- At press time, BTC was buying and selling at a value stage final seen in August 2022.

- The rally in value for the reason that starting of the 12 months has put many holders in revenue.

Robust features between 20 – 22 January pushed Bitcoin’s [BTC] value to rally by over 2% in the course of the intraday buying and selling session on 23 January. This prompted the main coin to commerce at ranges final seen in August 2022, knowledge from CoinMarketCap confirmed.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

With BTC at present exchanging fingers above the $23,000 value mark, main on-chain knowledge supplier Glassnode, in a brand new report, famous shifts within the behaviors of latest traders (short-term holders), long-term holders, and miners, which could point out profit-taking, following a big bearish buying and selling interval in 2022.

On-chain metrics level to at least one factor

In line with the report, an evaluation of BTC’s % Provide in Revenue metric revealed that the surge in value for the reason that 12 months began represented one of many sharpest spikes in profitability in comparison with prior bear markets.

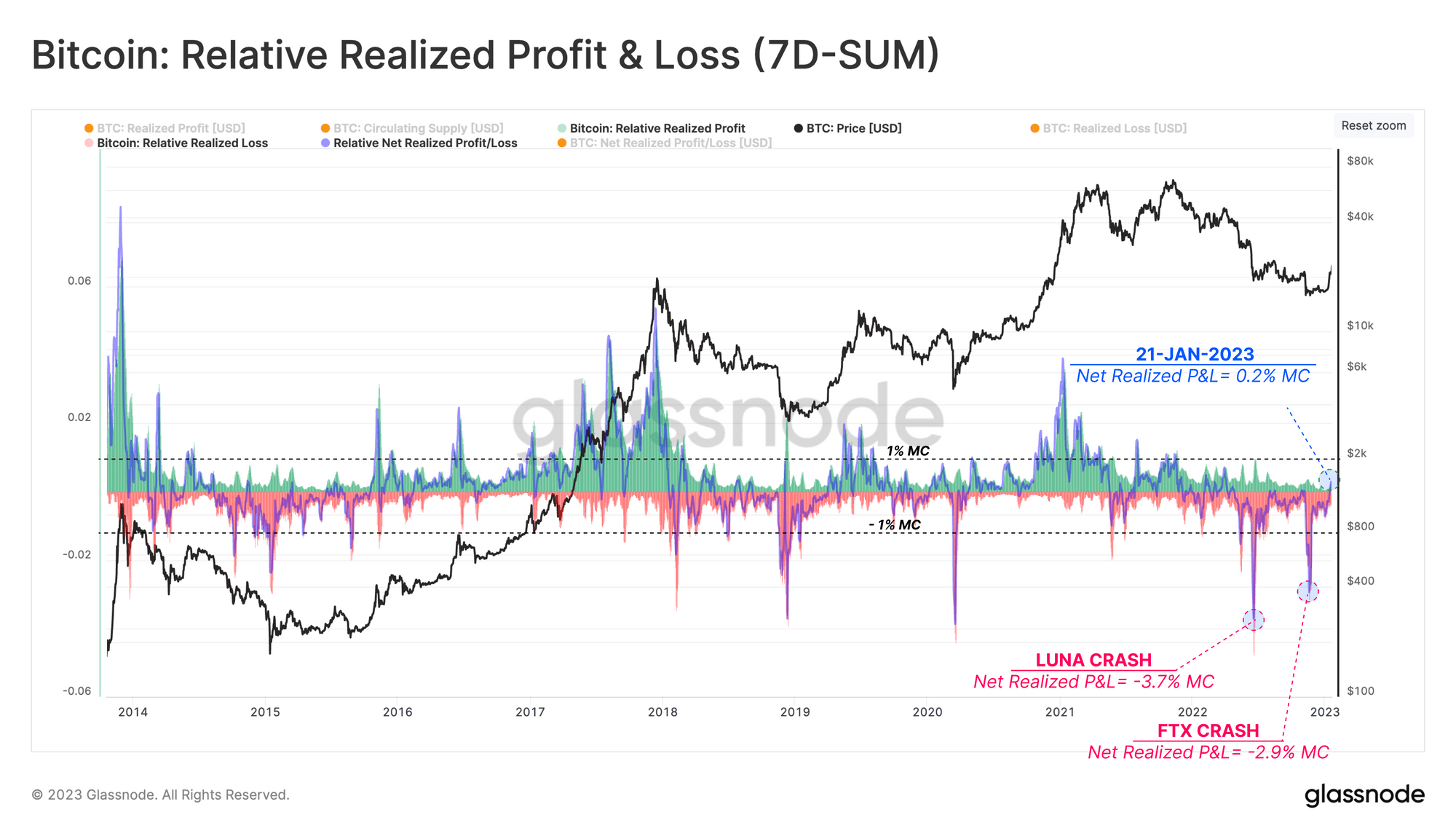

In line with Glassnode, within the present bear market that started in November 2021, BTC’s Web Realized Revenue and Loss metric has suffered two giant capitulation occasions (Terra-Luna and FTX collapse), which resulted in a internet lack of 2.9% and three.7% of the king coin’s market capitalization per week, respectively.

