- Defrost Finance will get hacked and funds price $12 million get stolen

- Avalanche’s TVL and income generated declines

A DEX on the Avalanche community, generally known as Defrost Finance, was compromised by an assault from a hacker. Based on information offered by PeckShield Inc, a crypto safety analytics agency, the attacker was in a position to get away with $12 million.

Learn Avalanche’s Worth Prediction 2023-2024

The unfolding of all of it…

The attacker managed so as to add a pretend token as collateral, then proceeded to make use of a pretend value oracle. A value oracle is a supply of value information streamed onto a blockchain. Utilizing these instruments, the attacker managed to liquidate $12 million price of person funds.

This was not the primary assault that had occurred on Defrost Finance. On 23 December, Defrost Finance was hacked and the hacker was in a position to make use of flash loans (which is an uncollateralized loans) to steal funds worth $173,000. It’s unsure whether or not these assaults had been carried out by the identical or completely different hackers.

The Defrost Finance group was prepared to barter with the hacker. In a latest tweet, the group at Defrost Finance introduced that they are going to be prepared to pay as much as 20% of the funds to the hacker. This was if the hacker manages to present again the remaining funds to Defrost Finance.

The Defrost group is prepared to barter with the hacker(s).

We’re prepared to debate sharing 20% (negotiable) of the funds in trade for the majority of belongings and are calling on the hackers to contact us asap.

