Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- TON is in an virtually impartial market construction throughout all timeframe charts

- TON’s correction retested a key worth space that might provide a robust rebound

For the reason that finish of January, The Open Community’s TON, has consolidated within the $2.2 – $2.6 vary. At press time, its value motion had retested a key worth space that might induce the market to a restoration. Nonetheless, a pullback retest on this key worth space may provide new shopping for alternatives and further positive factors if total market sentiment improves.

Is your portfolio inexperienced? Try TON Revenue Calculator

Can the important thing worth space of $2.3 enhance restoration?

Supply: TON/USDT on TradingView

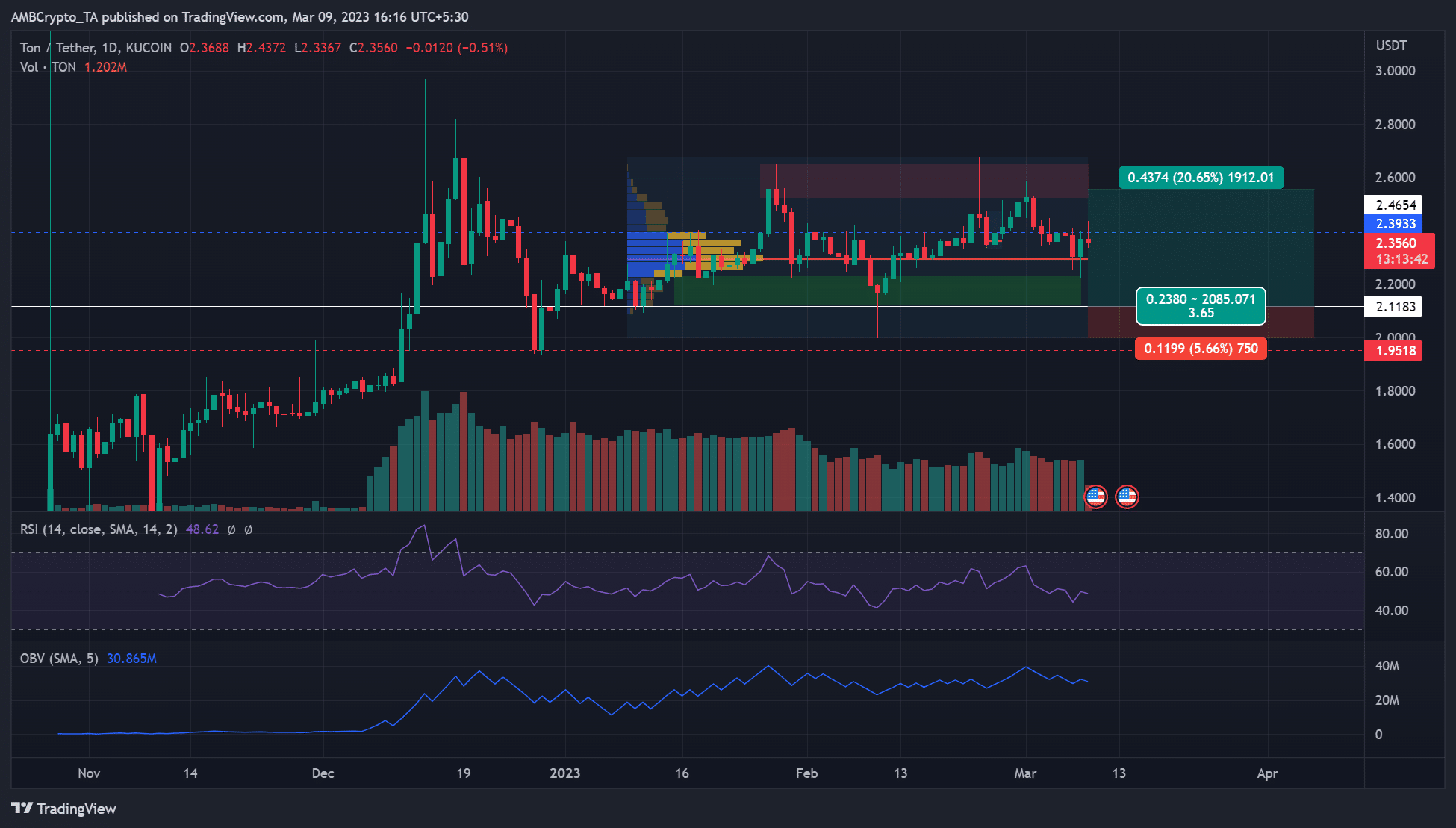

On the day by day chart, the worth rejection across the provide zone (pink) at $2.6 set TON right into a correction. At press time, TON had retested the demand zone (inexperienced) and the high-value node (HVN) of the Fastened Vary Worth Profile (FRVP). The FRPV’s level of management (POC), pink line, of $2.3 had the best traded quantity and will provide a robust restoration if pullback retests it.

