A intently adopted crypto analyst says that a number of indicators are all lining as much as counsel that Bitcoin (BTC) is now able to launch into a brand new chapter.

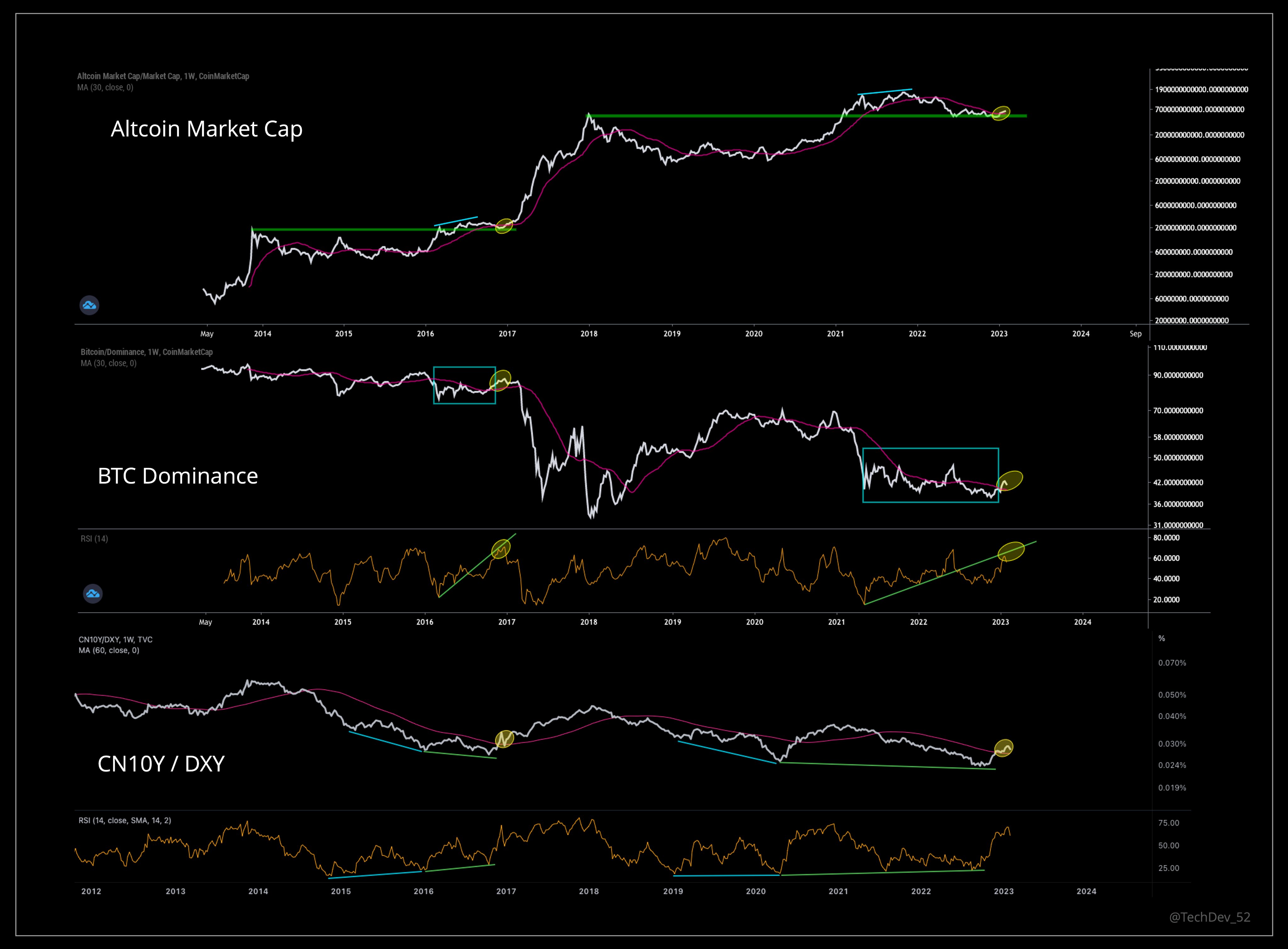

The pseudonymous analyst often known as TechDev tells his 406,000 Twitter followers that he believes Bitcoin follows international cycles of greenback liquidity, which he portrays with a chart that pits Chinese language ten yr bonds (CN10Y) in opposition to the US greenback index (DXY).

He additionally factors out that Bitcoin’s shifting common convergence divergence (MACD) indicator, which goals to pinpoint reversals, has flipped bullish on the month-to-month timeframe.

“When liquidity flows, Bitcoin strikes.

CN10Y/DXY broke above its one-year shifting common…

And its month-to-month MACD has crossed bullish.

5 out of the final 5 instances, a significant BTC impulse adopted.

What occurs this time?”

TechDev reiterates the similarities in market cycles between the CN10Y/DXY and Bitcoin to assist his thesis.

CN10Y / $DXY … leads #Bitcoin. pic.twitter.com/ztc3nQyaux

— TechDev (@TechDev_52) December 9, 2022

The analyst additionally compares the CN10Y/DXY chart with the Bitcoin dominance chart (BTC.D) and the entire altcoin market cap, saying that the present market construction is especially paying homage to the crypto bull market in 2017.

“Altcoin market cap

Bitcoin dominance

CN10Y / DXY (international liquidity)

As we speak’s market setup stays far nearer to 2017, than 2015 or 2019.”

The favored analyst says that BTC’s current value motion on the shorter timeframes suggests bullish continuation on the excessive timeframe. He factors out the comparatively small quantity of pink hourly candles for Bitcoin as of late.

“The market response to pink hourly candles is a wholesome signal for this excessive timeframe transfer.

When ‘purchase the dip’ tendencies instantly and the $9,000 charts vanish, a [medium-term] correction turns into extra probably.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Mia Stendal