Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The market construction noticed a bullish break in late November

- Since reaching $313, BNB has bled slowly and will put up additional losses

Bitcoin traded inside a spread from $17.7k to $15.6k since 9 November. Particularly prior to now two weeks of buying and selling, the volatility has decreased as BTC meandered from $16.7k to $17.3k. On the identical time, Binance Coin registered a bullish break available in the market construction. Nevertheless, $313 posed stern resistance to BNB bulls.

Learn Binance Coin’s [BNB] Value Prediction 2023-24

The Open Curiosity behind BNB has declined prior to now ten days. This meant Binance Coin might put up additional losses. Patrons can search for a chance to enter longs on such a dip.

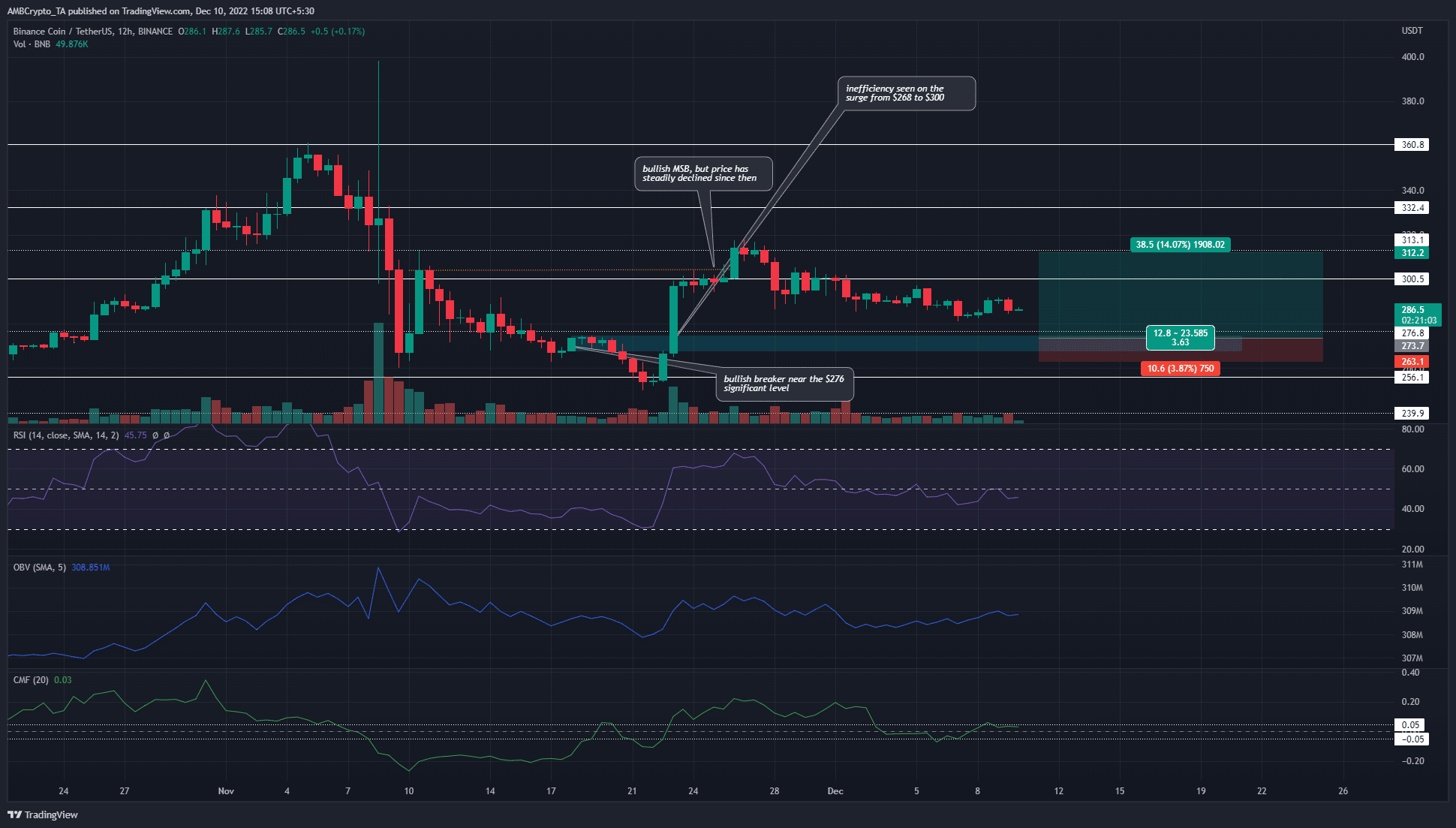

Binance Coin confronted rejection at $313 and has descended slowly towards $284

Supply: BNB/USDT on TradingView

On 18 November, the value fashioned a bearish order block. At the moment the market construction was bearish. Just a few days after that, a powerful surge again above the $276 degree flipped this bearish notion and bulls have been within the ascendancy as soon as extra. A market construction break towards the bullish facet was seen, and a surge to $313 adopted. The bearish order block demarcated in cyan on the chart flipped right into a bullish breaker.