Subsequently, bulls may get new shopping for alternatives at $2.3 if the pullback retests the POC of $2.3. Nonetheless, essentially the most best and secondary shopping for alternative can be a retest of the demand zone ($2.16 -$2.23). The goal can be the bearish order block of $2.6 within the provide zone – A 20% potential hike with a risk-to-reward (RR) ratio of 1:4.

A break under the demand zone degree of $2.1183 will invalidate the aforementioned bullish thesis. Such a downswing may provide shorting alternative at $1.9518.

The RSI (Relative Power Index) gave the impression to be hovering close to the impartial line too. On the identical time, the OBV (On Stability Quantity) fluctuated, displaying a impartial construction that might prolong the worth consolidation if the development persists.

TON recorded a rising Imply Coin Age

Supply: Santiment

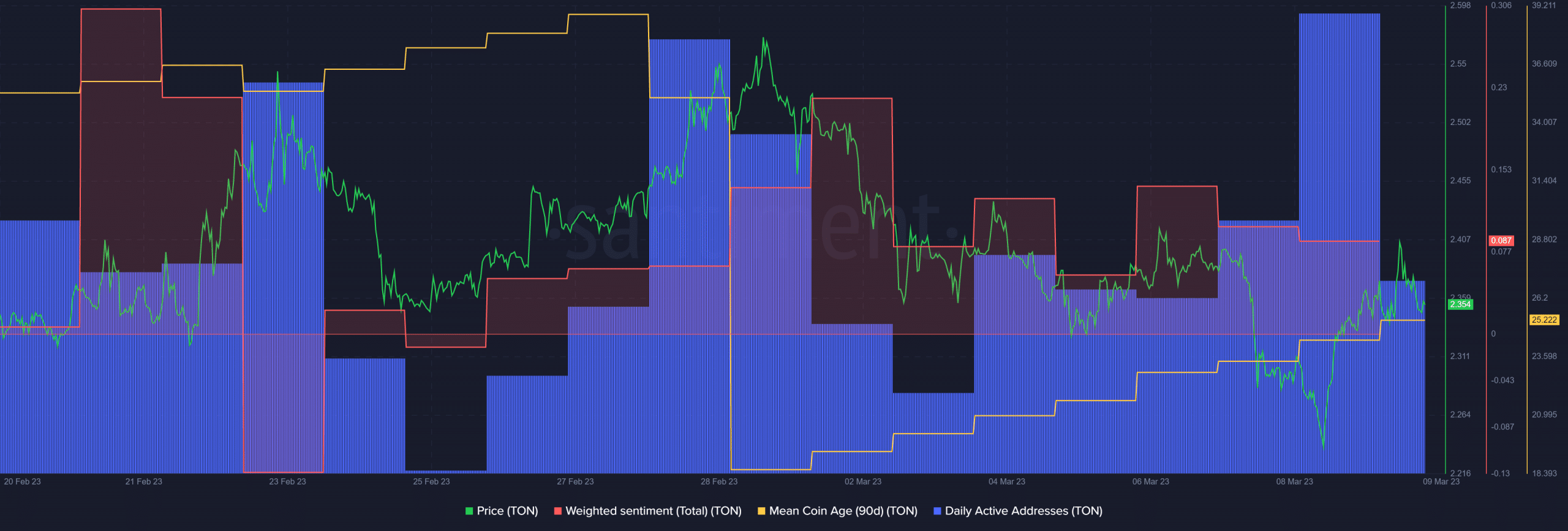

In line with Santiment, TON recorded a rising 90-day Imply Coin Age, underlining a wide-network accumulation of tokens. It highlights a excessive likelihood of a bullish rally, one which may see TON pump in the direction of the availability zone.

How a lot is 1,10,100 TONs price in the present day?

Moreover, the weighted sentiment was constructive, displaying buyers had been bullish on the digital asset. Equally, TON registered a pointy hike in day by day energetic addresses. This might enhance the buying and selling volumes and shopping for stress in the long term.

Nonetheless, dismal job studies on March 10 may deepen the market’s bearish sentiment and push TON into an prolonged correction. Particularly if bulls fail to defend the demand zone.