In current months, the NFT sector noticed an enormous decline in gross sales and merchandise costs throughout the board. Nonetheless, the exercise within the NFT house continues to be excessive and it could be fallacious to say NFTs are lifeless, particularly if we consider the emergence of Blur as essentially the most lively NFT market, a greater than +100% improve in buying and selling quantity in February, and different indicators that present NFTs are right here to remain.

There was a rising debate in regards to the sustainability of the NFT market and whether or not it’s only a passing fad or a viable long-term funding. Some argue that NFTs are a bubble ready to burst, whereas others consider they’re right here to remain and can revolutionize the best way we take into consideration possession and authenticity within the digital world.

Associated: What are NFTs and the way do they work? Non-Fungible Tokens Defined

On this article, we are going to discover the present state of the NFT market, look at what may support the restoration, and attempt to reply the query on everybody’s thoughts: Are NFTs lifeless?

How we bought right here?

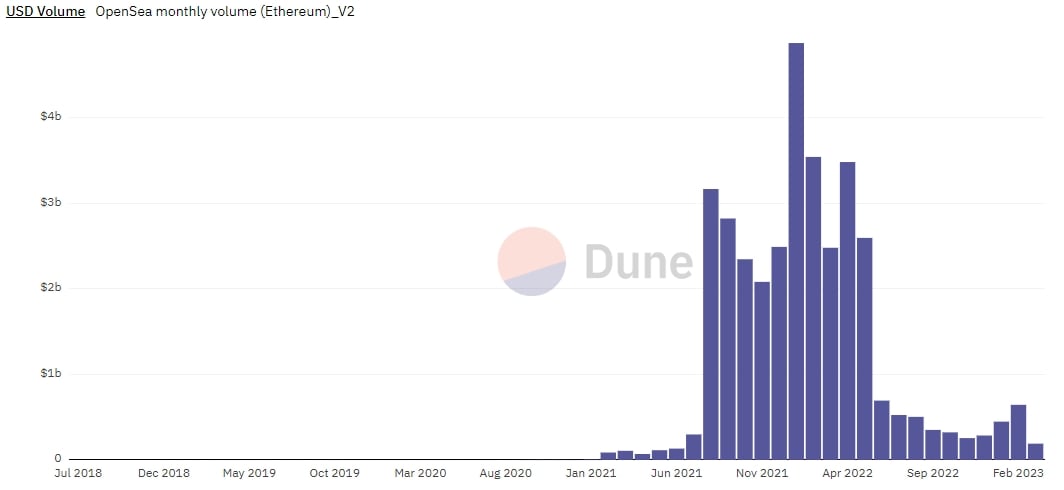

Final January, the world’s largest NFT market, OpenSea, recorded a whopping $4.87 billion in NFT buying and selling quantity. On the time, the hype surrounding NFTs was at an all-time excessive, with mainstream celebrities like Eminem and Jimmy Falon supporting Bored Ape Yacht Membership (BAYC) NFTs and different NFT tasks.

NFT quantity on OpenSea noticed an excessive decline following the $4.87 billion peak in Q1 2022. Supply

The market frenzy led to some NFTs reaching insane valuations, like Beeple’s digital photograph collage promoting for over $69 million and Pak’s “Clock” for $52 million. Now, roughly a yr later, the scenario is totally totally different, with no NFT promoting for 7 figures or extra previously month (the highest-selling NFT within the interval was Bored Ape Yacht Membership #5116, which bought for $693,000 value of ETH).

The most important cause for the decline was the broader crypto market decline that noticed Bitcoin, Ethereum, and most different digital belongings lose excessive double digits because the November 2021 peak. NFTs had been significantly onerous hit, as many individuals outdoors of crypto grew to become disillusioned with NFTs and noticed no concrete causes for the sky-high valuations ape NFTs and another tasks reached.

Additionally, many smaller tasks had been rug pulled by their creators, resulting in unfounded accusations of all NFTs being scams and never worthy of funding. All in all, a mix of a crypto bear market and plummeting NFT gross sales created a very bearish surroundings.

Nevertheless, with digital belongings exhibiting clear indicators of restoration not too long ago and Bitcoin reaching its nine-month excessive following encouraging inflation information, NFTs have additionally began trending in a optimistic route.

Are NFTs lifeless? A deep dive into NFT stats

Probably the most goal method to gauge the well being of the NFT sector is to take a look at numerous buying and selling information to see how a lot shopping for and promoting is going down on digital collectible marketplaces. This enables us to look at the present state of the NFT market and evaluate it to its historic efficiency.

