Polygon [MATIC] was final week’s high performer among the many high 20 cryptos by way of market capitalization, as its worth surged by over 30%. At press time, MATIC was buying and selling at $1.20 with a market capitalization of $10.4 billion, in keeping with CoinMarketCap.

CoinGecko’s knowledge revealed that MATIC was additionally fairly standard, at press time because it was on the listing of trending cryptos on 6 November.

⚡️Trending Searches by @CoinGecko

6 November 2022#FTX $FTT $XCAD #Aptos $APT $PROS #Chiliz $CHZ $FTM $GALA $STG $MATIC $AR pic.twitter.com/PuXYU80TY0— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) November 6, 2022

Right here’s AMBCrypto’s Worth Prediction for Polygon [MATIC] for 2023-24

A number of developments on MATIC’s NFT additional elevated the community’s capabilities, such because the launch of Versify on the Polygon community, which is a web3 buyer loyalty platform for Web2 firms. This new integration will assist those that wish to create digital collectible loyalty packages.

Do you suppose creating NFT loyalty packages is just too complicated? Suppose once more.@versifylabs, a #web3 buyer loyalty platform for web2 firms, is LIVE #onPolygon!

Now, it’s insanely simple for even the least tech savvy to create digital collectible loyalty packages like a professional 😎 pic.twitter.com/qfQtERjahz

— Polygon – MATIC 💜 (@0xPolygon) November 6, 2022

In reality, Polygon’s NFT house registered a rise in its complete commerce rely and commerce quantity in USD over the past week in response to those developments.

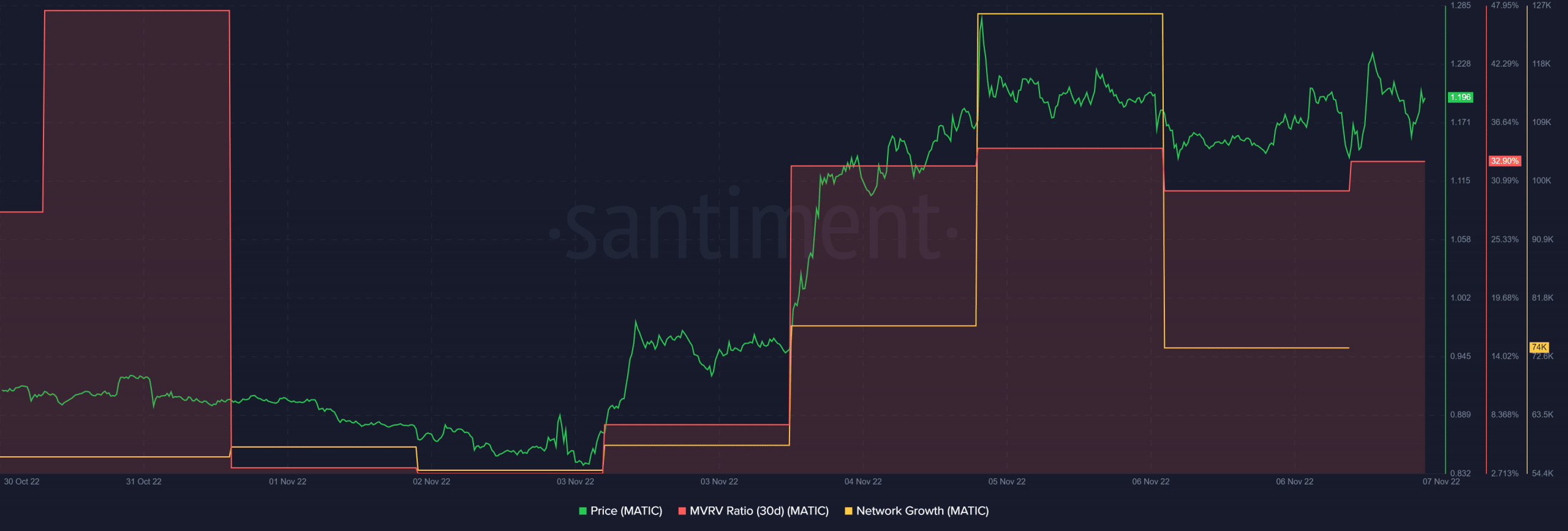

Picture Supply: Santiment

Nonetheless, issues may quickly take a U-turn as, in keeping with CryptoQuant’s data, the bears have been gearing up and have been able to overtake the bulls.

What traders ought to contemplate about MATIC

MATIC’s Relative Energy Index (RSI) was in an overbought place, which is a large bearish sign suggesting a pattern reversal which might be anticipated quickly. Furthermore, its community development registered a decline on 6 November, which was a destructive sign.

