- Lido sees enhancements in lots of areas.

- Costs of LDO and Lido’s APR fell.

Lido [LDO] has been dominating the DeFi house for some time. Over the past week, it even furthered the enhancements on its protocol in a number of areas. Nevertheless, its declining APR could trigger bother for the protocol sooner or later.

Is your portfolio inexperienced? Try the Lido Revenue Calculator

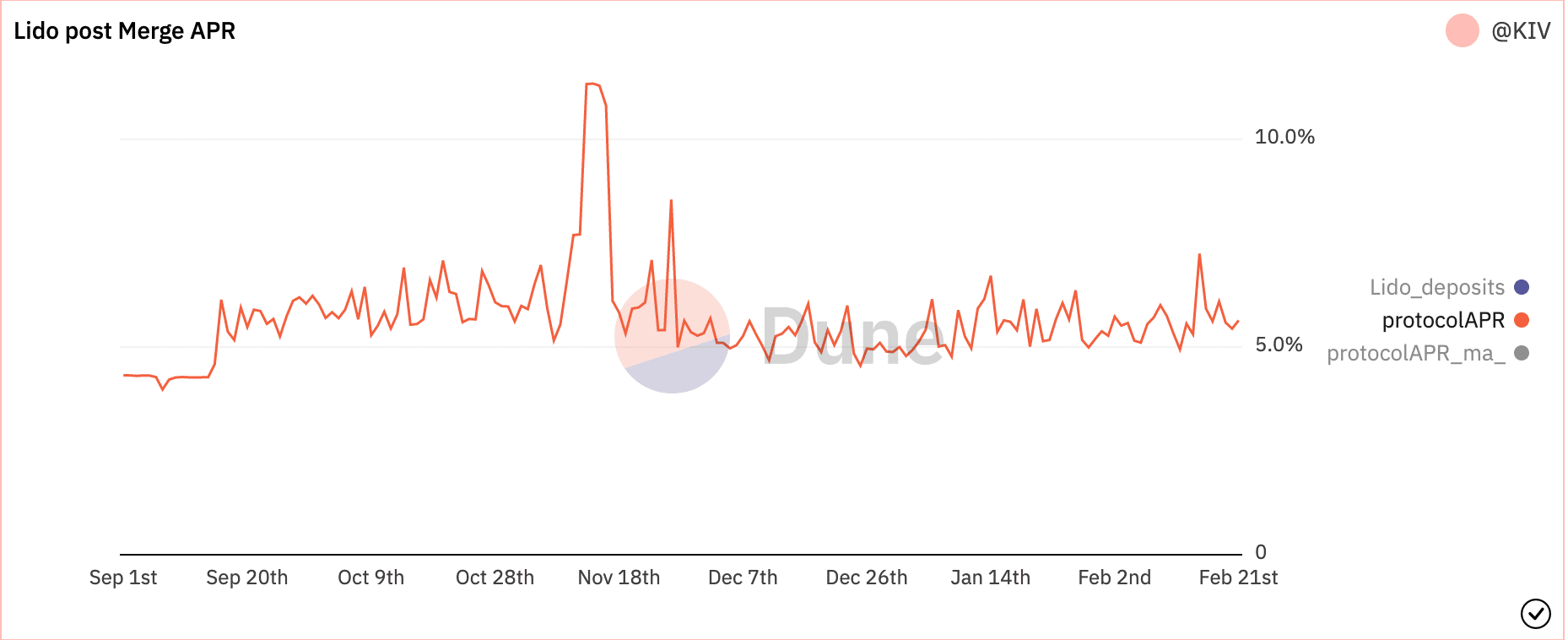

In response to Dune Analytics’ knowledge, the general APR generated by Lido for its customers has fallen from 7.2% to five.6% over the previous few weeks. A decline in APR may incentivize the customers of the protocol to hunt different alternate options to stake their ETH.