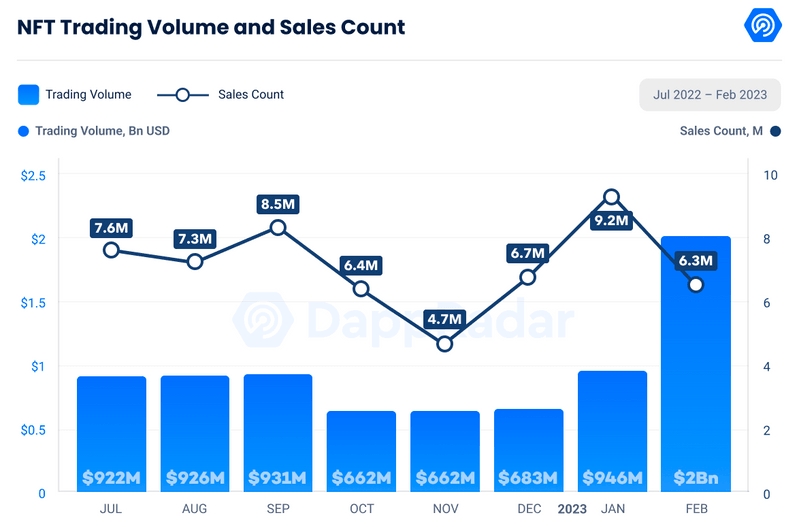

NFT buying and selling quantity greater than doubled to $2 bln in February

NFT buying and selling quantity spiked to $2 billion after failing to surpass $1 billion within the earlier 7 months. Supply: Dapp Radar

After months of declining buying and selling quantity, the pattern reversed in January, with a +38.5% improve from the month prior. The spike in buying and selling quantity was even bigger in February – it reached $2 billion, a +111% improve from the earlier month.

In keeping with NFT and DeFi analytics firm Dapp Radar, the rise was pushed by Blur, a brand new market that took the NFT storm by storm in current months. We’ll talk about Blur in additional element within the following part.

Apparently, the rise in buying and selling quantity in February got here regardless of a rise within the gross sales depend, which dropped from 9.2 million in January to six.3 million in February. That implies that the typical sale worth of a traded NFT elevated to account for the sizeable improve in buying and selling quantity.

In January 2022, a file $5.5 billion value of NFTs modified palms throughout OpenSea and different main marketplaces. Supply

Whereas the spike in February was undoubtedly spectacular, the entire buying and selling quantity continues to be a far cry from the file month recorded in January 2022, when over $5.5 billion value of NFTs had been traded throughout the most important NFT marketplaces.

Prime NFT chains: Ethereum leads the best way, Solana is second

When NFTs first began gaining reputation, Ethereum was principally the one viable chain for issuing and buying and selling NFTs. Nevertheless, the excessive price of transactions and low all through left many digital collectors and artists wishing for an answer that might be quicker and, most of all, cheaper.

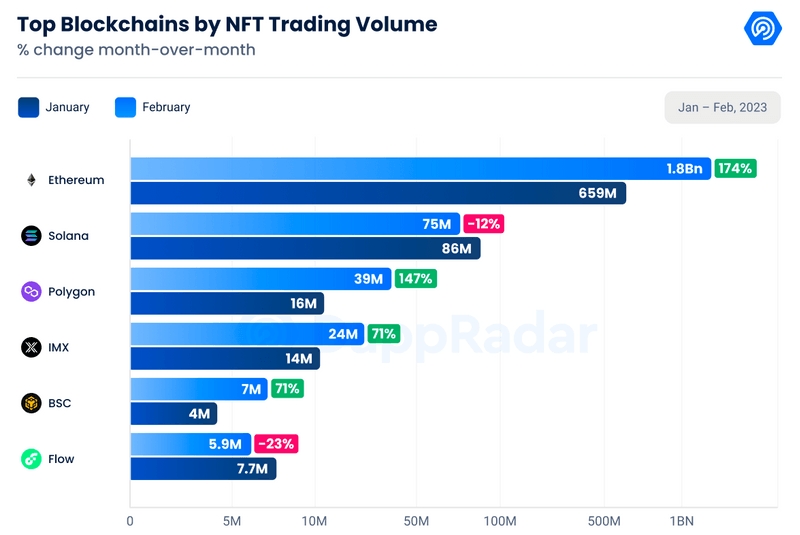

Ethereum has an insurmountable lead over different blockchains within the NFT house. Supply: Dapp Radar

A number of different chains emerged that accomplished that function, however no different as efficiently as Solana, which boasts one of many highest TPS within the business and transactions that price only a fraction of a penny (in comparison with Ethereum, the place the associated fee for a single transaction had averaged ~$40 between Jan. 2021 and Could 2022).

However, Ethereum is clearly nonetheless having fun with its first-mover benefit as Dapp Radar information exhibits that Ethereum accounted for $1.8 billion in buying and selling quantity in February. The second most lively chain was Solana, which accounted for $75 million. Regardless of the large hole between the 2, Magic Eden and different high Solana NFT marketplaces have been gaining in reputation not too long ago.

