Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought of funding recommendation.

- Bitcoin rebounded from its near-term EMAs to disclose a robust bullish inclination.

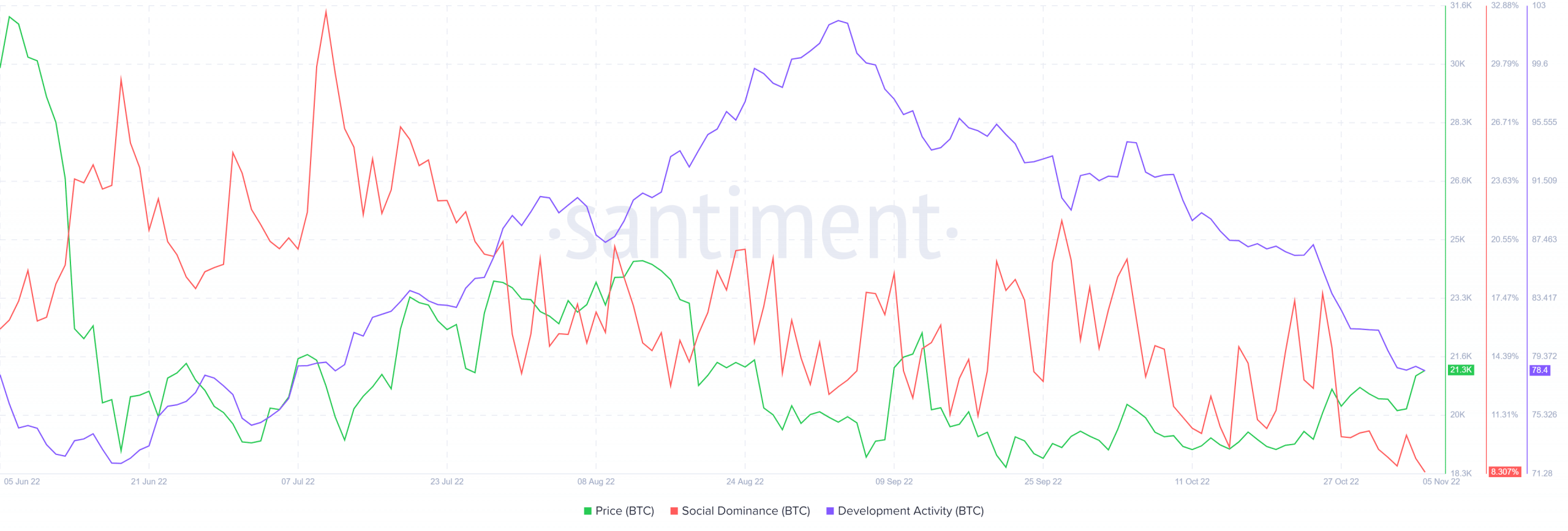

- Bitcoin’s social dominance and improvement exercise chalked out a downtrend.

