South Korea has begun a probe into cryptocurrency exchanges within the nation in relation to providing native tokens, as per a local news report. The Korea Monetary Intelligence Unit (KoFIU) is the monetary regulatory company of South Korea. This regulatory physique was investigating this matter within the wake of the chapter submitting of crypto change FTX.

The worth fall of FTT tokens, the native tokens of FTX, had been behind the collapse of crypto change FTX and its 130 affiliate companies. On 11 November, the change filed for chapter because of this.

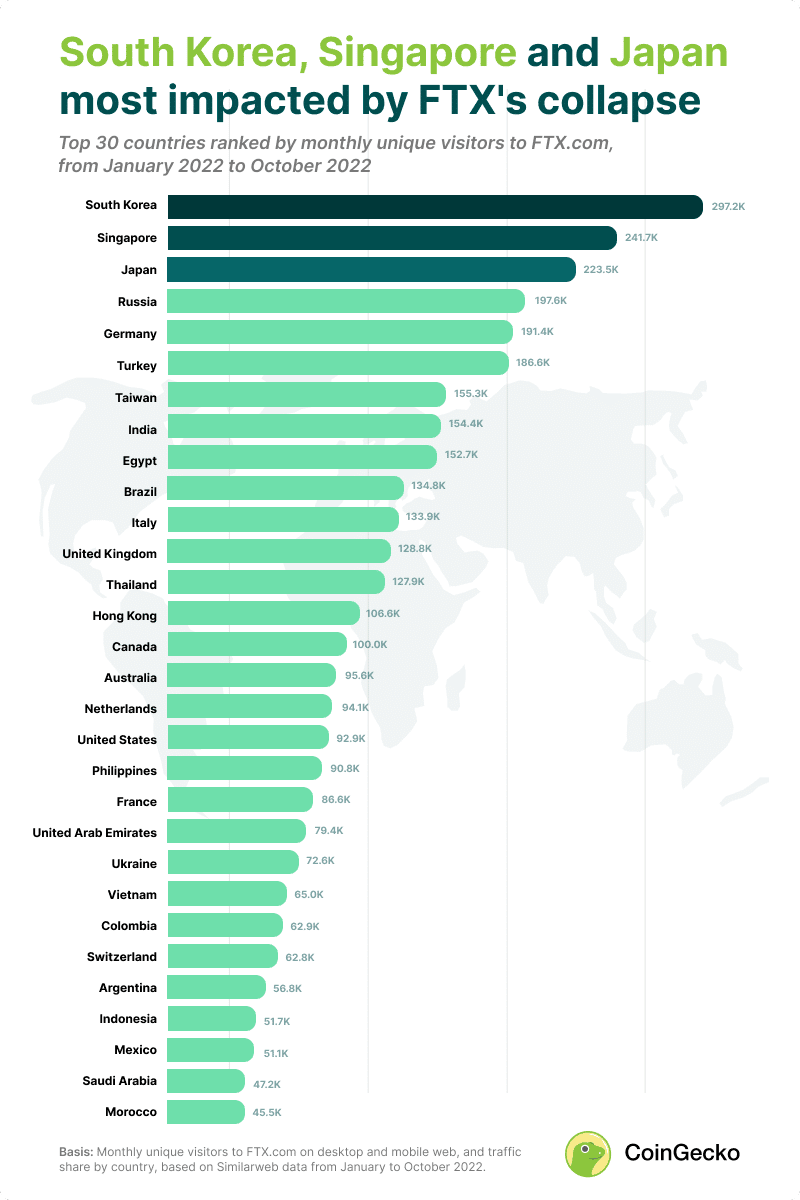

South Korea: The worst-hit nation due the FTX collapse

As per a CoinGecko analysis, South Korea leads the checklist of nations by way of the variety of FTX customers. Amongst all international locations, South Korea noticed the best site visitors share of 6.1%. This meant that not less than 297,229 distinctive month-to-month customers visited FTX.com on a median.

The research additionally examined month-to-month distinctive guests and site visitors share by nation on FTX.com desktop and cell internet. This was primarily based on SimilarWeb’s knowledge from January to October 2022.

Supply: CoinGecko

In essence, South Korea has been the worst hit nation as a result of collapse of the FTX change.

Exchanges in South Korea are prohibited from issuing native tokens. Thus, KoFIU’s investigation meant to make sure regulatory adherence for investor security. All cryptocurrency exchanges in South Korea operated legally, however an investigation has been launched as a result of there have been nonetheless some issues about token listings.

Flata Change was one of many main suspects, having listed its native token, FLAT, in January 2020. Authorities additionally cleared main exchanges resembling Upbit and Bithumb. Nevertheless, the investigations are anticipated to give attention to smaller crypto exchanges.

FTX Debacle: Simply one other push for rules?

The debacle surrounding the collapse of FTX has solely added to South Korea’s additional push for its crypto regulation course of, as per a current report. Kim So-young, vice chairman of the Monetary Providers Fee, emphasised,

“As revealed within the FTX incident, it’s obligatory to organize a tool to control unfair commerce, such because the digital asset operator’s responsibility to guard customers’ property and the permission of self-issued cash.”

The nation’s Nationwide Meeting just lately held a gathering to debate laws associated to cryptocurrency. This assembly was a follow-up to an emergency assembly held to guard traders after the Terra-Luna incident in Might.

Lee Myung-soon, senior vp of the Monetary Supervisory Service, stated,

“With the market declining resulting from international tightening, the Terra-Luna incident, Celsius and FTX have had successive failures, and it has been a 12 months through which belief has declined. Contemplating the fast tempo of change within the digital asset market, The Monetary Supervisory Service can even actively assist laws by monitoring in order that total rules resembling disclosure of digital property will be ready.”