- Binance just lately introduced changing into a member of the ACSS.

- This transfer got here after the FUD surrounding BNB because of the FTX collapse and SEC inquisitions.

In current weeks, there was a whole lot of concern, uncertainty, and doubt (FUD) surrounding Binance Coin [BNB] after FTX’s [FTT] collapse and the downward pattern of its native cryptocurrency. The collapse triggered alternate tokens to be checked out with mistrust.

Learn Binance Coin’s [BNB] Value Prediction 2023-24

Additionally, the scenario with Binance was made even worse as a result of the alternate got here underneath scrutiny from the SEC. Binance has taken an progressive strategy as of late to take care of the problem of compliance punishments.

Binance to work on regulatory compliance

Per a press release on 6 January, Binance made historical past by being the primary cryptocurrency alternate to hitch the Affiliation of Licensed Sanctions Specialists (ACSS). In accordance with an official statement, the corporate’s staff will practice at ACSS as a part of the method.

#Binance joins the Affiliation of Licensed Sanctions Specialists (ACSS).

As the primary crypto alternate to hitch the affiliation, we intention to leverage ACSS coaching supplies, databases, and networks to additional compliance requirements inside the crypto business.https://t.co/uEOw147gke

— Binance (@binance) January 6, 2023

The aim of the ACSS coaching is to teach the employees working for the alternate on the rules supplied by the Workplace of International Belongings Management (OFAC) inside the USA Treasury and to alert them of the potential risks related to violating these standards.

BNB in compliance?

The day by day timeframe chart of BNB‘s worth motion revealed that the token noticed a surge in late October 2022. It noticed a climb into the $350 vary throughout October. The worth vary instrument revealed that BNB misplaced almost 26% of its worth from when the token’s droop started in November till the noticed timeframe.

As of this writing, the token’s worth hovered round $260. Its worth rose by nearly 2% within the final 48 hours, suggesting that the newest information has positively affected its motion.

Supply: TradingView

In accordance with the chart, a brand new assist degree would possibly kind if the token sustains or continues its advance. The vary for the present assist degree was between $235 and $217.

The Relative Energy Index line, seen above the impartial line, confirmed that the token was in a bullish pattern. Moreover, the Bollinger Band displayed an indication of contraction, indicating that volatility, almost definitely to the upside, is about to happen.

