Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- AVAX’s MFI was in an overbought zone and is ripe for a attainable worth reversal

- Nonetheless, a breakout above $12.10 would invalidate the bearish forecast

Avalanche’s [AVAX] 2023 rally gained over 14% after rising from $10.71 to $12.30. It then cooled off, and the value correction settled at $11.45.

At press time, AVAX was in one other uptrend however confronted a problem after Bitcoin [BTC] failed to beat $17K resistance. AVAX was buying and selling at $11.77 and will fall decrease to retest the $11.45 help if the BTC worth correction continued.

Learn Avalanche’s [AVAX] Worth Prediction 2023-24

The goal at $12.10: Can the bulls intention at it?

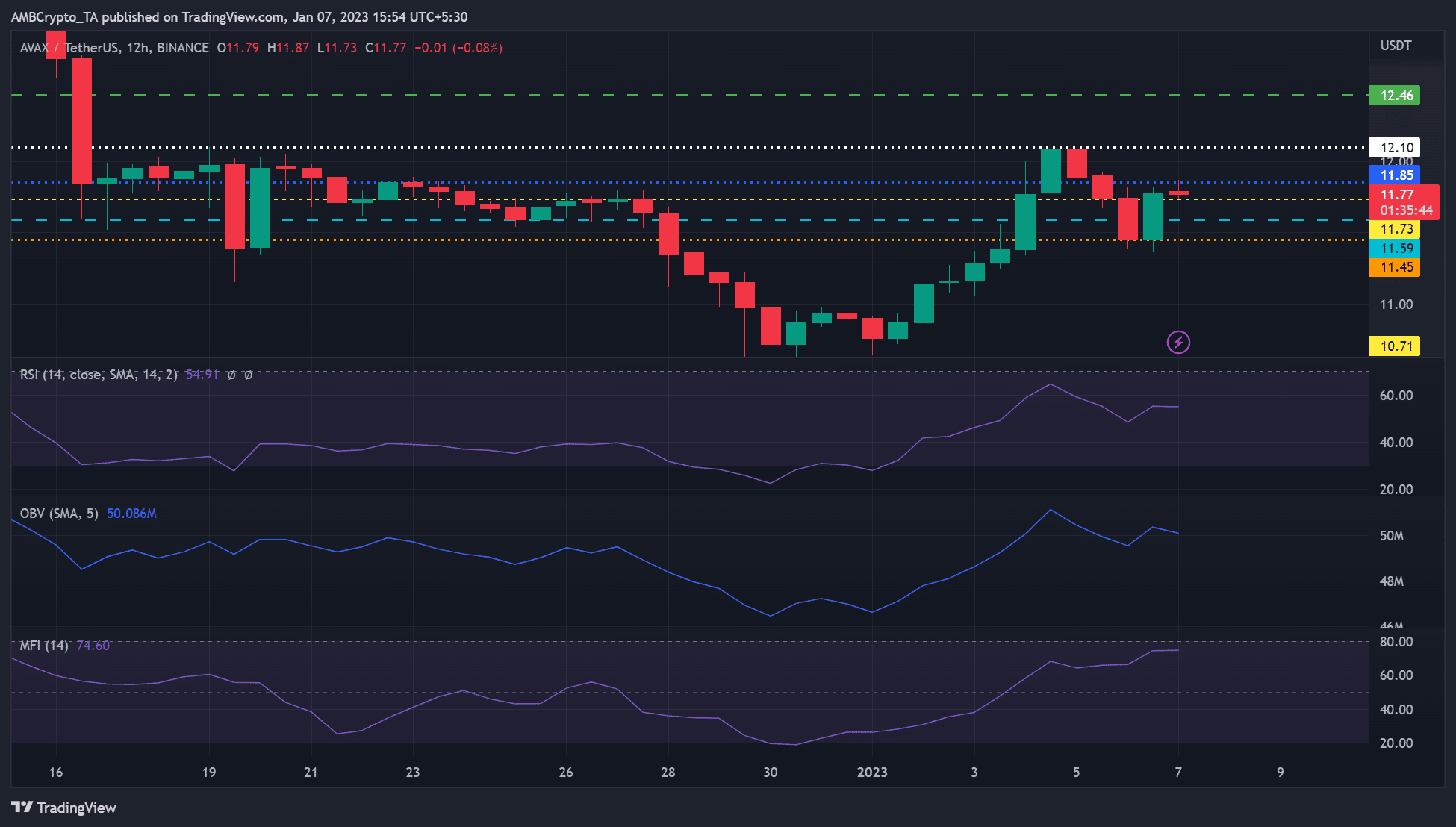

Supply: AVAX/USDT on TradingView

AVAX fell beneath its late December buying and selling vary of $11.59 – $11.85 however discovered strong help at $10.71. The transition into the brand new 12 months fashioned a double backside, which set the stage for a worth restoration.

Nonetheless, AVAX encountered a bearish order block at $12.10, forcing it to a worth correction, which was held in test by help at $11.45.

The press time worth restoration might show troublesome because the Cash Movement Index (MFI) had reached overbought territory. This means that accumulation has peaked and distribution might be underway, which may set off a worth reversal.

The Relative Power Index (RSI) was rejected on the midpoint however moved barely up and sideways. The On-Stability Quantity (OBV) additionally declined barely. This indicated that purchasing stress steadily elevated after a steep decline, however it was not sufficient to push the bulls to focus on the $12.10 stage.

Due to this fact, AVAX may fall again to $11.59 or $11.45. Quick sellers can promote excessive and purchase again cheaper at these ranges.

