- BUSD has been capable of preserve the $1 peg regardless of its FUD.

- Binance’s BUSD reserve has declined to round 12.4 billion.

The regulatory hammer hung above Binance for a while earlier than touchdown on Binance USD (BUSD). Regardless of the FUD that has gripped the stablecoin, one metric has turned out to be optimistic for it to date.

BUSD maintains its peg

As a result of Wells discover issued by the Safety and Trade Fee (SEC) to Paxos, the Binance USD (BUSD) has been put via a rigorous stress take a look at.

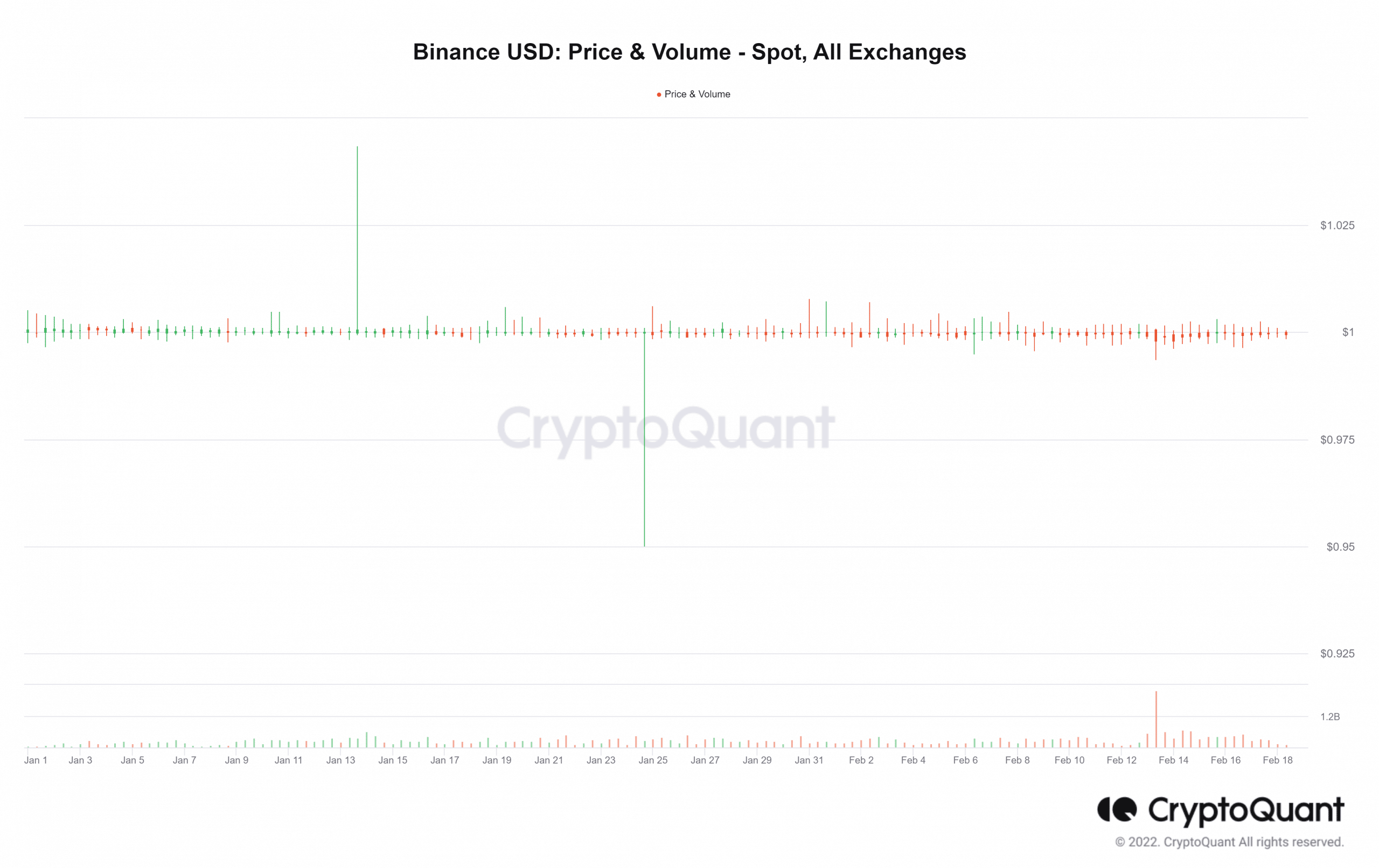

Consequently, stablecoin buyers have been compelled to promote their holdings. It was estimated that as of 17 February, there had been near $500 million value of trades seen to the general public.

Regardless of the excessive quantity of transactions, BUSD has stored its worth mounted at one greenback, as per Crypto Quant. As of this writing, the quantity had already exceeded 200 million whereas remaining secure at its present stage. Regardless of the asset’s obvious fall, that is excellent news.

