Disclaimer: The datasets shared within the following article have been compiled from a set of on-line sources and don’t mirror AMBCrypto’s personal analysis on the topic

After plenty of Texas-based bitcoin mining firms had been momentarily down on December 25, 2022, Bitcoin’s hashrate elevated from the low 170 exahash per second (EH/s) noticed this week to above the 300 exahash stage. Moreover, in line with three-day hashrate distribution statistics taken on December 29, 2022, two mining swimming pools management greater than 50% of the world’s hashrate.

The yr has not been good for Bitcoin. For the reason that starting of 2022, the biggest cryptocurrency on this planet by market capitalization has misplaced virtually 65% of its worth.

Greater than 50% of BTC traders are at the moment shedding cash on account of this, which has pushed the market right into a meltdown. However plenty of indicators recommend that Bitcoin will make a comeback in 2023.

Learn Value Prediction for Bitcoin [BTC] 2023-24

The truth that institutional traders are putting substantial bets on Bitcoin have to be famous. Michael Saylor, a co-founder of MicroStrategy, has a powerful bullish outlook for Bitcoin.

Roughly 130,000 BTC, or 0.62% of the 19 million Bitcoin at the moment in circulation, are owned by his firm.

A CNBC article pointed out that historical past has proven that bull runs within the value of Bitcoin usually final 4 years. The preliminary step of this cycle is the buildup of Bitcoin, which is adopted by an uptrend, promoting or distribution of the cryptocurrency, and eventually a downtrend. Some students consider 2023 would possibly mark the beginning of the buildup part.

Moreover, if constructive financial information prompts traders to reevaluate their assumptions that the Federal Reserve would swap to a extra dovish financial coverage any time quickly, Bitcoin protects traders from losses in U.S. shares.

In accordance with McGlone, the Fed’s rate of interest negotiations will almost certainly lay the framework for Bitcoin to take care of its upward trajectory and outperform most asset courses. The commodity skilled additionally predicted that Bitcoin can be the asset with the most effective efficiency in H2 2022.

Regardless of this, Bitcoin supporters have contended that the cryptocurrency is uniquely positioned to exchange gold as a haven asset, an inflation hedge, and even each.

Actually, according to on-chain knowledge, extra Bitcoin whales with 1,000 to 10,000 BTCs of their wallets have appeared not too long ago, indicating that traders have been accumulating the cryptocurrency.

Within the meantime, BitVol, a volatility indicator, has “begun to interrupt down,” plunging to shut to its lowest ranges for the reason that spring, in line with Jake Gordon at Bespoke Funding Group. The index, at press time, was hovering at 69, down from over 111 in Could.

In accordance with Mike Novogratz, the CEO of cryptocurrency investing agency Galaxy Digital, the gloomy development could proceed for one more two to 6 months. The vast majority of traders that required fiat have already offered their belongings, he claimed, and sellers are severely depleted. Nonetheless, the Fed’s financial coverage must shift to buck the development.

Prime-tier Bitcoin whales are persevering with to promote, and so they at the moment have between 100 and 10,000 BTC. Over the course of the earlier yr, 3.5% of the availability on these essential addresses was moved to places having decrease impression on future value fluctuations. Simply in September, one other 0.4% of BTC’s provide was burned. A big tendency to be careful for in October is the buildup of potential whales.

Since there’s nonetheless a dearth of distinctive BTC touring from tackle to deal with, the NVT sign has given out a bearish sign for the second consecutive month. A change in the identical might point out a bullish development. And but, the crypto has developed into one of many largest belongings on this planet from being finally virtually nugatory. Bitcoin’s market capitalization peaked even increased than a number of well-known firms.

One factor that’s immediately clear from this knowledge is that Bitcoin’s value cycles are getting shorter. Moreover, regardless that the coin ceaselessly loses worth, the common value of Bitcoin retains rising. This means a promising sample for the long run.

And regardless of everybody writing it off, the crypto-sector, together with Bitcoin, is famend for its resilience and capability for comebacks. For the previous eight years, completely different monetary consultants have persistently predicted that the Bitcoin bubble will burst “quickly.” Nonetheless, the coin continues to be in demand and BTC traders make important returns.

Why these projections matter

The next article will contact upon these projections. With BTC rising as a powerful retailer of worth of late, it’s essential traders are conscious of the place standard analysts see the cryptocurrency heading over the following decade. These projections, whereas not an absolute certainty in any manner, might help merchants and holders make good selections.

