- USDT lately witnessed elevated actions from sharks and whales.

- Tether influx to exchanges additionally noticed a bump.

Since an 11 January report revealed Tether’s [USDT] plans to delist from the Canadian market, the stablecoin has turn into the topic of Worry, Uncertainty, and Doubt (FUD). Tether, nevertheless, continued to draw curiosity from sharks and whales regardless of the newest replace till press time.

Is your portfolio inexperienced? Try the USDT Revenue Calculator

Tether: Sharks and Whales at play

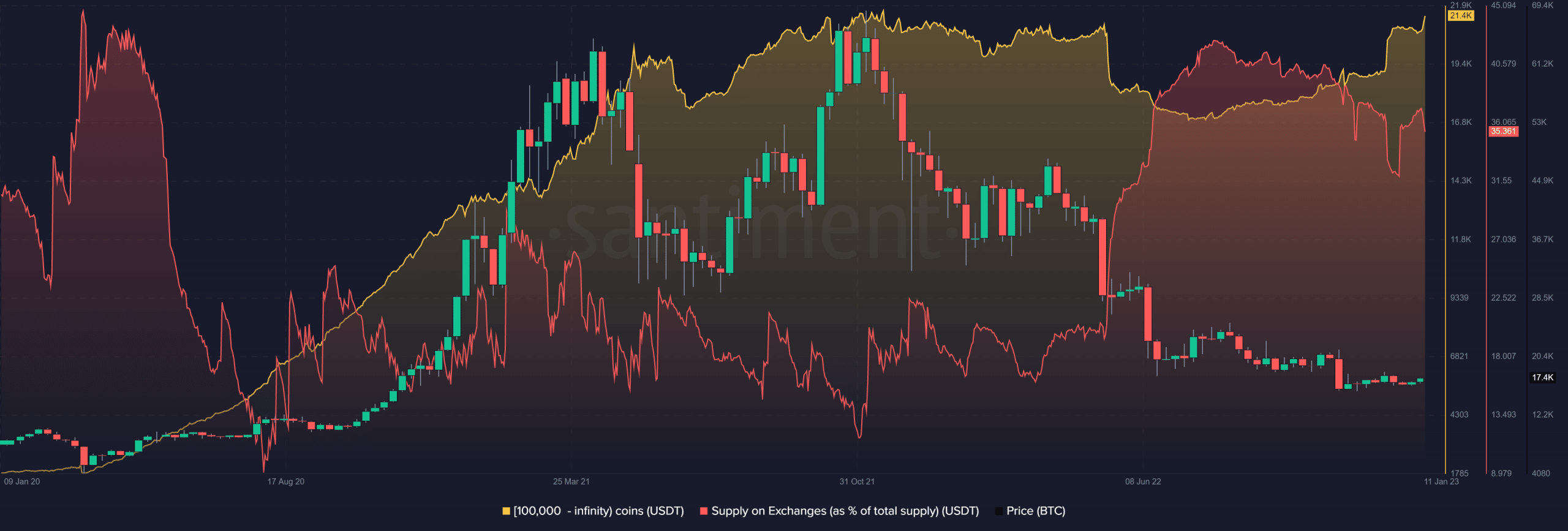

Sharks and whales have elevated their accumulation actions, in response to a chart by Santiment. The determine identified that there have been an rising variety of addresses holding 100,000 USDT or extra in current weeks.

On the time of writing, nearly 21,000 addresses held 100,000 USDT or extra. This quantity was 1% away from setting a brand new all-time excessive (ATH) at present degree.

Supply: Santiment

The chart additionally revealed that at press time, over 35% of the full USDT provide was accessible on exchanges. In response to information from CoinMarketCap, the stablecoin’s present whole circulating provide was above $66 billion, and the market cap was in the identical ballpark.

USDT is the most important stablecoin globally, and USDT was the third-largest cryptocurrency on the time of writing.