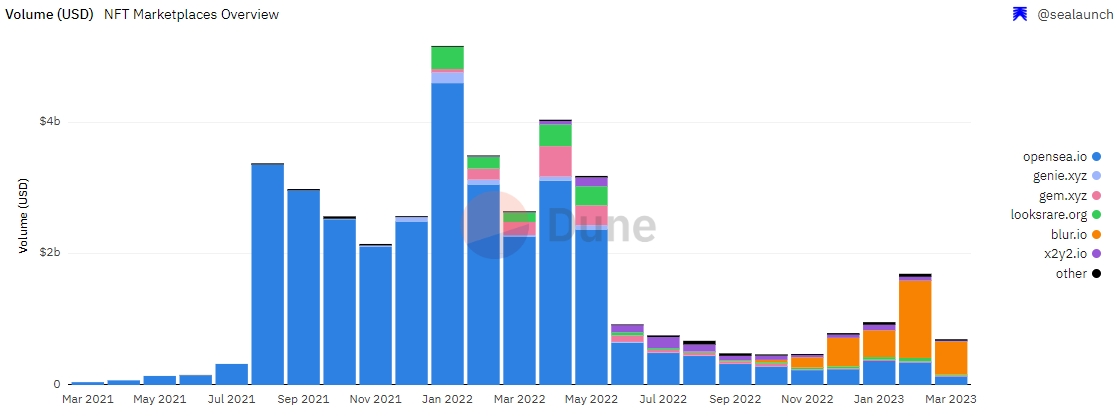

Blur overtakes OpenSea when it comes to buying and selling quantity

The Blur NFT market launched in mid-October 2022 and shortly began gaining traction amongst NFT collectors and merchants. Nevertheless, it wasn’t till February that {the marketplace} exploded in reputation, overtaking OpenSea as the most important NFT market within the meantime.

The explanation for the February surge was the airdrop occasion for the BLUR token. BLUR was airdropped to loyal Blur customers, that means that solely these customers who used the Blur market solely to checklist NFTs had been eligible to obtain the utmost airdrop quantity. That launched a transparent incentive for NFT customers to decide on Blur over OpenSea and different marketplaces that don’t have related incentive mechanisms in play.

Blur has emerged as the most important NFT market in current weeks. Supply

It’s onerous to estimate how massive of an influence the launch of BLUR had on the broader NFT market, however the rise in buying and selling quantity clearly coincided with the launch of the token.

Why NFTs may turn into extra standard sooner or later

Whereas NFTs are primarily identified for his or her use for costly profile footage, the potential of NFTs is much higher, as they can be utilized for quite a lot of functions throughout totally different sectors, together with digital artwork, music, video games, and extra. Listed below are a number of explanation why NFTs may get better and turn into extra standard sooner or later:

- Improvement of infrastructure: Because the know-how behind NFTs continues to enhance and turn into extra accessible, it may entice extra buyers and patrons to the market.

- Shortage: NFTs are distinctive and can’t be duplicated, which makes them inherently scarce. As extra folks need to personal a specific NFT, the worth may improve as a result of restricted provide.

- Diversification: NFTs provide a singular alternative to spend money on digital belongings, which is a comparatively new and unexplored space. As buyers search to diversify their portfolios, they might look to incorporate NFTs as a part of their funding technique.

- Rising adoption: NFTs have gained a whole lot of consideration lately as a result of rising curiosity in digital artwork and collectibles. Nevertheless, the gaming sector and different makes use of have remained comparatively untapped however may present an enormous increase to NFTs sooner or later.

- Rising acceptance: An increasing number of mainstream artists and types are beginning to create and promote NFTs. Rising acceptance may result in extra folks shopping for and buying and selling NFTs, thus driving up their worth.

Whereas there are not any ensures that NFTs will get better sooner or later, the elements talked about above counsel that there’s potential for development within the NFT market. Nevertheless, as with all funding, you will need to understand the inherent dangers, that are all of the extra pronounced with nascent belongings like NFTs. At this level, we are able to solely wait and see how issues will play out.

The underside line: No, NFTs should not lifeless – however they’ve been on a transparent decline

After Could 2022, the buying and selling quantity of NFTs plummeted for quite a lot of causes, however primarily as a result of broader crypto winter. With the crypto market exhibiting renewed bullish exercise within the first quarter of 2023, NFTs noticed a significant spike in exercise, recording $2 billion in quantity in February, up from $946 million the month earlier than.

Anyway you slice it, saying that an business clearing $2 billion in buying and selling quantity monthly is lifeless can be a giant stretch. Nevertheless, there’s no denying that the NFT sector is at the moment removed from its peak reputation in late 2021 and early 2022.

If you wish to learn extra about NFTs, examine how The Merge NFT raised over $90,000,000 and have become the highest-grossing NFT assortment ever, or our piece on how Logan Paul spent $623,000 on an NFT that’s now value simply $10.