That’s not all, nevertheless. In accordance with CoinGecko, for example, Bitcoin enjoys a market share of slightly below 38%. Whereas this determine isn’t as excessive because it was again in 2017 and even, 2021, it’s a big share. By extension, what it means is that no matter occurs to Bitcoin, the remainder of the altcoin market is certain to see a ripple impact. Ergo, even if you happen to’re solely into altcoins, what BTC performs will have an effect on you too.

This text will briefly take a look at the cryptocurrency’s current market efficiency, with a particular give attention to its market cap, quantity, and charge of appreciation/depreciation. The identical shall be expanded upon with using datasets corresponding to non-zero addresses, no. of whale transactions, et al. It should conclude by summarizing the projections of the most well-liked analysts/platforms, whereas additionally trying on the Concern & Greed Index to evaluate the temper of the market.

Bitcoin’s value, quantity, and every little thing in between

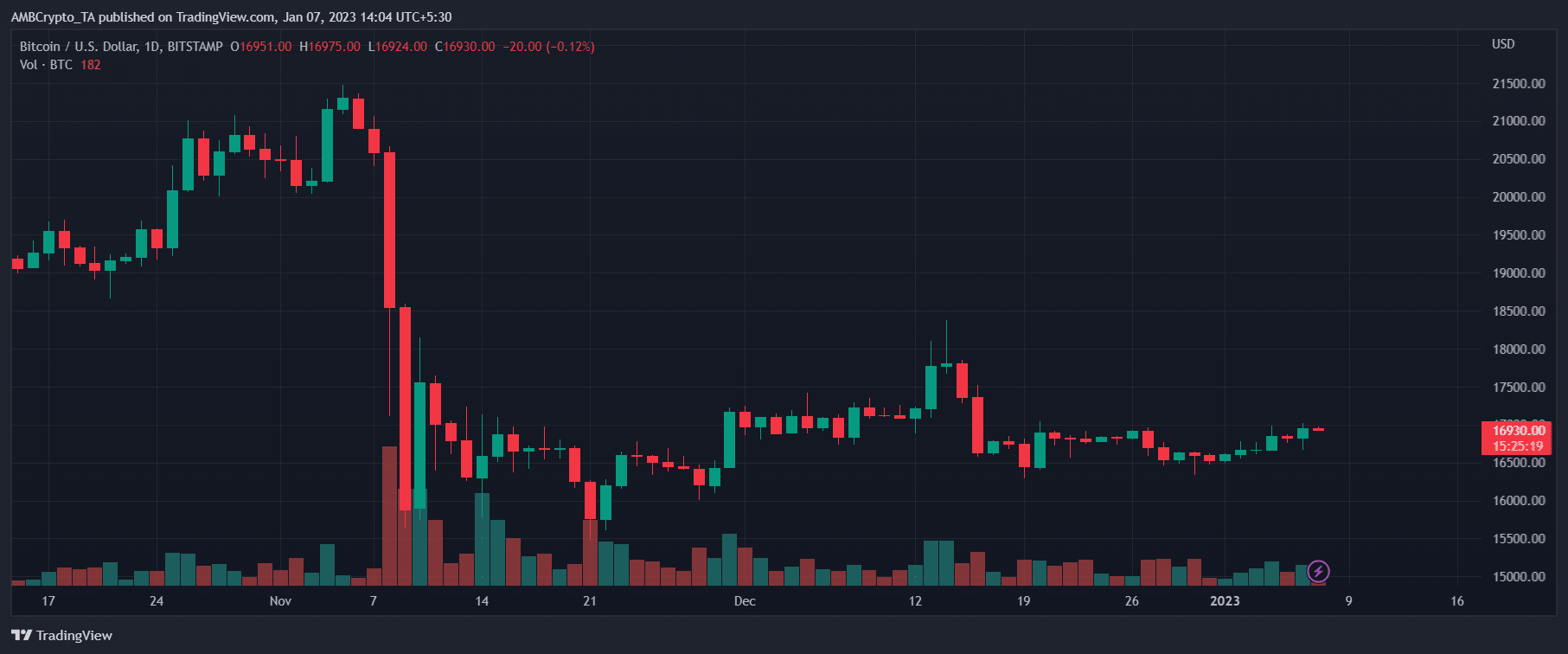

On the time of writing, Bitcoin was buying and selling at $16,930 on the worth charts with a number of volatility on the day by day chart.

