Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- Binance Coin breaks down beneath the vary lows

- Repeated retests of the assist zone noticed consumers exhausted

Binance Coin had a wholesome begin to November, but it surely all went haywire for the bulls. The implosion of FTX introduced many rallying cash to a screeching halt. Now, BNB has a bearish market construction on the upper timeframe charts, and sellers will likely be searching for a chance to place themselves brief within the futures market.

Learn Binance Coin’s [BNB] Value Prediction 2023-24

Bitcoin has been weak on the worth charts in current days as effectively. Due to this fact, there was a chance that one other leg downward can come up throughout the crypto market within the coming weeks. Binance Coin was prone to observe the development of Bitcoin. The bullish order talked about in a current article block didn’t maintain up.

The bullish order block was damaged after repeated retests

Supply: BNB/USDT on TradingView

The extra typically a assist degree (or space) will get retested, the weaker it will get. This was proved true in current days for Binance Coin. On 19 September, BNB shaped a bullish order block on the 12-hour timeframe. This candle was additionally in shut proximity to the numerous degree at $256. Furthermore, it had confluence with the vary lows for Binance Coin, a spread that it has traded inside since late August.

The Relative Power Index (RSI) sunk beneath the impartial 50 degree when BNB retraced all its features to drop from $360 to $280. Nonetheless, although the On-Stability Quantity (OBV) took a success, it was close to a zone of assist which acted as resistance in October. Additional dips on the OBV could be an added signal that sellers have been right here to remain.

Other than the technical indicators, the worth motion itself has been strongly bearish just lately. Regardless of the short-lived pump to $398 earlier this month, the promoting stress that started close to the $360 mark flipped the construction to bearish. Neither the $300 zone nor the $260 space was capable of halt the march of the bears.

Within the subsequent week or two, the previous bullish order block will seemingly be retested as a bearish breaker. Therefore, it might probably provide shorting alternatives focusing on $240 and $216 for bold brief sellers. A transfer again above $270 would counsel that bulls have been placing up a battle, and will current decrease timeframe merchants with a bullish bias.

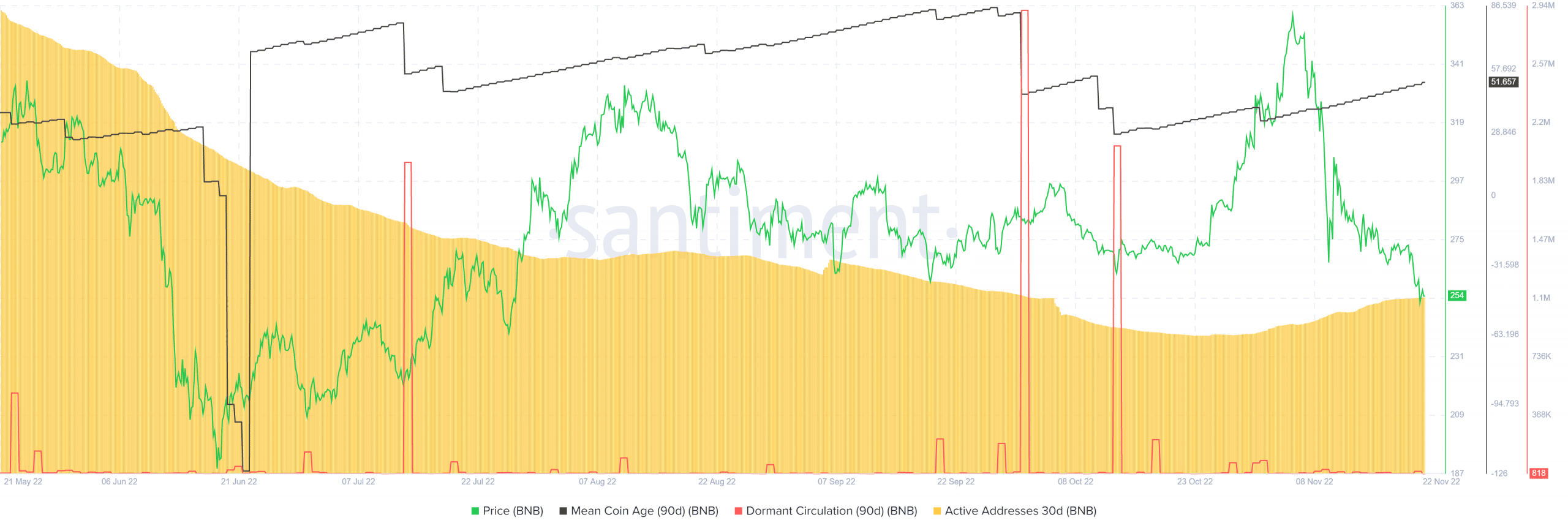

Imply coin age in an uptrend to indicate accumulation

Supply: Santiment

The imply coin age metric noticed a pointy decline in early October, however has been in a gradual uptrend since then. This meant that fewer cash moved from their present addresses and might be indicative of an accumulation section. Nonetheless, this metric by itself doesn’t point out native tops and bottoms effectively. Slightly, it was one thing to keep watch over.

Equally, the 30-day lively tackle depend has been falling since Could. It shaped a backside in mid-October, and has slowly crept upward since. As soon as once more, it may not give actionable data for merchants however fairly is one thing traders can keep watch over. The dormant circulation (90-day) metric didn’t see a pointy spike within the current weeks of heightened volatility, which prompt that holders from the previous 90 days may not have panicked regardless of the falling costs.