- Bitcoin opened curiosity returns, however funding price tanked

- Bitcoin volatility witnessed an increase upon contemplating the exercise of indicators

Bitcoin [BTC] launched into some upside final week, triggering hopes of a possible restoration above $20,000. Nevertheless, the upside was short-lived, and the cryptocurrency was again beneath $17,000 at press time.

However what can the market count on this week, now that demand slowed down in the course of the weekend?

Learn Bitcoin’s [BTC] Worth Prediction for 2023-24

A take a look at the present stage of demand out there would possibly assist decide how Bitcoin’s value motion will play out. In accordance with the newest Glassnode alerts, the variety of Bitcoin addresses holding greater than 10 BTC was at a two-year excessive. This remark meant there may be nonetheless some demand for BTC out there.

📈 #Bitcoin $BTC Variety of Addresses Holding 10+ Cash simply reached a 2-year excessive of 154,796

View metric:https://t.co/0NzRiyaeFg pic.twitter.com/Xt7oalCjU0

— glassnode alerts (@glassnodealerts) December 17, 2022

This confirmed that Bitcoin was nonetheless experiencing important demand whilst the worth continued to slip. However this may not be sufficient to generate sturdy bullish momentum. A take a look at BTC’s efficiency within the derivatives market might assist present a greater understanding of the extent of volatility to count on within the subsequent few days.

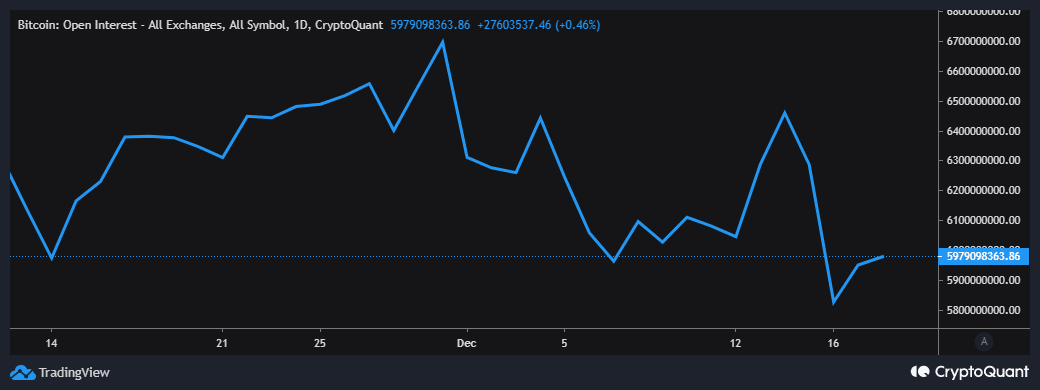

Bitcoin skilled a pointy drop in open curiosity within the derivatives market between 14 – 16 December. This was across the similar time that the worth gave up its weekly positive factors.

Supply: CryptoQuant

The identical metric revealed that Bitcoin’s open curiosity recovered barely within the final two days, though not with as a lot enthusiasm as its earlier decline. Regardless of this slight restoration, the Bitcoin funding price had not recovered but.