Supply: TradingView

Evidently, BTC’s value motion had an impression on its market cap too. When the crypto’s value hit a short-term peak on 30 July, so did the market capitalization, with the identical rising to $469 billion. At press time, it was right down to $318 billion. As anticipated, BTC/USDT was the most well-liked buying and selling pair in the marketplace, with Binance having fun with a share of over 7.1% for a similar.

On 19 September, 620K Bitcoin tokens had been added to all exchanges, in line with Santiment’s Change Influx Indicator. In consequence, there are at the moment 11,879,200,000 {dollars}’ value of Bitcoin accessible on the market at any time.

The aforementioned could also be excellent news for traders. Particularly since many would see this as a superb alternative to purchase BTC on the low. Actually, whereas BTC continues to be over 69% away from its ATH of over $69,000, there’s a number of optimism round.

Take into account the feedback of the legendary Invoice Miller, for example. He was within the information some time again when he claimed,

“Bitcoin’s provide is rising round 2.5 % a yr, and the demand is rising quicker than that.”

To Miller, this development in demand shall be accompanied by a corresponding hike in value too, with a goal of $100,000 being thrown round by some. Actually, an analogous logic was utilized by Bloomberg Intelligence when it claimed that the demand and adoption curves pointed to a projection of $100,000 by 2025.

The very best instances to begin Bitcoin companies are throughout bear markets. The nine-week Legends of the Lightning match between competing Bitcoin companies would appear to assist that.

Over 65 occasions from all around the world participated within the tournament-turned-hackathon, which comprised 73 tasks competing for a chunk of the three BTC ($50,000) up for grabs. The champions of the International Adoption and Constructing for Africa competitors tracks had been introduced as Lightsats, Mutiny Pockets, and AgriMint, respectively.

One can argue that over the previous couple of years, a lot of Bitcoin’s demand and adoption has been pushed by its emergence as a retailer of worth. Actually, whereas fairly a number of are into it for the tech, many others are into Bitcoin for a superb return on their funding. It’s on this regard that it’s value taking a look at how its ROIs have been. In accordance with Messari, for example, on the time of writing, BTC was providing unfavorable ROIs of -27% and -41% over a 3-month and a 1-year window, respectively.

Supply: Messari

Understandably, the aforementioned datasets are merchandise of how BTC has been doing on the worth charts of late. Because of its most up-to-date drawdown, its ROIs have been unfavorable. Even so, there are a number of components that appear to underline a bullish flip for the world’s largest cryptocurrency.

As an example, the variety of Bitcoin addresses holding 0.1+ cash hit an ATH. Moreover, the $BTC P.c Provide in Revenue (7d MA) simply hit a 1-month high of 60.513% too whereas the aSOPR (7d MA) struck a 3-month excessive. That’s not all both –

📉 #Bitcoin $BTC Imply Block Measurement (7d MA) simply reached a 1-month low of 1,136,459.461

Earlier 1-month low of 1,138,589.185 was noticed on 08 October 2022

View metric:https://t.co/GT3eQ9z0Qw pic.twitter.com/gdq4s1dzG0

— glassnode alerts (@glassnodealerts) October 9, 2022

Moreover, in line with IntoTheBlock, 53% of traders recorded revenue at BTC’s press time costs. Quite the opposite, 39% of the holders had been in loss.

Along with this, holder composition by time projected one thing constructive too. A complete of 62% held their cash for a interval of multiple yr, whereas 32% have held their cash for between one to 12 months. Proving extra assist for the holding exercise, Glassnode too underlined one thing comparable. BTC’s addresses with a steadiness of 1 BTC hit a brand new excessive.

That’s not all.

Actually, regardless of the bearish outlook, the adoption charge didn’t fail to fulfill the crypto’s credentials. Speaking about adoption, BTC buying giants inside this sport (massive holders) too reiterated the development. As an example, take a look at MicroStrategy‘s newest spree.

In a prospectus filed with the SEC on 9 September, the corporate goals to promote as much as $500 million in shares to fund extra Bitcoin purchases. Since 2020, MicroStrategy has bought about 130,000 Bitcoins, value greater than $2 billion, utilizing funds raised from inventory and bond choices.

