- Aave has frozen stablecoin buying and selling on the V3 Avalanche deployment.

- AAVE is due for a worth decline as promoting strain exceeds shopping for strain.

In response to the current worth volatility on stablecoins, notably after the USD Coin (USDC) depegged on 11 March, lending protocol Aave, has suspended buying and selling of the USDC, USDT, DAI, FRAX, and MAI on its V3 deployment on the Avalanche community.

In mild of the present volatility surrounding stablecoins, Aave DAO has frozen USDC, USDT, DAI, FRAX, and MAI on Aave v3 Avalanche. This measure prevents new positions from including danger to the protocol. https://t.co/ndH0qtIdFV

— Aave (@AaveAave) March 11, 2023

The buying and selling halt was carried out following an evaluation by the danger administration agency Gauntlet Community, which analyzed varied outcomes for USDC following the deppeging and steered that each one Aave V2 and V3 markets be briefly paused.

How a lot are 1,10,100 AAVEs price at the moment?

In accordance with Gauntlet, when the value of USDC, one of many stablecoins used on Aave, depegged from the U.S. greenback on 11 March, it created a divergence within the worth of stablecoins.

Because of this they now not moved collectively in worth as they have been anticipated to do. Consequently, the danger of insolvencies elevated on Aave, which may result in losses for the platform and its customers.

Additional, Gauntlet famous that at present costs of the stablecoins used on Aave, insolvencies have been roughly 550,000. Nevertheless, the danger administration agency acknowledged that this might change relying on worth trajectory and additional depegs.

Consequently, it really useful briefly pausing all Aave V2 and V3 markets to forestall additional losses to customers.

Herein lies the implications

Following the suspension of stablecoin buying and selling on Aave V3 on the Avalanche community, the chain has suffered a drop within the worth of property locked (TVL). Per information from DefiLlama, Avalanche has suffered a ten% drop in TVL within the final 24 hours.

As for AAVE, Aave’s native token, whereas its worth rallied by 1% within the final 24 hours, it registered a 25% decline in buying and selling quantity throughout the identical interval.

Sometimes, a rise in an asset’s worth coupled with a decline in buying and selling quantity throughout the identical window interval signifies a scarcity of conviction within the asset’s worth development.

Such divergence is usually adopted by a worth reversal (decline) or consolidation until conviction improves.

Nevertheless, AAVE’s efficiency on a day by day chart steered that an enchancment in traders’ conviction may take some time, with the alt considerably oversold at press time.

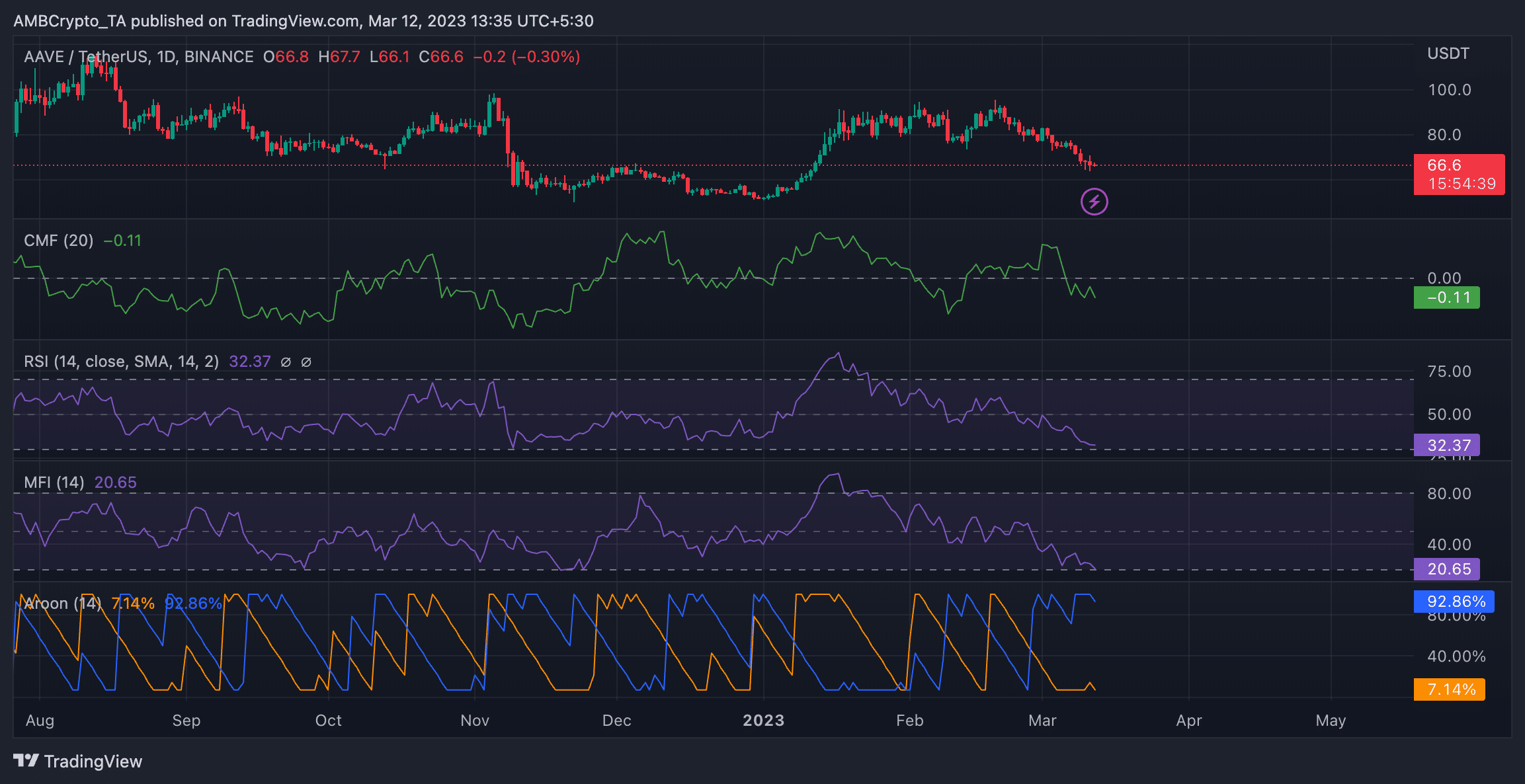

AAVE’s key momentum indicators, resembling its Relative Energy Index (RSI) and the Cash Circulation Index (MFI), rested at 32.37 and 20.65, respectively.

Learn Aave’s [AAVE] Worth Prediction 2023-2024

Additional, the Aroon Up Line (orange) at 7.14% confirmed that AAVE’s most up-to-date excessive was reached way back. Conversely, the Aroon Down Line (blue) at 92.86% steered that the value downtrend was sturdy, and the newest low was reached comparatively lately.

Lastly, the dynamic line (inexperienced) of AAVE’s Chaikin Cash Circulation (CMF) was beneath the centerline at -0.11. This meant that promoting strain exceeded shopping for strain, and the value was due for an extra decline.

Supply: AAVE/USDT on TradingView