“Truthful worth” is a time period that’s not typically used within the crypto market, however it’s one that may assist traders place their trades to take advantage of out of the unstable market. Realizing a “honest worth” of a crypto asset allows traders to know whether or not the asset is overvalued or undervalued at its present worth.

The ratio that exhibits the distinction between an asset’s market cap and realized cap is known as the MVRV-Z Rating. The rating additionally exhibits the usual deviation of all historic market cap information.

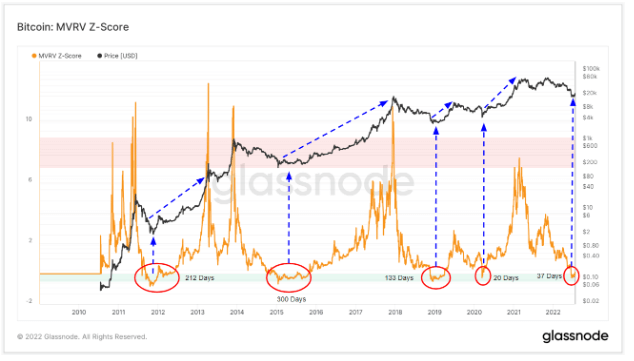

Traditionally, the MVRV-Z Rating has been used to mark tops and bottoms in Bitcoin market cycles with spectacular reliability. A excessive MVRV-Z Rating normally indicated a market high, whereas a low MVRV-Z Rating confirmed a market backside adopted by an upturn.

Within the chart beneath, Bitcoin’s worth completely correlates with market tops predicted by the MVRV-Z Rating. Overheated market cycles pushed Bitcoin’s MVRV-Z Rating deep into the purple zone and have all the time resulted in an aggressive worth droop. However, when the market worth falls beneath the realized worth, it has traditionally indicated a market backside.

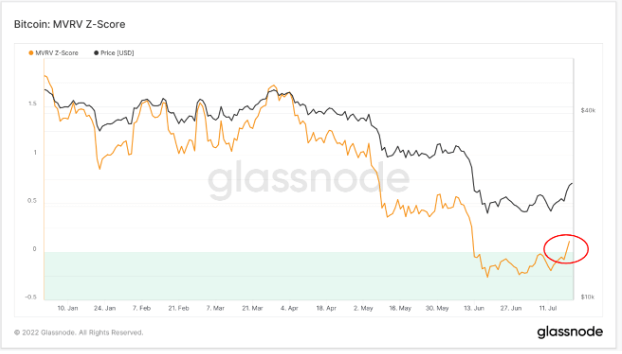

In June, the MVRV-Z Rating dropped considerably and entered the “inexperienced zone,” a transfer that indicated a possible worth backside throughout this bear market.

Based on Bitcoin’s earlier MVRV-Z Scores, the final cycle backside occurred in March 2020, when the onset of the COVID-19 pandemic set international markets spiraling down as traders rushed to money out.

The MVRV Z-Rating has accurately known as the final 4 bear market bottoms. The chart above confirmed that the MVRV-Z Rating spent 212 days within the inexperienced zone in 2012. In 2015, the MVRV-Z Rating spent over 300 days within the inexperienced zone. In 2019, the low MVRV-Z Rating lasted for 133 days, whereas 2020 noticed it spend solely 20 days within the inexperienced zone. The inexperienced zone on the MVRV Z-Rating chart exhibits when Bitcoin is “undervalued.”

Nonetheless, the MVRV-Z Rating isn’t foolproof.

The ratio can’t predict how lengthy an asset will stay undervalued or overvalued and exhibits no discernible repeating sample. How lengthy the rating spends within the inexperienced or purple zones can even range considerably, because the ratio doesn’t think about macroeconomic components that have an effect on worth actions.

Take, for instance, the worldwide market crash in March 2020. Brought on by the onset of aggressive financial measures to fight the COVID-19 pandemic, the crash worn out trillions from the worldwide economic system, decimating the crypto market. Bitcoin’s MVRV-Z Rating skilled a pointy drop on the time, indicating that the asset was considerably undervalued. Nevertheless, it stayed undervalued for under 20 days, as a large portion of stimulus checks supplied by central banks worldwide went immediately into the crypto market, most notably Bitcoin.

After spending 37 days within the “inexperienced zone,” Bitcoin’s MVRV-Z Rating elevated and confirmed the asset was not undervalued. Whereas this might point out a revival of the market’s bullish sentiment, traders ought to stay cautious, as this isn’t the primary time Bitcoin’s MVRV-Z Rating briefly exited the inexperienced zone.

Till the worldwide macro sentiment adjustments and demand for Bitcoin returns to its pre-crash ranges, Bitcoin can proceed to fall out and in of the “unvervalued” class.