newbie

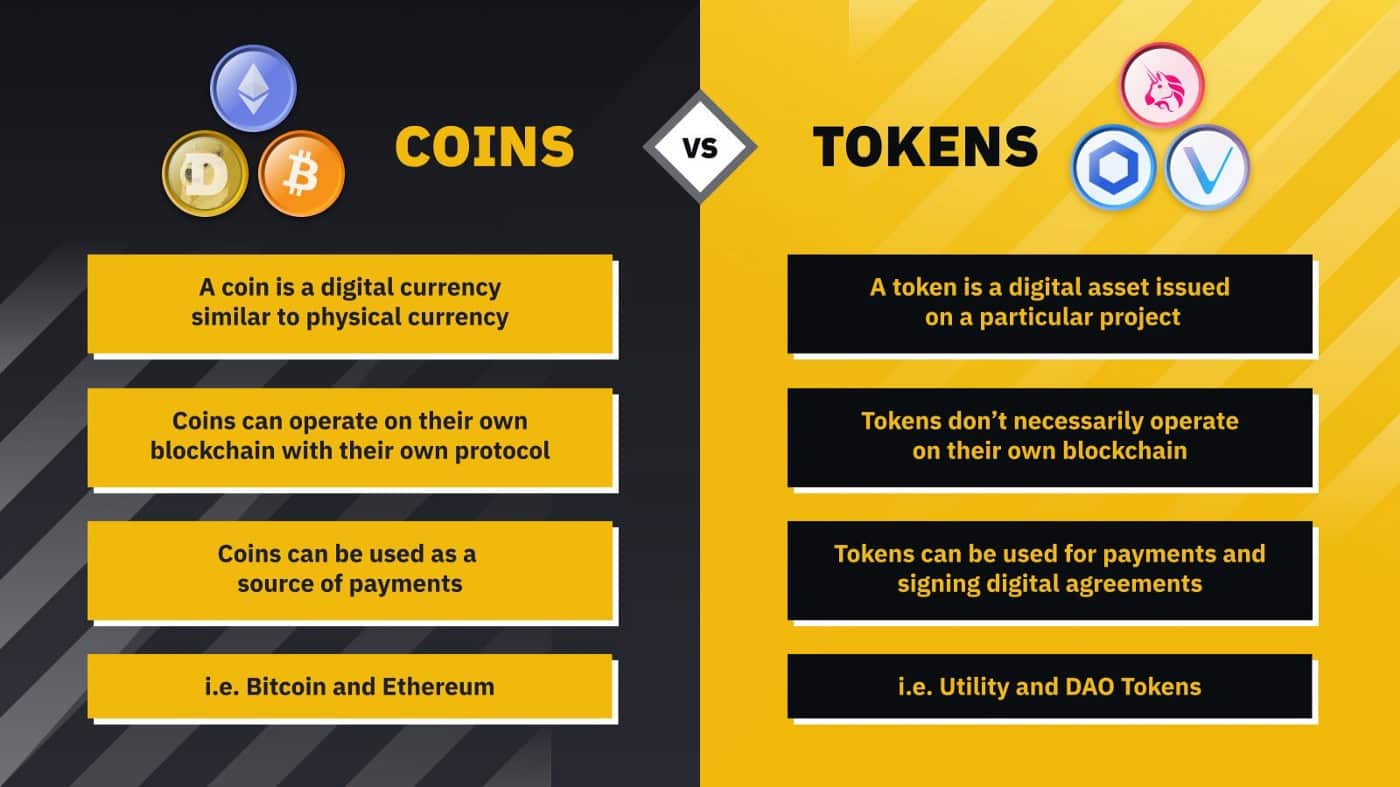

Though they’re generally used interchangeably, these two phrases – coin and token – have totally different meanings. They could not appear that totally different at first look, however in actuality they usually serve basically totally different functions.

With the ability to inform crypto cash and tokens aside is a vital ability for any crypto investor. So, let’s learn the way they differ and whether or not one will be thought-about to be a greater funding choice than the opposite.

What Is a Crypto Coin?

Cash are crypto property which have their very own underlying blockchains and protocols. They function in a method that’s much like how fiat currencies work and are largely designed to be fee strategies or storages of worth.

Crypto cash are what folks often consider once they hear the phrase “cryptocurrency” – digital foreign money. The preferred ones are Bitcoin, Ethereum, and Ripple.

Wanna see extra content material like this? Subscribe to Changelly’s e-newsletter to get weekly crypto information round-ups, value predictions, and data on the most recent traits instantly in your inbox!

Keep on high of crypto traits

Subscribe to our e-newsletter to get the most recent crypto information in your inbox

What Is a Crypto Token?

Not like cash, tokens don’t have their very own blockchains. As a substitute, they run on different cryptocurrencies’ networks. They’re often developed by varied organizations and tasks on high of different chains.

Seeing as they use the identical blockchain, digital tokens and their “unique” coin could generally share some similarities – and they’re often suitable. Nonetheless, tokens are (sometimes) not designed to be purely a retailer of worth or a fee methodology: they’re a unique asset sort.