Nevertheless, with a spike in BTC profitability prior to now few weeks, Glassnode discovered that the market has shifted to a state of revenue dominance, which it described as a:

“Promising signal of therapeutic after the heavy deleveraging pressures inflicted within the second half of 2022.”

Supply: Glassnode

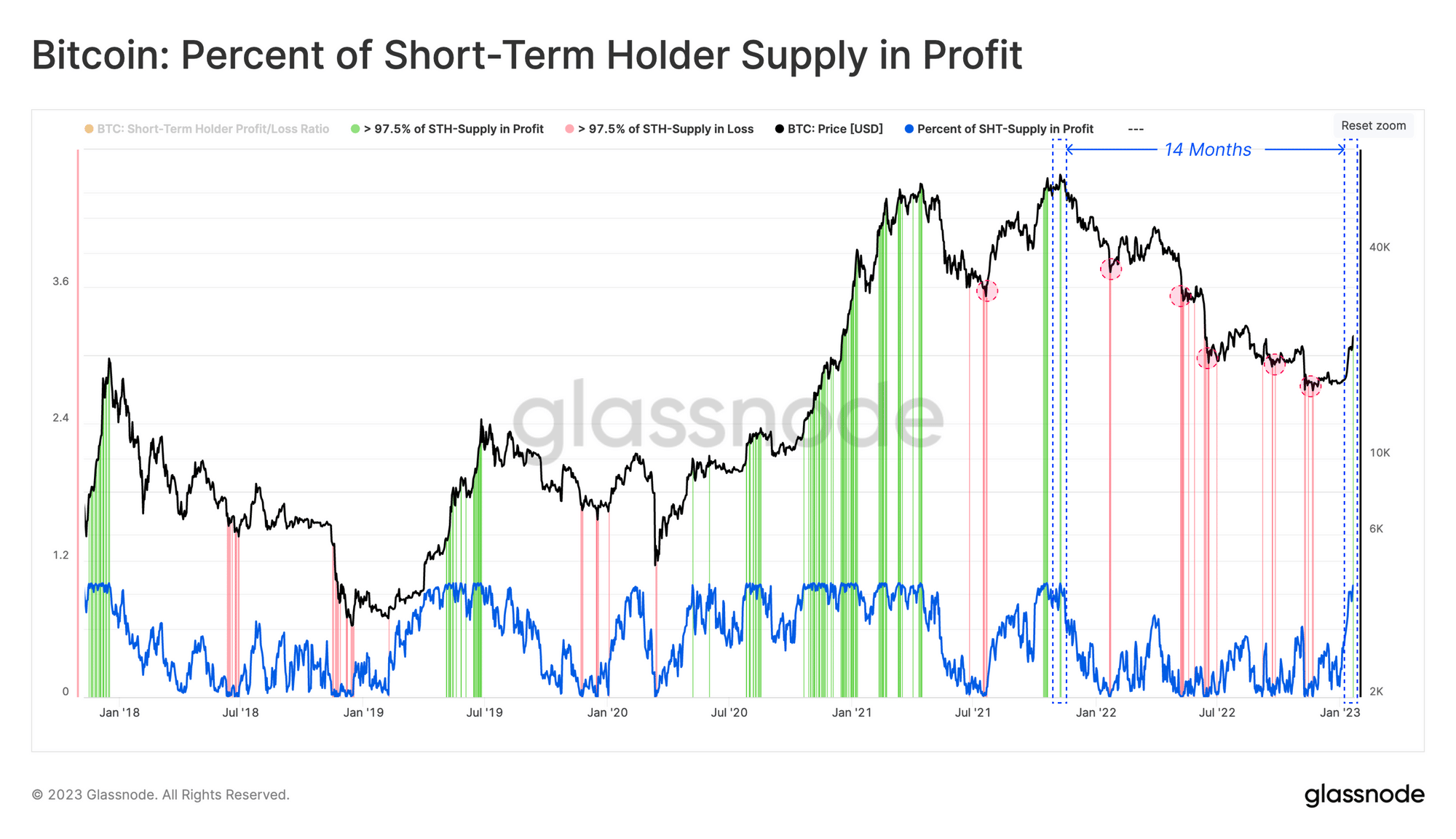

Additional, in figuring out what new BTC traders have been as much as, Glassnode assessed the coin’s Share of Quick-Time period Holder Provide in Revenue metric. It discovered that the latest surge in Bitcoin’s value to $23,000 pushed this metric to above 97.5% in revenue for the primary time for the reason that all-time excessive in November 2021.

Nevertheless, traders ought to stay cautious, as when greater than 97.5% of short-term holder provide is in revenue, these gamers usually tend to exit at break-even or revenue, Glassnode opined.

