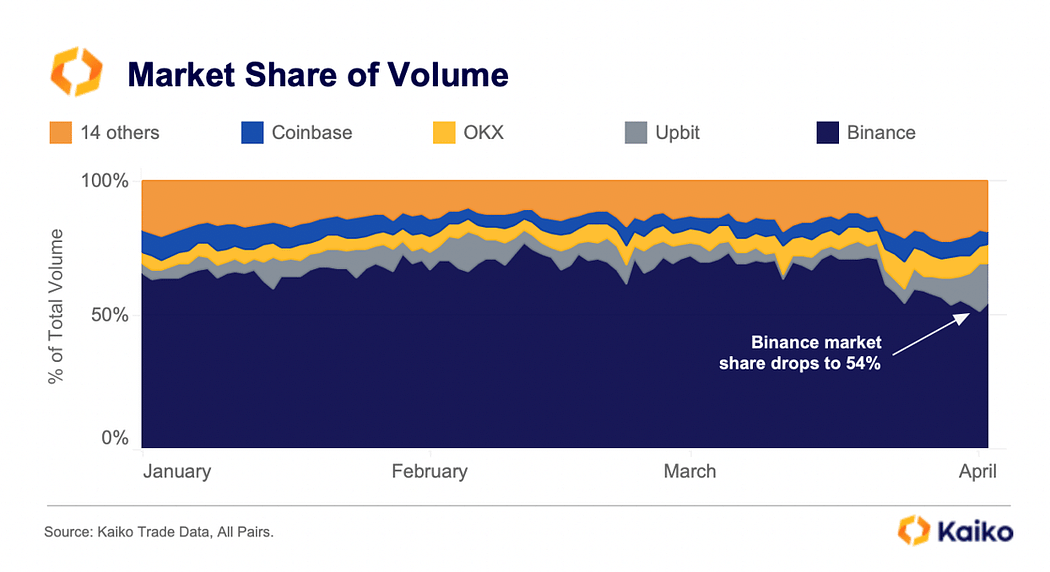

Prime crypto trade Binance has seen its market share plunge in latest weeks amid regulatory points in america, in keeping with crypto information supplier Kaiko.

Kaiko notes in a latest newsletter that Binance misplaced 16% of its market share in simply the previous two weeks.

The agency notes that the decline occurred partially as a result of latest information that the Commodities Future Buying and selling Fee (CFTC) charged the trade, its CEO Changpeng Zhao, and the corporate’s former chief compliance officer Samuel Lim with an extended checklist of regulatory violations.

Nonetheless, Kaiko attributes the vast majority of the misplaced market share to Binance ending its no-fee buying and selling promotion for 13 BTC spot buying and selling pairs.

“Binance misplaced 16% market share of spot quantity in simply two weeks after the CFTC lawsuit and finish of zero-fee buying and selling. However the development is sort of completely different when taking a look at derivatives volumes: Binance solely misplaced about 2% of market share for perpetual futures commerce quantity. This means that almost all of market share was misplaced purely as a result of finish of zero-fee spot buying and selling, quite than trepidations round a lawsuit.”

The information supplier notes that Binance stays the most important trade on this planet with 54% dominance over the worldwide market.

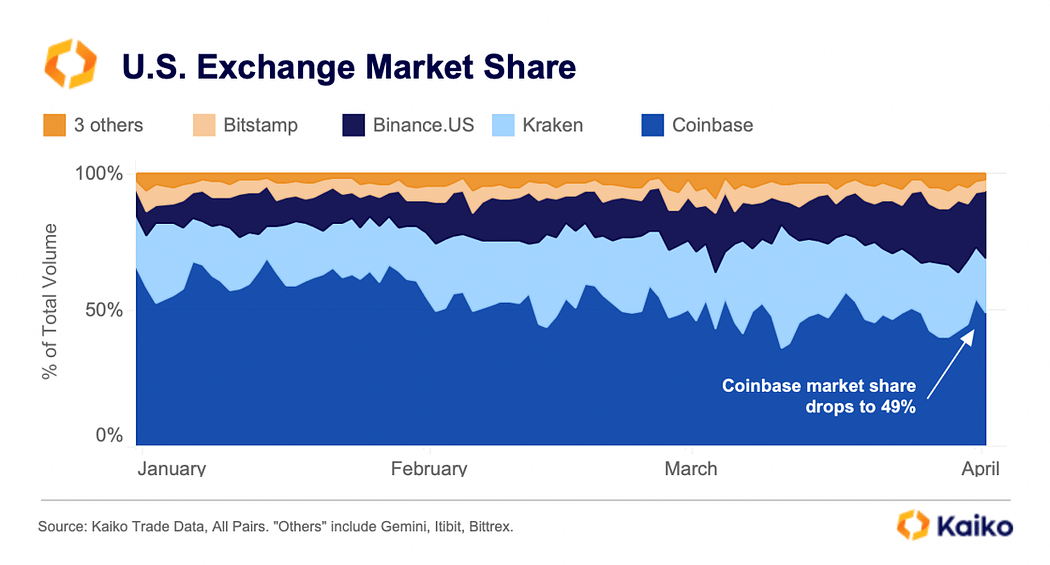

Kaiko additionally experiences that high US crypto trade Coinbase misplaced a big chunk of its home market share.

“Even Coinbase, which has traditionally made very sturdy efforts with regulators, acquired a Wells Discover centered on its staking service whereas Kraken was compelled to close down its service earlier this 12 months. All through Q1, Coinbase’s [US] market share dropped from a weekly common of 60% to simply 49%.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney