Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- Binance Coin surged above resistance; retracement might be a shopping for alternative.

- The market construction remained bullish.

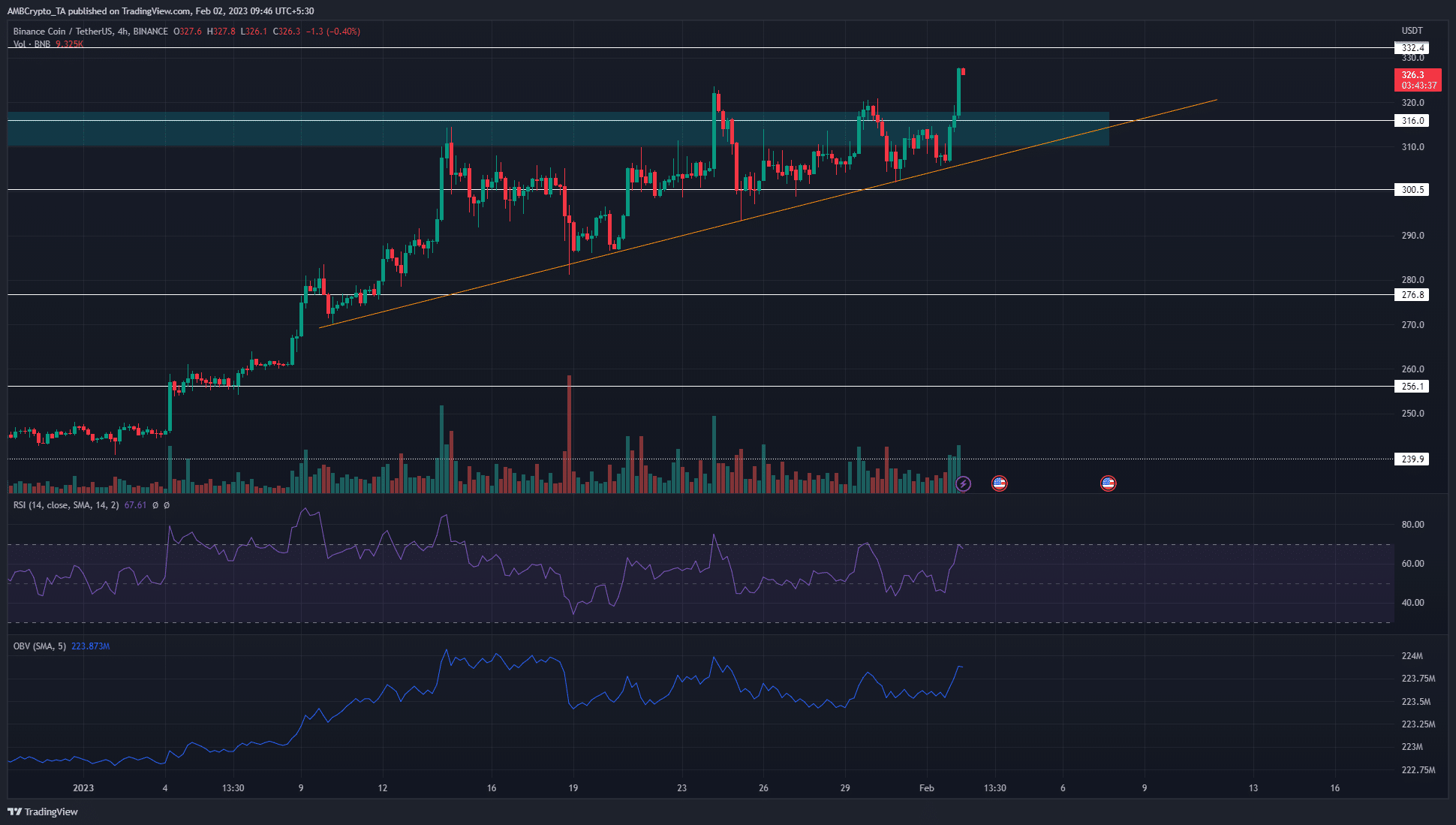

Binance Coin [BNB] beat the 12-hour bearish order block close to $316 after two weeks of battle. In late November 2022 and since mid-January 2023, the $315 zone offered stiff resistance to BNB bulls.

How a lot is 1,10,100 BNB value at present?

$332 and $350 are the upcoming main ranges of resistance for Binance Coin. Bitcoin [BTC] itself has a bullish outlook, though it too confronted some resistance round $24.5k. If BTC continues to tick upward, the remainder of the altcoin market is prone to comply with.

The H12 order block at $320 was crushed convincingly

Supply: BNB/USDT on TradingView

The primary two days of February noticed massive inexperienced candles on Binance Coin. Over the previous few days, since 25 January, the $300 zone was examined a number of instances. Every candlewick in that space noticed a bounce, which indicated that patrons held agency.

The orange trendline assist of the previous two weeks was not damaged both. $315 has been important up to now. In late November, a transfer into this resistance zone noticed BNB crash to the $223 low simply two weeks thereafter.

Nevertheless, the four-hour session shut above $320 was bullish. A retrace into the $307-$310 could be best for patrons, however Binance Coin might be set for a extra aggressive transfer upward. In that case, bulls needs to be ready to bid on a retest of the $319-$323 zone. Additionally it is doable that BNB catapults larger within the coming hours.

Somewhat than FOMO-ing, patrons can anticipate value motion to develop and anticipate a flip of $332 to enter longs. To the north, the $350-$360 area represented an H12 bearish order block the place bulls can take revenue at.

Spot CVD and Open Curiosity see monumental beneficial properties

Supply: Coinalyze

The one-hour chart of BNB on Coinalyze confirmed that the previous couple of days noticed the spot CVD take an enormous U-turn. This confirmed robust demand from patrons and indicated that the rally was prone to proceed upward.

Reasonable or not, right here’s BNB’s market cap in BTC’s phrases

The anticipated funding charge was optimistic as properly, and has remained so for the previous two weeks. This instructed that market individuals have been bullish total. The market construction flipped bullish after BNB broke previous $256 early in January. A transfer again under the $300-$304 mark will flip this bias to bearish.

The surge in OI alongside the costs pointed towards bullish dominance and instructed a bearish flip was unlikely to occur quickly.