- BTC noticed an enormous variety of brief dealer liquidations within the final month, therefore the value rally.

- With waning shopping for stress, BTC’s value would possibly quickly undergo a correction.

In January 2023, Bitcoin [BTC] markets skilled their strongest month-to-month efficiency since October 2021, with a year-to-date (YTD) improve of over 43%. Glassnode, in a brand new report, discovered that this surprising spike in worth put BTC’s value at its highest stage since August 2022, with a weekly improve of 6.6% from its low of $22,400.

How a lot are 1,10,100 BTCs price right now?

Whodunit: Unpacking the thriller of Bitcoin’s rally

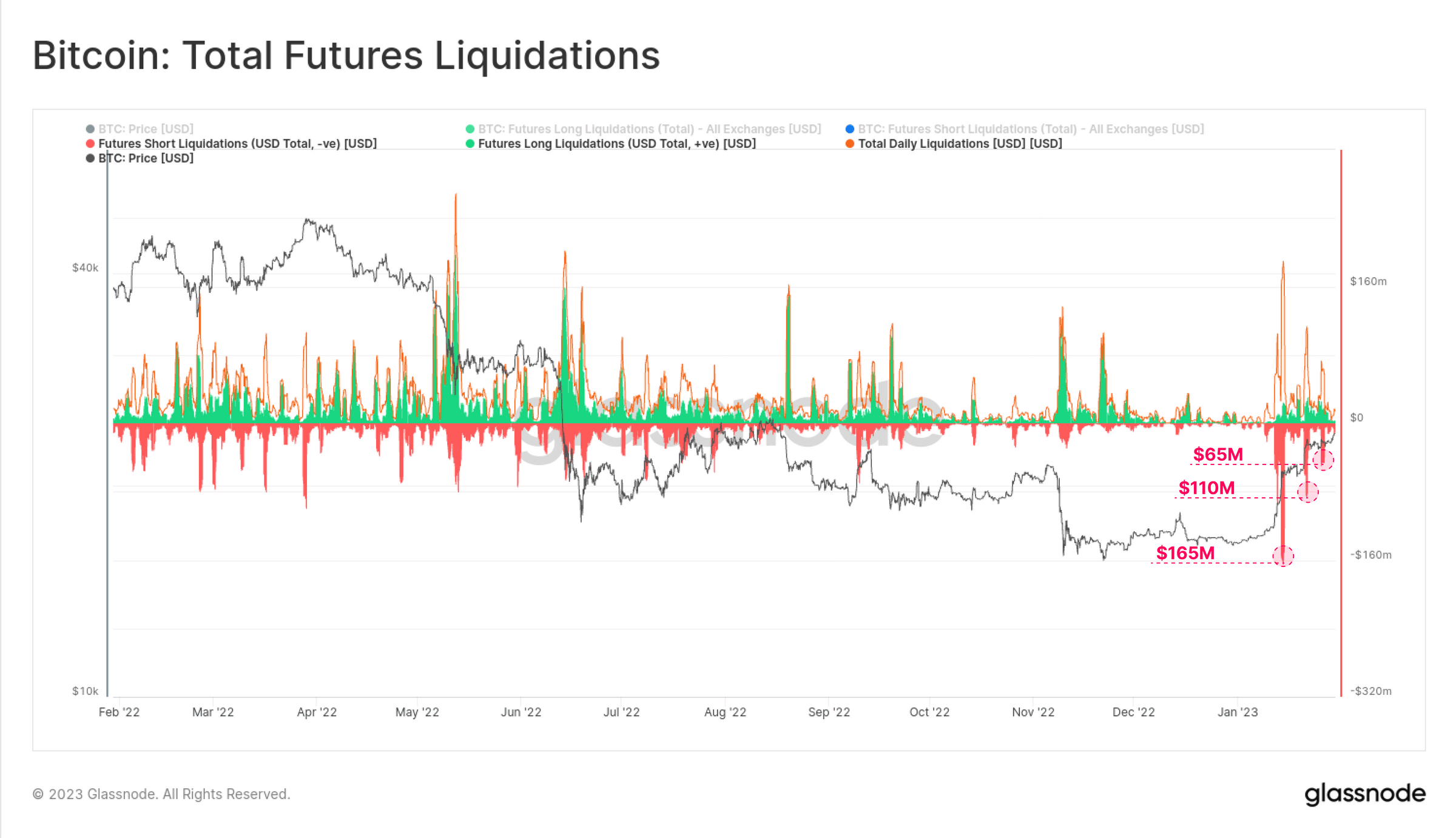

Glassnode reported that a rise within the variety of brief squeezes within the derivatives market was the principle purpose behind the current surge in BTC’s value over the previous month. The current rally was pushed by brief squeezes within the derivatives market, with over $495 million in brief futures contracts liquidated in three waves.

