- Bitcoin fell to a two-year low following the collapse of FTX and this led to a decline in buyers’ conviction

- Lengthy-held BTCs are shifting addresses

With the overall cryptocurrency market taking a stab at restoration following the collapse of FTX, on-chain information appears to counsel that long-held Bitcoin [BTC] has began to see some exercise.

Learn Bitcoin’s [BTC] value prediction 2023-2024

In mild of favorable macro elements, when long-held crypto-assets change arms, this often signifies that dormancy on the coin’s community is beginning to dissipate and a major value rally is imminent.

Nonetheless, within the present market, a more in-depth take a look at on-chain information revealed that buyers’ selections to maneuver beforehand dormant BTC cash had been borne out of worry and lack of conviction.

Previous arms awakening

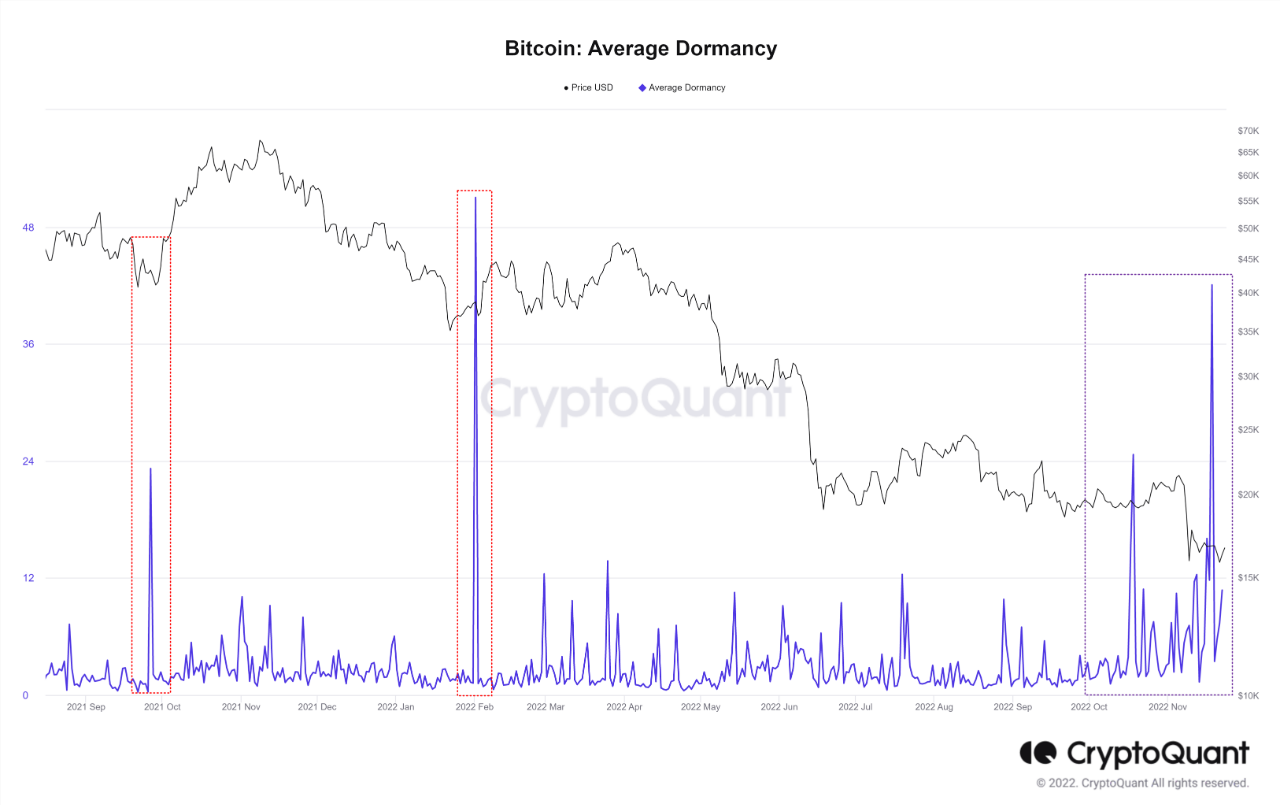

In response to CryptoQuant analyst Wenry, BTC’s Common Dormancy is at its highest degree since February. This metric measures the typical interval that each coin stays dormant from the time it was final traded. A spike on this metric signifies a rally in coin distribution.

Wenry famous that previously, this metric often rose “in the course of the first technical rebound after a big value drop.” BTC traded at a two-year low because of the collapse of FTX and it has since tried to get better. Nonetheless, earlier than this may very well be taken as conclusive proof of a primary “technical rebound,” Wenry warned,

“If $BTC, which has not moved for a very long time for a couple of days, strikes and there’s a stronger motion within the corresponding indicator sooner or later, it’s judged that it’s essential to focus extra on threat administration from a buying and selling perspective.”

