- Aave tops the record of the main polygon tasks by market cap.

- Its token bounces again quickly regardless of latest whale outflows.

Decentralized Finance (DeFi) protocols have maintained wholesome exercise regardless of taking a large hit in the course of the bear market. Prime DeFi tasks felt the impression within the type of liquidity outflows however many have survived.

Aave is at present the main DeFi challenge inside the Polygon ecosystem.

Is your portfolio inexperienced? Try the AAVE Revenue Calculator

In response to the newest rating performed by the Twitter account Ben GCrypto, Aave’s whole worth locked (TVL) clocked in at $317 million.

Quickswap got here in second with $166 million whereas Balancer had the third-highest TVL at $132 million.

Regardless of Aave being on the prime of the Polygon desk so far as TVL is anxious, its native token skilled elevated promote stress for the reason that begin of the week.

Prime 10 Polygon Ecosystem Cash by Whole Worth Locked@0xPolygon $MATIC is a decentralised @ethereum scaling platform that allows builders to construct scalable user-friendly dApps with low transaction charges.$AAVE $QUICK $BAL $UNI $CRV $BIFI $TETU $SUSHI $KLIMA $STG pic.twitter.com/arsBKoy1bi

— Ben GCrypto (@GCryptoBen) March 1, 2023

AAVE bears dominate till encounter assist

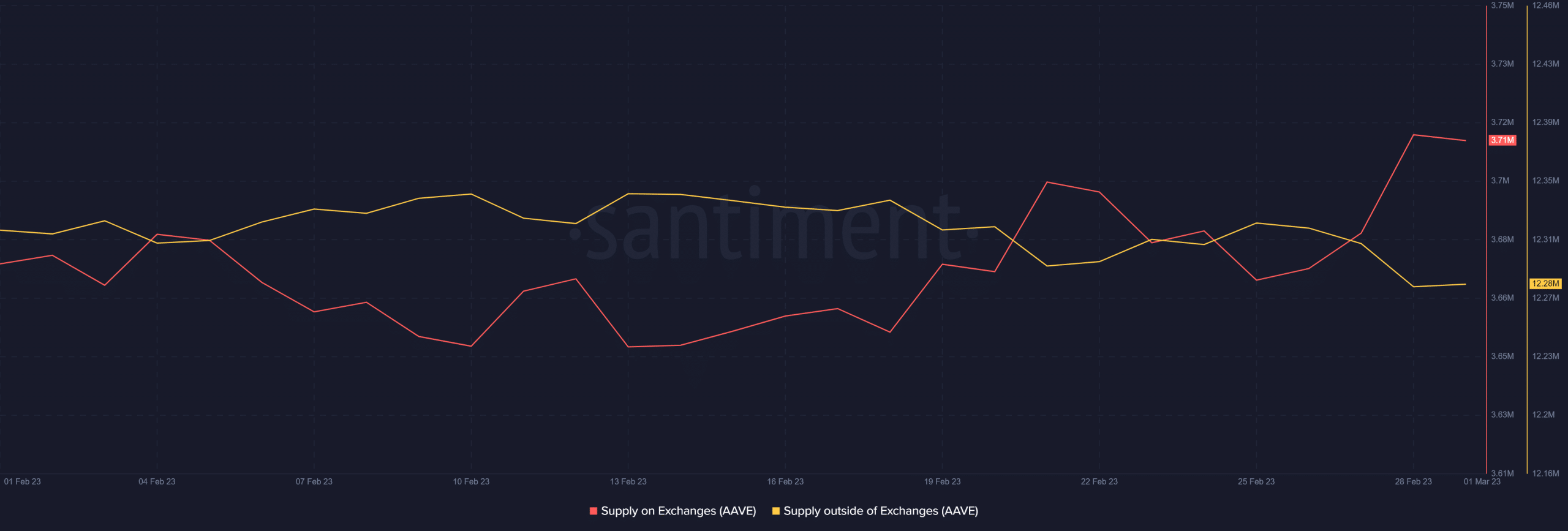

An evaluation of AAVE’s provide dynamics reveals that AAVE’s provide on exchanges elevated for the reason that begin of the week.

On the identical time the provision outdoors of exchanges tanked by a large margin throughout the identical interval. These observations level towards a rise in promote stress.