Supply: Dune Analytics

Lido stays unaffected

Regardless of this decline in APR, the Lido protocol has seen progress. By way of TVL, the Lido protocol noticed a surge of 11.89%. One cause cited for the spike in TVL was the surge of Ethereum’s [ETH] value during the last week.

Together with Lido’s TVL, the variety of deposits on the community additionally witnessed progress. In response to Lido’s knowledge, Lido has a 44.8% share in weekly new ETH deposits. However it isn’t simply ETH deposits the place Lido confirmed enhancements. The variety of Wrapped stETH [wstETH] on each lending swimming pools and L2 options additionally grew over the past week.

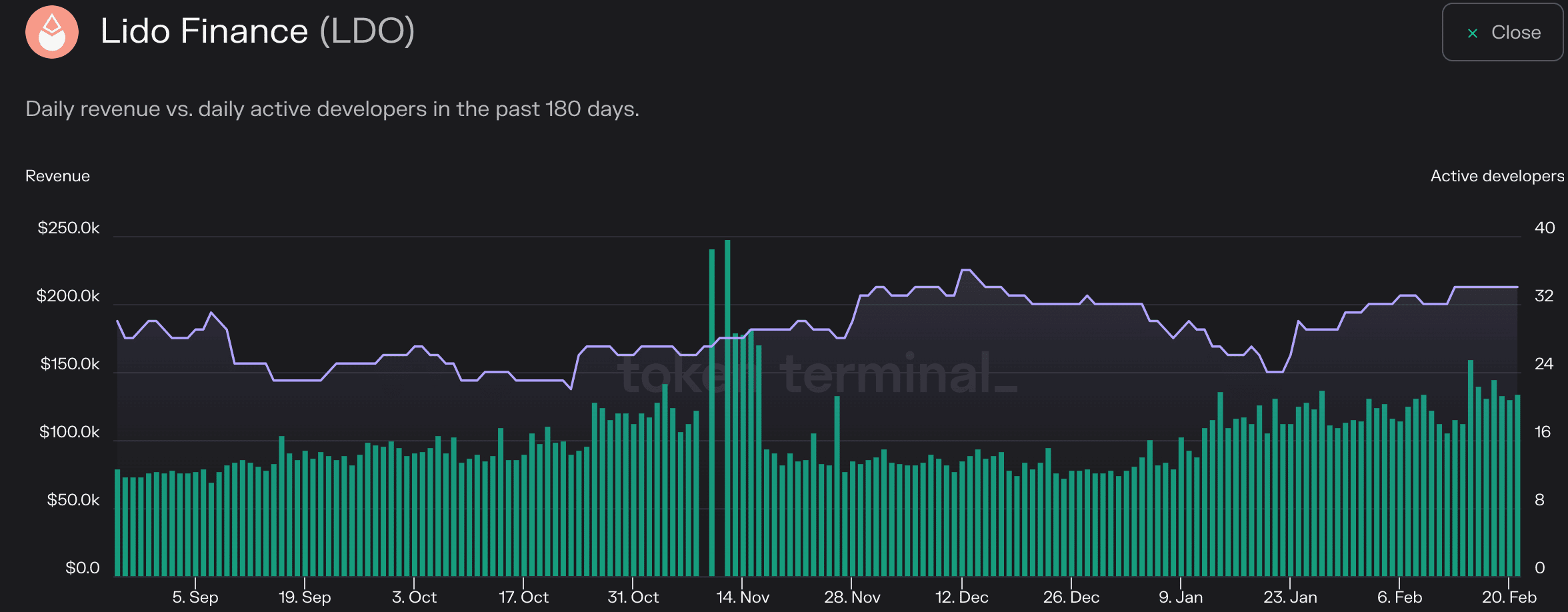

These developments aided Lido in producing much more income. In response to Token Terminal, the income generated by Lido elevated by 30.7% during the last month. It appeared that this income that was being generated by Lido was being put to good use. This was showcased by the growing variety of energetic builders on the Lido protocol.