Practical or not, right here’s USDT’s market cap in BTC’s phrases

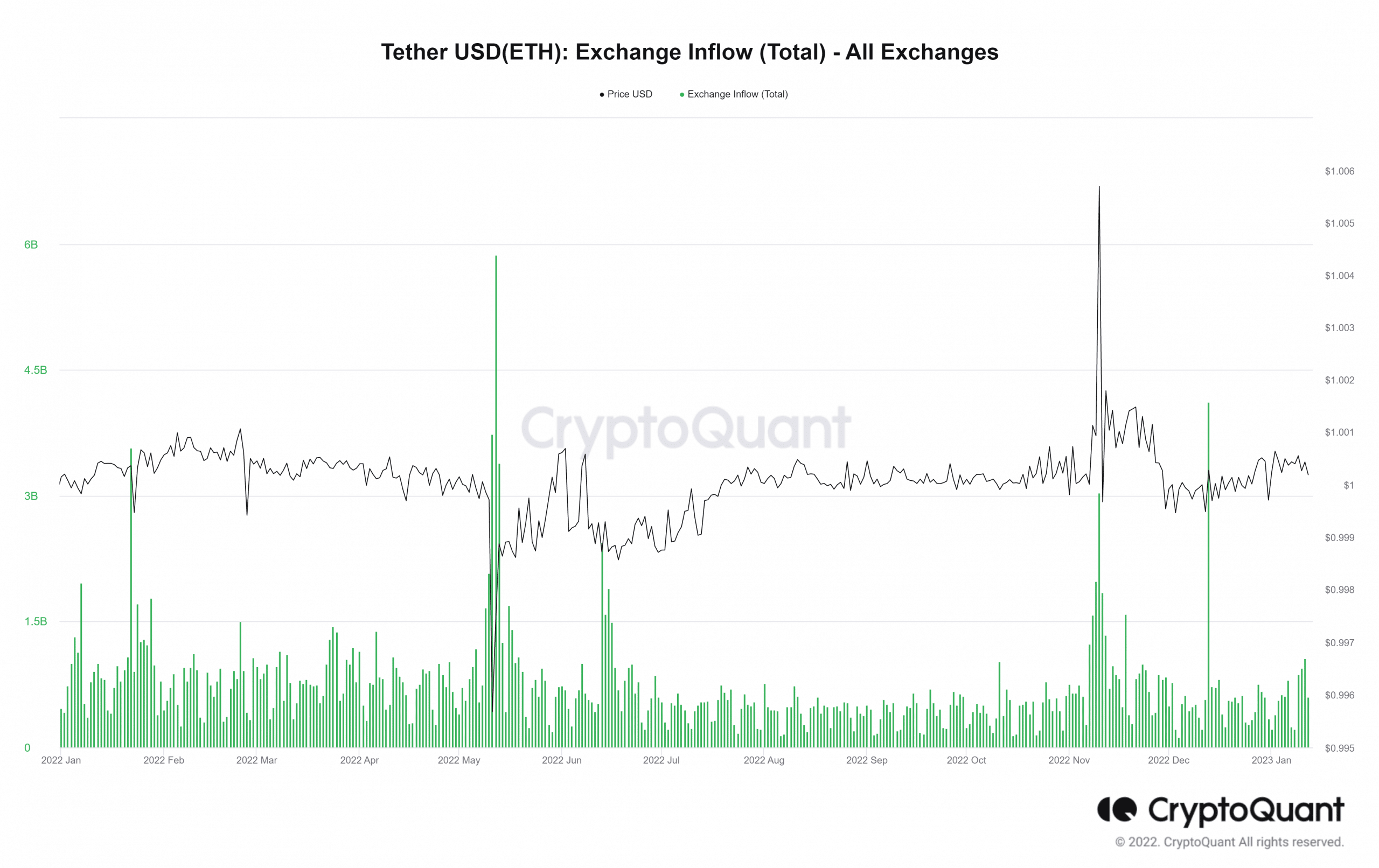

Alternate Influx gathers steam

Transferring on, CryptoQuant’s change influx indicator confirmed that USDT was experiencing vital inflows at press time. The inflow was already over $500 million throughout this era and was persevering with to develop. As of 11 January, the full change influx on the chart was greater than $1 billion.

Supply: CryptoQuant

Lastly, the above charts could possibly be consultant of the truth that whales and sharks should be on a observe run for the crypto market’s upcoming bull run. As accumulation continues, the variety of addresses holding 100k or extra USDT could ultimately attain an ATH.

![Assessing Tether’s [USDT] health as whales and sharks take a bullish stance](https://ambcrypto.com/wp-content/uploads/2023/01/tether-1000x600.jpg)