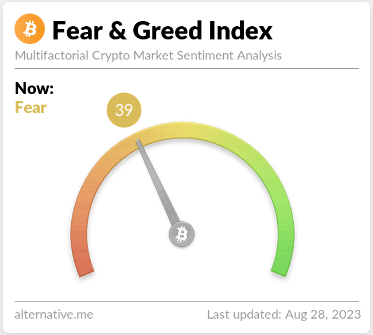

Bitcoin (BTC) is at present marked by cautious sentiments because the Crypto Concern and Greed Index holds regular throughout the concern zone, scoring 39 out of 100 and displaying a slight enhance from yesterday.

This sentiment displays the prevailing uncertainty within the cryptocurrency realm. Amidst this backdrop, Bitcoin’s value development takes middle stage, influenced by the evolving dynamics of the market.

Zooming in on the worth motion reveals a definite sample on the 4-hour timeframe. Bitcoin’s value, guided by a falling channel sample, traces a constant downtrend, oscillating between two parallel trendlines.

This value motion hints on the formation of a well-recognized bullish reversal sample, often called the falling parallel channel.

At its present valuation of $25,877 in line with CoinGecko, Bitcoin skilled a minor 0.6% dip within the final 24 hours and a marginal 0.3% decline over the previous week.

Regardless of these fluctuations, the worth habits strikingly emulates the falling parallel channel, suggesting the potential for a shift in momentum.

Deciphering Bitcoin Falling Parallel Channel

The falling parallel channel is a technical sample typically noticed throughout a downtrend. It options two parallel trendlines encompassing the worth motion inside an outlined vary.

The decrease trendline offers a help stage, whereas the higher trendline acts as resistance. This sample usually signifies a doable development reversal, with a breakout above the higher trendline indicating an imminent bullish restoration.

For Bitcoin, a big breakout involving a 4-hour candle closure above the higher trendline may set off the anticipated bullish bounce. This potential surge, in line with price analysis, has the capability to propel costs upwards by roughly 8%, resulting in a retest of the $28,500 resistance.

Nevertheless, prudence stays paramount because the overarching development nonetheless shows unfavorable undertones. Merchants and cryptocurrency holders are urged to proceed cautiously at this resistance level, because the potential for sellers to regain bearish momentum persists, probably leading to an prolonged corrective section.

Bitcoin (BTC) is at present buying and selling at $25.928. Chart by TradingView.com

Understanding The Concern And Greed Index’s Significance

In a sentiment-driven market, the Crypto Fear and Greed Index holds substantial significance. It presents useful insights into the collective psychological state of traders and merchants, shedding mild on their general outlook.

A protracted presence throughout the decrease spectrum, exemplified by the present concern rating of 39/100, underscores the prevailing apprehension and uncertainty amongst market individuals. This underscores the necessity for even handed decision-making amidst the interaction of technical patterns and market sentiment.

The sustained place of the Crypto Concern and Greed Index throughout the concern zone, coupled with Bitcoin’s value dynamics marked by the falling parallel channel, underscores the intricate interaction of forces throughout the cryptocurrency market.

As merchants carefully monitor the potential breakout and its potential repercussions, exercising warning stays pivotal in navigating this intricate panorama.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. While you make investments, your capital is topic to threat).

Featured picture from Makersplace