- There’s a rising convergence between Bitcoin [BTC] and conventional shares.

- Bitcoin’s correlation with DXY is, nonetheless, nonetheless at a divergence.

After dropping for months beforehand, the worth of Bitcoin [BTC] has been rising for the reason that starting of the yr. Regardless of the numerous value enhance, it’s but to get well to the extent that noticed it attain $60,000.

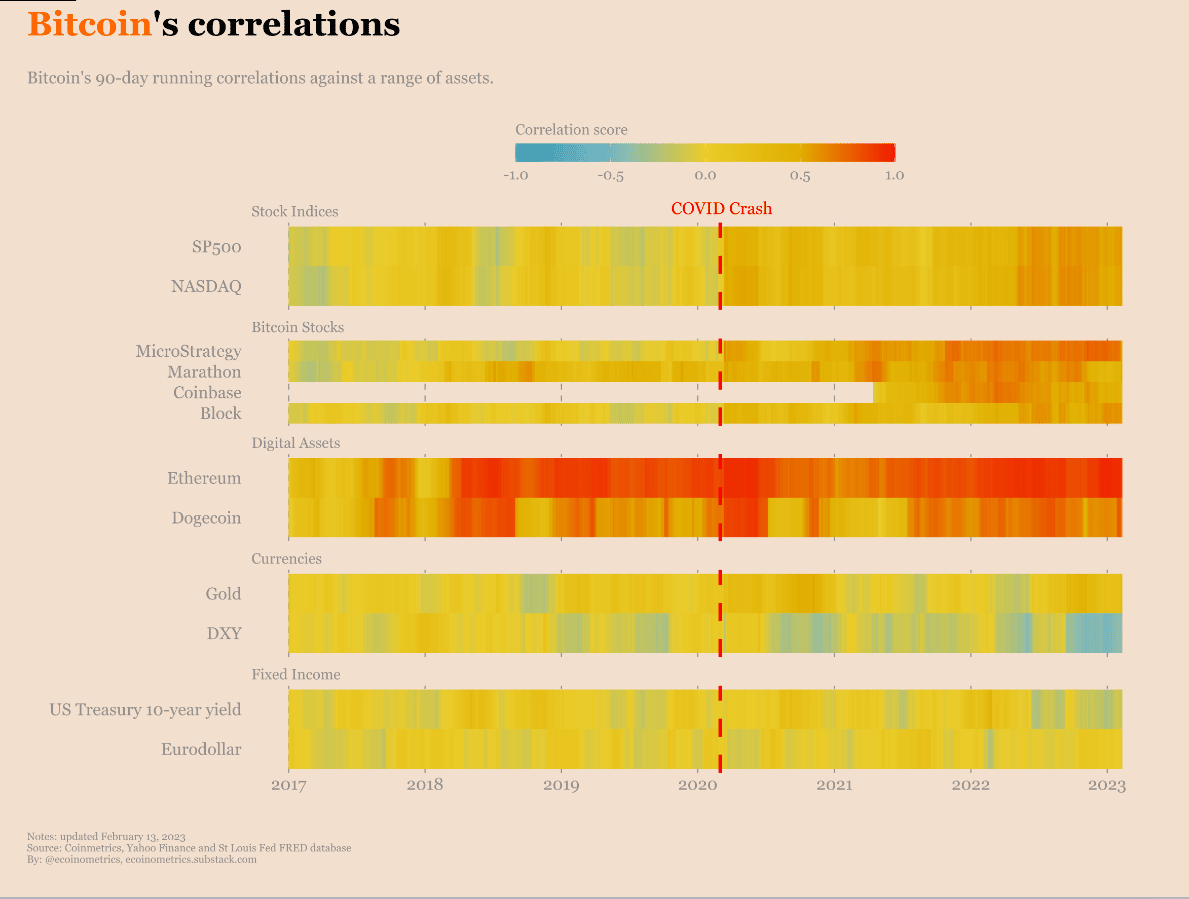

Significantly following the Covid-19 outbreak, Bitcoin’s value has correlated with conventional property. How does the BTC correlation rating now stand, and what does it imply for cryptocurrency investments?

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Explaining the Bitcoin correlation rating

When evaluating the worth of Bitcoin to a different asset or basket of property, the correlation rating can be utilized to gauge the diploma to which the 2 costs transfer in tandem.

To find out the correlation, we have a look at Bitcoin and the opposite asset’s value actions over time and see how intently they’ve tracked each other.

If the correlation rating is -1, then the values of the 2 property are completely uncorrelated with each other; if it’s zero, then there isn’t any affiliation between the costs of the 2 property; and if it’s 1, then there’s a good optimistic correlation between the costs of the 2 property (which means that the costs of the 2 property transfer in the identical path).

To assist diversify their holdings, traders can use the correlation rating. Investing in a number of varieties of property with low correlation helps mitigate danger.

Nevertheless, it’s essential to keep in mind that correlation scores can shift over time. This highlights the necessity for fixed asset correlation monitoring and subsequent investing technique changes.

Bitcoin correlation rating put up Covid-19

Ecoinometric information exhibits that following the Covid-19 epidemic, Bitcoin’s correlation rating modified considerably. Some varieties of investments had been chosen for this research in order that we may get a really feel for the correlation rating that’s now accessible.

