Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought-about funding recommendation

- AAVE chalked up a bearish pennant chart sample

- AAVE holders nonetheless struggling losses because the market crash

After Bitcoin [BTC] flipped resistance at $16.5K into help, AAVE additionally transformed $58.1 into help within the intraday session.

At press time, AAVE was buying and selling at $59.5, up by about 3% within the final 24 hours. The king coin additionally recorded positive factors, setting AAVE up for a doable breakout from its 2-week bearish pennant sample.

Learn AAVE’s Worth Prediction 2023-24

Given the unfolding story on the affect of Genesis’s FTX publicity, any bearish BTC sentiment will ship AAVE additional under the $57-support degree.

AAVE chalks a bearish pennant – A massacre in ready?

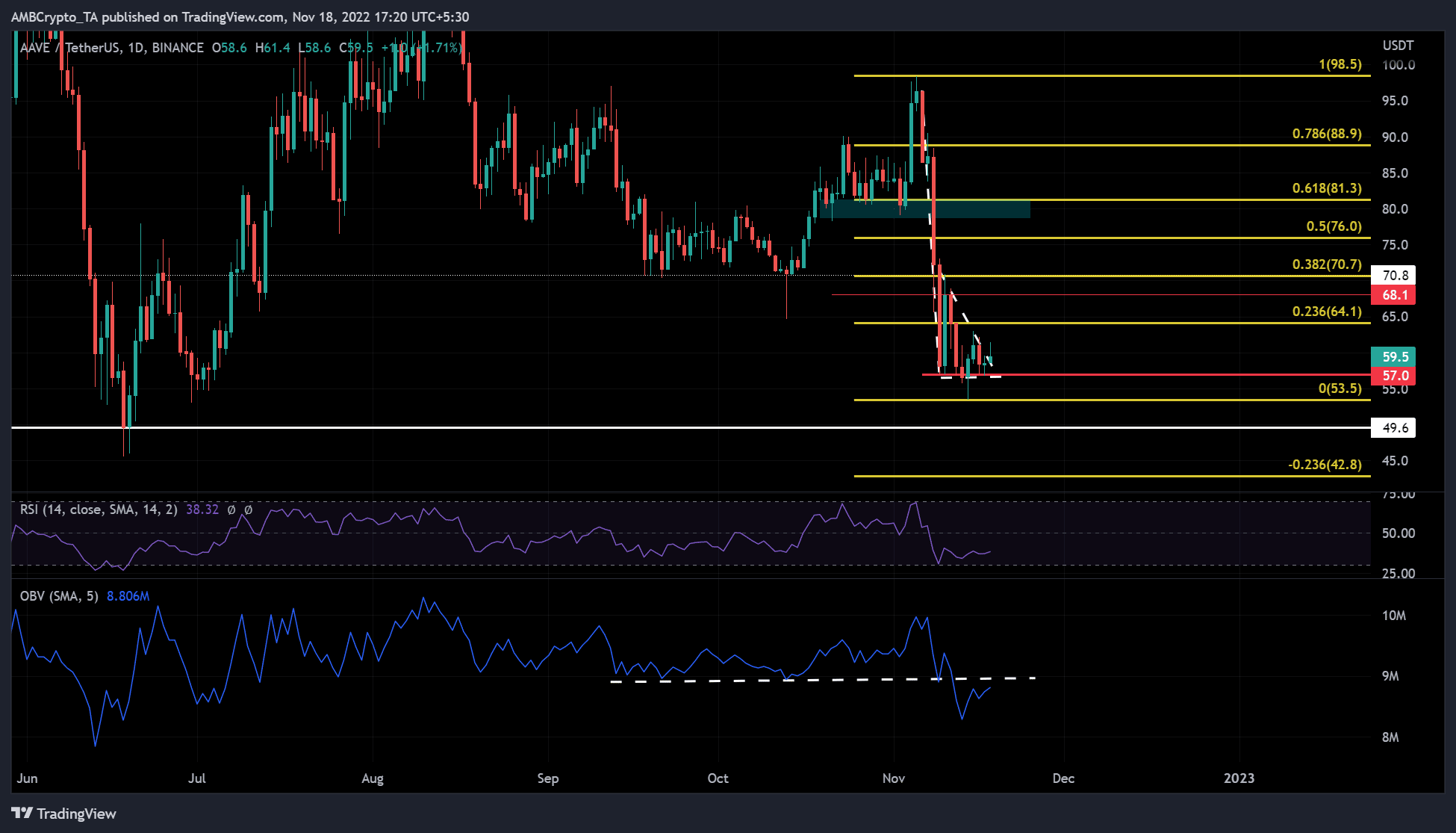

Supply: AAVE/USDT, TradingView

The latest market crash brought about AAVE to fall from its November ATH at $98. The latest rallies ended with decrease highs with the identical decrease lows, leading to a bearish pennant sample. Bearish pennant patterns are development continuation patterns so, an extra drop in AAVE costs is probably going within the subsequent few days.

