Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The day by day construction has been bearish with the decrease timeframe momentum southbound too

- Additional losses for Bitcoin may see SHIB shed worth quickly on the charts

Shiba Inu has been bearish on the worth charts in latest weeks. Investor sentiment has been adverse and the buying and selling quantity additionally noticed a fall in latest days. This, though the community efficiency has remained wholesome.

Learn Shiba Inu’s [SHIB] Value Prediction 2023-24

For Bitcoin‘s half, though it approached a crucial degree of assist, it remained unsure whether or not the downtrend throughout the crypto-market would see some reduction. Federal Reserve Chair Jerome Powell cautioned that rates of interest may head greater, an replace that negatively impacted investor sentiment.

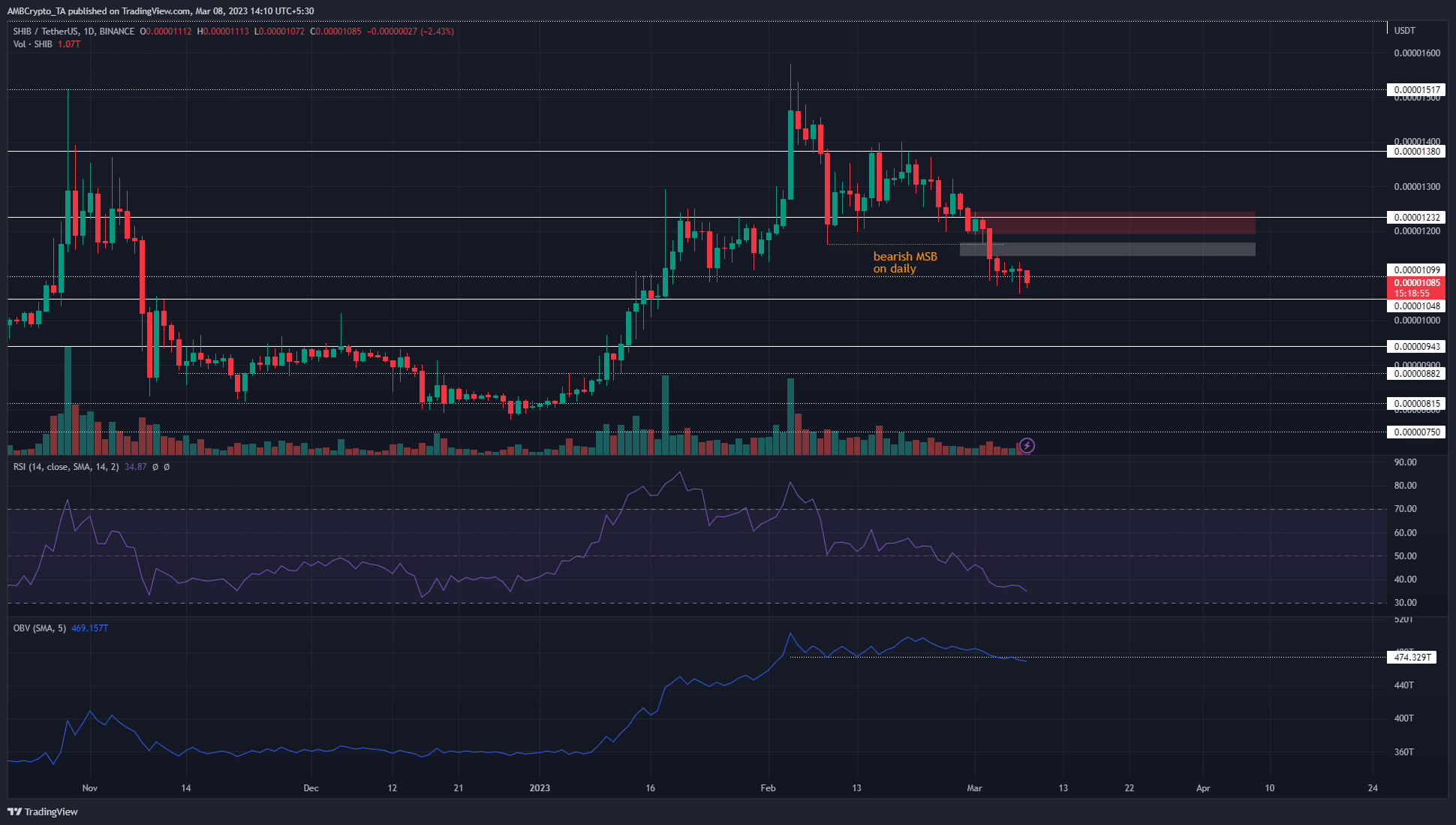

A bounce to the imbalance above may current a shorting alternative

Supply: SHIB/USDT on TradingView

On the day by day chart, the construction was bearish after SHIB broke beneath the upper low at $0.0000117 (proven in orange). This occurred on 3 March and the worth has additionally left a good worth hole (white) on this zone. Subsequently, the conclusion is that sentiment was strongly bearish and sellers dominated the market.

