- Miners continued to promote their BTC as they removed 10,000 BTC this week

- Big capitulation may very well be in sight because of the indications revealed by the Bitcoin hash ribbon

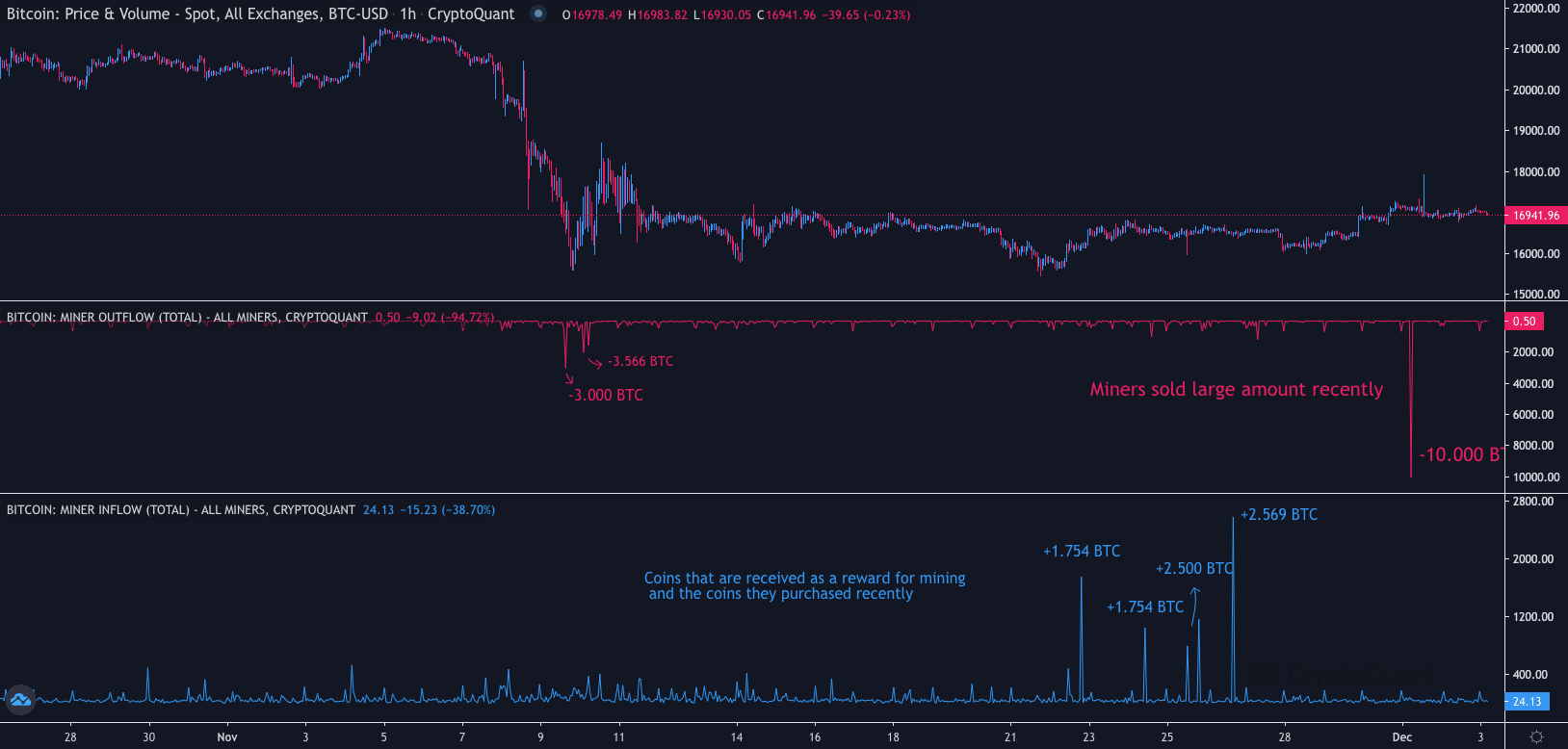

Bitcoin [BTC] miners continued promoting off huge models of the king coin because the strain to uphold its keep mounted. This growth got here to gentle by Joaowedson, a CryptoQuant analyst. He pointed out that the rising price of mining may need compelled this place. Joaowedson, who doubles as a knowledge scientist, elaborated,

“Confronted with the present value of Bitcoin and the excessive price of mining in a number of nations. Miners are being compelled to promote their positions.”

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Get it out in giant sums

CryptoQuant’s information showed that the latest BTC offered by miners was not insignificant by any means. At press time, Bitcoin miners had let go of 10,000 BTC as of 1 December. For the influx, it was not shut in any respect. The final time there was a big influx by miners was on 26 November when 2,569 BTC flooded in.