A excessive variety of energetic builders on the protocol steered that the variety of contributions being made to Lido’s staff to its GitHub had elevated. This surge in growth exercise may counsel future upgrades and updates to the Lido community.

Supply: token terminal

Not all excellent news

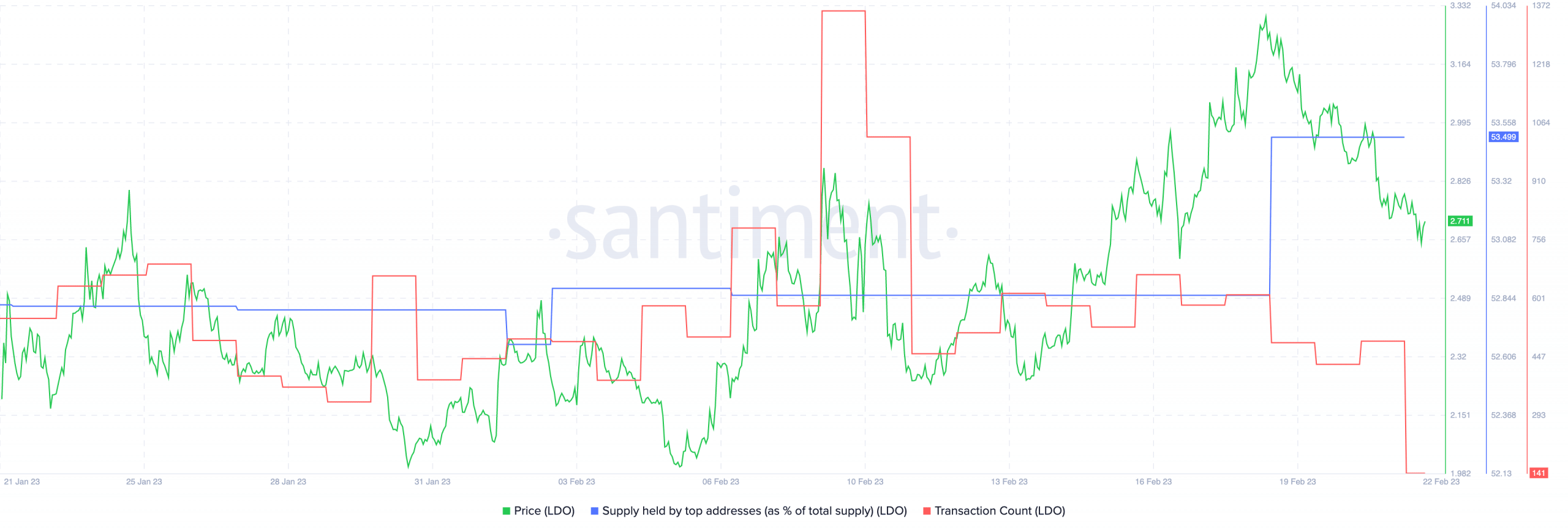

No matter these developments, LDO’s costs declined.

Life like or not, right here’s LDO market cap in BTC’s phrases

Nevertheless, despite the fact that the costs fell, it didn’t discourage whales from shopping for the LDO token. This was indicated by the rising proportion of huge addresses holding the LDO token. Nevertheless, over the past week, the transaction rely of LDO fell. This implied that developer exercise had declined over the previous week.

Supply: Santiment

Despite the fact that the APR of Lido has declined, its protocol has continued to indicate enhancements. And regardless of LDO’s costs falling, many whales continued to indicate curiosity within the token. It’s but to be seen if Lido may maintain curiosity in its protocol and overcome the challenges it confronted.

![Can Lido [LDO] maintain its dominance despite declining APR?](https://ambcrypto.com/wp-content/uploads/2023/02/ciro-di-lauro-eylnE68kyZ8-unsplash-1000x600.jpg)