Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- AAVE oscillated in a variety prior to now few weeks.

- A restoration may supply vital positive aspects if it overcomes a key hurdle.

AAVE traded within the $73 – $95 vary prior to now few days. Bitcoin [BTC] sharp decline on Thursday (2 March) despatched the AAVE to retest its vary assist zone.

However it appears traders aren’t exiting the market, which may probably enhance a bullish restoration if demand will increase for AAVE at its present discounted costs.

Learn AAVE’s [AAVE] Value Prediction 2023-24

AAVE dropped to the important thing assist zone

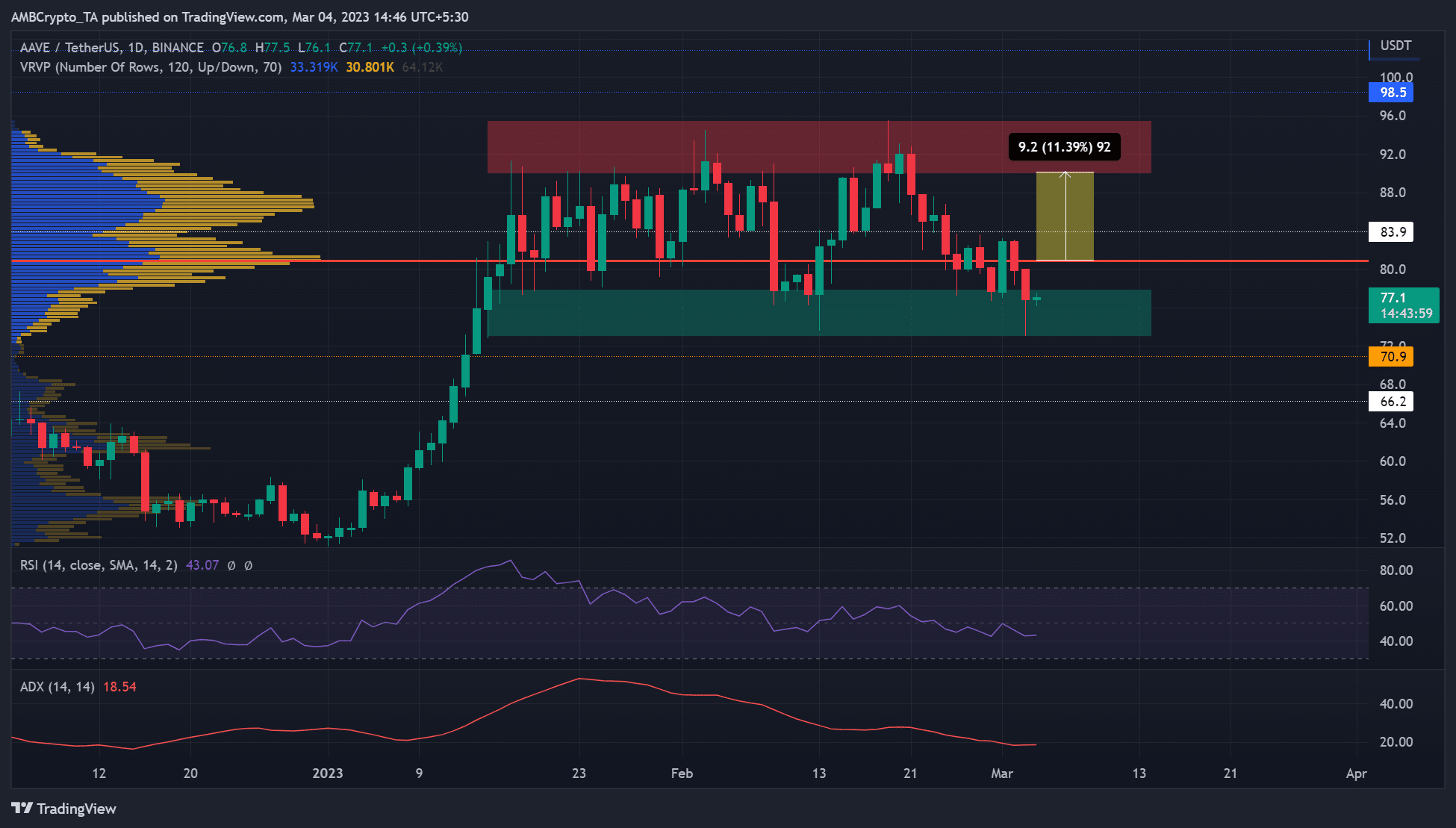

Supply: AAVE/USDT on TradingView

The $95 degree has grow to be a key resistance, stopping bulls from inflicting additional positive aspects after the spectacular rally in January. To this point, the $90 – $95.5 zone has grow to be a key promote strain space.