The RSI mirrored the shift in bias when it fell under the impartial 50-mark and retested it as resistance in late February. Nonetheless, the OBV didn’t but notice massive losses, though it did fall beneath a assist degree from February. This highlighted that Shiba Inu sellers are more likely to strengthen within the coming days.

Additional above the imbalance gave the impression to be a bearish order block at $0.0000123. This zone has acted as an important space of provide and demand over the previous two months. Therefore, a retest of this zone would probably current a great risk-to-reward shorting alternative.

Is your portfolio inexperienced? Examine the Shiba Inu Revenue Calculator

In the meantime, the following ranges of assist have been at $0.0000105 and $0.0000094 – 3.4% and 13.2% under the worth of SHIB, on the time of writing.

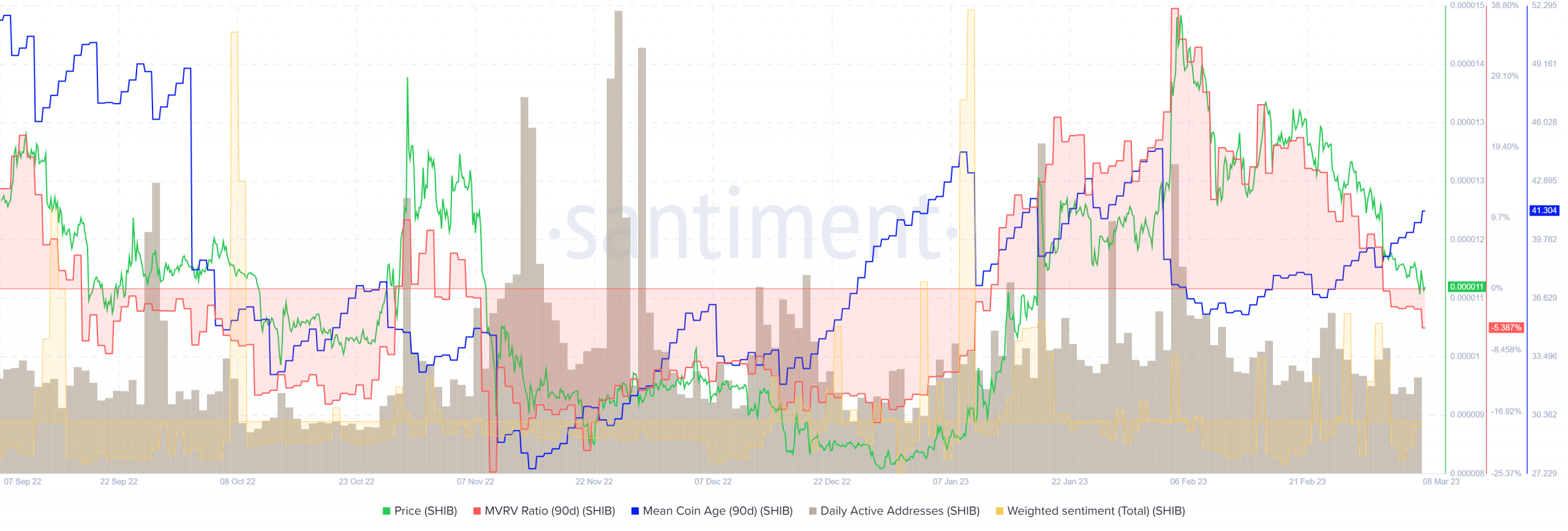

Each day lively addresses trended decrease however accumulation seen

The 90-day MVRV ratio hit 6-month highs in early February and has fallen since. At press time, it was in adverse territory, implying that brief holders have been at a loss general. That didn’t imply that promoting strain would abate however highlighted that holders probably booked a revenue in February.

The day by day lively addresses depend has declined since 21 February because it shaped a collection of decrease highs. In the meantime, weighted sentiment retreated into the adverse territory after a powerful displaying in early March.

Quite the opposite, the 90-day imply coin age has been on the rise, signalling a network-wide accumulation section. This, nonetheless, won’t instantly flip the downtrend.

![Assessing how Shiba Inu [SHIB] will present an attractive selling opportunity](https://ambcrypto.com/wp-content/uploads/2023/03/PP-2-SHIB-cover-1000x600.jpeg)