Supply: CryptoQuant

This situation meant that miners might stay unprofitable for a interval longer than anticipated. Moreover, the fixed miner sending out implied that it was doable for both one other drop in BTC’s value or a volatility enhance. This was as a result of the Miners’ Place Index (MPI) pertains to the one-year Transferring Common (MA). Therefore, this might have propelled the miners’ motion when put next with the declining provide.

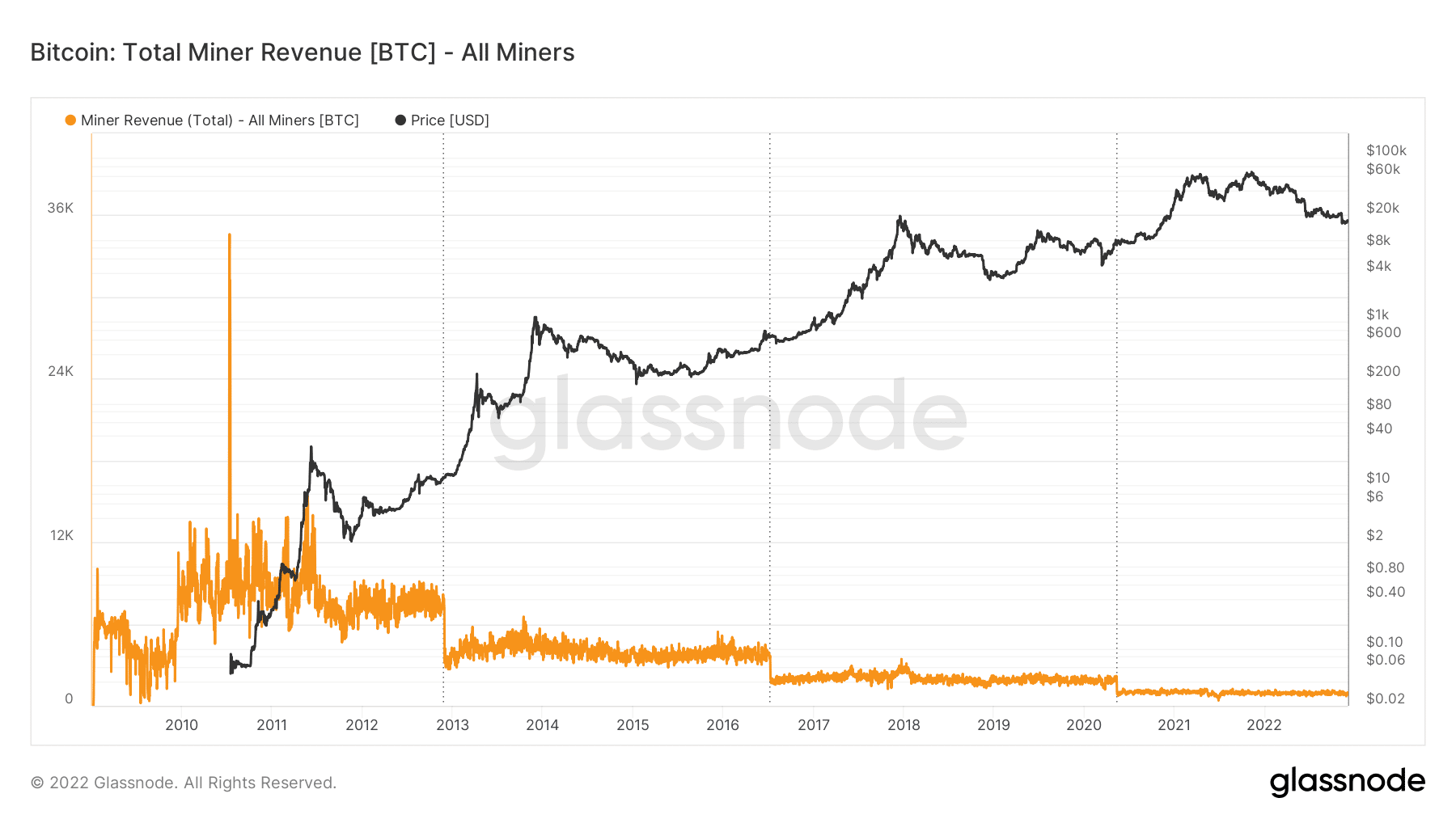

As anticipated, the promote–offs had affected the mining revenue despite the fact that it had been in an analogous state for months. In keeping with Glassnode, the entire income of BTC miners on the time of writing was 814.28 BTC. This meant that the rewards and costs generated since 2022 started had been nothing to be enthusiastic about.