“We could use the web proceeds from this providing to buy further Bitcoin,” the corporate said within the submitting.

Publicly traded software program firm MicroStrategy (MSTR) is already the single-largest company holder of Bitcoin

Now that the background and context is taken care of, what do standard platforms and analysts say about the place they see Bitcoin heading in 2025 and 2035? Effectively, just one solution to discover out.

What number of BTCs can you purchase for $1?

Bitcoin Value Prediction 2025

Earlier than we get to predictions, it’s necessary that one salient characteristic be recognized and highlighted. Predictions fluctuate. From one platform to the opposite, from one analyst to the opposite, predictions could be considerably completely different from one another.

Take into account the yr 2025, for example –

In accordance with Changelly, Bitcoin’s common buying and selling value shall be as excessive as $124,508 in 2025, with the platform claiming it’d go as excessive as $137k.

Quite the opposite, there’s cause to consider that the cryptocurrency’s upside gained’t be as excessive. Why? Effectively, as a result of the crypto is but to be uniformly supported by international regulatory and legislative regimes. With CBDCs being slowly launched in lots of international locations, the perspective in direction of cryptos isn’t precisely constructive both.

Lastly, the final six months additionally highlighted the tendency of most retail traders to run with their holdings as soon as the market massacre begins.

One other fascinating manner to have a look at it’s utilizing the expansion of tech to spotlight how far Bitcoin would possibly go.

Take into account the straightforward case of Google, for example. Regardless of current turmoil, it’s anticipated to develop exponentially over the following 5 to 10 years. Nonetheless, it may be argued that this development will go hand in hand with the expansion of Bitcoin and the crypto-market, by extension. This, owing to the correlation between the 2.

Bitcoin searches on Google being 7x and 42x increased than the no. of searches for USD and Euro, respectively, is proof of the identical. Actually, according to studies, there has traditionally been a 91% correlation between BTC costs and Google search volumes.

Bitcoin Value Prediction 2030

For starters, one factor have to be made clear. 2025 and 2030 are 5 years aside. Predictions are tough to get proper as it’s. It’s maybe much more tough when the timeframe in query is an efficient 8 years down the road.

Even so, one can see that most individuals’s predictions for Bitcoin’s 2030 value are on the bullish facet. Now, whereas there’s good cause behind such optimism, it’s value stating that these projections don’t account for variables like black swan occasions.

So, what’s everybody saying?

In accordance with Changelly, BTC would possibly peak at round $937k in 2030, with the cryptocurrency buying and selling at a median value of $798k. I

What drives these projections? Effectively, a few causes. For starters, most are optimistic concerning the worth of the crypto’s shortage coming into play. Secondly, maximalists envision a future the place demand for Bitcoin is countless. Lastly, with Bitcoin adoption rising by 113% yearly, many consider the identical will at some point be highlighted by BTC’s value.

There are different projections too, ones much more bullish. In accordance with Parallax Digital’s Robert Breedlove, for example, BTC will hit $12.5M by 2031. Now, he did say that the cryptocurrency will hit $307k by October 2021. Ergo, there’s good cause why some may not take him severely.

Bitcoin Value Prediction 2040

2040 is eighteen years away. 18 years. Even Bitcoin isn’t 18 but.

Evidently, projecting a value stage for 2040 is much more tough, with a complete host of uncertainties round. For the sake of argument, let’s simply assume every little thing else stays the identical as it’s, how then is BTC prone to do on the charts by 2040?

Effectively, some have taken a superb shot at answering this query.

In accordance with Telegaon, BTC will take pleasure in a median buying and selling value of $553k, ‘relying on market development,’ by 2040. It went on to foretell,

“Our most value prediction for Bitcoin is $618,512.87 in 2040. If the market will get bullish, Bitcoin could surge greater than our BTC value forecast in 2040.”

Others have been extra imprecise, with some declaring million-dollar valuations with out a definitive timeline for a similar. Maybe, that is for good cause too. In any case, blockchain and crypto-trends would possibly change by 2040. Moreover, who is aware of what is going to occur if Bitcoin’s rising adoption doesn’t coincide with a corresponding drive to deal with its velocity and scalability.

Additionally, for all its development, it’s tough to see the crypto outgrow the worth dynamics that include its provide and demand facet. Actually, look no additional than the previous couple of months when many miners like Riot Blockchain and BitFarms grow to be net sellers of Bitcoin.