— Defrost Finance 🔺 (@Defrost_Finance) December 25, 2022

The present state of Avalanche

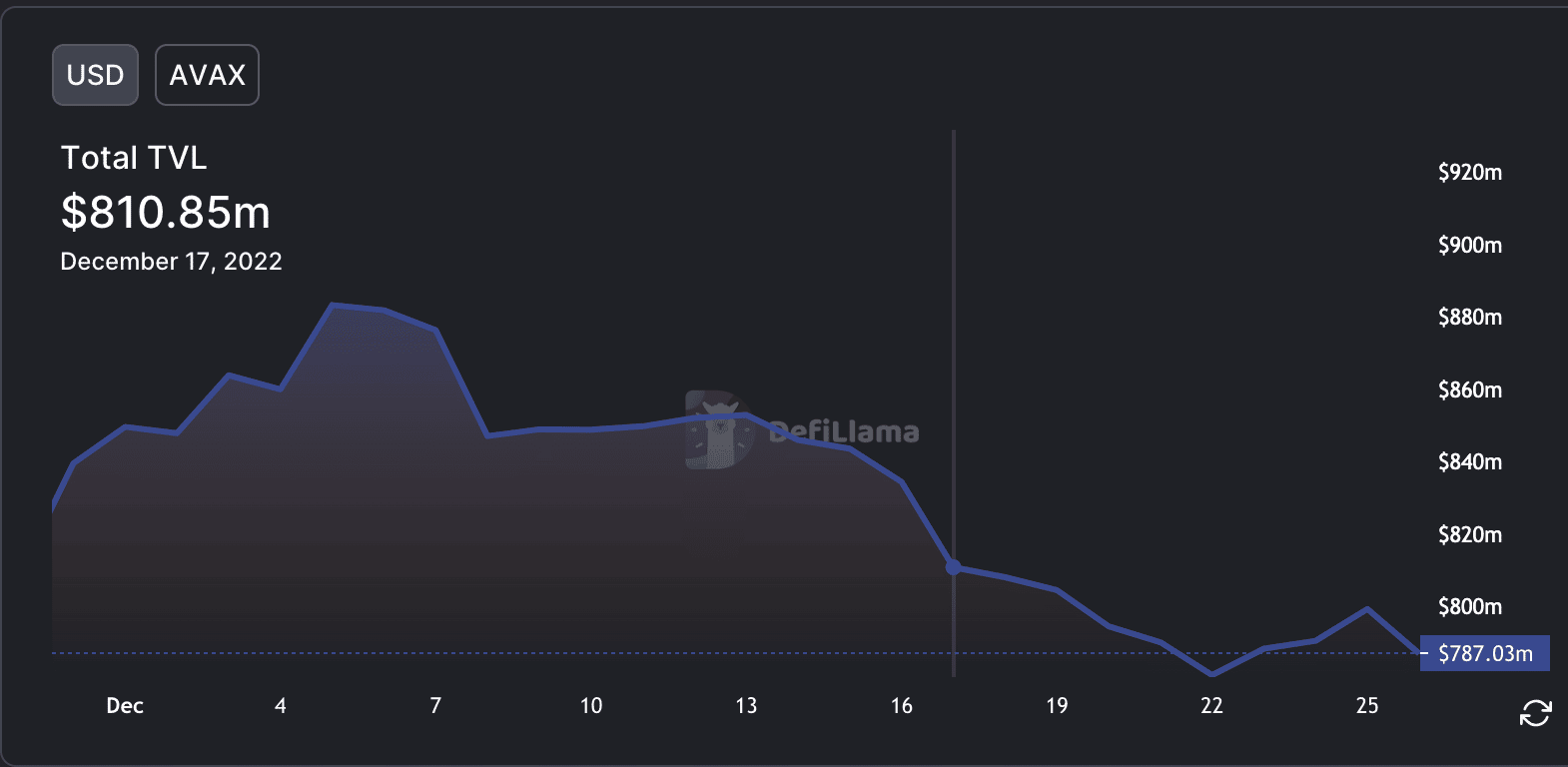

These concurrent assaults occurring in Avalanche’s DeFi ecosystem may have an effect on the general TVL collected by Avalanche. Based on DefiLlama, Avalanche’s TVL diminished from $903 million to $787.03 million over the past month.

Supply: Defi Llama

Moreover, the income generated by Avalanche declined as properly. Avalanche’s income fell by 41.3% within the final 30 days, primarily based on token terminal’s information. On the time of writing, the cumulative income generated by Avalanche stood at $3.8 million.

A 38.38x hike on the playing cards if AVAX hits ETH’s market cap?

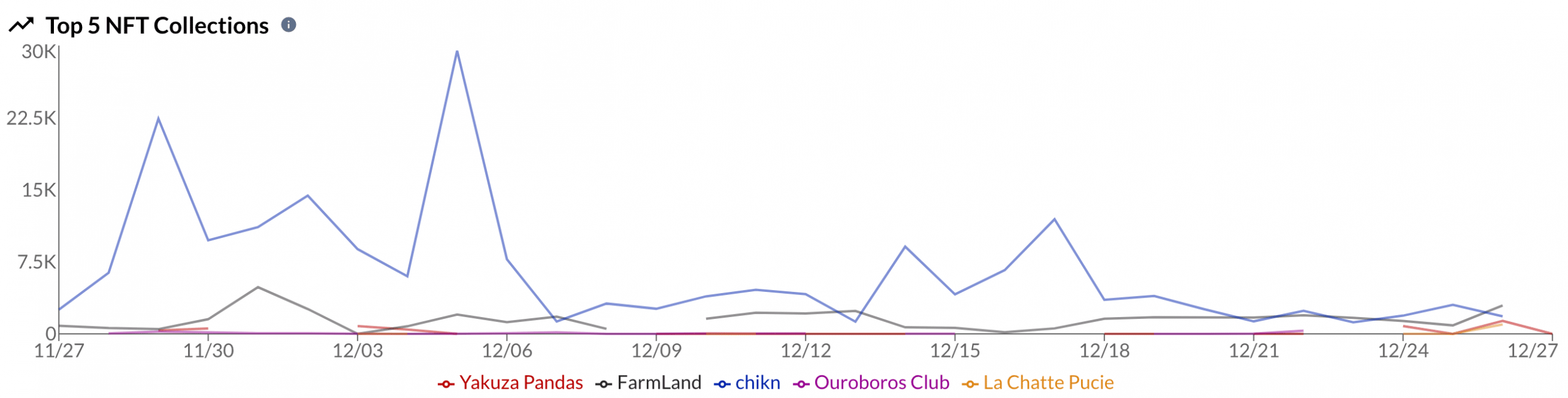

Avalanche wasn’t in a position to fare properly by way of the NFT sector as properly.

Based on information offered by AVAXNFTSTATS, it was noticed that the highest 5 NFT collections on the NFT community witnessed an enormous decline by way of quantity. Moreover, widespread AVAX NFT collections comparable to chikn and FarmLand began to lose curiosity from NFT traders.

Supply: AVAXNFTSTATS

The assaults on protocols in Avalanche’s ecosystem coupled with the declining curiosity in its NFTs may impression Avalanche’s progress negatively within the close to future.

On the time of writing, $AVAX was buying and selling at $11.69 and its value had elevated by 0.45% within the final 24 hours.