Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- AAVE might escape from its latest parallel channel sample.

- Holders sustained a decline in good points in the course of the worth consolidation interval.

Aave’s [AAVE] latest rally provided traders and merchants spectacular returns. It rose from $52 to $91, posting over 70% good points. Nonetheless, the worth consolidation that adopted after hitting $91 undermined further earnings.

Learn Aave’s [AAVE] Worth Prediction 2023-24

On the time of publication, AAVE’s worth was $83.20 and will try to interrupt from its present worth consolidation vary.

The worth consolidation vary of $79 – $90: Is a breach probably?

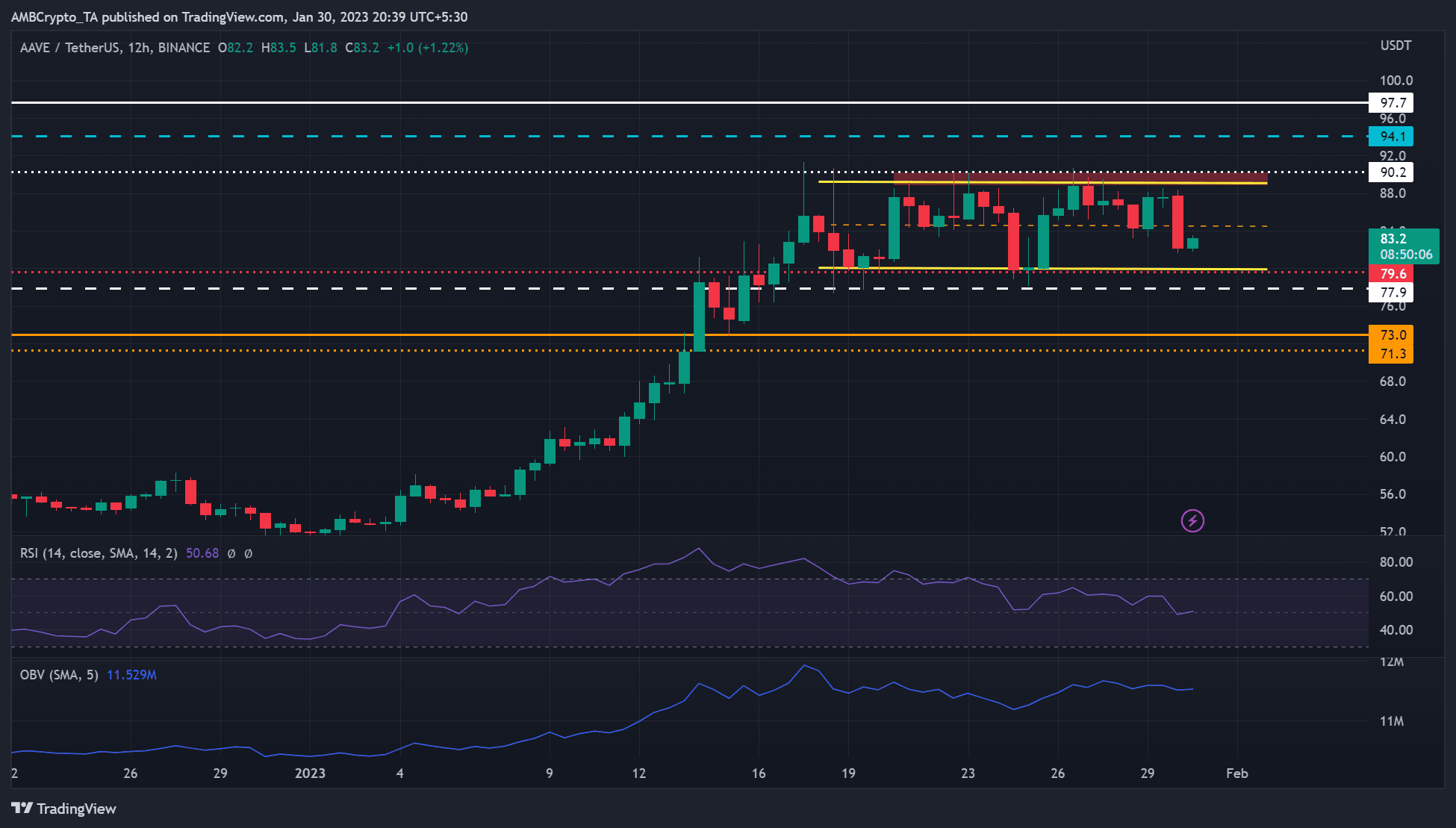

Supply: AAVE/USDT on TradingView

Since mid-January, AAVE oscillated between $79 and $90, curving a parallel channel sample (yellow). Notably, the worth motion was predominantly within the higher vary of $85 – $90 in the identical interval.

