Bitcoin liquidations have been ramping up over the past day following the market crash that rocked the crypto area on Thursday. The results of this can be a liquidation occasion, the likes of which haven’t been seen for the reason that FTX collapse again in 2022. And Bitcoin’s numbers have shot up as lengthy merchants are fully obliterated within the course of.

Largest Single Crypto Liquidation Occasion In 2023

Following Bitcoin’s worth decline to the low $25,000s, the liquidations picked up shortly with over $1 billion {dollars} of crypto positions being closed quickly. Bitcoin, specifically, suffered the brunt of those liquidations as its numbers shortly climbed to 9 digits.

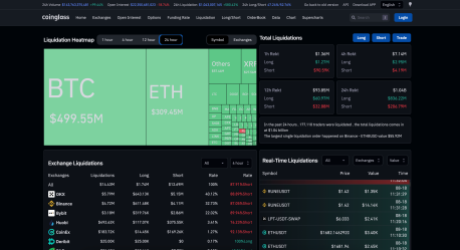

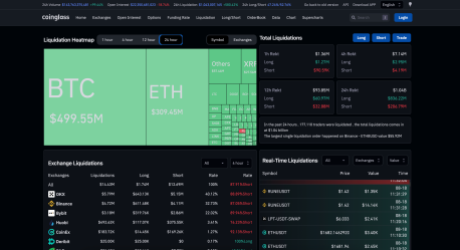

By the point Friday morning rolled round, the digital asset’s liquidation was at roughly $500 million with lengthy merchants struggling nearly all of losses. Based on knowledge from Coinglass, Bitcoin’s lengthy liquidation figures had been already over $373 million, with shorts coming in at $125 million.

BTC liquidations virtually at $500 million | Supply: Coinglass

Whereas Bitcoin was within the lead as anticipated, Ethereum was not that far behind. The second-largest cryptocurrency by market cap noticed an excellent bigger proportion of lengthy liquidations in comparison with shorts. Out of the $308 million in liquidations, lengthy merchants misplaced $254.59 million whereas quick merchants got here in at $54.3 million.

Ethereum additionally noticed the biggest single liquidation order. The order which was value $55.92 million on the time befell on the Binance crypto trade throughout the ETH/BUSD pair. Nevertheless, the OKX trade noticed the biggest Ethereum liquidations at $108.87 million, 92.8% of which had been longs.

The Tide Is Beginning To Flip For Bitcoin

Following the preliminary plummet, Bitcoin started to point out power which noticed its worth add over $1,000. This restoration to $26,000 signaled a doable flip for the digital property and the shorters started to really feel the warmth at this level.

Within the final 4 hours, lengthy merchants have gotten some reprieve as $8.53 million of the $10.96 million in liquidations to date had been quick trades. Nevertheless, lengthy merchants are nonetheless not overlooked with $2.46 million in liquidations as nicely.

Because the Bitcoin worth stays extraordinarily unstable at this level, liquidation volumes are anticipated to rise. Nevertheless, there isn’t any indication to date of the place the value of the digital asset could be headed subsequent as bulls and bears proceed a tug-of-war for management.

Bitcoin is presently buying and selling at a worth of 26,451, representing a worth decline of seven.48% over the past day, in response to knowledge from Coinmarketcap. The asset has additionally seen a 110% enhance in each day buying and selling quantity which is now sitting at $34.47 billion.

BTC worth falls from $29,000 to $25,000 | Supply: BTCUSD on TradingView.com