To the sound of struggle drums between Russia and Ukraine, Bitcoin continued its downward spiral on Monday. Over the weekend, the digital forex par excellence misplaced essential assist under $40,000, and on Monday, it made a low under the subsequent management zone at $37,000. Regardless of closing close to $38,000, the crypto forex is swinging across the aforementioned essential assist, in accordance with TradingView knowledge, and threatens to increase its losses.

Bitcoin’s worth has dropped for six days in a row. Late final evening, the pioneer fell to $36,545 — its lowest degree in two weeks. That is round 45 p.c decrease than the all-time excessive set in November.

BTC/USD trades at $37k. Supply: TradingView

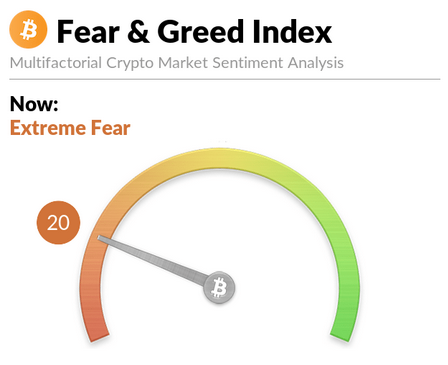

Sentiment Shift Excessive Worry

Specialists, alternatively, have gotten pessimistic after the digital forex fell sharply after failing to interrupt by way of the $45,000 resistance barrier, and lots of anticipate that the $30,000 degree will probably be reintroduced.

It’s comprehensible that traders are involved, given how crypto values have fluctuated in latest months. The Federal Reserve’s determination to reduce on pandemic-related financial stimulus measures, in addition to mining difficulties in Kazakhstan, initially weighed on costs. Nonetheless, most cryptos have struggled to regain any traction.

Bitcoin Worry and greed index.

The index function a superb indicator of investor sentiment. It considers a wide range of indicators, together with as commerce volumes, social media exercise, and volatility. The market scored 84 in November, when costs have been at all-time highs, placing it in extreme greed territory.

Associated Studying | Bitcoin Costs Bear The Brunt Of Lengthy Liquidations And Geopolitical Tensions

Bloomberg Analyst Optimistic

Mike McGlone, a senior commodity strategist at Bloomberg, has an intriguing prediction for Bitcoin. McGlone had already tweeted on Sunday, February 20, that Bitcoin might endure important headwinds within the close to future. He goes on to say that inflation gained’t go down until threat property fall, which hasn’t occurred but.

Regardless of the grim short-term forecast, McGlone believes Bitcoin is on the verge of building a brand new development. McGlone additionally said {that a} majority of property will reply to the “ebbing tide” in 2020, because the Fed’s monetary tighten insurance policies.

Nonetheless, as inflation tightens its grip, McGlone predicts Bitcoin will attain a key milestone in 2022. Final Sunday, the Bloomberg analyst wrote on Twitter, ”

Bitcoin indicating a tough week forward – Inflation Unlikely to Drop Except Threat Property Do: Most property are topic to the ebbing tide in 2022, on the inevitable reversion of the best inflation measures in 4 many years, however this 12 months might mark one other milestone for Bitcoin.

#Bitcoin indicating a tough week forward – Inflation Unlikely to Drop Except Threat Property Do:

Most property are topic to the ebbing tide in 2022, on the inevitable reversion of the best inflation measures in 4 many years, however this 12 months might mark one other milestone for Bitcoin. pic.twitter.com/drnXyYea4F— Mike McGlone (@mikemcglone11) February 20, 2022

McGlone beforehand stated that Bitcoin has proven divergent energy as in comparison with equities. BTC is predicted to succeed in $100,000 in 2022, in accordance with Bloomberg’s Crypto Market Outlook for February. McGlone is optimistic on Ethereum (ETH) and stablecoins, generally often known as “crypto {dollars},” along with Bitcoin.

Value prediction relating to Bitcoin has at all times been measured and conflicting. Some analysts are advising traders to buy the drop within the hope of seeing the pioneer cryptocurrency attain $100,000 this 12 months. Others are anticipating a crypto winter, with the worth plummeting to zero.

Associated Article | TA: Bitcoin Resumes Slide, Why BTC Bears Purpose $35K

Featured picture from Unsplash, chart from TradingView.com