Supply: Santiment

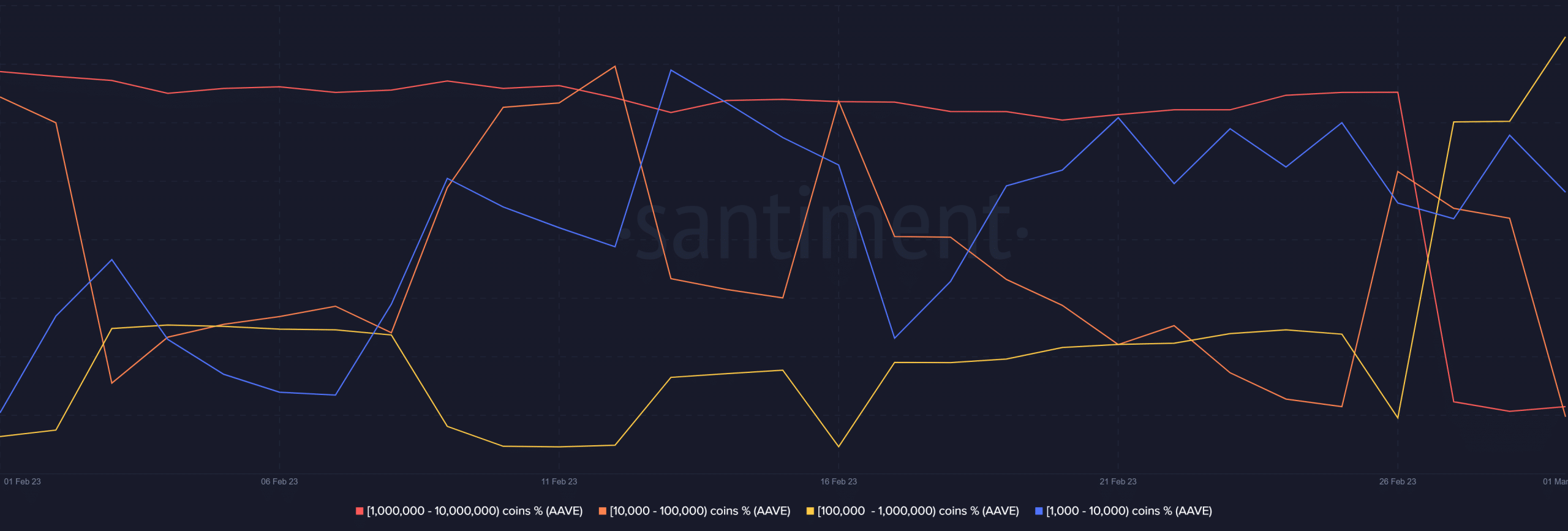

The trade flows information displays observations in AAVE’s provide distribution. The metric reveals a pointy drop within the balances of addresses holding essentially the most tokens.

This consists of addresses inside the 10,000 to 10 million AAVE bracket. Addresses inside this class managed over 60% of AAVE’s present circulating provide.

Supply: Santiment

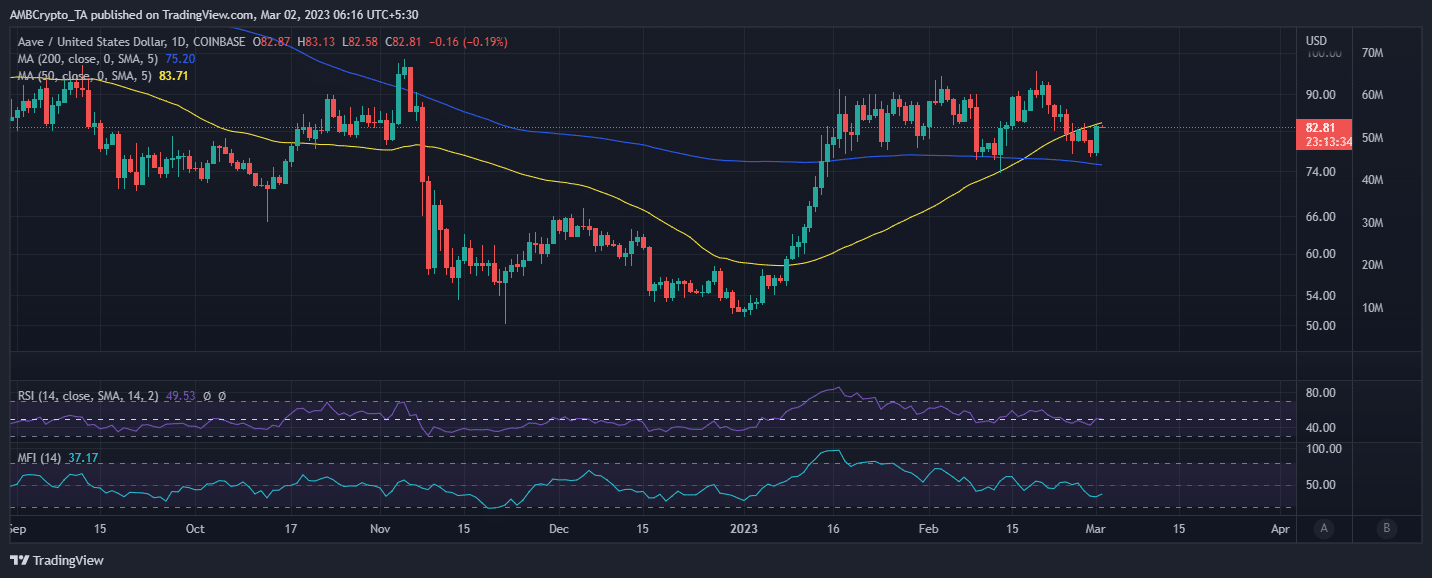

These outflows from the highest addresses affirm that whales have been promoting. As a consequence, AAVE has been bearish for a number of days now. Nevertheless, it did expertise a 6.82% mid-week bounce to its $82.76 press time value.

Supply: TradingView

There are a number of causes for this bounce in line with market observations. The value was already down by 19% which is a large retracement earlier than the bulls begin preventing again.

The second cause is that the draw back pushed AAVE again right into a assist vary that has prevailed for the reason that second week of January. The 200-day Shifting common underpins the identical assist vary.

What number of are 1,10,100 AAVEs price at this time?

However the principle cause for the mid-week bounce goes again to whale exercise. The identical provide distribution metric reveals that addresses holding over 1 million stopped promoting on the finish of February. In consequence, the promoting stress shortly died down, paving the way in which for demand.

Addresses holding between 100,000 and 1 million AAVE contributed essentially the most to purchasing stress. This class of whales represented 24% of AAVE’s circulating provide.

Notably, the identical class has been closely accumulating for the final 5 days. This alignment of things together with the assist retest made for a powerful bounce.