The report famous that the money and carry foundation for perpetual swap and calendar futures had been now in constructive territory, indicating a return of constructive sentiment and hypothesis out there.

Though the full Open Curiosity in BTC, in relation to its market capitalization, has declined since November 2022, and the leverage ratio has dropped from 40% to 25%, Glassnode opined that this represented a lower in futures leverage and short-term speculative pursuits.

Supply: Glassnode

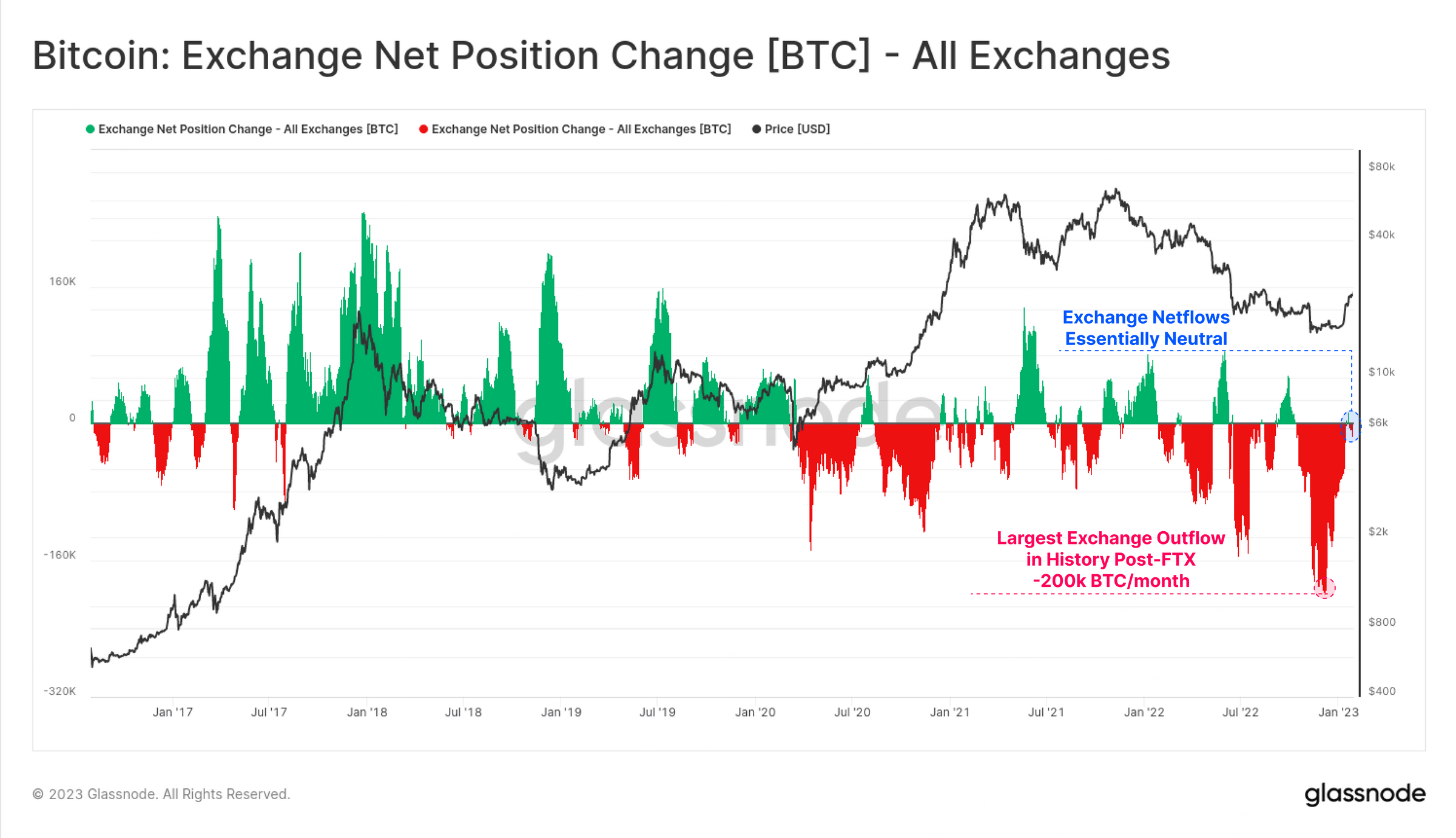

Additional, Glassnode discovered that as value rallied within the final month, new demand for the king coin slowed. In response to the report, the full BTC stability held on exchanges has reached a multi-year low of 11.7% of the circulating provide.

The day by day influx and outflow of cash from exchanges was balanced, with a web circulate of $20 million, reflecting a slowdown in new demand. The most important month-to-month outflow of cash in historical past occurred from November to December 2022 however has returned to impartial, indicating a cooling down of outflows.

