- Some feedback from the crypto neighborhood recommend that there might be a buying and selling abettor after Binance listed RPL.

- The BNB momentum remained bullish though the quantity move was diminished.

Binance, the alternate backing Binance Coin [BNB] is infamous for itemizing plenty of rising cryptocurrencies, and its 18 January addition of Rocket Pool [RPL] aligned with the identified habits. Nonetheless, the world’s largest alternate itemizing of the decentralized Ethereum [ETH] staking pool token was not with out fuss.

Learn Binance Coin’s [BNB] Value Prediction 2023-2024

Based on “smartmoney” analyst, Lookonchain, three separate addresses purchased RPL earlier than the itemizing. This similar set bought the asset as quickly as the worth elevated.

1/ After the itemizing of $RPL on Binance, the worth of $RPL elevated by 31%.

We discovered 3 addresses that purchased $RPL earlier than the itemizing, then bought instantly after the rose and made a revenue.👇 pic.twitter.com/PE3JWwyg12

— Lookonchain (@lookonchain) January 18, 2023

Fingers level to a co-conspirator

The revelation raised eyebrows across the crypto neighborhood as some pointed to doable insider buying and selling within the agency. Based on the small print of the transaction, one tackle deposited 200,000 Tether [USDT] in alternate for RPL.

Inside minutes, it bought again for $255,398. The opposite two exchanged ETH for the token and made income of $76,000 and $318,240 respectively. Whereas it remained unsure if it was certainly a case of insider buying and selling, feedback below the revelation appeared to have judged the situations as such.

However Binance might not be capable of afford so as to add an insider buying and selling controversy to its listing of challenges. The final time the alternate had such issues was in 2021 however it was capable of overcome the hurdle.

Just lately, america SEC confirmed that the alternate was on its radar. Additionally, the nation’s Division of Justice (DOJ) contemplated prosecuting Binance because of some illicit funds allegations.

Nonetheless, the cryptocurrency in query may keep the inexperienced bars it produced for lengthy. Based on CoinMarketCap, RPL was exchanging hands at $33.89 at press time. This was after it had misplaced 16.83% of its worth within the final 24 hours.

BNB within the eyes of watchdogs

For BNB holders, a regulatory hammer hitting the alternate may spell doom for the coin. In wake of that, BNB adopted the primary notable market downturn of 2023. Within the final 24 hours, the coin’s worth decreased by 3.91%.

How a lot are 1,10,100 BNBs price right this moment?

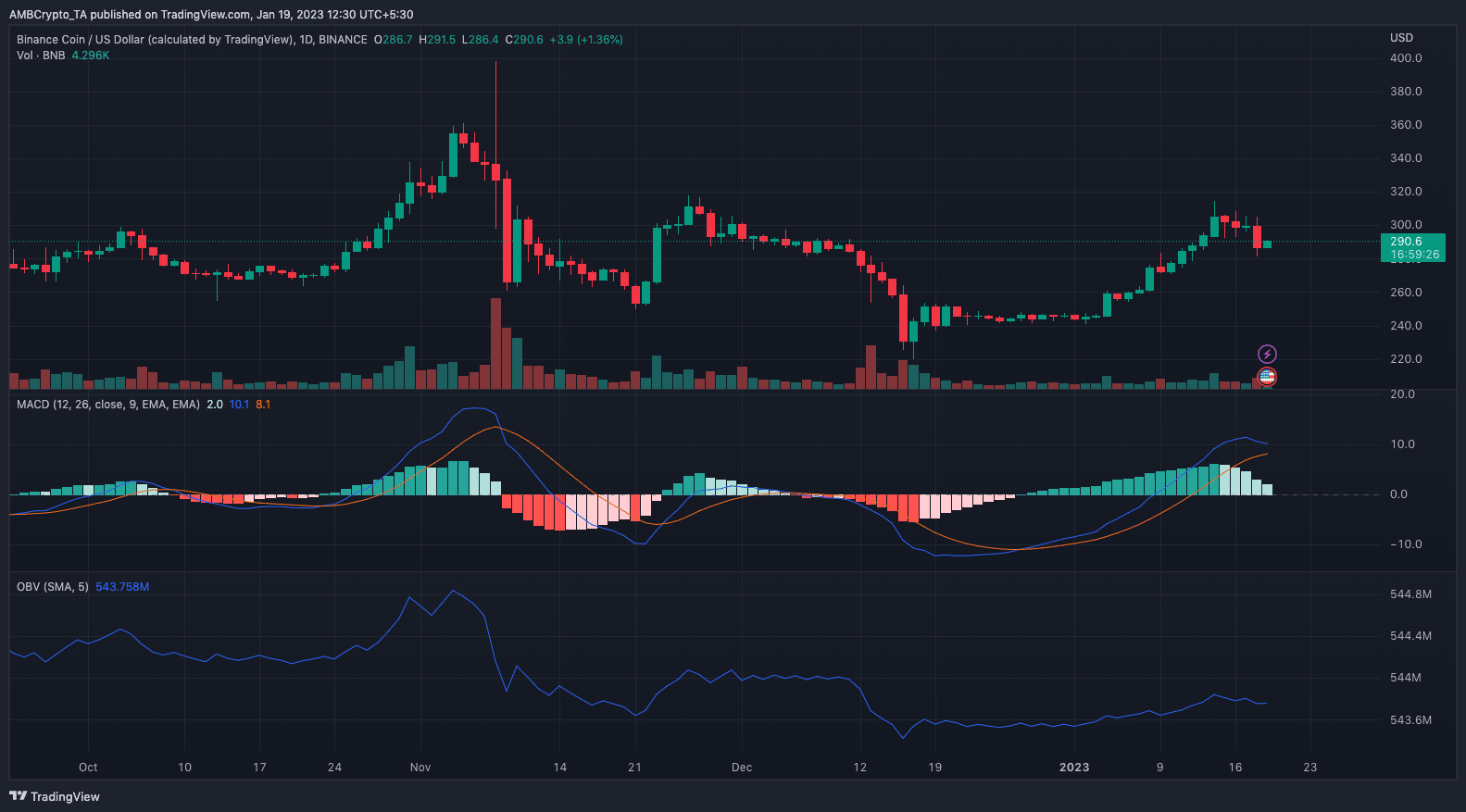

On the every day chart, the Shifting Common Convergence Divergence (MACD) displayed BNB’s energy in sustaining the bullish momentum. This was because of the dynamic blue line positioning over the orange.

An interpretation of this stance admits to purchaser management. Moreover, the MACD remained above the zero degree, additional indicating that sellers had been far off from regaining authority.

Supply: TradingView

Per the above chart, the On-Stability-Quantity (OBV) was 543.75 million. At this level, the technical indicator means that the group sentiment was not fully bullish on BNB for the reason that quantity flowing was minimal. Therefore, BNB may need challenges in its push for a value uptick.