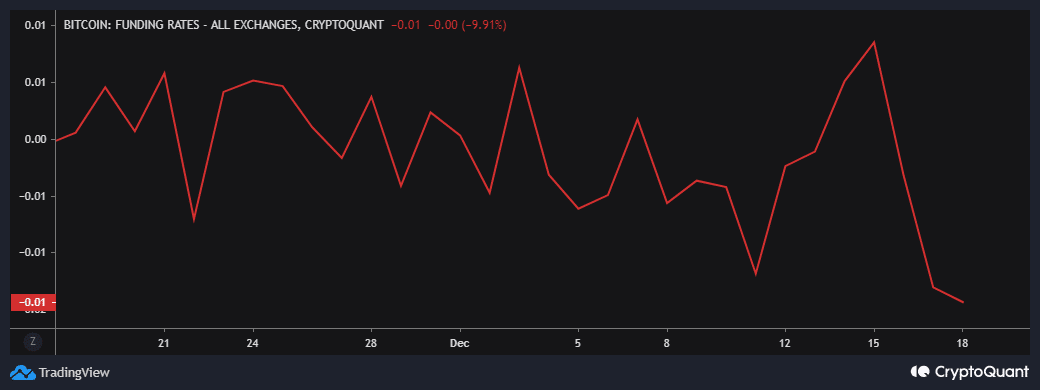

Supply: CryptoQuant

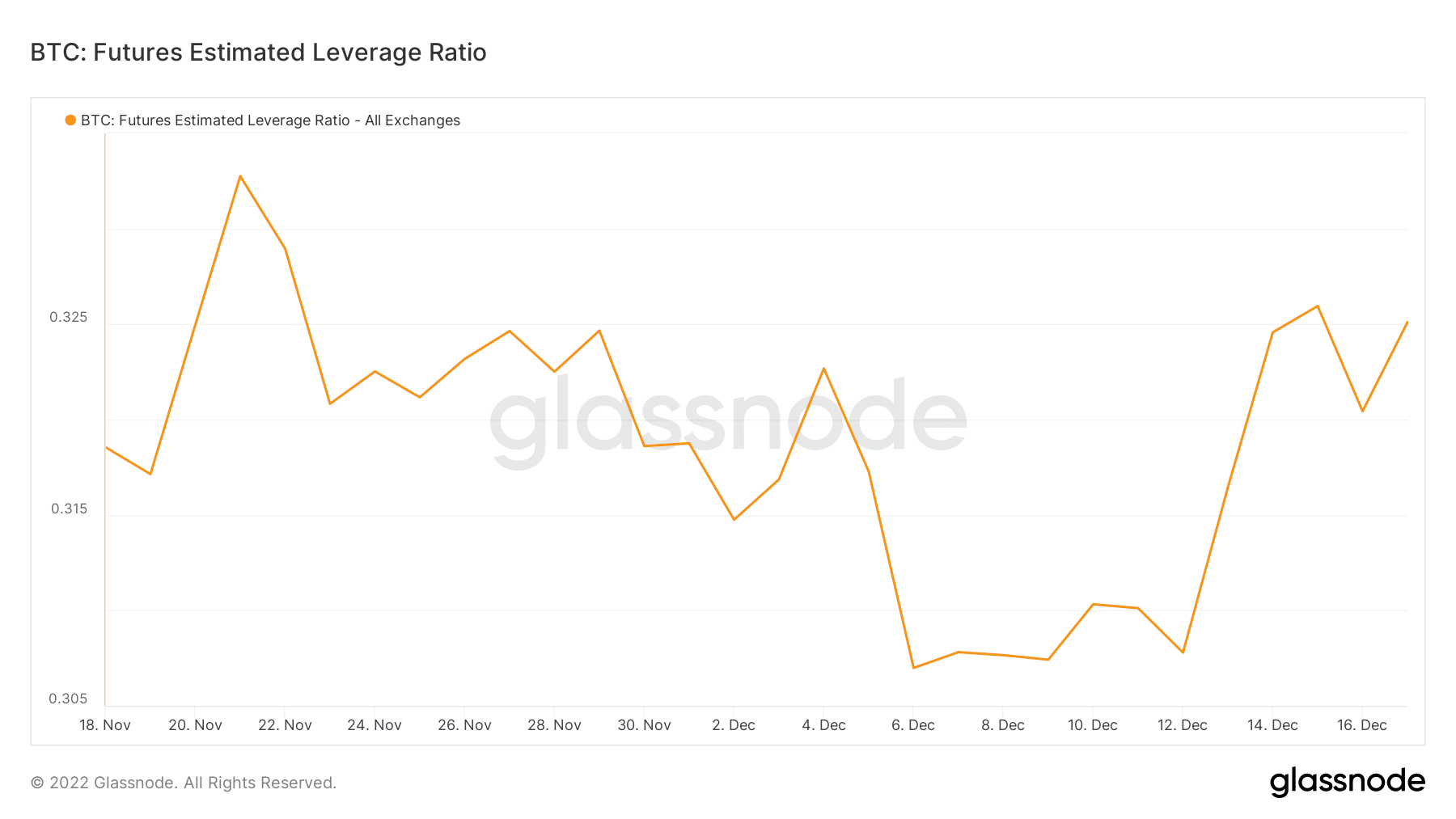

This drop in funding charges indicated that quick merchants had the higher hand and had been keen to pay funding to long-term merchants. However does this imply that traders would possibly see extra volatility in favor of the draw back? Bitcoin’s futures estimated leverage ratio rose during the last six days.

Supply: Glassnode

Larger leverage meant that Bitcoin was more likely to expertise larger volatility. A collective remark of the indications urged a considerable chance of extra downward strain. Nevertheless, the demand for BTC at lower cost ranges urged that it would face important friction on its approach down.