Supply: CryptoQuant

Outflow continues as reserve declines

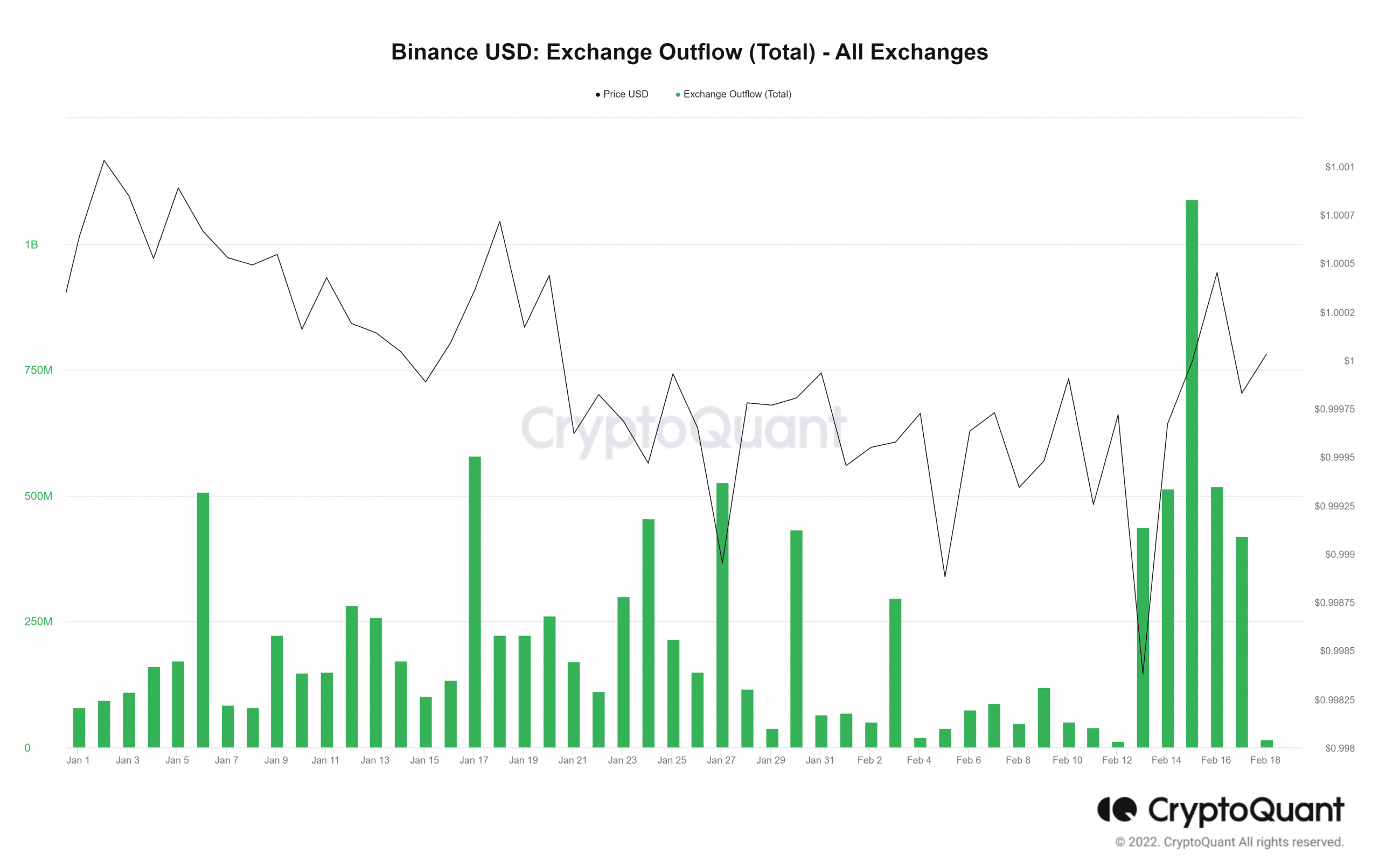

All indicators level to BUSD holders being in a rush to promote their belongings as a result of they’re not sure of what would possibly occur subsequent.

Analyzing the influx and outflow statistics for all exchanges revealed that though the influx had decreased, the outflow was nonetheless at a big stage.

The newest figures indicated that the outflow was almost 500 million. Holders could also be switching to fiat or different stablecoins, as seen by the rising outflow.

