- Bitcoin’s value hit the $24,000 value vary for the primary time in six months.

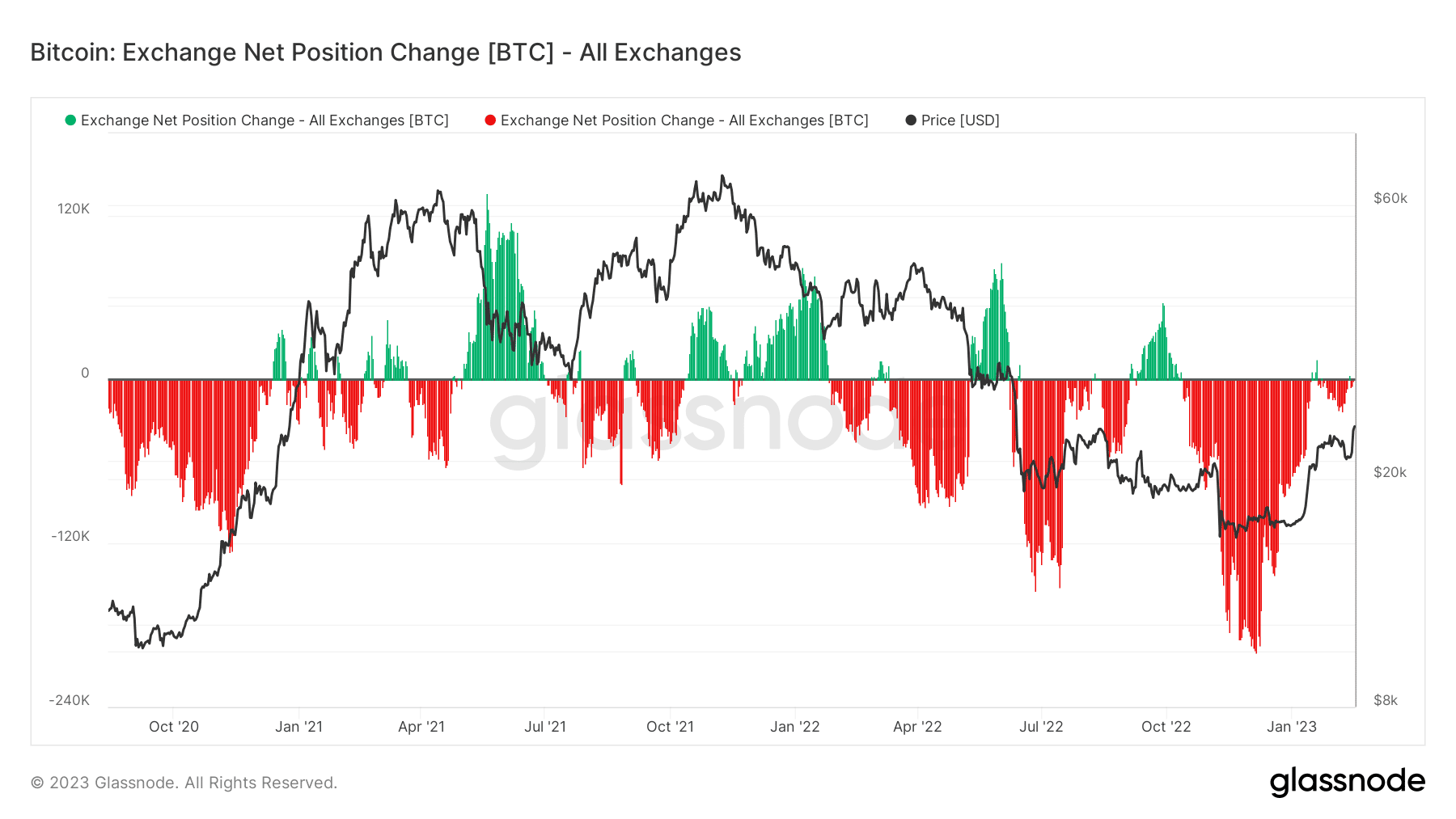

- Web place change confirmed brief positions dominating commerce.

The preliminary reactions to 13 February’s launch of the Client Value Index knowledge on Bitcoin [BTC] had been divided. Current pricing exercise, nonetheless, instructed it had weathered the storm moderately with a return to a spread seen months in the past. So, is that this a brief upswing or the start of a brand new development?

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Upswing into the $24,000

Bitcoin entered the $24,000 value stage for the primary time since August on the shut of buying and selling on 15 February. A each day timeframe evaluation of the value motion revealed that it had elevated in worth by the tip of buying and selling by 9.47%. It was buying and selling at about $24,500 as of this writing and had reached $24,800 in the identical time, with over a 1% acquire already registered.

Supply: Buying and selling View

There was a correlation between the value motion and the amount, as seen by a test on the On Stability Quantity (OBV). This factors to a optimistic value motion for BTC. value transfer was additionally indicated by a motion above the lengthy and brief Shifting Averages (blue and yellow traces).

Based on the Relative Energy Index (RSI), the asset was in a powerful bull development. The RSI line was above the impartial area and gave the impression to be shifting towards the overbought territory.

Lengthy vs. brief

Regardless of this surge, most merchants continued to take brief positions in opposition to Bitcoin. Most exchanges had been dominated by brief holdings, as indicated by the Web Place shift seen on Glassnode. This was an indication that the asset’s value would possibly decline.