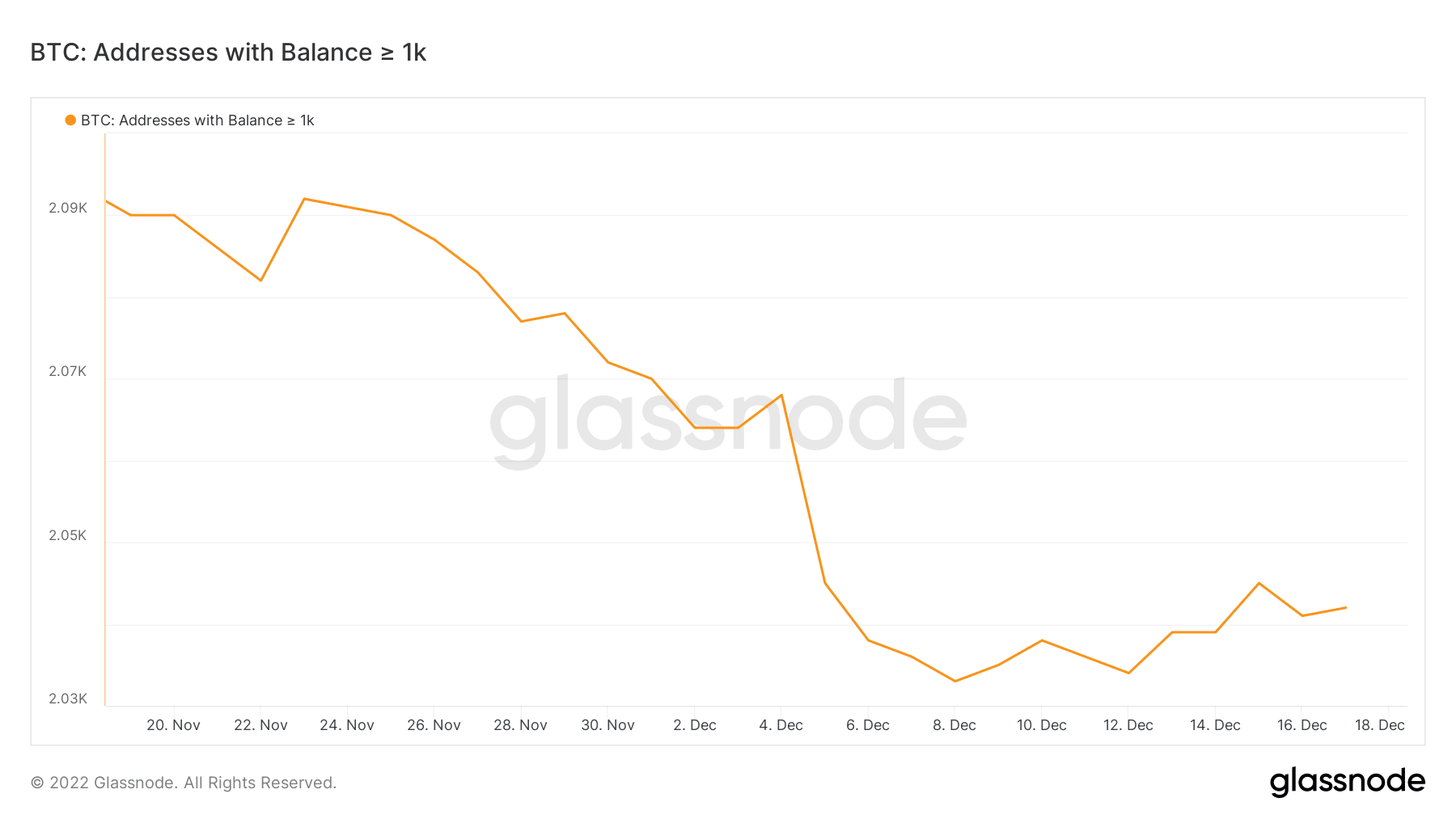

On the plus aspect, Bitcoin noticed a gradual demand restoration from whales. Addresses holding over 1,000 BTC elevated barely within the final 10 days. This may also soften the draw back and herd BTC in the direction of a slim vary.

Supply: Glassnode

Based mostly on the above observations, it’s clear that Bitcoin’s volatility was on its technique to restoration, and so was demand from whales. Alternatively, bullish demand was nonetheless low. Promote strain and low funding price urged the potential for an attention-grabbing week forward.

![Assessing the state of Bitcoin’s [BTC] demand in the derivatives market](https://ambcrypto.com/wp-content/uploads/2022/12/1671359324931-143de8c2-9593-416c-a7cd-1db57863c131-1000x600.png)