Since this surge was fast, an inefficiency was left on the charts. This honest worth hole lay between $275 and $290. The FVG has confluence with the $276 degree of significance, in addition to the bullish breaker.

Due to this fact a revisit to this zone might be of curiosity to the consumers. On decrease timeframes, a swing failure sample close to the $260-$270 mark can be utilized to alert consumers that a chance might come up. To the north, a transfer to $300-$315 can be utilized to take revenue.

The RSI has been close to impartial 50 because the starting of December. It confirmed a scarcity of robust momentum behind BNB. In the meantime, the OBV and the CMF have been additionally flat prior to now few days. Neither the sellers nor the consumers have been dominant based mostly on the previous week’s buying and selling.

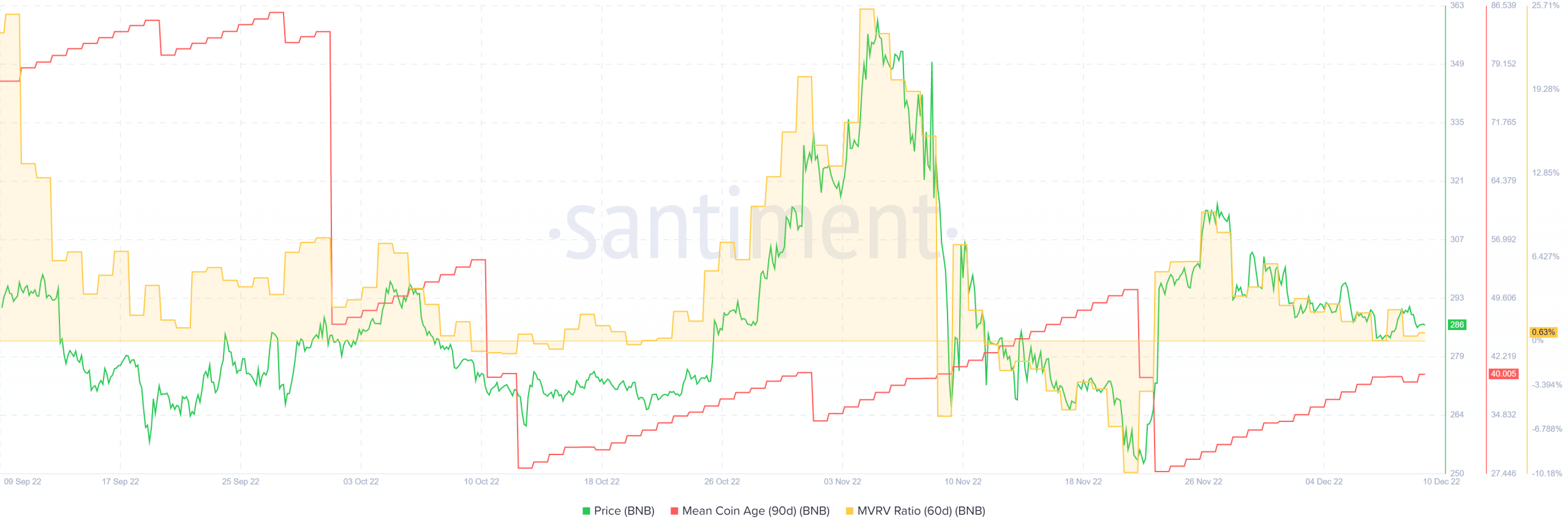

60-day MVRV was in decline as soon as extra, imply coin age reveals short-term accumulation

Supply: Santiment

Santiment knowledge confirmed that the 60-day MVRV ratio has labored effectively in current months to mark native tops. This occurred round 3 and 26 November as effectively. On the time of writing the MVRV was near zero.

Because the earlier MVRV peak, the imply coin age (90-day) metric has been on the rise. This confirmed BNB tokens have stayed of their addresses, and indicated a network-wide short-term accumulation.

Supply: Coinglass

On the Open Curiosity facet, the bias was not bullish but. The rally from $260 to $313 noticed a pointy ascent on the OI. However following this transfer, each the value and the OI slowly declined. This might level towards discouraged lengthy positions.

In abstract, though a transfer to $270-$280 might supply shopping for alternatives, bulls should look ahead to an entry set off earlier than shopping for.