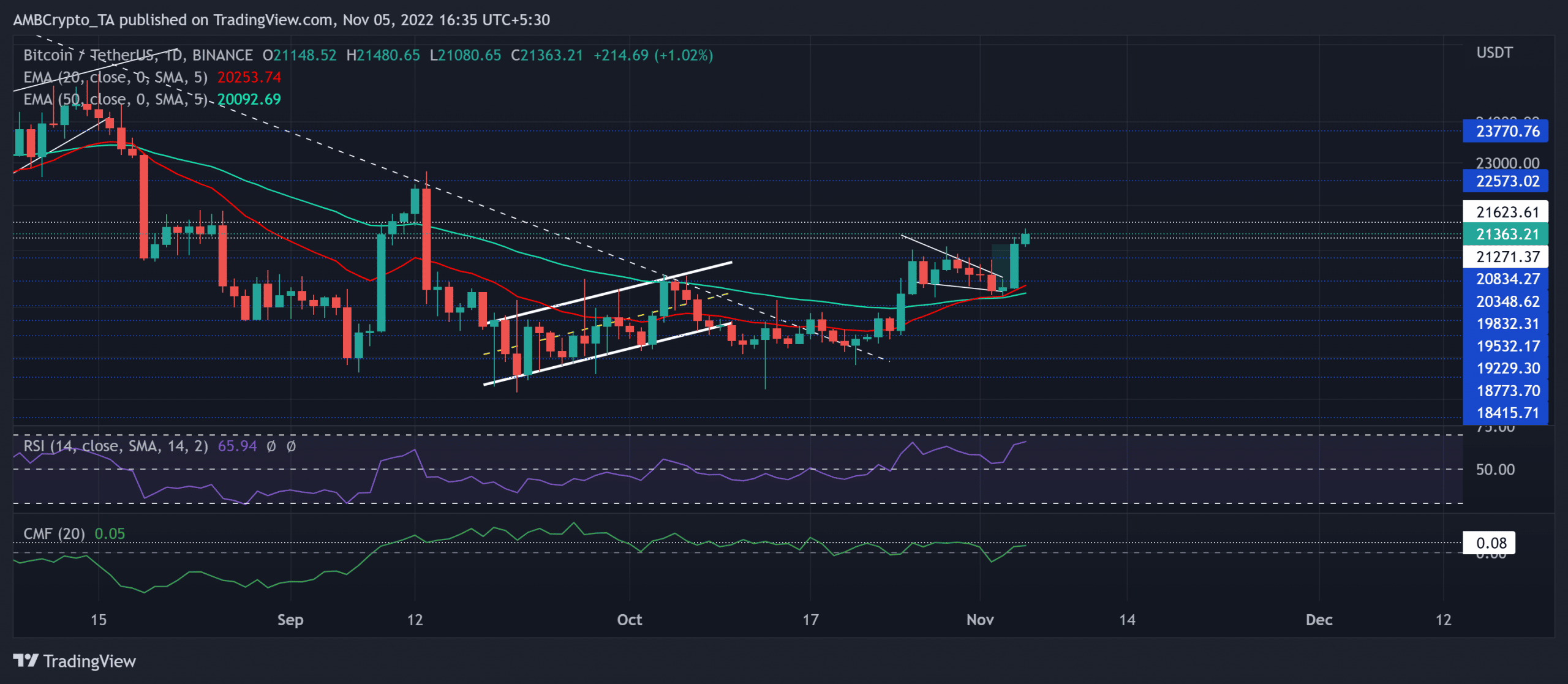

Bitcoin’s [BTC] ongoing good points aided the patrons in inducing a detailed above its 20 EMA (purple) and the 50 EMA (cyan) on the each day chart. The patrons renewed their strain, particularly after leaping above its long-term trendline assist (white, dashed) (earlier resistance).

Right here’s AMBCrypto’s value prediction for Bitcoin [BTC] for 2023-24

The value motion escaped the excessive liquidity zone because it broke into excessive volatility after the bullish resurgence. At press time, BTC was buying and selling at $21,363.21, up by 3.51% within the final 24 hours.

BTC witnessed a patterned breakout

Supply: TradingView, BTC/USDT

On the time of writing, the king coin discovered a convincing rebound from the 20 EMA assist. In doing so, the bulls strived to problem the restrictions of the $21.3K-$21.6K vary. Ought to the bulls inflict a detailed above this degree, the coin may see continued development within the coming periods.

In such circumstances, the primary main resistance degree for BTC would lie within the $22.5k zone. The crypto entered a excessive volatility part after an prolonged compression within the $19.1K area. Any reversals from the quick resistance vary can delay the near-term restoration prospects.

Any quick pulls may seemingly discover dependable rebounding grounds from the 20 EMA within the $20.3K area. The bullish cross on the 20/50 EMA additional improved the probabilities of bulls sustaining their edge available in the market.

The Relative Energy Index (RSI) witnessed development because it eyed the overbought area at press time. However the Chaikin Cash Circulation’s (CMF) lack of ability to sway above the 0.08-mark unveiled a gentle bearish divergence. Any decline beneath the zero mark may invalidate the bullish inclinations.

A decline in social dominance and improvement exercise

Supply: Santiment

Submit its comparatively excessive ranges of improvement exercise in September, this metric noticed a constantly declining pattern for 2 months. To prime it up, the king coin’s social dominance adopted an identical south-looking path. Ought to the worth motion observe, the sellers would look to maintain the bullish rallies below their verify.

Nonetheless, the targets would stay the identical as mentioned. Additionally, buyers/merchants ought to think about macro-economical components affecting the broader sentiment. This evaluation will assist them enhance the probabilities of a worthwhile wager.

![Bitcoin [BTC] buyers should know these caveats before opening a long position](https://ambcrypto.com/wp-content/uploads/2022/11/Untitled-design-11-1000x600.png)