Supply: Glassnode

To maintain the present rally, Glassnode stated:

“Due to this fact, the sustainability of the present rally may be thought of a steadiness between inflowing and newly deployed demand, assembly the availability drawn out of investor wallets by these increased costs.”

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

As for long-term holders of the king coin, following the shake in conviction that led a lot of them to distribute their BTC holdings when FTX collapsed, the latest leap in value has led to an increment in long-term holdings. Glassnode stated:

“The availability held by HODLers has shifted from a contraction of -314k BTC/month following FTX collapsing to an enlargement at a price of +100k BTC/month.”

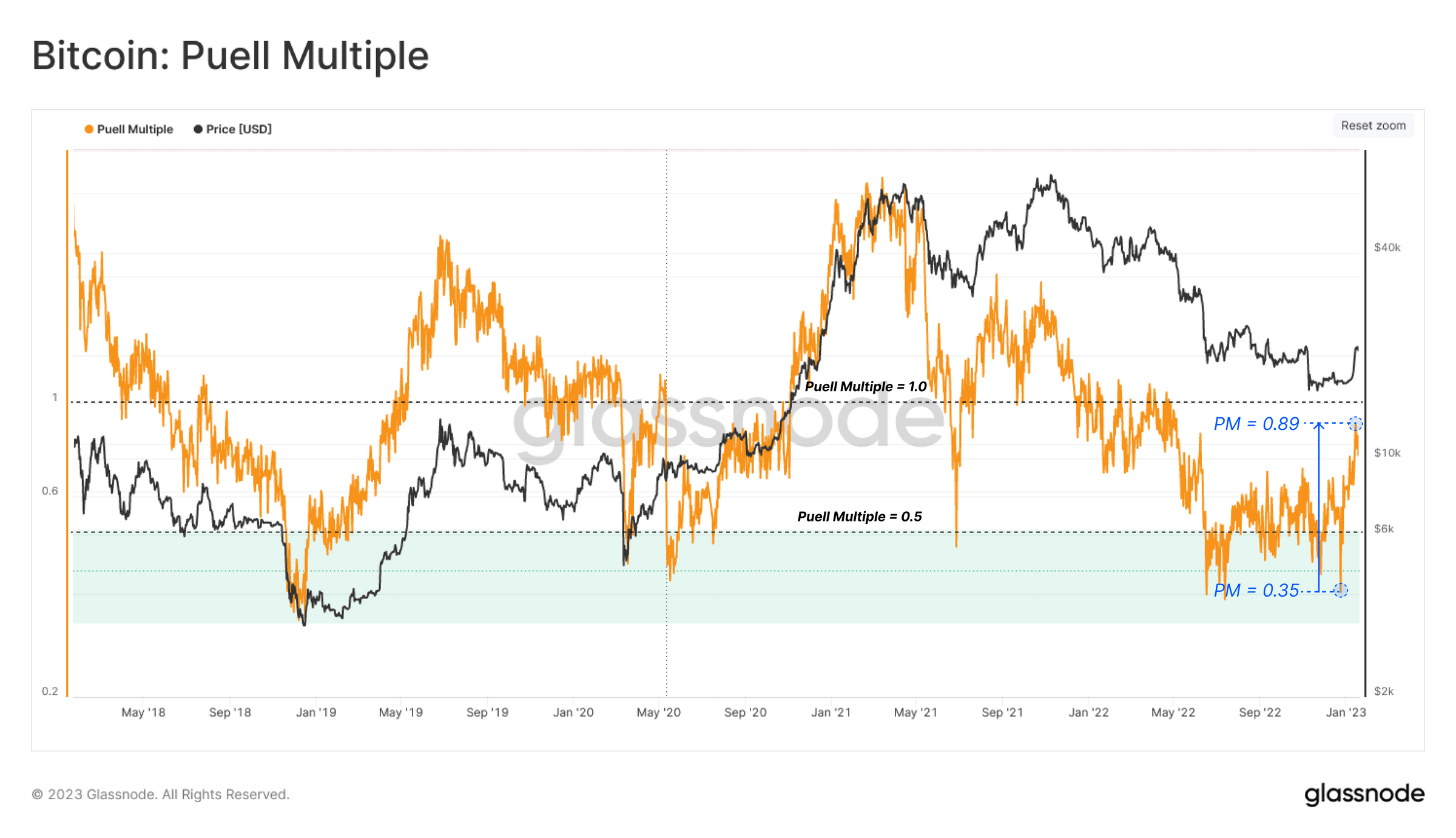

Supply: GlassnodeLastly, as for the miners working the BTC community, an evaluation of the Puell A number of revealed:

“That the relative miner income has elevated by 254% in comparison with early January, highlighting how immense the monetary stress skilled by the trade has been all through the bear market.”

Supply: Glassnode

![Bitcoin [BTC]: Recent price jump has put holders in profit, new report shows](https://ambcrypto.com/wp-content/uploads/2023/01/1674479364229-185abaee-5498-4375-bb7d-5eaf1a437138-3072-1000x600.jpg)