A well-liked crypto analyst thinks Bitcoin (BTC) and the broader altcoin markets may begin to bounce again subsequent yr.

In a brand new evaluation, pseudonymous dealer TechDev says that the crypto correction really started within the second quarter of 2021, moderately than the fourth quarter of that yr after Bitcoin hit its all-time excessive.

“We begin with the altcoin market cap, the place I view the market divided right into a cyclical set of areas, Correction > Accumulation > Markup. The beneath chart ought to point out why I imagine we’re in accumulation, and that markup is anticipated subsequent.

It additionally serves as additional proof of the correction beginning Q2 2021, breaking the native RSI uptrend simply because the correction earlier than.”

RSI stands for relative power index, a metric analyzing the crypto asset’s candle oscillation over 14 durations.

TechDev thinks the broader market construction mimics late 2016/early 2017.

“It’s simply taking 1.5-2x longer to develop, as has the remainder of the construction so far.”

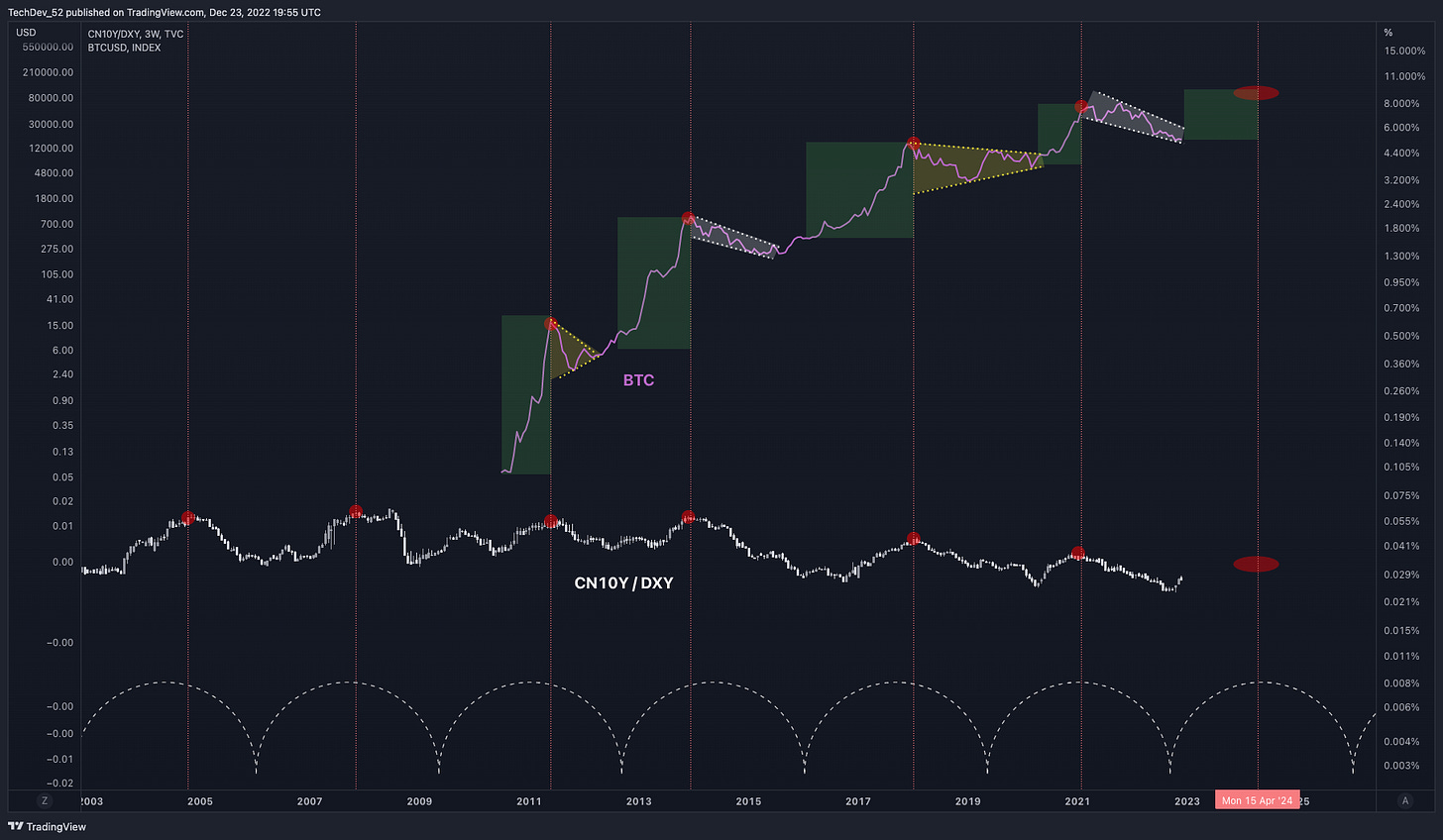

The analyst says Bitcoin has tended to comply with the worldwide liquidity “cycle.” TechDev thinks this cycle is portrayed by charting the Chinese language 10-year bond yield (CN10Y) over the US greenback index (DXY).

“Word the clear cycle on this chart which has a peak-to-peak timing of roughly 3.4 years that has been printing lengthy earlier than Bitcoin existed.

Every native high in CN10Y/DXY marked or led a significant impulse high in Bitcoin, and every native upside reversal marked or led the beginning of a significant Bitcoin impulse.”

The analyst says the chart’s native tops have been “steadily declining alongside a trendline” since 2014.

“Its subsequent hit may anticipate the subsequent Bitcoin/crypto high. Cyclical timing during the last 20 years suggests this could possibly be across the late 2023-mid 2024 timeframe.”

Learn TechDev’s full publication here.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/TadashiArt/Natalia Siiatovskaia