Picture Supply: Santiment

Nonetheless, the opposite metrics appeared nice for MATIC. As an example, the MVRV ratio was up, which hinted at the opportunity of a continued value surge within the coming days. Moreover, MATIC’s change reserves have been falling, indicating decrease promoting stress.

The variety of transactions and transaction quantity additionally appeared fairly promising, as each have been up within the final 24 hours. Not solely this, however MATIC was additionally fairly standard among the many whales, as MATIC was among the many listing of cryptos that the highest 2000 Ethereum whales have been holding, at press time.

Higher days to return?

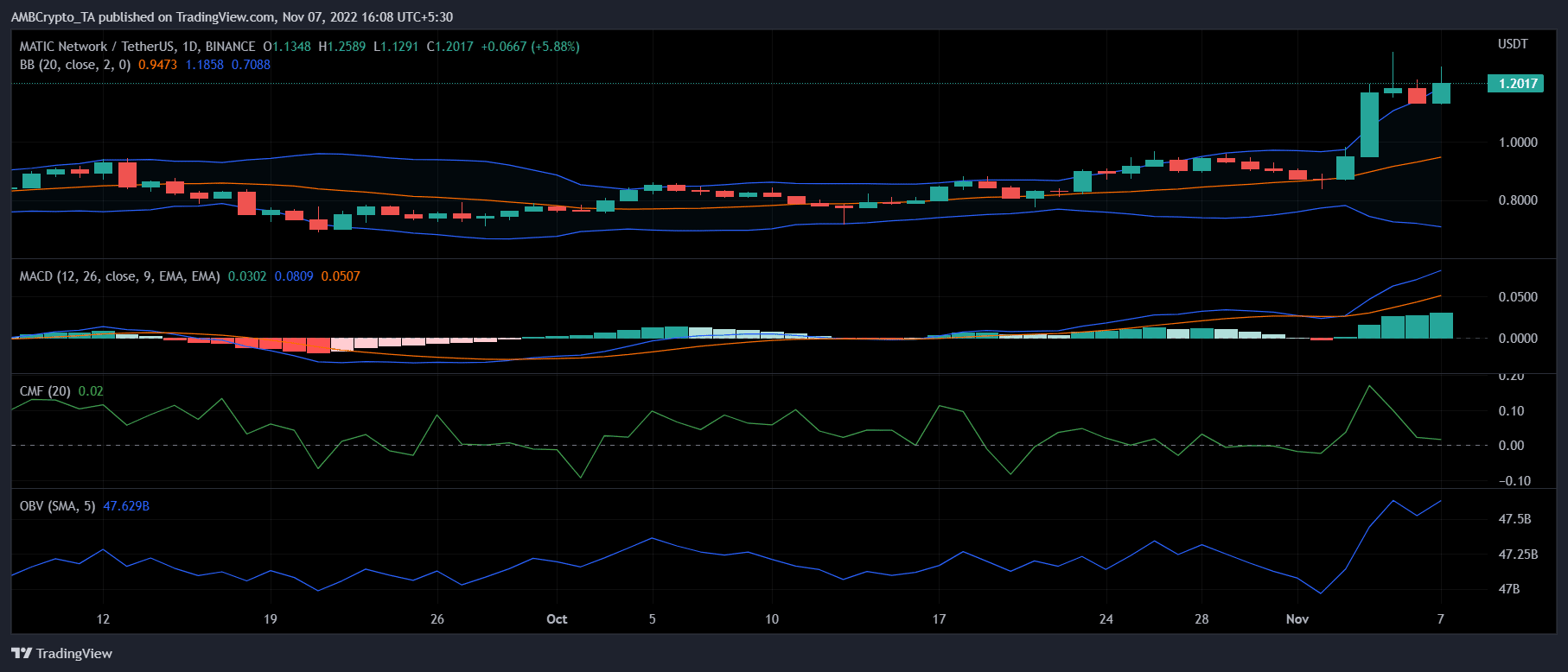

MATIC’s each day chart indicated that issues have been nonetheless in traders’ favor, and an extra value surge can’t be dominated out. The MACD’s studying revealed a large bullish benefit out there. The On Steadiness Quantity (OBV) additionally registered an uptick, which was a constructive sign.

Apparently, the Bollinger Band’s knowledge confirmed that MATIC’s value was in a excessive volatility zone, additional rising the possibilities of a continued northbound motion within the days to return. Nonetheless, MATIC’s Chaikin Cash Stream (CMF) went down and was resting close to the impartial mark, which is likely to be regarding.

Picture Supply: TradingView