Nonetheless, a breakout above the $12.10 bearish order block would invalidate the forecast. Such a transfer may permit AVAX bulls to focus on $12.46, particularly if BTC is bullish.

AVAX’s OI fell, however its outlook and demand within the futures market remained unchanged

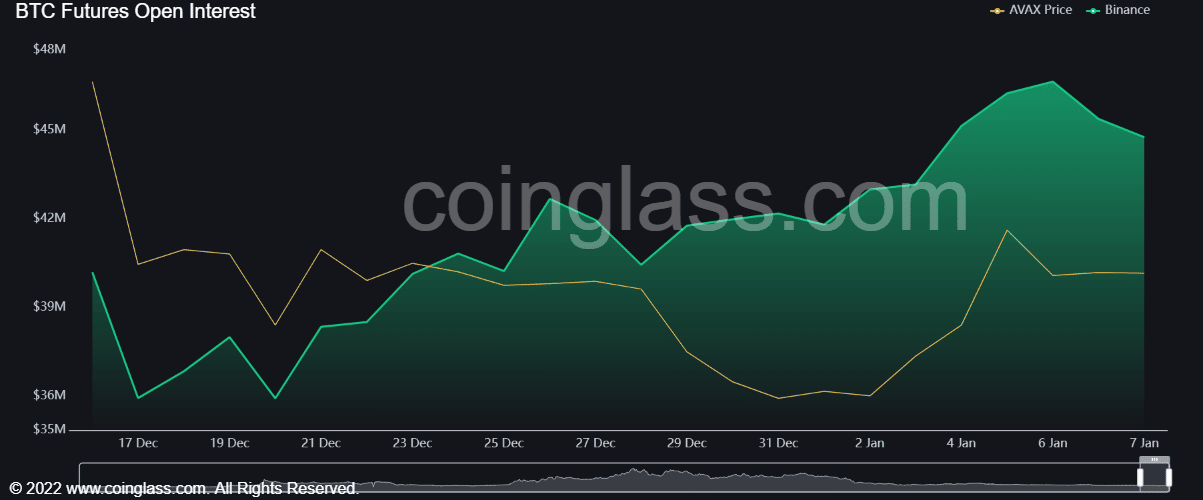

Supply: Coinglass

In keeping with Coinglass, AVAX’s open curiosity elevated from mid-December and appeared to have peaked at press time. This indicated that AVAX noticed an elevated influx of cash into the choices and futures markets.

Nonetheless, the decline in AVAX’s OI at press time means that more cash was leaving the futures market.

Are your holdings flashing pink or inexperienced? Verify with AVAX Revenue Calculator

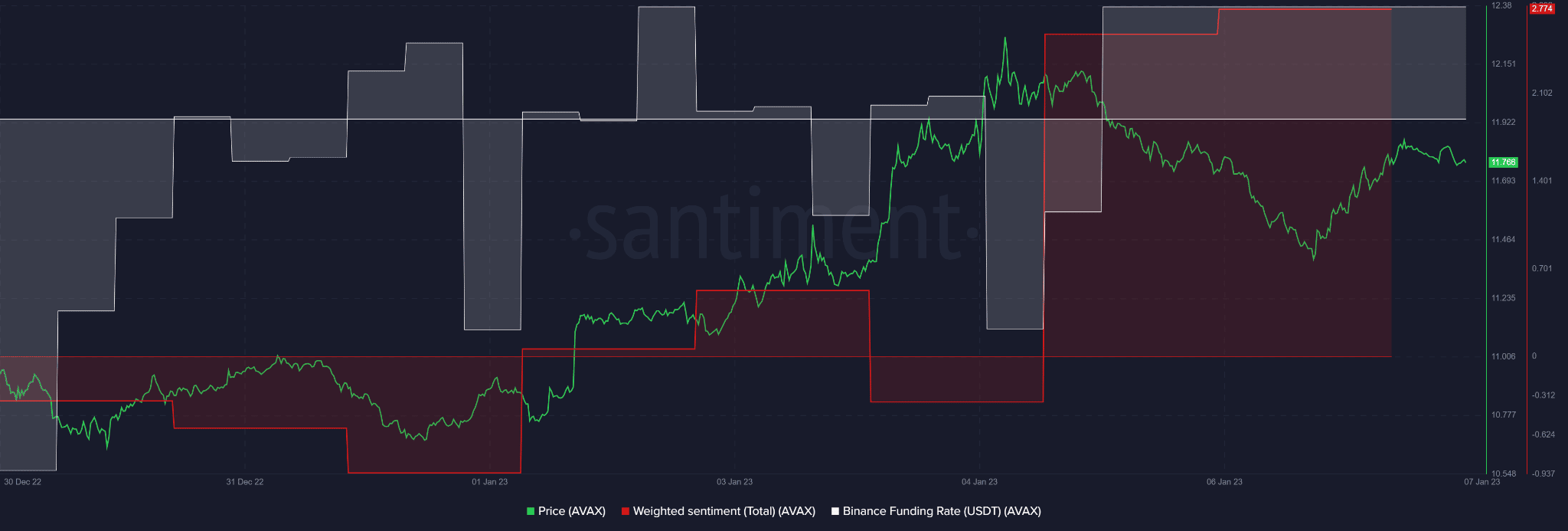

Nonetheless, AVAX’s sentiment remained optimistic, and demand within the derivatives market remained unchanged, as evidenced by the optimistic and unchanged Binance Funding Price for the AVAX/USDT pair.

Supply: Santiment

Which means AVAX may probably rally if BTC makes a restoration try. Due to this fact, buyers ought to watch BTC earlier than taking any motion.