How a lot is 1,10,100 AAVEs value at present?

Within the subsequent few hours/days, bulls might try to interrupt above the parallel channel and purpose on the bullish goal of $97.7 primarily based on the channel’s peak. Nonetheless, bulls should clear the hurdles on the channel’s mid-range stage of $85 and overhead resistance stage of $90 for such a transfer to be possible.

Alternatively, bears might acquire leverage and inflict a bearish breakout beneath the channel’s decrease boundary of $79. The transfer would invalidate the above bullish bias. However such a drop might settle on the bearish goal of $71.3, with a few potential regular grounds alongside the way in which.

AAVE’s improvement exercise spiked, however hodlers’ earnings fluctuated

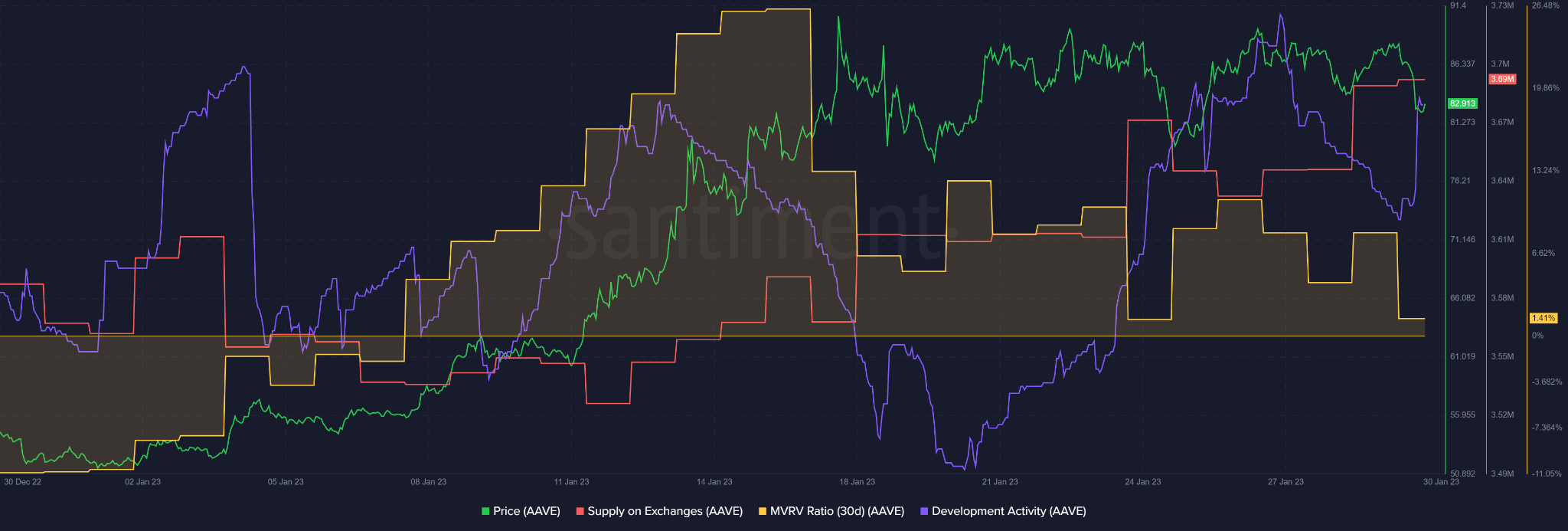

Supply: Santiment

In response to Santiment, AAVE recorded a pointy enhance in improvement exercise, indicating the community noticed large constructing development at press time. This might enhance traders’ confidence and the token’s worth in the long term.

Nonetheless, holders’ earnings fluctuated, as evidenced by fluctuating MVRV, as a result of AAVE’s worth was restricted in a consolidation vary. However, a ten% acquire was probably if a bullish breakout occurred within the subsequent few hours/days.

However merchants and traders should be cautious with the short-term promote strain, which was indicated by the spike in Provide on Exchanges.