- Binance Chain’s day by day transactions recorded a year-to-date development of 229%.

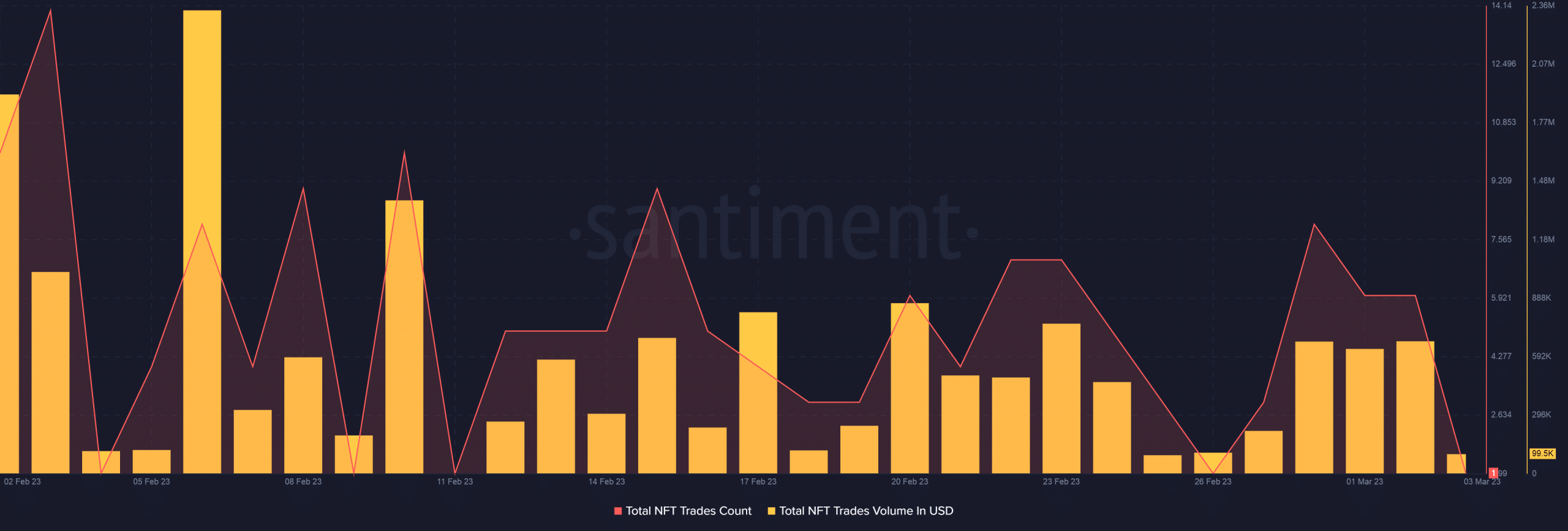

- The community’s NFT buying and selling quantity declined sharply in February.

Binance Chain [BNB] recorded a giant bounce in its day by day transaction quantity over the week, rising from 3.5 million to over 5 million on the time of writing.

Whereas this amounted to a virtually 47% rise, a more in-depth take a look at the information revealed that the chain’s year-to-date (YTD) development was additionally spectacular. BNB chain’s complete transactions have greater than doubled because the begin of 2023.

One thing is going on on BSC. Each day transactions are all of a sudden up from 3.5M earlier this week to over 5M at this time. pic.twitter.com/b7GVzkjD9u

— Patrick | Dynamo DeFi (@Dynamo_Patrick) March 3, 2023

Moreover, the Binance chain registered a 50% development in its day by day energetic customers (DAUs) because the begin of the week, in keeping with Token Terminal.

Because of the improve within the variety of DAUs, the protocol’s transaction charges additionally expanded by 21% in the identical time interval.

Supply: Token Terminal

Learn Binance Coin’s [BNB] Value Prediction 2023-24

It’s a flop present on DeFi, NFT entrance!

The expansion in community adoption might be resulting from some big-ticket launches in its NFT vertical. On 1 March, a platform named Bicassso was unveiled by Binance, which might mix synthetic intelligence (AI) and non-fungible token (NFT) know-how.

Nonetheless, knowledge from Santiment narrated a special story. Barring the short-term upticks at completely different intervals, the whole NFT buying and selling quantity has plunged 67% from the height of 6 February till 2 March.

Supply: Santiment

BNB Chain’s efficiency on the DeFi entrance additionally left so much to be desired. The overall worth locked (TVL) declined by 12% over the past three weeks and dipped properly under $7 billion.

Supply: DeFiLlama

Is your portfolio inexperienced? Verify the Binance Coin Revenue Calculator

Is BNB heading towards losses?

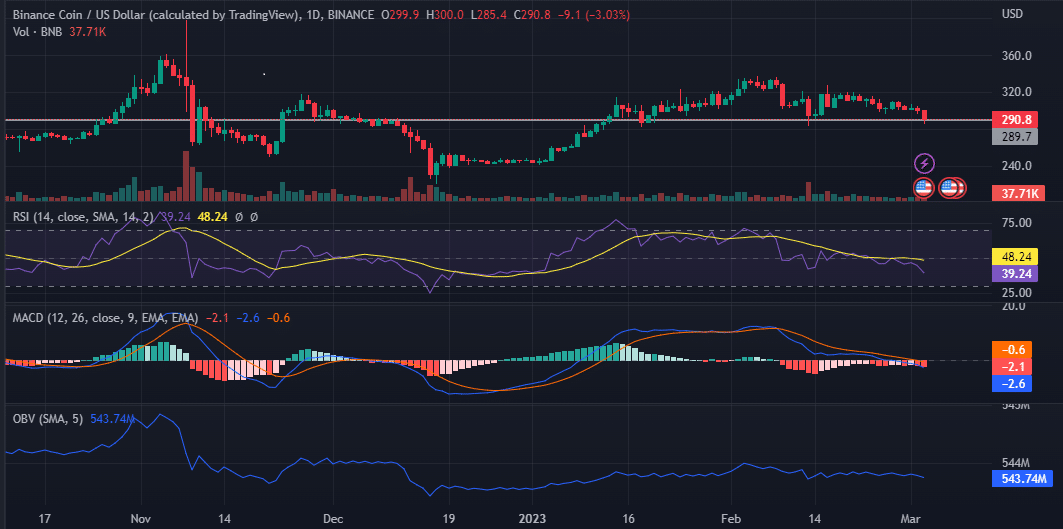

Binance Coin has shed greater than 6% of its worth within the final week and was down 2.7% within the final 24 hours, as per knowledge from CoinMarketCap.

The Relative Energy Index (RSI) fell sharply over the past 10 days and dipped under 40, on the time of writing. This indicated that BNB confronted elevated promoting strain and will sink additional.

The Shifting Common Convergence Divergence (MACD) instructed a bearish consequence for the coin as properly whereas the On Stability Quantity (OBV) confirmed a marginal drop.

These indicators sounded a warning alarm for BNB and the assist at $289 won’t maintain for good.

Supply: Buying and selling View BNB/USD