There are fairly a number of blockchains that assist the creation of tokens. The preferred one is Ethereum – it homes essentially the most generally used token normal, ERC-20.

All tokens depend on a know-how known as good contracts and have 4 defining traits. They should be:

- Clear

Everybody can see and confirm each the transaction information and the foundations that govern the token.

- Programmable

Tokens are developed and launched utilizing good contract know-how. They’re used to stipulate and program the token’s options, features, objective, and guidelines.

- Trustless

Tokens are decentralized – as an alternative of counting on a government, they’re run by the foundations outlined in its protocol utilizing good contracts.

- Permissionless

Lastly, tokens should be accessible to everybody. They can not require any explicit credentials from potential holders and customers.

What Do Tokens Truly Do?

Firstly, tokens can be utilized in the identical method cash are – as a speculative asset to be invested in. Nonetheless, in contrast to crypto cash, they’ve precise functions, and may also signify bodily property and even sure utilities or providers.

Tokens enable crypto tasks to offer a few of their customers particular entry to issues like unique merch gross sales, dApps, blockchain video games, and extra. They can be used to vote on varied governance proposals and protocol upgrades.

Varieties of Crypto Tokens

Tokens will be divided into a number of totally different sub-groups relying on their design and objective. Let’s check out the most typical ones.

Non-Fungible Tokens (NFTs)

NFTs, or non-fungible tokens, are in all probability essentially the most well-known sort on this checklist. They serve no sensible objective and are largely made and handled as luxurious gadgets. Every non-fungible token represents a separate asset.

Non-fungible tokens are basically digital certificates of possession. They often signify distinctive digital property similar to items of artwork, movies, and even tweets. They’re developed in the identical method as different tokens – utilizing good contracts know-how.

Utility Tokens

Utility tokens present their holders entry to items and providers. Typically they merely provide the proper to work together with a platform or a digital product, different instances they offer a reduction on charges, or make entry to that platform utterly free. They’re the spine of most dApps and different DeFi tasks. In consequence, proudly owning a utility token could give you advantages far past financial ones.

Utility tokens are sometimes not regulated and usually are not thought-about to be funding merchandise.

Safety Tokens

Safety tokens are related to exterior property that may be traded as securities. They’re a tokenized model of bonds, shares, property, and so forth. Due to this, their issuance and trade are sometimes closely managed by varied monetary regulators.

Typically, a safety token solely represents a stake or a share within the asset it’s tied to. Its holders can obtain particular advantages, similar to a part of the revenue or the power to partake in some decision-making processes. Not like conventional securities, tokens can present market contributors with transparency, instantaneous settlement, and different substantial advantages that include being a crypto.

There are two kinds of safety tokens: fairness and asset-backed tokens.

Governance Tokens

Governance tokens do precisely what their identify suggests – they offer their holders entry to governance selections similar to deciding which new improve will probably be pushed by. Sometimes, these selections get utilized routinely because the system operates on good contracts. Nonetheless, generally they’re carried out manually by the group managing the undertaking.

Governance tokens can empower their holders and thus make tasks that use them considerably much less centralized.

Examples of Crypto Tokens

There are a lot of totally different tokens on the market. NFTs embody in style collections just like the Bored Ape Yacht Membership (take a look at our value prediction for his or her native token, ApeCoin, right here) and even the world’s first tweet. The very best instance of a governance token is Maker (MKR).

The vast majority of tokens these days are nonetheless based mostly on the Ethereum blockchain. Nonetheless, another networks are additionally beginning to entice increasingly more builders, particularly as ETH gasoline charges proceed to rise. Tron and Solana are two different in style chains which have good contract performance and get chosen by many token creators.

Some cryptocurrencies have totally different token variations on totally different blockchains – for instance, the stablecoin USDT.

The Distinction Between a Coin and a Token

The first distinction between cash and tokens is the truth that the previous have their very own blockchain whereas the latter don’t. Moreover, tokens are often constructed with an precise objective in thoughts, so their value is usually decided by extra than simply the legislation of provide and demand and market hypothesis – though that is additionally true for some cash, particularly those who have further options like Ethereum or ones that can be utilized as fee in some locations like BTC.

There are millions of varied tokens in circulation – much more than cash. That’s as a result of the previous are a lot simpler to create, as one doesn’t must code a whole new blockchain to make them.

With the ability to differentiate tokens and cash is necessary because it lets you higher perceive the cryptocurrency you’re buying and selling or investing in. In the end, nonetheless, you possibly can all the time lookup whether or not a cryptocurrency is a coin or a token on-line.

You should purchase the cash and tokens talked about on this article (in addition to many others!) at truthful charges and with low charges on Changelly.

FAQ

Which is best – cash or tokens?

Cash and tokens serve totally different functions and can’t be stated to be higher than the opposite.

Is Bitcoin a coin or a token?

Bitcoin has its personal blockchain, so it’s a coin.

Can a token change into a coin?

Tokens can change into cash in the event that they handle to develop their very own profitable blockchain and migrate to it. Some examples are the Binance Coin (BNB) and Tron (TRX).

Does each blockchain want a token?

No, tokens aren’t a necessity for blockchains.

Disclaimer: Please word that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.