Right here, it’s value stating that in line with a Finder survey, many consider HyperBitcoinization shall be upon us by 2040. Possibly even 2035. These occasions will definitely dictate the place BTC shall be by 2040.

Conclusion

These projections aren’t set in stone. Not by an extended shot. As talked about, fairly a number of issues would possibly change by the point 2040, 2030, and even 2025 come round. Nonetheless, if you happen to’re an investor, it’s greatest to maintain a watch out for what these are.

Analysts predict that Bitcoin and Ether will each begin a “Wave 5 extension decrease” in 2023, coinciding with the resurgence of threat belongings, the U.S. forex, and bonds. They are saying that Bitcoin is “buying and selling in lock-step” with ETH and that “we proceed to anticipate any substantial rises in BTC to satisfy appreciable promoting strain.”

In gentle of every little thing said above, it’s evident from a technical perspective that the present state of the Bitcoin value is dire. Nonetheless, we are able to nonetheless observe some underlying energy for the king coin on the entrance of the on-chain metrics. Thus, one would possibly draw the conclusion that whereas Bitcoin’s short-term prospects are dim proper now, a rebound is unquestionably possible sooner or later.

Miners began working at a better price than the block subsidy and transaction charges they generated when BTC/USD dropped 20% in a matter of days. In consequence, mining rigs are idled, and miners are compelled to promote BTC to fund prices.

Sooner or later, issues might worsen if important mining firms find yourself promoting their held BTC in massive portions to fulfill money owed.

Simply contemplate BTC’s newest value motion for instance of the identical. Simply final week, the crypto was buying and selling near $24,000 – Optimism was excessive. At press time, nevertheless, the other was the sensation round, with many nervous the cryptocurrency will now quickly go under $20k once more.

Now, it’s value stating that there was good cause behind the aforementioned drop in value. In accordance with stories, this was on the again of US Federal Reserve officers reiterating their resolve to maintain elevating rates of interest till inflation is contained. Correspondingly, BTC’s drop in value mimicked the drop seen throughout fairness markets – Unsurprising, particularly since there was a gentle correlation between Bitcoin’s value and U.S shares. Actually, such is the correlation that,

“… marking the strongest correlation since 2010 between digital belongings and key equities indices such because the S&P 500 and Nasdaq.”

Such was the dimensions of the aforementioned fall that over $220M in crypto-positions was liquidated, with Bitcoin accounting for nearly half of it, in line with CoinGlass.

Now, whereas that’s what’s the case on the worth entrance, it’s value taking a look at what’s occurring within the background too. Take into account this – In accordance with the AASA indicator, whereas BTC has appreciated of late, the identical wasn’t supported by a associated hike in energetic addresses on the community. The identical was additionally not too long ago pointed out by the Founding father of LookIntoBitcoin.

In accordance with Tim Rice, CEO of the analytics agency CoinMetrics, extra conventional monetary establishments have began to enter the cryptocurrency market. Large banks are nonetheless ready for extra clear regulation of the cryptocurrency business, nonetheless, to decrease their dangers.

Nonetheless, prior to now, 15 months earlier than the mining reward halving, which is a deliberate 50% slowdown within the charge of provide enlargement each 4 years, Bitcoin has bottomed out to begin a brand new rise. In March or April 2024, the following Bitcoin halving is scheduled. If the previous is any indication, the bear market in Bitcoin could have come to an finish in November at round $15,473, and the digital forex could rise as excessive as $63,000 earlier than the halving.

The Twitter settlement with Elon Musk has been a key issue within the total favorable feeling towards Bitcoin, which has been extra prevalent than not. Many individuals assume the billionaire would find yourself encouraging the utilization of Bitcoin and different digital belongings on the platform due to his ardent assist for cryptocurrencies.

Evidently, there’s nonetheless a number of optimism round. Take into account the opinions of CryptAM’s Niraali Patel, for example, a panel member for Finder-

“We should take into consideration the long-term implications of Bitcoin and Proof-of-Work cryptocurrencies. As soon as mined, this would be the subsequent fundamental retailer of worth as gold as soon as was. The halving is about to happen in 2024, and this may, by definition, enhance the USD value of Bitcoin by fairly a bit. Because of this, I consider that is the time to purchase. As soon as the halving occurs, BTC shall be value at the very least $100,000.”