Bitcoin has been unable to interrupt above key resistance ranges at round $23,000. As a consequence, the cryptocurrency has been shifting sideways over the previous two days whereas preserving a few of its features over the previous week.

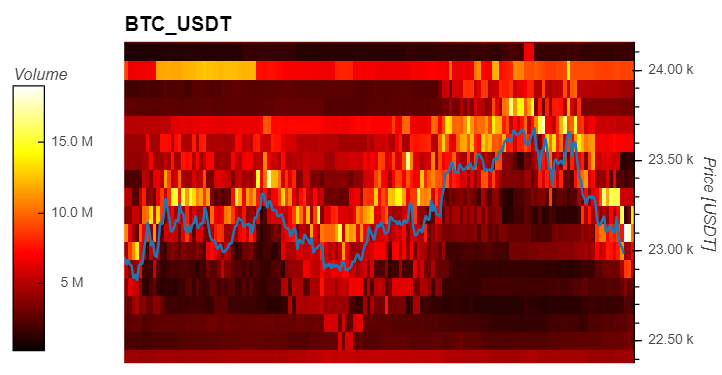

The slowdown in bullish momentum coincides with a rise in asks (promote orders) liquidity for BTC’s value above its present ranges and a spike in BTC’s provide inflows on crypto trade platforms. On quick timeframes, there are over $70 million in promote orders for Bitcoin from $23,000 to $24,000.

Associated Studying | Crypto Market On The Mend: ApeCoin And Curve DAO Present Features

These ranges appear poised to proceed working as resistance whereas the worth of Bitcoin continues to push to the upside. BTC’s value has been tapping into the rapid zone at $23,100, however knowledge from Materials Indicators data $18 million in promoting orders at this degree alone.

As seen beneath, BTC’s value is seeing much less liquidity beneath its present ranges with huge liquidity gaps at key ranges. This might trace at excessive volatility to the draw back if BTC continues to lose momentum and may’t break above $24,000 within the quick time period.

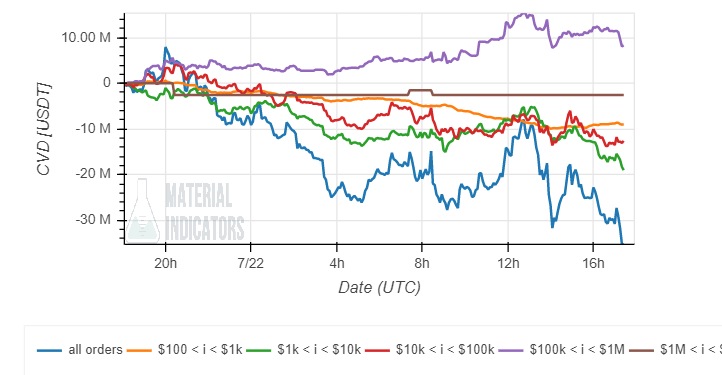

As well as, Materials Indicators data a rise in promoting strain from traders with promote orders above $100,000. These traders have been accumulating BTC over the previous week exercising a whole lot of affect on the worth motion.

Because the chart beneath exhibits, these traders (in purple beneath) have begun promoting into the present value motion. On this timeframes, it appears too early to conclude if this development will proceed and if it should have a unfavourable influence on BTC’s value.

Analyst Ali Martinez concurred with the info proven above. By way of Twitter, Martinez confirmed knowledge on the spike in promoting strain from BTC whales and miners with a decline within the variety of addresses with over 1,000 BTC and a 1% decline within the Bitcoin held by addresses related to miners.

Bitcoin Provide On Exchanges Rises, Hints At Additional Weak point?

Additional knowledge offered by Ali Martinez data a rise within the Bitcoin held by crypto trade platforms. This metric is taken into account bearish as these BTCs are sometimes unloaded into the market.

Associated Studying | Ethereum Reveals Indicators Of Exhaustion, However May It Nonetheless Contact $1,700?

Since July 12, the analyst stated, there was a spike of 27,000 BTC or $621 million despatched to those venues. Martinez commented the next on these metrics:

The rise in open curiosity mixed with a decline in community progress and rising promoting strain from whales and miners means that the current Bitcoin value motion is pushed by leverage. These community dynamics enhance the likelihood of a steep correction.