Supply: Glassnode

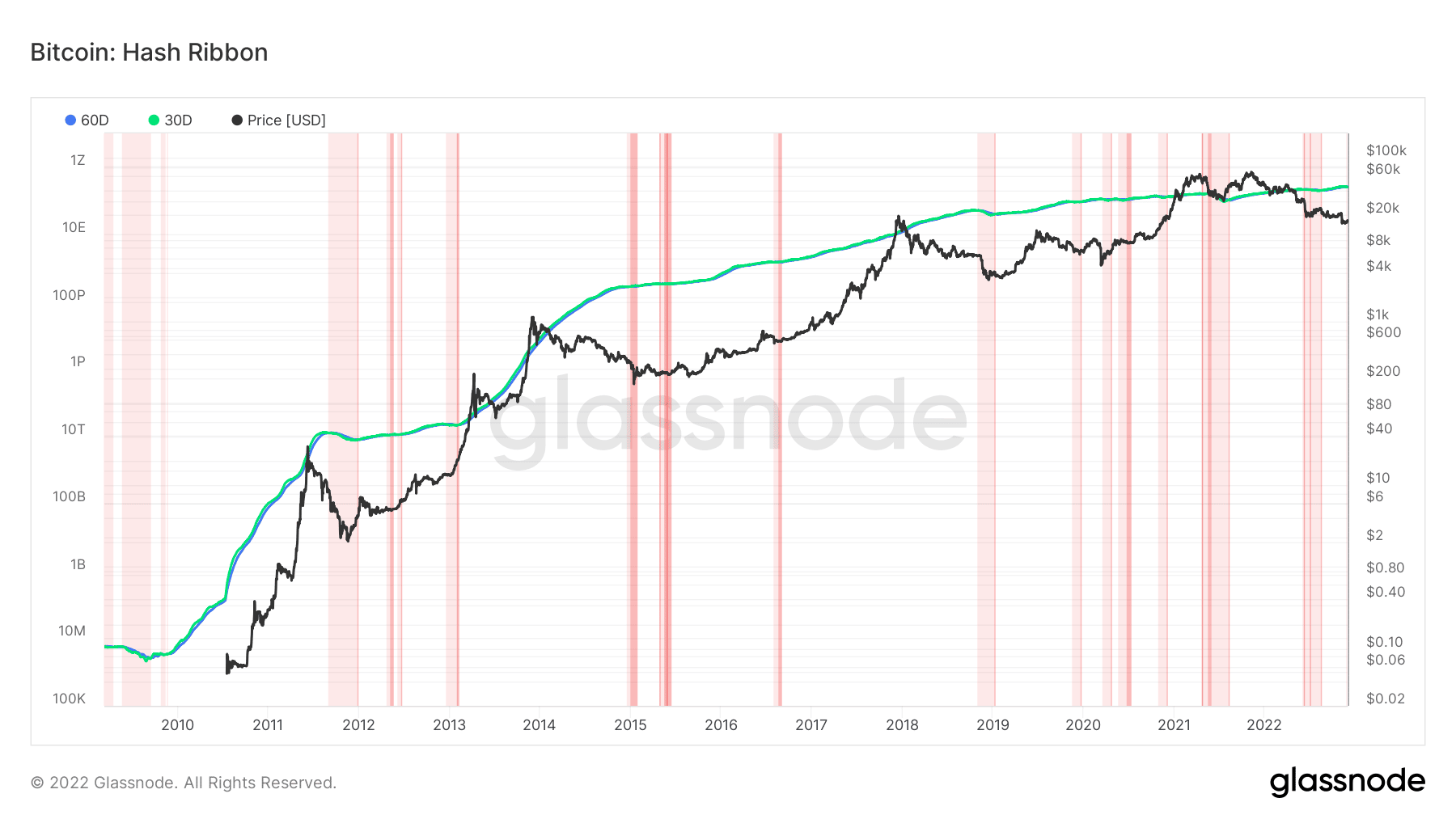

The hash ribbon says Bitcoin capitulation in sight

In addition to the income discount, the BTC hash ribbon indicated that extra fall may very well be shut by. In keeping with Glassnode, the hash ribbon revealed that Bitcoin was nonetheless costly in comparison with the mining price. Additionally, the metric indicated that the worst was not over but, because the 30-day MA had not crossed the 60-day MA.

In a case the place this occurs, the hash ribbon adjustments from the sunshine purple sign to darkish purple. Because the situation at press time was gentle purple, it meant that BTC might see additional draw back and the present value was more than likely not the underside.

Supply: Glassnode

As for its value, BTC was exchanging arms at $16,971. Based mostly on information by CoinMarketCap, this worth represented a 2.28% respite within the final seven days. Nonetheless, the 30-day efficiency was at a decline of 16.43%. Contemplating the information analyzed above, BTC may be unable to constantly commerce above $17,000 within the brief time period.