Inventory market indices just like the SP500 and the NASDAQ, Bitcoin shares like MicroStrategy, Marathon, Coinbase, and Block, the U.S. Greenback Index (DXY), and Eurodollar futures had been chosen to look at whether or not or not they correlate with the worth of BTC.

Nicely, curiously, Ethereum and Dogecoin had been additionally chosen to examine their correlation.

Pre-March 2020 (pre-Covid), the inventory market indices had been largely unrelated to Bitcoin. After that, there’s a constant orange sample, indicating a hyperlink.

As could be anticipated, Bitcoin has a powerful relationship with different cryptocurrencies. The worth of Bitcoin and gold has been extremely correlated as of late, however their previous actions into and out of correlation zones.

Regardless of this, there was zero correlation between the DXY and Euro futures, both earlier than or after the outbreak. Excessive correlation is denoted by deep purple, excessive anti-correlation is denoted by deep blue, and no correlation is denoted by yellow.

Supply: Ecoinometrics

BTC’s value motion

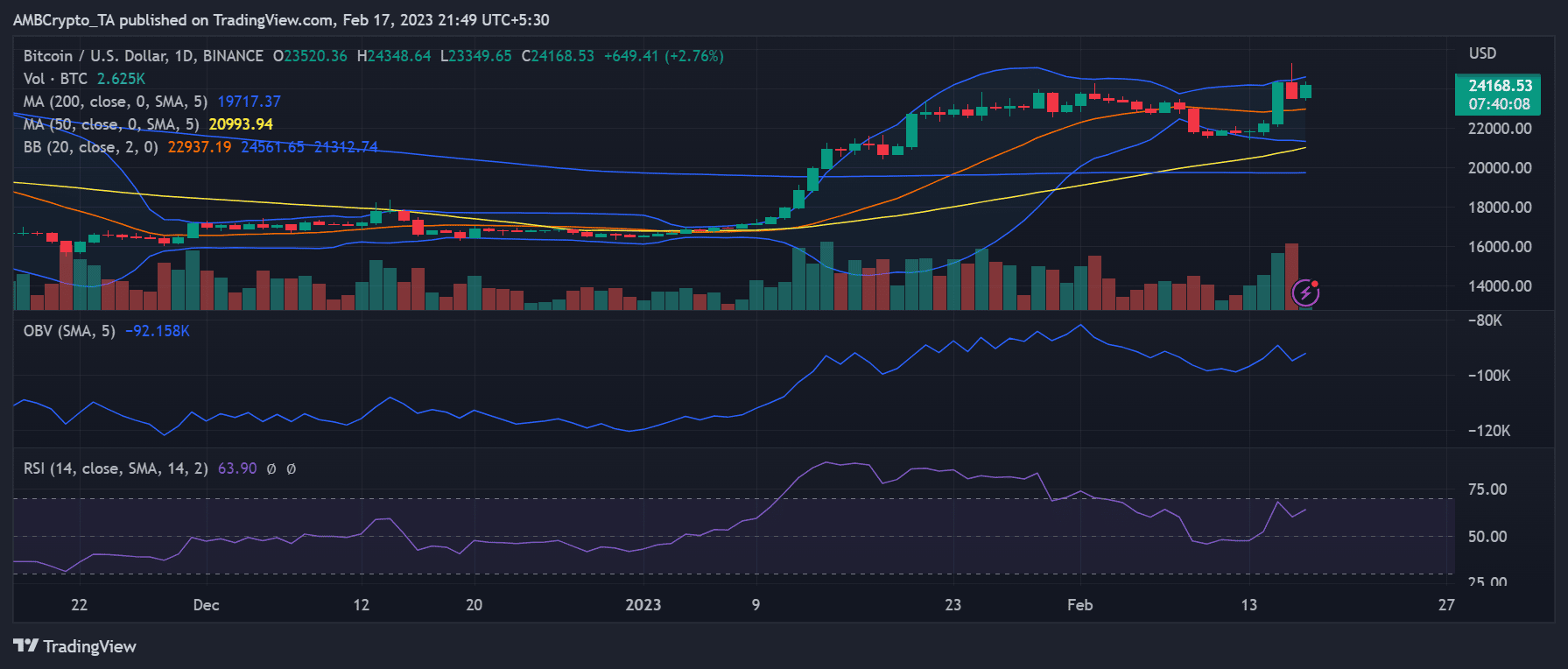

The SP500, Nasdaq, and Bitcoin Index as of this writing revealed that they had been all shifting in separate instructions.

The SP 500 and Nasdaq had been experiencing losses, however they had been lower than 1%, whereas the Bitcoin Index flashed inexperienced and recorded good points of over 1%. The DXY, nonetheless, in addition to the Euro futures, had been flashing inexperienced.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Trying on the each day chart of BTC’s value motion, we are able to see it trending upwards. A bullish development was indicated by the Relative Power Index line being above 60.

As of this writing, the worth of a single Bitcoin was simply over $23,700. It additionally mirrored a acquire of greater than 2% for the reason that begin of the buying and selling day.

Supply: Buying and selling View

![A look at the Bitcoin [BTC] correlation score and its essence for investors](https://ambcrypto.com/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1-1-1000x600.jpg)