- Lido Finance data its largest-ever every day ETH stake influx.

- LDO at present suffers from patrons’ exhaustion.

In a tweet printed on 25 February, main liquid Ethereum (ETH) staking platform Lido Finance [LDO] confirmed that it recorded its largest every day stake influx with over 150,000 ETH staked.

Lido protocol has registered its largest every day stake influx thus far with over 150,000 ETH staked. 🎉

Upon reaching this quantity, a curious (however necessary) protocol security characteristic referred to as Staking Charge Restrict was activated.

Right here’s the way it works🧵👇 pic.twitter.com/ngBtWz7q18

— Lido (@LidoFinance) February 25, 2023

On-chain analytics Lookonchain platform discovered that the stated 150,000 ether tokens had been staked by Tron founder Justin Solar.

Within the early hours of 26 February, Solar staked a further 10,000 ETH, bringing his complete staked ETH portfolio to 200,100 ETH, value round $320 million.

Justin Solar staked 10,000 $ETH($16M) on @LidoFinance once more simply now.

He at present staked 200,100 $ETH ($320M).

And he acquired an earnings of 18.68 $ ETH inside 24 hours, the APY is ~3.6%.https://t.co/oZxE8KpjHy pic.twitter.com/OSFlkIUOGM

— Lookonchain (@lookonchain) February 26, 2023

In accordance with Lido Finance, the surge in staked ETH in a single-day commerce led to the activation of the protocol’s security characteristic referred to as the Staking Charge Restrict.

The Staking Rate Limit is employed on Lido as a dynamic mechanism to make sure the protocol’s security and stop rewards dilution attributable to giant inflows of stake.

Primarily based on current deposits, this mechanism decreases the full quantity of stETH that may be minted at any given time utilizing a sliding 24-hour window.

Is your portfolio inexperienced? Take a look at the LDO Revenue Calculator

The protocol capability is replenished on a block-by-block foundation, with a restoration charge of round 6,200 ETH per hour. The restrict applies to all events making an attempt to mint stETH, regardless of the tactic employed.

State of ETH staking on Lido

Per information from Dune Analytics, 5.35 million ETH tokens have been staked by way of Lido Finance, bringing its share of the ETH-staking market to 29%.

With the Shanghai Improve scheduled to happen in a couple of weeks, these previous few months have seen a surge within the creation of recent liquid ETH staking protocols, resulting in a gradual drop in Lido’s market share.

To offer context, Lido Finance held 32% of all staked ETH as of Could 2022. Nevertheless, with centralized staking platforms resembling Coinbase providing greater Annual Share Charges (APR) to liquidity suppliers, these platforms witnessed a surge in ETH staking.

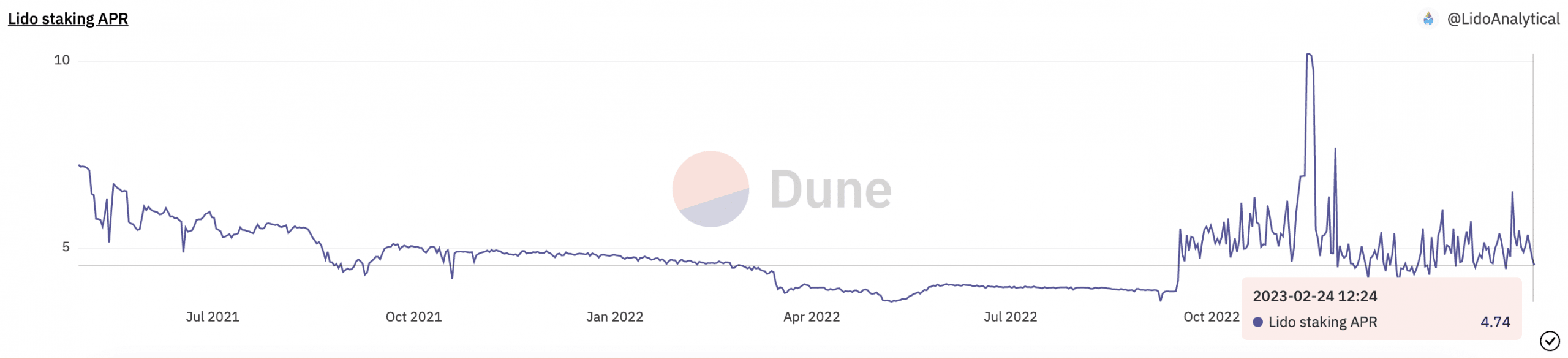

As for staking APR on Lido, it was pegged at 4.74% at press time. It peaked at a excessive of 10.20% final November and has since been on a downward pattern.

Supply: Dune Analytics

How a lot are 1,10,100 LDOs value in the present day?

LDO within the final 24 hours

At press time, LDO exchanged fingers at $3, with its worth spiking by 10% within the final 24 hours. Nevertheless, whereas LDO’s worth rallied, buying and selling quantity declined by 19% throughout the identical interval, per information from CoinMarketCap.

Worth/buying and selling quantity divergence of this type is normally frequent in a market the place patrons are present process exhaustion. This urged {that a} potential reversal in LDO’s worth was imminent if the liquidity wanted to drive up its worth fails to enter the market.