Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- Axie Infinity labored beneath stern promoting strain

- A transfer under $6.6 and $6 can present bears with alternatives

Axie Infinity fell under the $7.7 mark but once more in mid-December, after the bulls fought all through November to climb previous this mark. Given the sentiment throughout the crypto market, a robust uptrend may not be seen for a number of extra months.

Therefore, long-term traders would possibly wonder if to DCA or wait for an additional leg downward, given AXS’ pattern since September.

What number of AXSs are you able to get for $1?

The market construction on the 12-hour timeframe was bearish. To vary this, AXS should shut a buying and selling session above $8.23. Even so, $8.8 would loom giant above the consumers. Have they got the energy to power costs above $8.8 within the weeks to come back?

The try to reclaim $8.8 exhausted the bulls and sellers have dominated since

Supply: AXS/USDT on TradingView

The orange trendline related the sequence of decrease highs that AXS has made on the worth charts since 3 September. Even earlier than that, the pattern had been bearish, and $19 was flipped to resistance in August.

On 5 December, Axie Infinity tokens noticed a big surge from $6.87 to $10.4. This indicated a shift in sentiment to a bullish bias might need occurred. Nonetheless, that day’s buying and selling closed at $8.79, simply beneath the numerous resistance at $8.8. Subsequent makes an attempt to flip $8.8 to help have been met with failure.

The Relative Power Index (RSI) fell beneath the impartial 50 mark on 12 December within the 12-hour timeframe to point momentum favored the bears. At press time, it stood at 45 to sign weak bearish momentum. The Chaikin Cash Stream (CMF) climbed up to now ten days to point sturdy capital circulation into the market however AXS has not reacted positively but.

A 403.58x hike on the playing cards IF AXS hits Bitcoin’s market cap?

Increased timeframe help lay at $6, and $6.6 was necessary on decrease timeframes. A transfer beneath $6.6 and a subsequent retest can be utilized to enter quick positions focusing on $6. Beneath $6, $4. and $3.42 may function help ranges.

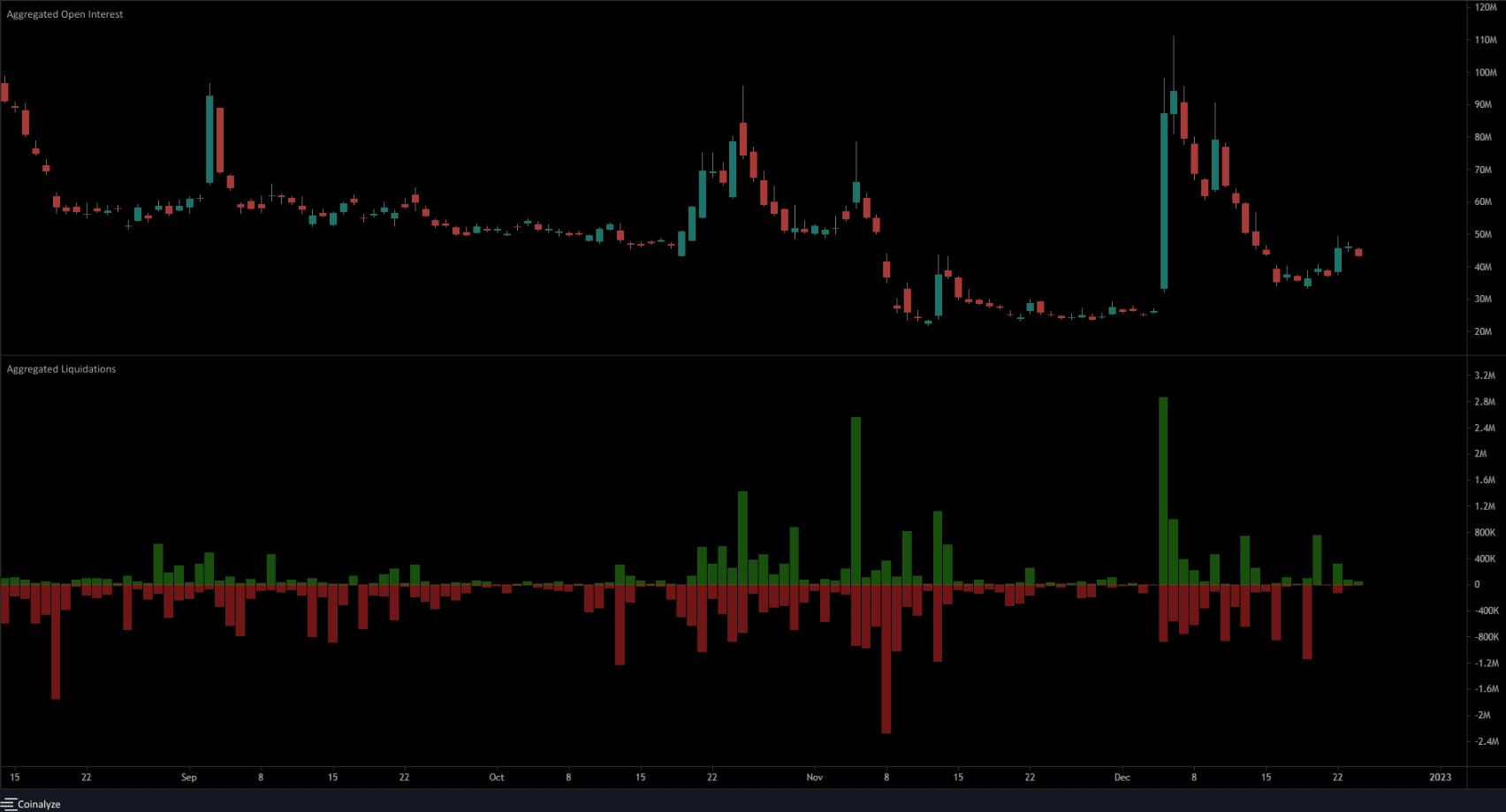

Open Curiosity declines alongside the worth to sign bearish sentiment

In early December, Axie Infinity encountered a wave of euphoria and surged to $10.4. Aggregated Open Curiosity soared and quick positions have been liquidated in giant numbers because of the violent motion.

Since then, the worth continued to comply with the upper timeframe downtrend. On decrease timeframes such because the four-hour, the momentum was bearish as effectively. The drop in Open Curiosity coupled with declining costs meant lengthy positions have been discouraged and sentiment remained bearish in futures markets.