Are your holdings flashing inexperienced? Verify the BNB Revenue Calculator

The story of revenue and loss

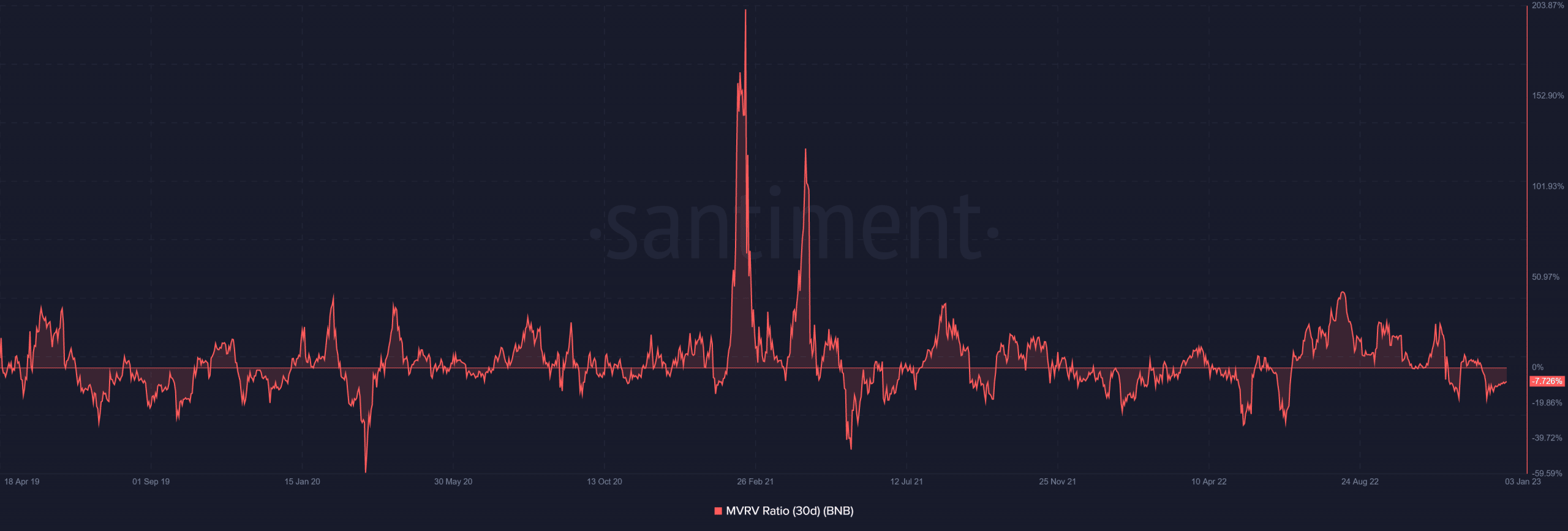

The Market Worth to Realized Worth Ratio confirmed that BNB has had problem being worthwhile over the previous 30 days. As of the time of writing, the MVRV ratio was about 7.7%, and holders had been switching between income and losses. The noticed returns could also be thought-about respectable, given the current FUD engulfing the token.

Supply: Santiment

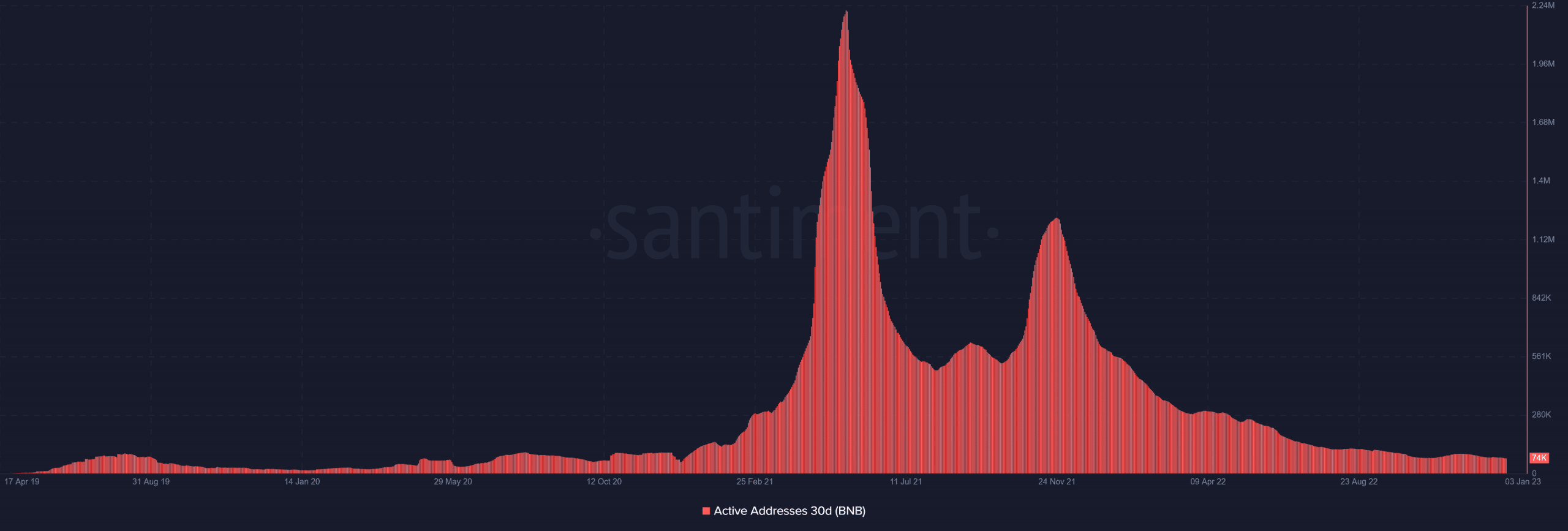

A peek into the energetic handle metric revealed that the exercise degree was largely fixed. This means that fewer buyers are buying and selling the tokens nowadays.

The latest motion taken by Binance is designed to extend person confidence within the alternate’s actions. This may additionally improve the worth of the alternate’s tokens.

As folks grow to be extra assured within the alternate, there could also be a rise within the variety of energetic addresses. Additionally, a sizeable improve within the quantity of transactions may be witnessed.

Supply: Santiment