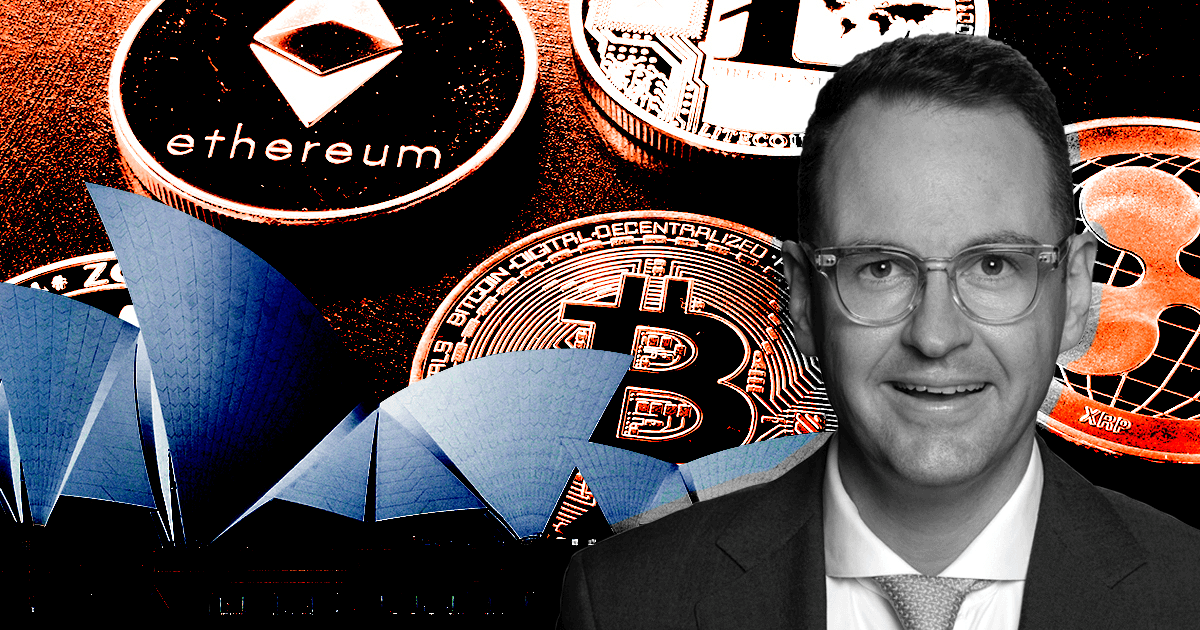

Australian liberal senator Andrew Bragg launched a draft invoice to supply regulation of stablecoins, digital asset exchanges, and disclosure necessities for the Chinese language CBDC, e-Yuan, on Sept. 19.

The draft invoice, titled “Digital Property (Market Regulation) Invoice 2022”, welcomes stakeholder session earlier than its clearance on Oct. 31.

Braggs defined that Australia is falling behind the remainder of the world in client safety and funding promotion whereas he lays the groundwork for crypto regulation within the nation.

Licensing necessities

The brand new guidelines would require digital asset exchanges, custody service suppliers, and stablecoin issuers to carry acknowledged overseas licenses.

Such licenses should adjust to digital asset custody necessities, which embody the designation of key personnel in Australia liable for working the digital asset custody providers, in addition to adhering to minimal capital and following auditing, assurance, and disclosure procedures.

Additional, stablecoin issuers should maintain the face worth of their liabilities. They should be stored in reserve with an ADI in Australia within the type of Australian {dollars} or a overseas nationwide forex.

Digital e-Yuan reporting necessities

The draft invoice states that Chinese language state-owned banks that facilitate the provision or use of the digital e-Yuan should report on Australian companies that settle for e-Yuan funds, the variety of digital wallets facilitated by the designated financial institution, and the entire quantity held in these wallets.

APRA and the Reserve Financial institution of Australia are required to supply annual studies based mostly on studies from Chinese language state-owned banks for the Minster and the Parliamentary Joint Committee on Intelligence and Safety.

The state of crypto regulation in Australia

On August 2022, Labour Occasion’s Treasurer Jim Chalmers introduced a multi-step plan to ascertain a crypto regulatory framework for business and regulators.

The Treasury will perform a “token-mapping” train, which entails conducting analysis on how cryptocurrency and associated providers ought to be regulated. The Treasury will launch a public session on “token-mapping” outcomes “quickly.”