Supply: Glassnode

The upward development of BTC could come to a halt

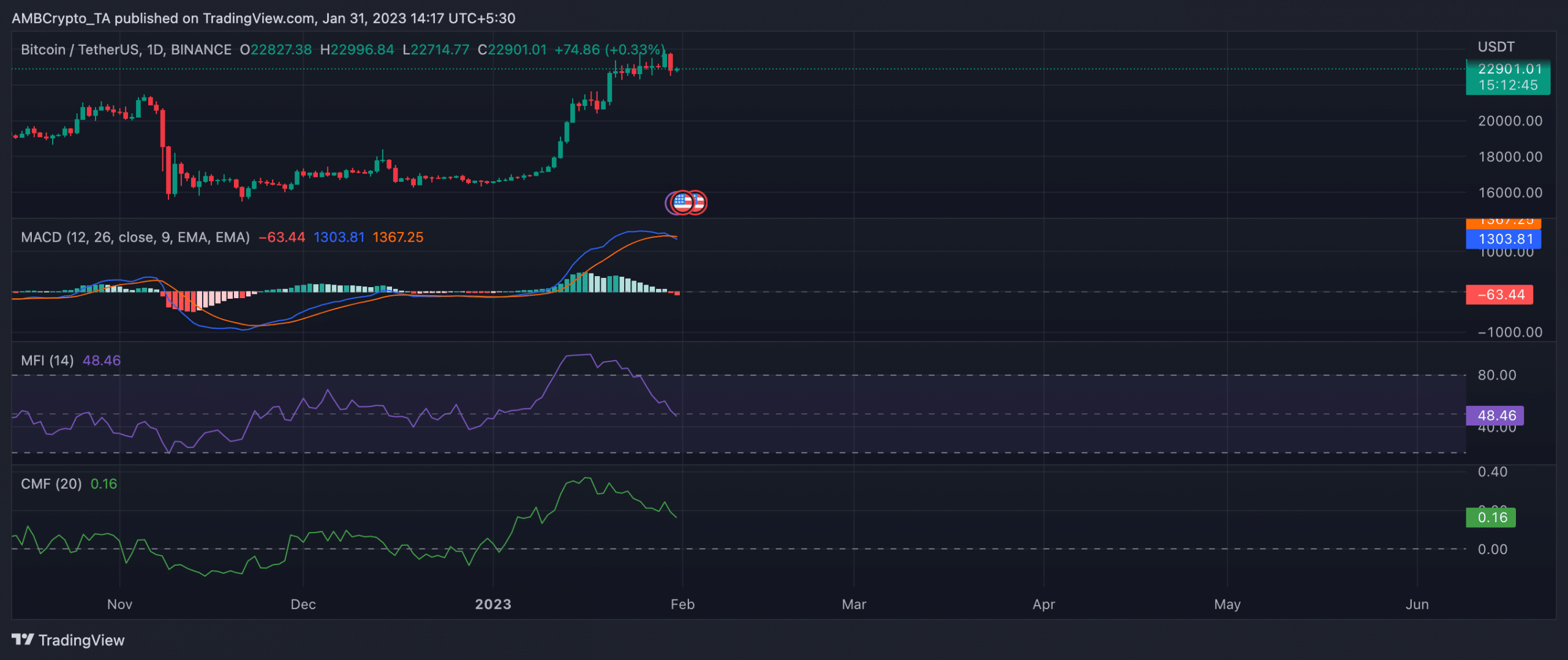

BTC’s actions on a day by day chart prompt that its value would possibly expertise a downside within the new buying and selling month. As of this writing, the main coin’s shifting common convergence/divergence (MACD) indicator revealed {that a} new bear cycle had commenced. The MACD line had intersected the development line in a downtrend, and BTC’s value fell to its 21 January stage.

Moreover, the coin’s value and Chaikin Cash Movement had moved in reverse instructions previously two weeks, making a bearish divergence.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

This bearish divergence indicated that there could be a possible value fall in February, because the development within the CMF prompt a lower in shopping for stress whereas the value continued to maneuver upwards. It is a pink flag for buyers, as it might point out that the upward development in value isn’t supported by underlying demand.

Lastly, BTC’s Cash Movement Index (MFI) was 48.46 and was in a downtrend at press time, having breached the 50-neutral spot. This additionally confirmed that purchasing momentum had declined considerably within the BTC markets.

Supply: BTC/USDT on TradingView

![Bitcoin [BTC]: A tale of how short traders caused a price rally in January](https://ambcrypto.com/wp-content/uploads/2023/01/1674497946922-5081218e-54e9-4762-83a2-bd718a5de68b-3072-1000x600.jpg)