Supply: CryptoQuant

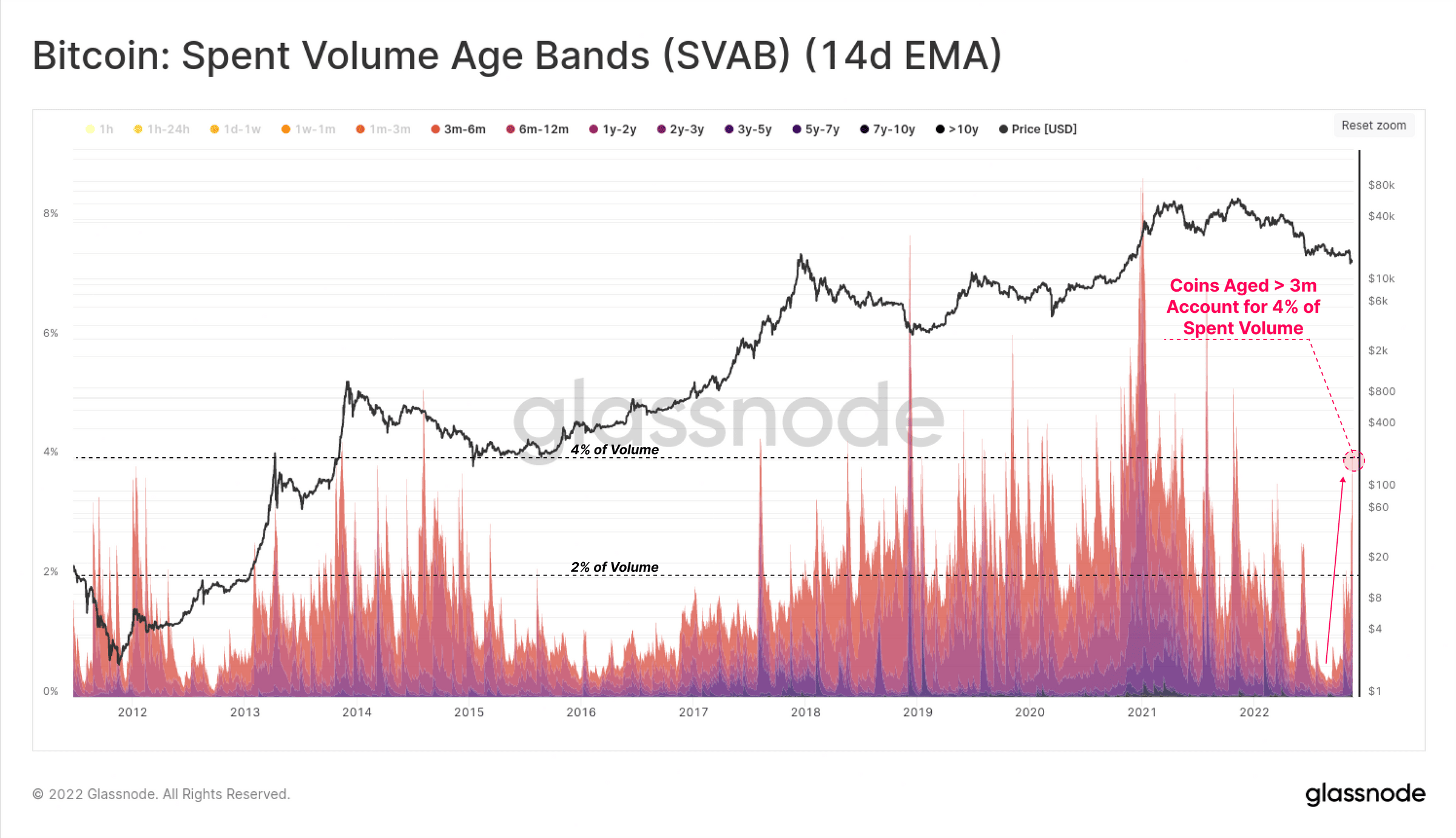

Additionally, Glassnode, in a brand new report, discovered that BTC’s Spent Quantity Age Bands (SVAB) hit their highest degree because the starting of the yr. The SVAB metric revealed that simply 4% of all cash spent final week had been sourced from cash older than three months. In response to the on-chain analytics platform,

“This relative magnitude is coincident with a few of the largest in historical past, typically seen throughout capitulation occasions and wide-scale panic occasions.”

Supply: Glassnode

Glassnode additional noticed that uncertainty permeated the minds of BTC long-term HODLers. The identical, it stated, has been “prompting the altering of arms, and/or shuffling of cash by longer-term buyers.”