Equally, the $73 – $77.8 is a key assist zone (inexperienced) that has seen vital demand prior to now retests. If the pattern repeats, the retest witnessed at press time may drive demand for AAVE on the present value degree. Such a requirement may push AAVE towards the promote strain zone (purple).

Bulls might be boosted if the value breaks above the value of management/worth space above $80 (purple line) and retest it. The Fastened Vary Quantity Profile (VRVP) exhibits the traded quantity over a value vary and highlights the value with the best quantity (purple line).

A break and pull-back retest at $80.8 may enhance the uptrend to focus on the provision zone – a possible 11% hike.

Quite the opposite, bears may undermine bulls’ efforts in the event that they sink AAVE under the assist zone. Such a downswing may see AAVE drops additional towards $66.

The RSI fell gently over the previous few days and was under 50 at press time, reinforcing that bears have leverage within the present construction. Equally, the Common Directional Motion Index (ADX) moved southwards, exhibiting the rally at first of the 12 months weakened and will expertise prolonged consolidation or retracement.

The Funding Price rebounded, however …

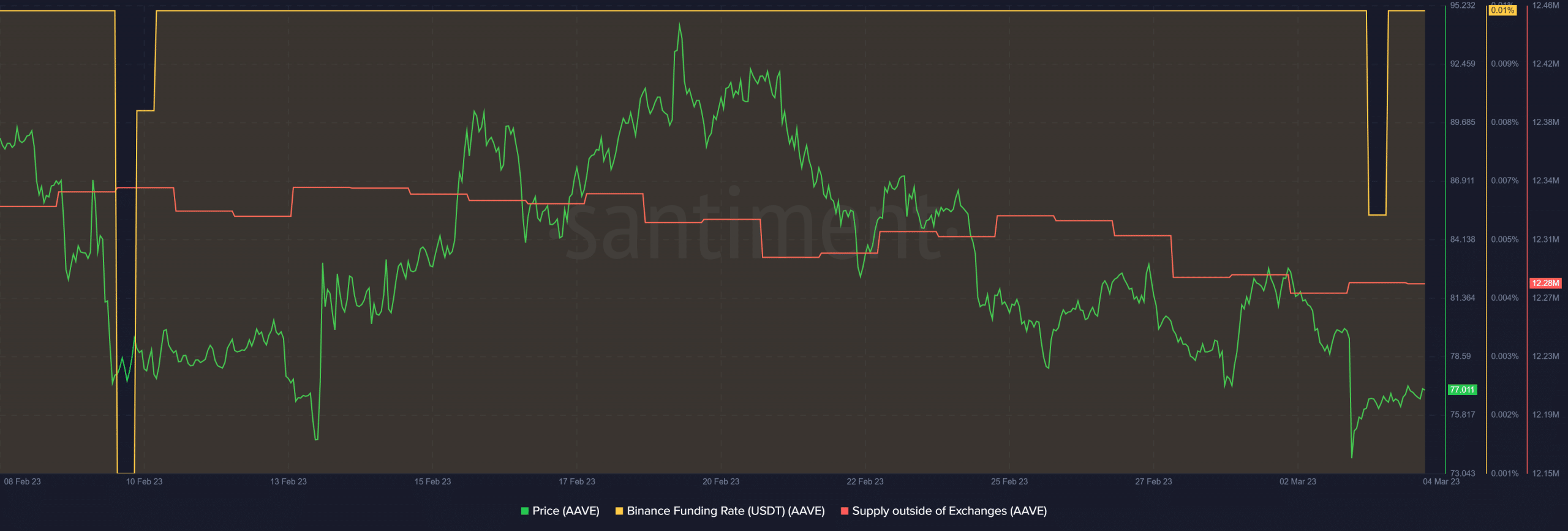

Supply: Santiment

AAVE’s Funding Price dipped and improved later, as proven by Santiment, indicating that demand improved – a bullish sign. Equally, provide out of exchanges spiked, confirming short-term accumulation, which may tip bulls to enter the market in the long term.

Is your portfolio inexperienced? Take a look at the AAVE Revenue Calculator

Nonetheless, promoting strain got here from addresses holding 1k to 10k AAVEs and 10k to 100k AAVEs, which managed 6% and 18% of the market provide, respectively.

However the dominant whale class (48% of provide) was inactive at press time. Due to this fact, cautious traders may anticipate a pullback retest on the assist zone earlier than making strikes.