The RSI has been shifting sideways after retreating from the oversold territory. This means that the sellers are nonetheless in management, regardless of easing promoting stress. As well as, the On Stability Quantity (OBV) hasn’t crossed the October threshold, indicating that AAVE is but to file stable bullish restoration.

In consequence, the bearish flag sample might facilitate a development continuation. The sellers might push AAVE decrease. If sentiment on BTC additionally turns bearish, AAVE might fall additional. Sellers can count on new help ranges at $49.6 and $48.2.

Nevertheless, a session shut above $64.1 will invalidate the bearish inclination.

A confirmed breakout on the upside would permit entry into an extended place with $70.7 as the first goal. The bearish order block at $86.1 and the 0.236 Fib degree ($64.1) can also be secondary targets.

Holders undergo losses regardless of improved sentiment

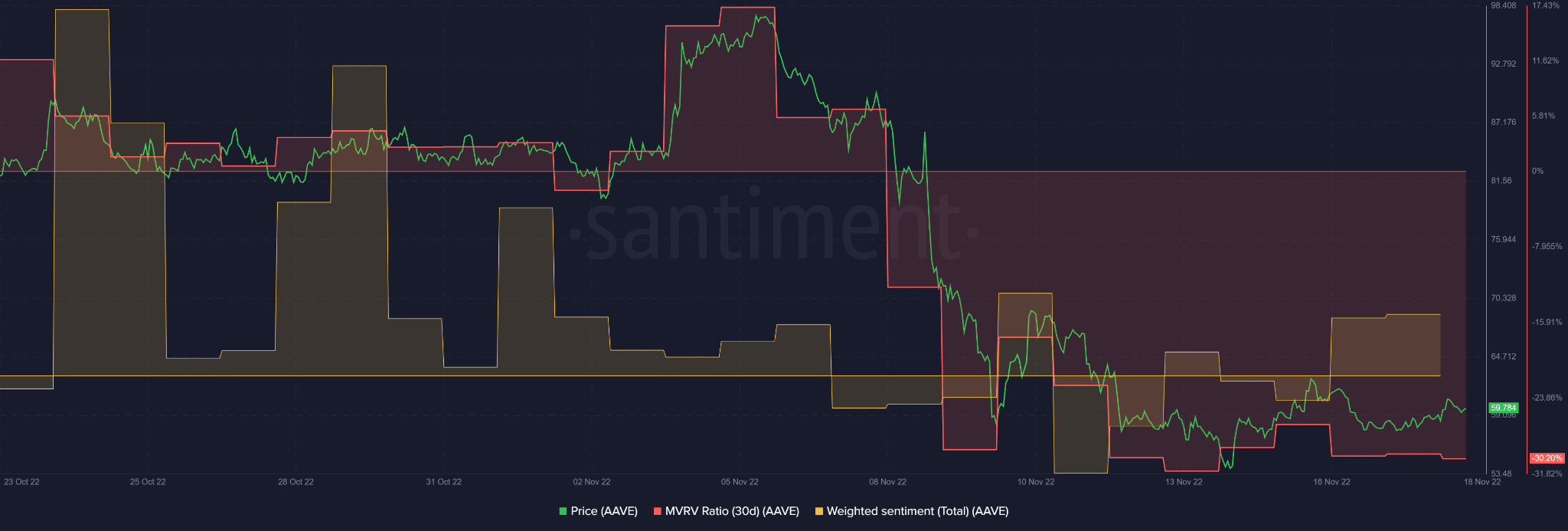

Supply: Santiment

An evaluation of Santiment’s information revealed that AAVE loved optimistic weighted sentiment at press time.

Nevertheless, optimistic sentiment remains to be inadequate to guard AAVE holders from losses. The 30-day market worth to realized worth ratio (MVRV) remained in unfavourable territory. This exhibits that short-term AAVE holders are nonetheless struggling losses because the market collapse on 8 November.

AAVE buyers ought to due to this fact monitor the king coin’s sentiment earlier than making any transfer on the doable patterned breakout.