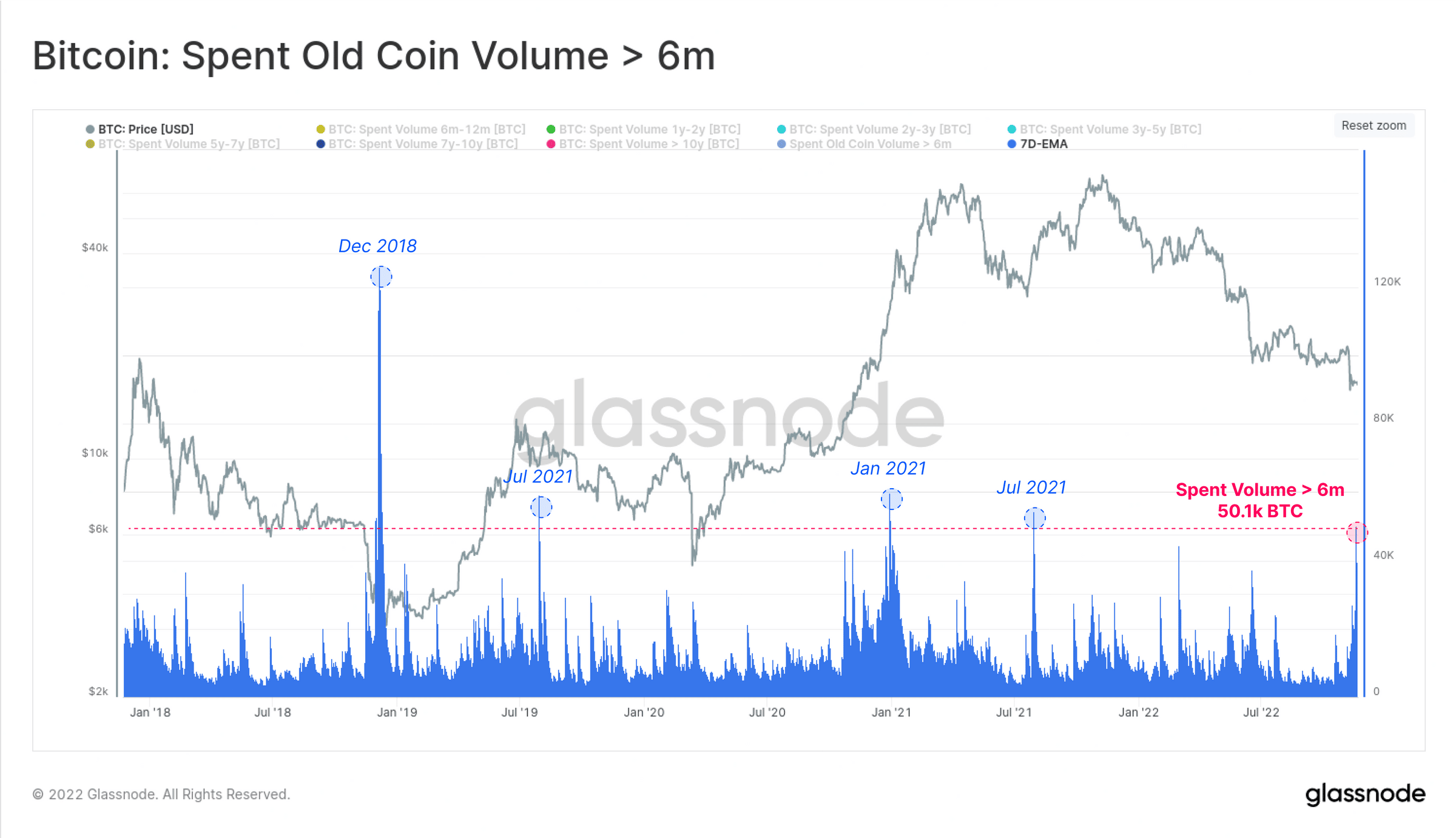

Lastly, an evaluation of BTC’s Spent Previous Coin Quantity older than 6 Months revealed that the metric hit its fifth-highest worth within the final 5 years.

“Within the time since FTX collapsed, a complete of 254k BTC older than 6-months have been spent, equal to round 1.3% of the circulating provide. On a 30-day change foundation, that is the steepest decline in older coin provide because the Jan 2021 bull run, the place long-term buyers had been taking income within the bull market.”

Supply: Glassnode

It’s, nevertheless, too quickly to say how these observations throughout datasets will have an effect on Bitcoin’s worth on the charts going ahead.

![Bitcoin [BTC]: Some conviction and a lot of changing hands is a sign of…](https://ambcrypto.com/wp-content/uploads/2022/11/btc-6-1000x600.jpg)