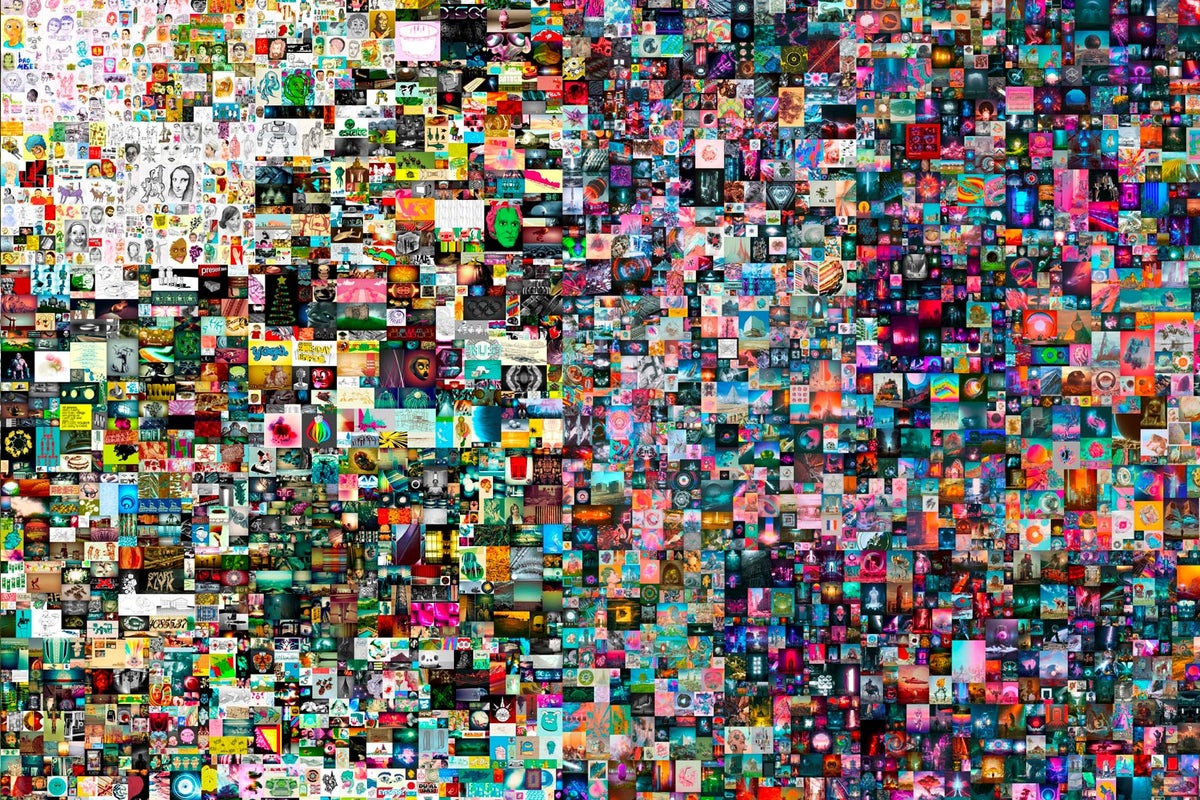

The USA Workplace of Authorities Ethics (OGE) has issued new steerage concerning non-fungible tokens (NFTs). In a legal advisory issued earlier this week, the OGE expanded its initiative aimed toward stopping conflicts of curiosity within the highest ranges of the US authorities. The brand new requirement? Senior officers should disclose the NFTs they personal.

In the end, this new steerage raises necessary questions on whether or not NFTs are considered as artwork or investments by the US authorities.

New guidelines for Web3

Yearly, US politicians must file statements containing details about their personal finances. These paperwork are declared to the general public and made accessible for any citizen to view. The latest authorized advisory from the OGE provides NFTs as one new “asset class” that US politicians want to incorporate in these yearly statements.

The brand new steerage additionally famous that people might want to disclose their possession of fractionalized NFTs (F-NFTs). In different phrases, if a authorities official needs to cling onto even only a fraction of a Bored Ape or CryptoPunk NFT that exceeds the OGE’s threshold, they should embody it of their yearly monetary assertion.

“Public monetary disclosure filers should disclose possession of collectible NFTs and F-NFTs when these belongings are held for funding or manufacturing of revenue,” the authorized advisory said.

Nonetheless, as famous, there’s a threshold. Not all NFTs must be declared.

NFTs: Funding or artwork?

In line with the OGE’s authorized advisory, any NFT held as an funding price over $1,000 have to be publicly declared as a part of a politician’s set of belongings. Along with this, any NFT that has produced revenue over $200 must be declared within the annual report as nicely, even when the precise worth of the NFT falls wanting $1000.

Within the discover, the OGE additionally made it clear that they’re not going to present authorities officers a lot wiggle room in the case of whether or not an NFT was bought as artwork or bought as an funding. In the end, the advisory states it’s a “factual query.” And the way do they reply this factual query?

In line with the discover, ought to an NFT be bought for its aesthetic worth and put up for show in a authorities official’s “house, workplace, or digital property,” then it’s thought-about digital artwork and doesn’t must be reported.

The steerage reads:

“Worker purchases a restricted version NFT of the artist Leandra Garcia’s Paper Moon. The unique Paper Moon is a pastel drawing by Garcia. Garcia provides the unique drawing, restricted run lithograph prints, and restricted run NFTs on the market on her web site. Worker bought the NFT from Garcia for $1,100. Worker intends to show the drawing at house and at work utilizing an NFT digital show body. Worker bought the NFT solely as a result of Worker enjoys Garcia’s art work. Worker has no plans to promote the NFT. Beneath the circumstances, Worker shouldn’t be holding the NFT for funding or manufacturing of revenue and subsequently needn’t report possession on their annual monetary disclosure report.”

Nonetheless, issues change if the NFT is ever offered. “For instance, an worker who bought an NFT art work for show within the worker’s house however later determined to promote it could be required to report the NFT as a supply of revenue if the sale resulted in additional than $200 in revenue,” the discover says. In different phrases, whether it is ever offered for a revenue over $200, it’s not thought-about artwork.

The OGE additionally encourages ethics officers reviewing these paperwork to do their very own diligence, advising them to look right into a politician’s NFT transaction historical past ought to disputes on the character of their purchases come up.