Supply: Glassnode

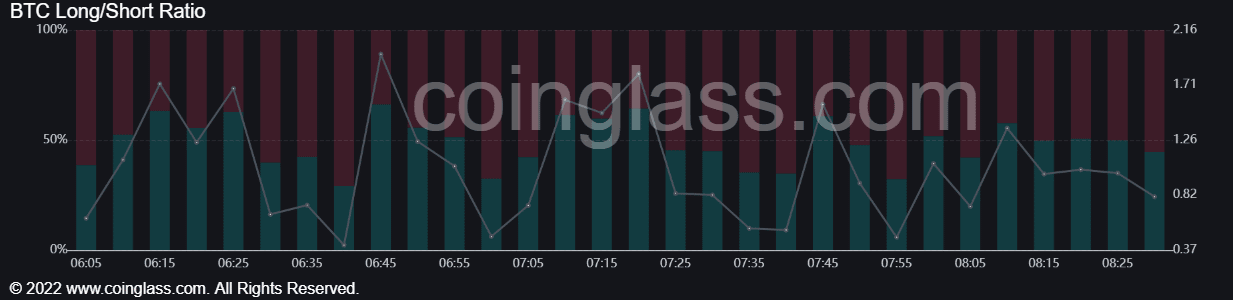

Moreover, a look at Coinglass’s BTC Lengthy/Brief Ratio revealed a relentless battle between lengthy and brief takers throughout exchanges. However as of this writing, the longs had been edging, standing at round 59%, whereas the shorts had been at about 40%.

Supply: Coinglass

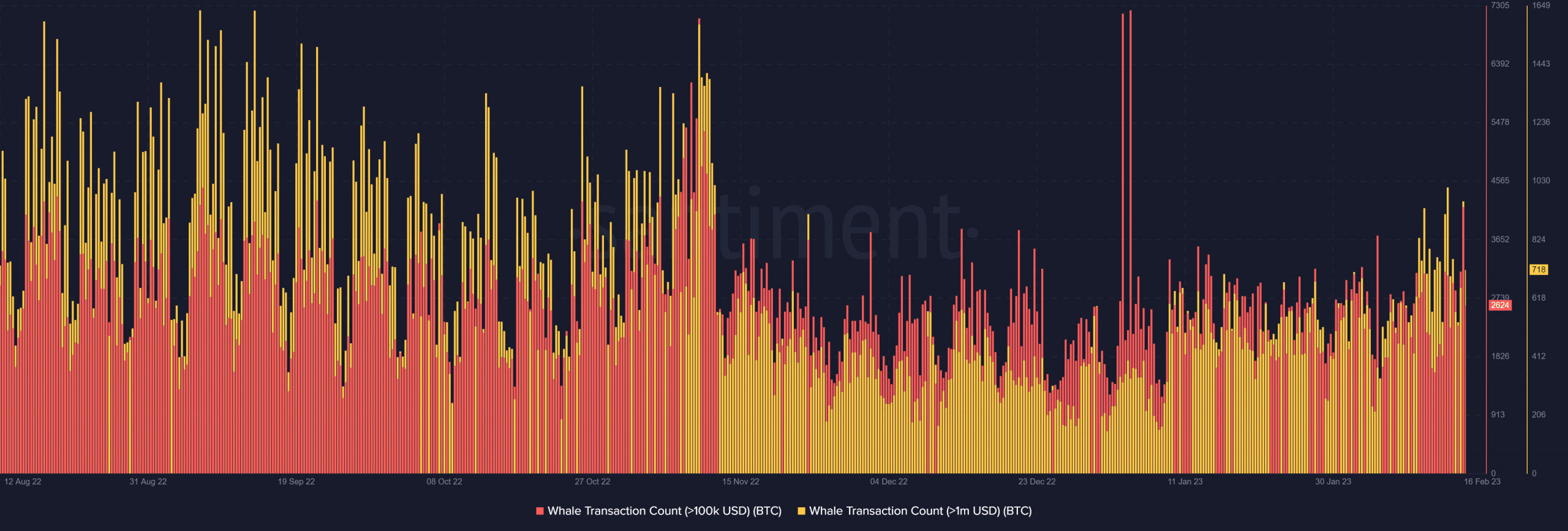

Whales’ actions enhance

Alternatively, whales seem content material to proceed buying Bitcoin whereas the lengthy and brief positions are battling it out. A look on the Whale transaction metric proved that it has began, as instructed in a publish by Santiment, that whale actions would possibly enhance.

Whale transactions elevated on 15 February, in response to the measured metrics of above 100,000 and 1 million. Besides for 2 spikes in January, Bitcoin transactions exceeding 100,000 elevated to a stage final seen in October. Based on the info, transactions of over a million have additionally elevated just lately.

Supply: Santiment

Liquidations if…

Constant shopping for by market heavyweights signifies they’re comfy with the market’s route. If the value of Bitcoin retains rising, many merchants will transfer to cowl their brief positions. The transfer would possibly spark a brand new wave of shopping for throughout the board. CoinMarketCap estimated that the overall worth of all cryptocurrencies was roughly $1.12 trillion, a rise of over 8% as of this writing.

How a lot are 1,10,100 BTCs price at this time?

Furthermore, on 15 February, Alabama Senator Tommy Tuberville announced his intention to reintroduce the Monetary Freedom Act. Based on the Senator, the Monetary Freedom Act overturned a Division of Labor guideline, limiting crypto investments in 401(okay) plans.

As well as, the senator claims that this laws will stop the DOL from taking authorized motion in opposition to anybody who makes use of brokerage home windows to spend money on cryptocurrencies. Though the invoice has not been thought-about on the Home ground, it might have generated optimistic sentiments within the crypto group.

![Bitcoin [BTC] breaks past $24k after CPI report: A rally in the making?](https://ambcrypto.com/wp-content/uploads/2023/02/btc-wale-1-1000x600.jpg)