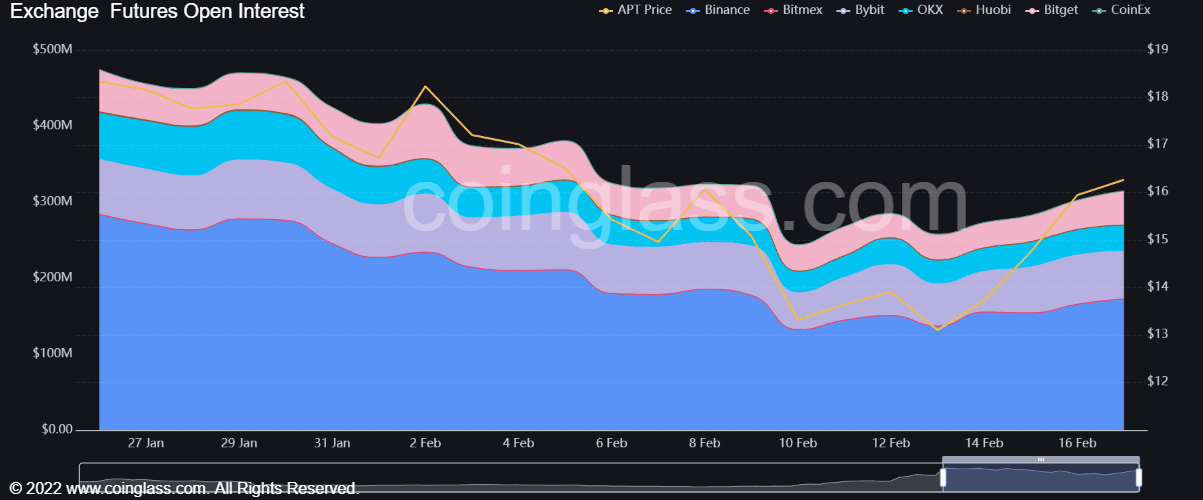

APT’s open rate of interest (OI) declined step by step from the top of January, solely to rebound on 13 February. The surge in OI on 13 February coincided with APT’s retest on the demand zone as a help, giving bulls the inexperienced mild to launch a restoration.

The underlying bullish sentiment, as seen by the surge in OI, might enhance APT to focus on the provision zone. Nonetheless, a drop in OI might sign a drop in demand and bearish sentiment, which might derail bulls’ efforts to succeed in the $20 provide zone.

![Aptos [APT]: Bulls focus on key supply zone, but there are crucial hurdles ahead](https://ambcrypto.com/wp-content/uploads/2023/02/brad-west-SHDCQ1l2WD0-unsplash-1000x600.jpg)