Supply: CryptoQuant

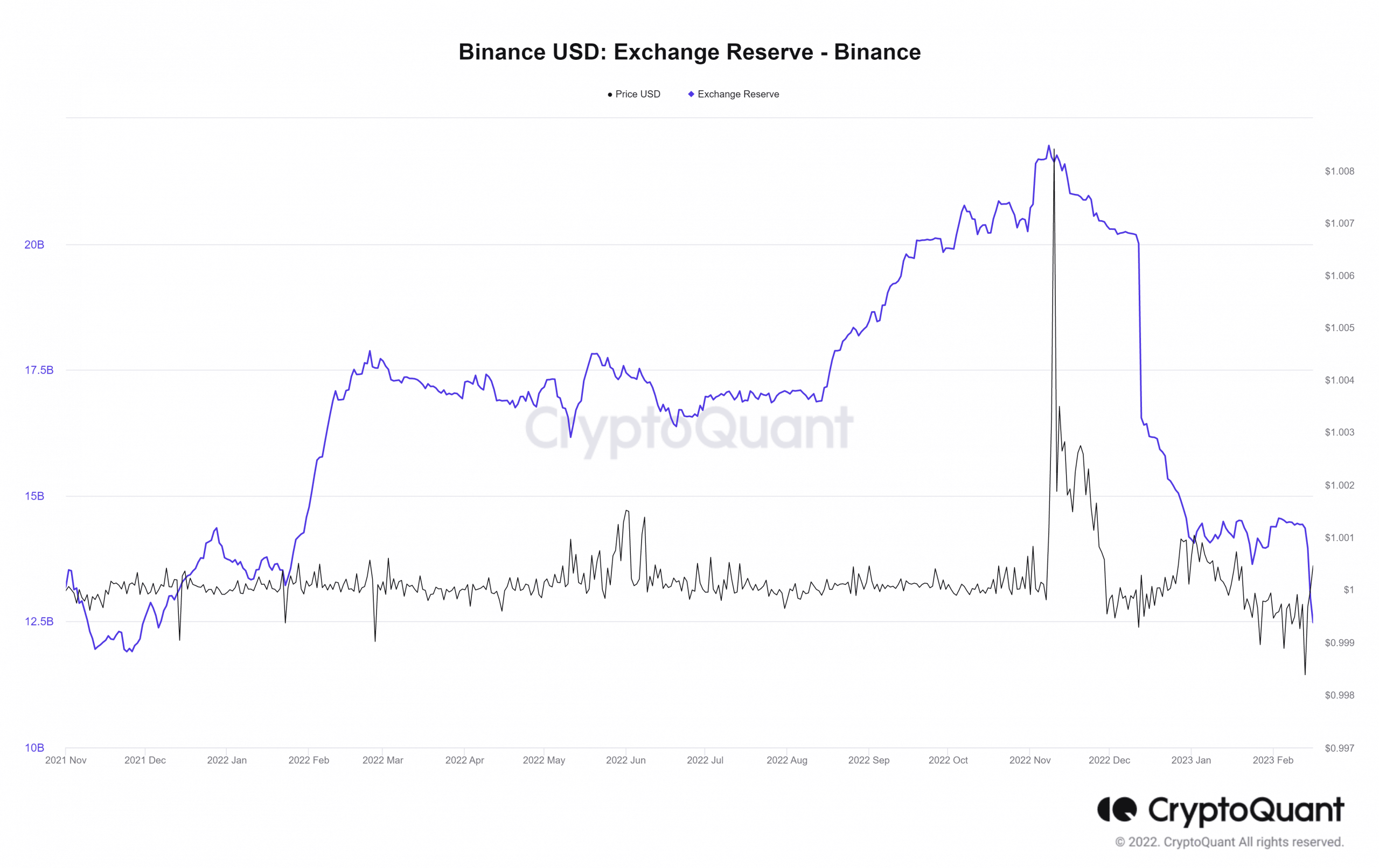

Moreover, Binance’s BUSD reserve has been diminishing with the large quantity of BUSD buying and selling.

A verify of Binance’s trade reserve measure revealed that the reserve had dropped to roughly $12.48 billion as of this writing. It began the 12 months with a reserve of almost $14 billion and stored it till the decline started.

Supply: CryptoQuant

The Aave freeze

It’s necessary to notice {that a} proposal to discontinue buying and selling in BUSD on Aave was offered on 13 February and shall be voted on till 19 February.

The proposal states that dropping the flexibility to mint further BUSD might hurt peg arbitrage and asset peg. Moreover, it was famous that freezing this reserve and inspiring customers emigrate to a different stablecoin was needed. As of this writing, the proposal had gathered 99.96% votes.

How Paxo’s dispute with the SEC over Binance USD (BUSD) shall be resolved remains to be largely unknown. Nevertheless, the true state of BUSD shall be revealed within the following weeks or months as occasions play out and paint an entire image.

![Binance USD [BUSD] maintains its peg even as outflow increases](https://ambcrypto.com/wp-content/uploads/2023/02/kelly-sikkema-mdADGzyXCVE-unsplash-1000x600.jpg)